240x Filetype PDF File size 0.67 MB Source: documents.worldbank.org

NOTE NUMBER 350 viewpoint

Public Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPUBLIC POLICY FOR THE PRIVATE SECTOR

Competition and Poverty

APRIL 2016

Tania Begazo and How Competition Affects the Distribution of Welfare

e

C

i Sara Nyman

Public Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedCTA literature review shows competition policy reforms can deliver

ra Tania Begazo (tbegazo@

p benefits for the poorest households and improve income distribution.

worldbank.org) is a Senior

Economist and Sara A lack of competition in food markets hurts the poorest households

Nyman (snyman@ the most. Competition in input markets and between buyers helps

worldbank.org) is an

Economist in the Trade farmers and small businesses. And more competitive markets bolster

iveness Global and Competitiveness job growth over the longer term. More research is needed, however,

T Global Practice of the

i

T World Bank Group. to better understand the impact of competition reforms and antitrust

1

enforcement on poverty and shared prosperity.

The authors would

like to thank Carlos While the impact of competition on overall wel- productive firms and higher-growth industries, and

Public Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedRodriguez Castelan, fare has been well documented, the relationship there are likely to be short-term costs involved in

Catriona Purifeld, between competition, poverty, and the distribu- this adjustment.

Trade and CompeMartha Licetti, and Jose tion of welfare is less well understood. Of the The distributional effects of a lack of competi-

Reis of the World Bank

Group, and Natalie evidence that does exist, most studies point to a tion have long been acknowledged in the literature.

Timan of the U.K. positive relationship between competition and Monopolies can have a major impact on inequality

Competition and Markets the distribution of gains toward the poorest, but in the distribution of household wealth (Comanor

2

Authority for their valu- there can be trade-offs and short-term costs. and Smiley 1975). Policies that reduce monopoly

able comments. Research The relationship between the level of compe- power can have positive effects on both growth

for this note was tition and the welfare of those at the lower end and income distribution (Dutt 1984). Rodriguez-

supported by the govern- of the income distribution can be examined in Castelan (2011) finds that, while theoretically

ments of Canada, the terms of the functions that households perform there are conditions under which higher prod-

United Kingdom, and in the market—namely as consumers, producers, uct market concentration could lower poverty, an

the United States through and employees. Because a lack of competition in increase in poverty is more realistic. Baker and

Public Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure Authorizedthe Impact Program of a specific market affects these actors differently, Salop (2015) hypothesize that market power con-

the World Bank Group’s competition can have mixed effects on their wel- tributes to inequality by raising the return to capital

Trade and Competitive- fare. For example, there may be a short-term relative to the rate of economic growth, and by

ness Global Practice. trade-off between lower prices for consumers and discouraging innovation and productivity. In this

returns to producers or employees, especially for context, they suggest that antitrust enforcement

less productive firms and their employees. Over and regulatory agencies might consider placing

THE WORLD BANK GROUP the long term, resources tend to shift to more a higher priority on reducing inequality. Several

Competition and COMPETITION AND PpovertyOvERTy How Competition Affe How CompeTiTion affeCCTts ts THHe e Distribution of disTribuTion of wwelfareelfAre

studies provide evidence that competition can Cournot duopoly at successive stages of the food

improve the distributional impact of trade lib- marketing chain, in conjunction with oligopsony

eralization by directing more benefits toward power among processors, reduces consumer sur-

developing country producers (Sexton et al. plus by 75 percent.

2007) and raising the relative wages of less- Households with lower income suffer rela-

skilled workers (Borjas and Ramey 1995). tively larger welfare losses from monopoly and

This review focuses, where possible, on devel- imperfect competition in basic goods than those

oping country evidence, although much of the with higher incomes. Lower-income households

literature relates to high-income countries. Results often have a greater share of basic goods in their

2 may not be directly transferable to developing consumption baskets. In Mexico, while all income

countries given differences in market character- groups experience reduced consumer welfare

istics, including the greater likelihood of market from market power in seven commodity mar-

and institutional failures in developing economies. kets, losses for the lowest income decile were

19.8 percent higher in urban areas (22.7 percent

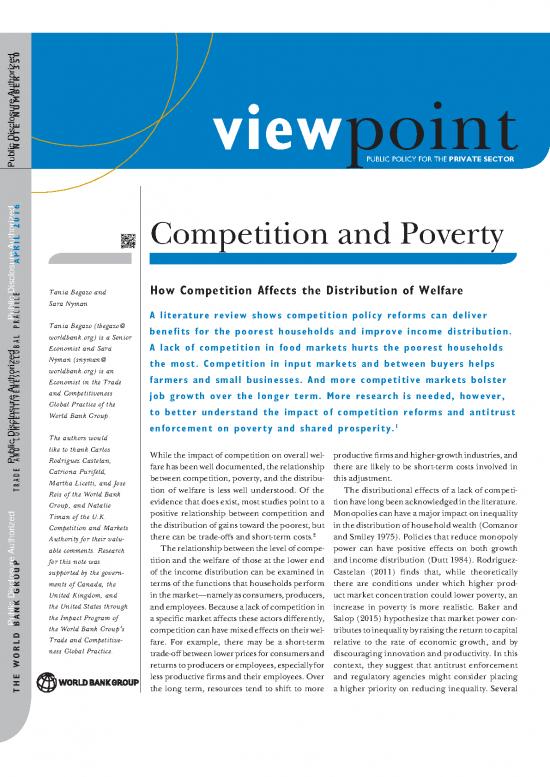

The bottom 40 percent as consumers higher in rural areas) than for the highest income

Food prices, together with the share of food in decile (Urzúa 2013).Similarly, the welfare loss

an income group’s expenditure basket, play an associated with monopoly power for 14 commod-

important role in how competition affects the ity groups in Australia is 46 percent higher for

distribution of consumer welfare. The low elastic- households in the lowest decile than for those in

ity of demand for staple foods and high spending the highest (Creedy and Dixon 1998). In Kenya,

on food (Figure 1), particularly for those in the allowing sugar prices to fall by 20 percent would

lowest income deciles, implies significant direct lead to welfare gains for all income deciles, but

welfare costs and distributional effects from high gains as a share of income would be 4.4 times

food prices as a result of market power in this higher for the poorest income decile than for

3

sector. Monopolies, collusion among competi- the highest (Argent and Begazo 2015).

tors, and rigid regulations that shield firms from Sanctioning and deterring anticompetitive

competition increase market power and harm behavior can generate important consumer sav-

the distribution of consumer welfare. Sexton ings, particularly by eliminating cartels in basic

and Zhang (2006) show that market power in a food products and commodities. Connor (2014)

suggests that cartels lead to a median overcharge4

Expenditure shares across product categories, by country in order of increasing of 23 percent and a mean of 49 percent, although

Figure per-capita expenditure Boyer and Kotchoni (2014) produce lower esti-

mates (about 16 percent for both mean and

1.0 median). According to Connor (2014), 60 per-

10.9

0.8 cent of cartel episodes that include overcharges

0.7 have an overcharge above 20 percent, and of

0.6 these, the mean overcharge is 79.7 percent.

0.5

0.4 Notaro (2014) finds that a cartel discovered in

0.3 2007 in the Italian pasta market overcharged by

0.2

0.1 around 11 percent. Mncube (2013) estimates

0.0 e that, due to price fixing among major bread

Niger Haiti IndiaAngola Serbia Turkey Kuwait

UgandaSenegalLao PDRPakistanMongoliaNamibiaEcuadorThailandJordanPanamaRomaniaMexicoUruguayLithuaniaCuraçaoFinlandAustriaNorwaymanufacturers in South Africa, independent

Mauritania IndonesiaGuatemalaEl Salvador Singapor

Guinea-BissauGambia, The South Africa The BahamasSaudi ArabiaSint MaartenUnited Statesbakeries were overcharged by 7–42 percent on

Congo, Dem. Rep. Turks and Caicos United Kingdom

St. Kitts and NevisMacao SAR, China the price of wheat flour, harming both baker-

Economies in ascending order of per capita expenditure ies and bread consumers. A World Bank study

Food Housing, furnishing and maintenance Health and education (2016) finds that, in South Africa, tackling only

Transport and communications Clothing Recreation Other four cartels (in wheat, maize milling, poultry, and

pharmaceuticals) reduced poverty by 0.4 percent-

Note: SAR abbreviates special administrative region. age points. In comparison, cash transfers and free

Source: Based on International Comparison Program (2011) data. basic services reduced poverty by 13 percentage

Table Effect of competition on shared prosperity of households as consumers

Country Study Reform / Impact of… Effect

1Welfare effects of limited competition

Mexico Urzúa (2013) High market power for seven markets, Welfare loss 19.8% higher for lowest income decile than

including food, beverages, and medicines for highest in urban areas, 22.7% higher in rural areas

Australia Creedy and Dixon (1998) Monopoly power for 14 commodity groups Welfare loss 46% higher for lowest income decile than

for highest

Effects of competition law enforcement: elimination of anticompetitive business practices

International Connor (2014) Cartel (sample of 1,530 cartel episodes across Median average overcharge of 23%; mean of 49%. 60%

3

sectors and countries) of the cartel episodes with overcharges of 20% or

higher have a mean overcharge of 79.7%

South Africa Mncube (2013) Cartel (wheat flour) Overcharge to independent bakeries of 7–42%

Effect of removing policy and regulatory obstacles to competition

Kenya Argent and Begazo (2015) Reducing barriers to competition leading to i) Effect equivalent to 1.2% increase in real income with

a 20% fall in the price of i) maize and ii) sugar greater gains for the poor, 1.8% fall in poverty

ii) Welfare gains for the poorest income decile 4.4 times

higher than for the highest, 1.5% fall in poverty

Dominican Republic Busso and Galiani (2015) Entry of new grocery stores into a conditional 1% increase in number of stores operating in the

cash transfer program market reduces prices by 0.06% without affecting

product or service quality

United States Hausman and Leibtag (2007) Entry and expansion of retail supercenters Welfare gains from direct effect of increased variety is

about 20% of average food expenditure; indirect price

effect of 5%

Lower-income households benefit by 50% more than

average effect

Mexico Atkin, Faber, and Foreign supermarket entry Significant welfare gains for average household (6.2%

Gonzalez-Navarro (2015) of household income), driven by direct consumer gains

from new foreign stores with cheaper prices; richest

income groups gain about 50% more than the poorest

points, but at a disproportionately greater cost tion in retail also affects the prices and quality

(3.8 percent of gross domestic product). of food and other necessities. Busso and Galiani

Competition can be intensified by removing (2014) show that entry into the retail market in

government-imposed barriers that stifle well- the Dominican Republic led to a significant

functioning markets. State interventions that and robust reduction in prices (around 6 per-

distort markets and raise food prices—including cent) without affecting the quality of products

import tariffs or minimum support prices—are or services provided by grocery stores. Griffith

often justified as a tool to increase the incomes of and Harmgart (2012) find that more restrictive

agricultural producers. However, most empirical planning regulation in the United Kingdom

analyses suggest that higher food prices generally reduces entry of large supermarkets, increases

harm low-income households, since poor people prices, and leads to consumer losses of up to £10

are often net consumers of food (Christiansen million per year. Hausman and Leibtag (2007)

and Demery 2007; Wodon et al. 2008; Wodon and find that the entry and expansion of supercenters

5 in the United States, which compete with tra-

Zaman 2010). Argent and Begazo (2015) find

that allowing sugar and maize prices to fall by 20 ditional retail food outlets, lead to direct con-

percent in Kenya by relaxing government policies sumer welfare gains (at 20.2 percent of average

that restrict competition would decrease poverty food expenditure) through increased variety,

by 1.5 percent and 1.8 percent, respectively. and to indirect gains through a price effect (4.8

Farther down the food value chain, competi- percent). Lower-income households benefit by

COMPETITION AND POvERTy How CompeTiTion affeCTs THe disTribuTion of welfare

Table Effect of competition on shared prosperity of households as producers

Country Study Reform / Impact of… Effect

2Effect of upstream anticompetitive behavior or regulations on the cost of inputs for small producers

United States (in trade Fink, Mattoo, and Neagu (2002) i) Removing anticompetitive practices, such as i) Transport prices decline by 25%, cost savings of $2

with developing countries) rate fixing by maritime conferences billion

ii) Removing restrictive government policies, ii) Transport prices decline by 9%, cost savings of $850

such as restrictions on foreign suppliers million

Sierra Leone Ghani and Reed (2015) Entry into the market for ice manufacturing as Each new manufacturer associated with a 5–6% fall in

an input for fishermen, previously held by a price

monopoly manufacturer 19 percentage-point increase in credit provision to

fishermen from retailers following introduction of

competition

Effect of downstream buyer power on prices for small producers

India Banerji and Meenakshi (2004) Buyer collusion in wheat auctions Prices paid to farmers depressed by about 1–4%

Benin, Burkina Faso, Porto, Chauvin, and Olarreaga Increased competition between processors

Côte d’Ivoire, Ghana, (2011) in export crops:

Malawi, Rwanda, i) Largest processing firm splits i) Average increase in farmer income of 2.8%

Uganda, and Zambia ii) Entry of a small processor ii) Average increase in farmer income of 0.25%

Effect of government policies on small producers

Madagascar Cadot, Dutoit, and Melo (2009) Elimination of the vanilla monopoly/ Price received by producers increases from 2–11% to

monopsony marketing board 22% of free on board price to 22%, 20,000 individuals

lifted out of poverty

Indonesia Warr (2005) Effective ban on rice imports Increase in poverty in urban and rural areas, 1% overall

about 50 percent more than the average house- pertinent in developing countries, where health

6

hold because they are more likely to shop at out- insurance coverage is rarer.

lets with lower prices. The progressive nature of

these gains, however, depends on context and the The bottom 40 percent as producers

type of entry. Atkin, Faber, and Gonzalez-Navarro Anticompetitive behavior and regulations that

(2015) find that entry of foreign supermarkets unreasonably constrain competition increase

in Mexico led to significant welfare gains for the the cost of inputs. Anticompetitive behavior can

average household, but that the richest groups inflict particular harm on low-income producers

gained around 50 percent more than the poorest when it occurs in markets for agricultural inputs

groups because poor people transfer less of their such as fertilizer, seeds, pesticides, and transport

retail consumption to foreign stores. services. Globally, the existence of international

Consumers can also benefit from competition cartels in the fertilizer sector raised prices of

in other sectors that play a key role in welfare chemical fertilizers by 17 percent on average

improvements and poverty alleviation, such as during 1990–2010 (Connor 2012). Jenny (2012)

pharmaceuticals (Bokhari and Fournier 2013; projects the price of potash for 2011–2020 under

Tenn and Wendling 2014). Consumer welfare a Canadian cartel arrangement to be double what

gains from new entry in the United States market it would be under a competitive scenario. In the

for anti-cholesterol drugs is higher for consum- transport sector, Arvis, Raballand, and Marteau

ers in the lowest income decile than for higher (2010) find that transitioning from cartelized

income deciles, driven in part by the fact that control of transit freight allocation to an efficient

lower-income households tend to be more price trucking market would reduce logistics costs by

sensitive (Dunn 2012). Indeed, more price-sen- over 30 percent in landlocked developing coun-

sitive consumers—such as those without health tries. Breaking up anticompetitive practices in

insurance—generally benefit more from the international shipping services would reduce

availability of low-priced generic drugs (Frank transport prices for goods shipped to the United

and Salkever 1992, 1997). This is particularly States from developing countries by 25 percent

no reviews yet

Please Login to review.