347x Filetype XLSX File size 0.14 MB Source: www.ynithya.com

Sheet 1: Instructions

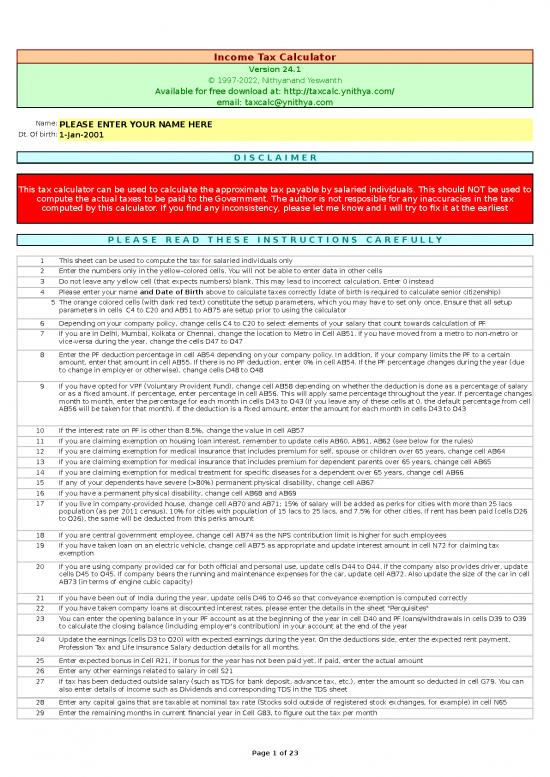

| Income Tax Calculator | |

| Version 24.1 | |

| © 1997-2022, Nithyanand Yeswanth | |

| Available for free download at: http://taxcalc.ynithya.com/ | |

| email: taxcalc@ynithya.com | |

| Name: | PLEASE ENTER YOUR NAME HERE |

| Dt. Of birth: | 1-Jan-2001 |

| D I S C L A I M E R | |

| This tax calculator can be used to calculate the approximate tax payable by salaried individuals. This should NOT be used to compute the actual taxes to be paid to the Government. The author is not resposible for any inaccuracies in the tax computed by this calculator. If you find any inconsistency, please let me know and I will try to fix it at the earliest | |

| P L E A S E R E A D T H E S E I N S T R U C T I O N S C A R E F U L L Y | |

| 1 | This sheet can be used to compute the tax for salaried individuals only |

| 2 | Enter the numbers only in the yellow-colored cells. You will not be able to enter data in other cells |

| 3 | Do not leave any yellow cell (that expects numbers) blank. This may lead to incorrect calculation. Enter 0 instead |

| 4 | Please enter your name and Date of Birth above to calculate taxes correctly (date of birth is required to calculate senior citizenship) |

| 5 | The orange colored cells (with dark red text) constitute the setup parameters, which you may have to set only once. Ensure that all setup parameters in cells C4 to C20 and AB51 to AB75 are setup prior to using the calculator |

| 6 | Depending on your company policy, change cells C4 to C20 to select elements of your salary that count towards calculation of PF |

| 7 | If you are in Delhi, Mumbai, Kolkata or Chennai, change the location to Metro in Cell AB51. If you have moved from a metro to non-metro or vice-versa during the year, change the cells D47 to O47 |

| 8 | Enter the PF deduction percentage in cell AB54 depending on your company policy. In addition, if your company limits the PF to a certain amount, enter that amount in cell AB55. If there is no PF deduction, enter 0% in cell AB54. If the PF percentage changes during the year (due to change in employer or otherwise), change cells D48 to O48 |

| 9 | If you have opted for VPF (Voluntary Provident Fund), change cell AB58 depending on whether the deduction is done as a percentage of salary or as a fixed amount. If percentage, enter percentage in cell AB56. This will apply same percentage throughout the year. If percentage changes month to month, enter the percentage for each month in cells D43 to O43 (If you leave any of these cells at 0, the default percentage from cell AB56 will be taken for that month). If the deduction is a fixed amount, enter the amount for each month in cells D43 to O43 |

| 10 | If the interest rate on PF is other than 8.5%, change the value in cell AB57 |

| 11 | If you are claiming exemption on housing loan interest, remember to update cells AB60, AB61, AB62 (see below for the rules) |

| 12 | If you are claiming exemption for medical insurance that includes premium for self, spouse or children over 65 years, change cell AB64 |

| 13 | If you are claiming exemption for medical insurance that includes premium for dependent parents over 65 years, change cell AB65 |

| 14 | If you are claiming exemption for medical treatment for specific diseases for a dependent over 65 years, change cell AB66 |

| 15 | If any of your dependents have severe (>80%) permanent physical disability, change cell AB67 |

| 16 | If you have a permanent physical disability, change cell AB68 and AB69 |

| 17 | If you live in company-provided house, change cell AB70 and AB71; 15% of salary will be added as perks for cities with more than 25 lacs population (as per 2011 census), 10% for cities with population of 15 lacs to 25 lacs, and 7.5% for other cities. If rent has been paid (cells D26 to O26), the same will be deducted from this perks amount |

| 18 | If you are central government employee, change cell AB74 as the NPS contribution limit is higher for such employees |

| 19 | If you have taken loan on an electric vehicle, change cell AB75 as appropriate and update interest amount in cell N72 for claiming tax exemption |

| 20 | If you are using company provided car for both official and personal use, update cells D44 to O44. If the company also provides driver, update cells D45 to O45. If company bears the running and maintenance expenses for the car, update cell AB72. Also update the size of the car in cell AB73 (in terms of engine cubic capacity) |

| 21 | If you have been out of India during the year, update cells D46 to O46 so that conveyance exemption is computed correctly |

| 22 | If you have taken company loans at discounted interest rates, please enter the details in the sheet "Perquisites" |

| 23 | You can enter the opening balance in your PF account as at the beginning of the year in cell D40 and PF loans/withdrawals in cells D39 to O39 to calculate the closing balance (including employer's contribution) in your account at the end of the year |

| 24 | Update the earnings (cells D3 to O20) with expected earnings during the year. On the deductions side, enter the expected rent payment, Profession Tax and Life Insurance Salary deduction details for all months. |

| 25 | Enter expected bonus in Cell R21, if bonus for the year has not been paid yet. If paid, enter the actual amount |

| 26 | Enter any other earnings related to salary in cell S21 |

| 27 | If tax has been deducted outside salary (such as TDS for bank deposit, advance tax, etc.), enter the amount so deducted in cell G79. You can also enter details of income such as Dividends and corresponding TDS in the TDS sheet |

| 28 | Enter any capital gains that are taxable at nominal tax rate (Stocks sold outside of registered stock exchanges, for example) in cell N65 |

| 29 | Enter the remaining months in current financial year in Cell G83, to figure out the tax per month |

| 30 | You can change the headings for the 10 "Misc" earnings and the 9 "Oth Ded" deductions columns to suit your salary structure |

| 31 | Rent can be entered in cells D26 to O26, if deducted through salary; Otherwise enter annual figure in Q26 to S26. If you enter rent amount in any cell between D26 to O26, do not enter any amount in cells Q26 to S26 and vice-versa |

| 32 | Enter expected other incomes/investments/savings/expenses information in cells N53 to N88 |

| 33 | Other exemptions entered in cell N53 is not validated. So, please be sure about the amount entered |

| 34 | Enter non-salary related other income in cell N65, Bank FD/other deposit interest in cell N64 and Savings Bank interest in cell N61 |

| 35 | Enter all dividends received from stocks of Indian companies as well as Mutual Funds in cell N63 |

| 36 | You can enter the details of NSC's purchased during the last 4 years in the "NSC Accrued Interest" sheet to calculate the accrued interest automatically. This interest is exempt under sec 80C. This interest is also taxable either on accrual basis every year or when received |

| 37 | You can enter details of Stocks sold during the year in the "Capital Gains - Equity" sheet to calculate the tax applicable |

| 38 | You can enter details of Property and Debt Mutual Funds sold during the year in the "Cap Gains - Property&Debt MF" sheet |

| 39 | HRA exemption is calculated on monthly basis and added up, which may not always be correct if your HRA, Rent or Basic+DA change month on month. In such cases, and if you have not moved from a metro to non-metro or vice-versa in the middle of the year, enter the rent only in cells Q26 to S26 and NOT in cells D26 to O26. This will calculate the exemption on the total basis instead of monthly basis |

| T A X R U L E S & O T H E R U S E F U L I N F O R M A T I O N | |

| 1 | HRA exemption = minimum of (40% (50% for metros) of Basic+DA or HRA or rent paid - 10% of Basic+DA) |

| 2 | LTA is exempt to the tune of ecomony class airfare for the family to any destination in India, by the shortest route. LTA can be claimed twice in a block of 4 calendar years. The current block is from Jan 2018 to Dec 2021 |

| 3 | Uniform allowance is exempt to the extent of bills produced for purchase of uniforms |

| 4 | Gratuity (max. 20 lac) , VRS (max. 5 lacs) and some such amounts are exempt upto certain limits. If you get any such payment, please find out the exact limit for you from a tax consultant and enter in cell N53 |

| 5 | Children's Education allowance is exempt upto ₹ 100/- per child per month plus ₹ 300/- per child per month for hostel expenses (max of 2 children only) |

| 6 | There is an exemption for interest on housing loan. If the loan was taken before Apr 1, 1999 exemption is limited to ₹ 30,000/- per year. If the loan was taken after Apr 1, 1999 exemption is limited to ₹ 2,00,000/- per year if the house is self-occupied; if this is the first house and stamp duty value of the house is less than 45 lacs and loan taken after 1-Apr-2019, there is additional ₹ 1,50,000 exemption; there is no limit if the house is rented out, but the rent (less 30% of rent as std. deduction and municipal taxes) needs to be declared as income. However, the total loss from all houses cannot be more than 2 lacs (plus 150000 for specific cases as above). Any excess loss can be carried forward for the next year |

| 7 | If you have rented out your house, enter the total rent income from the house (after deducting property tax and 30% of rent as standard maintenance expenses) in cell N59. If you have taken loan for the house, enter the interest component in cell N60 |

| 8 | Medical Insurance (such as Mediclaim) premium is exempt upto ₹ 25,000/- per year for self, spouse & dependent children. Within this limit, ₹ 5,000/- could be used for preventive health check expenses. An additional ₹ 25,000/- is exempt towards premium for parents (even if they are not dependent). If the parent(s) are above 65 years of age, an extra ₹ 25,000/- can be claimed |

| 9 | Deduction in respect of medical treatment of handicapped dependents is limited to ₹ 75,000/- per year if the disability is less than 80% and ₹ 1,25,000/- per year if the disability is more than 80% |

| 10 | Deduction in respect of medical treatment for specified ailments or diseases for the assesse or dependent can be claimed upto ₹ 40,000/- per year. If the person being treated is a senior citizen, the exemption can go up to ₹ 100,000/- |

| 11 | Interest repayment on education loan (taken for higher education from a university for self, spouse & children) is tax exempt from the 1st year of repayment up to a maximum of 8 years. There is no exemption for Principal payment |

| 12 | Donations to certain charities are tax exempt to the tune of 50% or 100% of donation with a qualifying limit of 10% of salary or without limit. Please find out which category your donation falls into and enter in cells S51 to S54 |

| 13 | If you do not get HRA, but have rented a house, an exemption is available. This will be calculated as minimum of (25% of total income or rent paid - 10% of total income or ₹ 60,000/- per year) |

| 14 | Donations for certain scientific research and rural development are exempt, as well as donations to some charities under section 35AC or section 80GGA. Please enter the actual amount exempt in cell N77 |

| 15 | Interest from Savings bank account is exempt up to ₹ 10,000/- per year. For senior citizens, all interest income (including FD, RD, etc.) is exempt up to ₹ 50,000/- per year |

| 16 | If you have a permanent physical disability, you can take an exemption of up to ₹ 75,000/- per year and ₹ 1,25,000 in case of severe disability |

| 17 | Investments up to 1.5 lac in PF, VFP, PPF, Insurance Premium, Housing loan principal repayment, Stamp duty/registration charges for purchase of new home, NSC, ELSS, long term bank Fixed Deposit, Post Office Term Deposit, New Pension Scheme, Sukanya Samriddhi Scheme, etc. are deductible from the taxable income under sec 80C. There is no limit on individual items, so all 1.5 lac can be invested in NSC, for example. An additional ₹ 50,000 exemption is available for employee contribution to New Pension Scheme |

| 18 | As per clarification from IT department, all perquisites such as rent-free accommodation, company provided car, free or concessional education facilities, employee stock option plan, free club membership, company provided credit card, gift vouchers, meal coupons, hotel stay beyond 15 days, are fully taxable. This tax calculator calculates the tax incidence for accommodation and car. If you receive any other perquisite, please include the value of such perquisite in cell S21 |

| 19 | For the current year, Govt. prescribed rate of interest for PF is 8.65%. If the employer pays interest higher than this, the differential interest earned is treated as perquisites |

| 20 | Residents of Sikkim are exempt from Income Tax |

| H O W T O G E T A N U P D A T E / C O N T A C T M E | |

| 1 | This tax calculator constantly gets updated to fix errors as well as to add new features |

| 2 | This may also be changed when there are changes in tax rules that affect income tax computation |

| 3 | The latest version of this tool is available for free download from the Internet at http://taxcalc.ynithya.com/ |

| 4 | Please check back frequently (at least once every 2 months) to see that you have the latest version. You can compare the version number at the top of this instructions page. However, if you have subscribed, you will automatically receive updates |

| 5 | You can also send a blank e-mail to taxcalc@ynithya.com with only the subject line as "SEND TAXCALC" and the latest version of tax calculator will be e-mailed to you within a couple of days |

| 6 | If you want to receive an automatic message whenever a major version is released, please send a blank e-mail to taxcalc@ynithya.com with only the subject as "SUBSCRIBE". There are no charges for subscription |

| 7 | If you find any inaccuracy in the calculation or want clarification on some aspect of the tax calculator, please send an e-mail with the details of your query to taxcalc@ynithya.com with subject as "CLARIFICATION" and I will try to reply within a week |

| 8 | If you are already on my list and no longer want to get updates, send a blank e-mail to taxcalc@ynithya.com with only the subject as "UNSUBSCRIBE" |

| 9 | While sending e-mail, please ensure that the subject line is exactly as given here (without the quotes), because the processing is done automatically. Other mails are deleted automatically |

| 10 | Since I am not a chartered accountant or a tax consultant, I am not in a position to answer specfic queries related to taxation. You will have to contact a tax consultant for your specific queries |

| Click here to go to the tax calculation sheet | |

| R E V I S I O N H I S T O R Y | |

| Version 24.1; Release date: Aug 10, 2021 | |

| Updated Cost inflation index, calculation error in capital gains sheet fixed | |

| Version 24.0; Release date: Apr 4, 2021 | |

| Updated for FY 2021-22; fixed minor errors; introduced a sheet to enter TDS on dividends and other incomes | |

| Version 23.3; Release date: Jan 3, 2021 | |

| Error in capital gains calculation under new scheme fixed | |

| Version 23.2; Release date: Sep 13, 2020 | |

| Updated Cost inflation index, sec 80G donations enhanced, fixed some errors, showing monthly tax under both schemes | |

| Version 23.1; Release date: Jun 7, 2020 | |

| Fixed some errors (superannuation exemption, conveyance exemption, capital gains calculation) | |

| Version 23.0; Release date: Apr 24, 2020 | |

| Updated for FY 2020-21; fixed minor errors | |

| Version 22.1; Release date: Aug 18, 2019 | |

| Updated based on final budget for FY 2019-20, Error in NSC accrued interest corrected | |

| Version 22.0; Release date: May 5, 2019 | |

| Updated for FY 2019-20; fixed minor errors | |

| Version 21.1; Release date: Jul 1, 2018 | |

| Cost inflation index updated | |

| Version 21.0; Release date: May 5, 2018 | |

| Updated for FY 2018-19, fixed errors related to surcharge and housing loan | |

| Version 20.1; Release date: Sep 24, 2017 | |

| Cost inflation index updated | |

| Version 20.0; Release date: May 1, 2017 | |

| Updated for FY 2017-18, Fixed car perquisites calculation, NPS added | |

| Version 19.1; Release date: Jul 3, 2016 | |

| Cost inflation index updated | |

| Version 19.0; Release date: May 1, 2016 | |

| Updated for FY 2016-17, fixed colors for viewability on Mac | |

| Version 18.0; Release date: May 10, 2015 | |

| Updated for FY 2015-16 | |

| Version 17.3; Release date: Nov 22, 2014 | |

| PF limits changed from Sept | |

| Version 17.2; Release date: Aug 24, 2014 | |

| Error in NSC accrued interest corrected | |

| Version 17.1; Release date: Jul 22, 2014 | |

| Updated based on final budget for FY 2014-15, added Capital Gains calculation for Property and Debt Mutual Funds sale | |

| Version 17.0; Release date: Apr 27, 2014 | |

| Updated for FY 2014-15, some enhancements | |

| Version 16.0; Release date: May 25, 2013 | |

| Updated for FY 2013-14 based on budget | |

| Version 15.1; Release date: Jun 10, 2012 | |

| Updated to remove long-term infrastructure bonds from the list of exemptions | |

| Version 15.0; Release date: May 06, 2012 | |

| Updated for FY 2012-13 based on budget | |

| Version 14.0; Release date: May 20, 2011 | |

| Updated for FY 2011-12 based on budget proposals | |

| Version 13.0; Release date: April 20, 2010 | |

| Updated for FY 2010-11 based on budget proposals | |

| Version 12.0; Release date: August 02, 2009 | |

| Updated for FY 2009-10 based on budget proposals. Fixed some errors | |

| Version 11.0; Release date: April 14, 2008 | |

| Updated for FY 2008-09 | |

| Version 10.1; Release date: April 11, 2007 | |

| Fixed some errors in PF calculation and perquisites valuation, added Capital Gains Tax calculation | |

| Version 10.0; Release date: March 25, 2007 | |

| Updated for FY 2007-08. Reformatted to include more heads for income & deductions | |

| Version 9.1; Release date: July 29, 2005 | |

| Updated to include the budget revisions, NSC interest calculation error corrected, Surcharge calculation fixed | |

| Version 9.0; Release date: May 01, 2005 | |

| Updated for financial year 2005-06, corrections and enhancements incorporated | |

| Version 8.2; Release date: January 14, 2005 | |

| Fixed some errors in calculation of HRA exemption, surcharge, section 88D rebate, etc. | |

| Version 8.1; Release date: September 18, 2004 | |

| Updated to include the budget revisions | |

| Version 8.0; Release date: May 10, 2004 | |

| Updated for financial year 2004-05, corrections and enhancements incorporated | |

| Version 7.1; Release date: May 08, 2003 | |

| Updated to correct mistakes in: perquisites calculation, children's education rebate under section 88 and inclusion of interest income in gross income | |

| Version 7.0; Release date: April 18, 2003 | |

| Updated to include the new budget proposals for financial year 2003-04 | |

| Version 6.5; Release date: March 03, 2003 | |

| Corrections: Housing loan interest and House/property income/loss was not being accounted correctly. Next year's (Financial year 2003-04) version 7.0 should be out sometime in late April or early May 2003 | |

| Version 6.4; Release date: February 25, 2003 | |

| Corrections: Std. deduction calculation, housing interest accounting, LIC SSS accounting, Perks calculation (different interest rates for the 2 loans) | |

| Version 6.3; Release date: January 09, 2003 | |

| Corrections: Problem in tax rebate calculation when the salary is between 1 lac and 2 lacs; Housing loan interest calculation | |

| Version 6.2; Release date: January 07, 2003 | |

| Updated to fix some errors in calculation of Std. deduction, Tax rebate, Vehicle maintenance exemption, Perquisites, etc. | |

| Version 6.1; Release date: May 15, 2002 | |

| Updated to include the changes as passed in the finance bill; Fixed some minor defects | |

| Version 6.0; Release date: April 10, 2002 | |

| Updated to include the new budget proposals for financial year 2002-03 | |

| PLEASE ENTER YOUR NAME HERE | ||||||||||||||||||||||||||||

| Incl PF? | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Total | Perks | Bonus | Others | Gross | |||||||||||

| Earnings | Basic | Y | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||

| DA | Y | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Convey | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| HRA | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Ch. Educ | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Medical | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| LTA | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Uniform All. | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Car allow | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Misc | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Misc | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Misc | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Misc | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Misc | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Misc | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Misc | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Misc | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Misc | N | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| Total | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||

| Deductions | Prof tax | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| PF | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| VPF | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||

| IT | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||

| Rent | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||

| Life Insur. | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Oth Ded | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Oth Ded | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Oth Ded | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Oth Ded | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Oth Ded | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Oth Ded | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Oth Ded | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Oth Ded | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Oth Ded | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Tot Ded | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||

| Net | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||

| PF | Loan/Wdwl | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||

| OB | 0 | 0 | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | 0 | |||||||||||||||

| Int | 0 | 0 | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | 0 | |||||||||||||||

| CB | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | #NAME? | 0 | |||||||||||||||

| VPF % | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||

| Co. Car used? | N | N | N | N | N | N | N | N | N | N | N | N | ||||||||||||||||

| Co. Car driver? | N | N | N | N | N | N | N | N | N | N | N | N | ||||||||||||||||

| In India? | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | ||||||||||||||||

| Metro/non? | N | N | N | N | N | N | N | N | N | N | N | N | ||||||||||||||||

| PF% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | ||||||||||||||||

| Tax Computation | Exemptions under section 10 & 17 | Produced | Limited | Donations (sec 80G) | Produced | Limited | SETUP PARAMETERS | |||||||||||||||||||||

| Old scheme | New scheme | HRA Exemption (sec 10 (13A)) | 0 | 0 | 50% without limit | 0 | 0 | Metro/Non-metro (M or N) | N | |||||||||||||||||||

| Gross Salary | 0 | 0 | Transport Exemption (sec 10(14)) | 0 | 100% without limit | 0 | 0 | HRA Exempt limit (of Basic+DA) | 40% | |||||||||||||||||||

| Standard Deduction | 0 | 0 | Other exemptions under sec 10 (10) (gratuity, etc.) | 0 | 0 | 50% with limit | 0 | #NAME? | PF/VPF deductions | |||||||||||||||||||

| Profession Tax | 0 | 0 | Children's Education Allowance Exemption (sec 10 (14)) | 0 | 0 | 100% with limit | 0 | #NAME? | PF as a percentage of "Salary" | 12.00% | ||||||||||||||||||

| Exemptions under section 10 & 17 | 0 | 0 | LTA exemption (sec 10(5)) | 0 | 0 | Total | #NAME? | PF limited to ₹ (if there is a max. limit for deduction) | 0 | |||||||||||||||||||

| Gross Salary after Section 10 & 17 exemptions | 0 | 0 | Uniform expenses (sec 10(14)) | 0 | 0 | *Please check which category your donations fall in | VPF as a percentage of "Salary" | 0.00% | ||||||||||||||||||||

| Accommodation & Car Perquisites | 0 | 0 | Total Exempted Allowances | 0 | Interest rate on PF/VPF | 8.50% | ||||||||||||||||||||||

| Taxable PF, NPS, Superannuation | 0 | 0 | Other income | Produced | Limited | VPF as "Percentage of salary" or "Fixed amount"? (P or F) | P | |||||||||||||||||||||

| Income chargeable under head 'Salaries' | 0 | 0 | House/property income (rent, etc.) | 0 | 0 | For Housing Loan | ||||||||||||||||||||||

| Income chargeable under head 'House/Property' | 0 | 0 | Interest on housing loan (for tax exemption) | 0 | 0 | House self-occupied? (Y or N) | Y | |||||||||||||||||||||

| Income chargeable under head 'Capital Gains' at nominal rate | 0 | 0 | Savings Bank interest | 0 | 0 | Loan taken after Apr 1, 1999? | Y | |||||||||||||||||||||

| Income chargeable under head 'Other Sources' | 0 | 0 | Bank deposit Interest | 0 | 0 | 1st home AND stamp duty value < 45L AND loan during FY19-22? | N | |||||||||||||||||||||

| Dividends from stocks and MFs | 0 | 0 | Dividends from Indian companies and MFs | 0 | 0 | Miscellaneous | ||||||||||||||||||||||

| Gross Total Income | 0 | 0 | Other income (excluding. SB & bank deposit int) | 0 | 0 | Sr. citizen included in self/spouse/children med insur prem? (Y or N) | N | |||||||||||||||||||||

| Deductions under chapter VI-A | #NAME? | 0 | Income chargeable under head 'Capital Gains' at nominal rate | 0 | 0 | Sr. citizen included in parent med insur prem / expenses? (Y or N) | N | |||||||||||||||||||||

| Deductions under sec 80C | 0 | 0 | Deductions under Chapter VI-A | Produced | Limited | Sr. citizen included in medical treatment u/s 80DDB? (Y or N) | N | |||||||||||||||||||||

| Net taxable income | #NAME? | 0 | Med Insur Prem / expenses / health chk (self, spoucse, children) (80D) | 0 | 0 | Dependents have permanent physical disability (>80%)? (Y or N) | N | |||||||||||||||||||||

| Med Insur Prem / expenses / health chk (parents) (sec 80D) | 0 | 0 | Have permanent physical disability? (Y or N) | N | ||||||||||||||||||||||||

| Tax credit (Sec 87A) | #NAME? | 0 | Medical for handicapped dependents (sec 80DD) | 0 | 0 | Is the permanent physical disability severe (>80%)? (Y or N) | N | |||||||||||||||||||||

| Tax on Income | #NAME? | 0 | Medical for specified diseases (sec 80DDB) | 0 | 0 | Do you live in Company provided accommodation? (Y or N) | N | |||||||||||||||||||||

| Capital Gains Tax (taxable @ 20%) | #NAME? | #NAME? | Higher Education Loan Interest Repayment (sec 80E) | 0 | 0 | If living in Co. acco, population of your city as per 2011 census | >25lacs | |||||||||||||||||||||

| Capital Gains Tax (taxable @ 15%) | #NAME? | #NAME? | Interest on electric vehicle (for tax exemption) (sec 80EEB) | 0 | 0 | Does company bear running/maint expenses for car? (Y or N) | N | |||||||||||||||||||||

| Capital Gains Tax (taxable @ 10%) | #NAME? | #NAME? | Donation to approved fund and charities (sec 80G) | #NAME? | Vehicle cubic capacity > 1600cc? (Y or N) | N | ||||||||||||||||||||||

| Surcharge on Income Tax | #NAME? | 0 | Rent deduction (sec 80GG) only if HRA not received | 0 | 0 | Central govt. employee? (Y or N) for NPS limit | N | |||||||||||||||||||||

| Health & Education Cess | #NAME? | #NAME? | Bank interest exemption (sec 80TTA) | 0 | First electric vehicle AND loan taken in 2019-2023? (Y or N) | N | ||||||||||||||||||||||

| Total Tax Liability | #NAME? | #NAME? | Deduction for permanent disability (sec 80U) | 0 | ||||||||||||||||||||||||

| Any other deductions (incl. donations u/s 35AC/80GGA) | 0 | 0 | ||||||||||||||||||||||||||

| Total Income tax paid from salary | 0 | Total Deductibles | #NAME? | |||||||||||||||||||||||||

| Tax paid outside of salary | 0 | Deductions under Chapter VI (sec 80C) | Produced | Limited | ||||||||||||||||||||||||

| TDS paid | 0 | National Pension scheme - Employee Contribution (sec 80CCD(1)) | 0 | 0 | ||||||||||||||||||||||||

| Income tax due | #NAME? | #NAME? | PPF, Pension scheme, Sukanya Samriddhi scheme, etc. | 0 | 0 | |||||||||||||||||||||||

| NSC (sec 80C) | 0 | 0 | ||||||||||||||||||||||||||

| Remaining months in year | 12 | Employees Provident Fund & Voluntary PF (sec 80C) | 0 | 0 | ||||||||||||||||||||||||

| Children's Education Tuition Fees (sec 80C) | 0 | 0 | ||||||||||||||||||||||||||

| #NAME? | #NAME? | Housing loan principal repayment, regn/stamp duty (sec 80C) | 0 | 0 | ||||||||||||||||||||||||

| Insurance premium & others (MF, ULIP, FD, ELSS, SS, etc.) (sec 80C) | 0 | 0 | ||||||||||||||||||||||||||

| #NAME? | #NAME? | National Pension scheme - Employer Contribution (sec 80CCD(2)) | 0 | 0 | ||||||||||||||||||||||||

| Superannuation fund - Employer Contribution | 0 | 0 | ||||||||||||||||||||||||||

| © 1997-2022, Nithyanand Yeswanth (taxcalc@ynithya.com) | Total Investments | 0 | ||||||||||||||||||||||||||

| PLEASE ENTER YOUR NAME HERE | ||||||||||||

| Perquisites Value of Loans Taken from the Company | ||||||||||||

| I Plan to remove this sheet from next year as I think it is not being used. | ||||||||||||

| If you use this regularly, please send me a mail giving details with subject as "CLARIFICATION" | ||||||||||||

| Housing Loan | Vehicle Loan | PC Loan |

Soft Loan |

Salary Loan |

Education Loan | Phone Loan | Marriage Loan |

Other Loan |

Other Loan |

Other Loan |

||

| Original Loan Amount | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Loan Taken In Month/Year | ||||||||||||

| Loan Closed Month/Year | ||||||||||||

| No. of instalments | 100 | 50 | 36 | 36 | 10 | 36 | 15 | 36 | 50 | 36 | 50 | |

| Co. interest rate | 0.00% | 4.00% | 0.00% | 4.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 4.00% | 0.00% | |

| EMI | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Second Loan Details (if loan of same type is taken again during the year) -- see Instructions below | ||||||||||||

| Original Loan Amount | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Loan Taken In Month/Year | ||||||||||||

| Loan Closed Month/Year | ||||||||||||

| No. of instalments | 100 | 50 | 36 | 36 | 10 | 36 | 15 | 36 | 50 | 36 | 50 | |

| Co. interest rate | 0.00% | 4.00% | 0.00% | 4.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 4.00% | 0.00% | |

| EMI | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Prescribed interest rate | 10.00% | 10.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | |

| Total value of Perquisites for the year | 0 | |||||||||||

| © 1997-2022, Nithyanand Yeswanth (taxcalc@ynithya.com) | ||||||||||||

| Instructions: | ||||||||||||

| 1. Enter the original loan amount, the month in which the loan was taken (e.g., DEC-2007), number of instalments and company interest rate in rows 5, 6, 10 and 11 respectively | ||||||||||||

| 2. If the loan was pre-closed, enter the month in which it was pre-closed (e.g., AUG-2010) in row 7. Otherwise leave blank | ||||||||||||

| 3. If you have taken another loan of same type, enter similar details in rows 14 through 20. For example, a Soft Loan taken in JUL-2007 may have | ||||||||||||

| completed its term (or pre-closed) in JUN-2010. These details can be entered in rows 5 through 11. Suppose another Soft Loan is taken in SEP-2010, those details | ||||||||||||

| may be entered in rows 14 through 20 | ||||||||||||

| 4. You can change the headings of the loans, if required. However, remember to change the corresponding "prescribed interest rate" in Row 23 as well. | ||||||||||||

| Prescribed interest rate is the rate charged by the State Bank of India as on 01-Apr-2018 for loans of same type advanced by it to the general public | ||||||||||||

no reviews yet

Please Login to review.