224x Filetype XLSX File size 0.10 MB Source: www.granvillecounty.org

Sheet 1: INSTRUCTIONS

| GRANVILLE COUNTY NON-EXEMPT TIME SHEET | |||||||||||

| BASIC INSTRUCTIONS | |||||||||||

| Read this worksheet in its entirety before beginning use of this timesheet and refer back to it if you have questions regarding how specific items are calculated. | |||||||||||

| Enter data in blue cells only. Other cells containing formulas, etc. have been locked to prevent accidental deletion. | |||||||||||

| START HERE. All employees must begin on the "START HERE" worksheet tab. | |||||||||||

| NEW EMPLOYEES: Complete Section I and "Hire Date" from Section II only, then proceed to the corresponding pay period worksheet. | |||||||||||

| EXISTING EMPLOYEES: Complete Sections I, II, and III for the period indicated. If you do not complete hours worked in the split week from the previous pay period, any comp time earned for the full week will not calculate correctly. ALL EMPLOYEES: If you begin using this timesheet AFTER the Dec 16 - Jan 15, 2022 pay period, you must be sure to use the correct file (the pay period start date is in the file name). If there is a "split week" at the beginning of the period, enter your work time in the first half of the "split week" on the preceeding pay period worksheet. For existing employees, do not complete the entire previous pay period timesheet, just the portion of any week that begins in the previous period and ends in the current period (i.e., a "split week). |

|||||||||||

| THE FLSA STANDARD WORK WEEK | |||||||||||

| The standard work week runs Sunday at 12:00 a.m. to the following Saturday at 11:59 p.m. and consists of 37.5 hrs of regular work time. | |||||||||||

| FAIR LABOR STANDARDS ACT (FSLA) STATUS COMP TIME | |||||||||||

| Compensatory time is earned only after performing 37.5 hrs of actual (physical) work during a regular work week. | |||||||||||

| Holiday, annual, sick, and other leave are not physically worked and are not included in calculations for comp time. However, during a holiday week it is possible to earn comp time by physically working more hours than needed and exceeding a total of 37.5 hrs including the holiday or other leave hours. | |||||||||||

| Non-Exempt staff earn straight time (hour-for-hour) for hours worked between 37.50 - 40 per week (2.5) and earn one and one-half (1.5) hours for every hour worked in excess of 40 hours per week. These hours are normally accrued as comp time (see Personnel Policy Article III Section 12). The calculation is [2.5 + (# hours > 40 x 1.5) = Total]. | |||||||||||

| IMPORTANT: Hours worked in the first part of a split week at the end of a pay period are carried over into the second part of the split week at the beginning of the next pay period to calculate comp time according to FLSA rules. For example: The 15th of the month is a Monday and this causes a one-day split week at the end of the pay period. You work 9.50 hours on Monday. Your total hours for Monday on the current pay date will reflect only the required 7.5 hours for the one-day split week schedule; The additional 2 hours are carried over to the split week at the beginning of the next pay period and included in the calculation for the 37.5 hour weekly requirement for the standard (full) workweek. |

|||||||||||

| RECORDING WORK TIME (IN/OUT) | |||||||||||

| Record the time you actually arrive and leave work NOT your work schedule (i.e., record 8:32 AM, 8:25 AM, 5:02 PM, 5:10 PM, etc. instead of always using 8:30 AM - 5:00 PM if you don't actually arrive/leave at those exact times). You can delete the 12:00 AM automatic entries in cells that you do not need as this will not affect the hour calculations. | |||||||||||

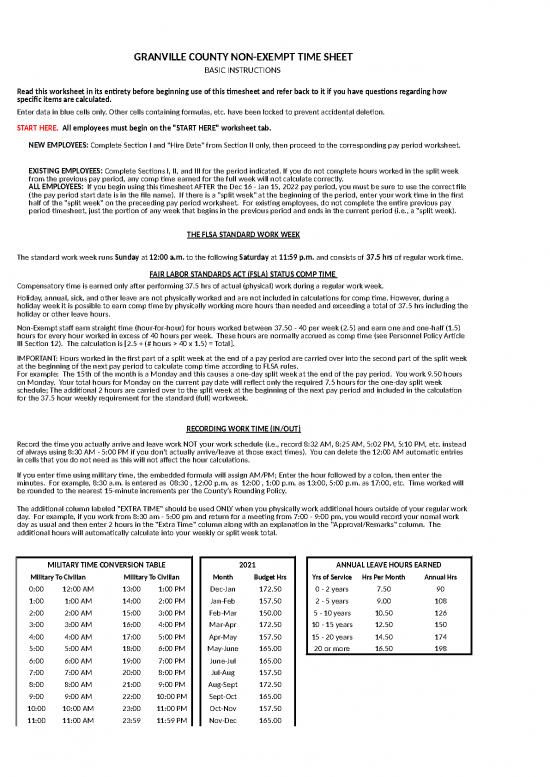

| If you enter time using military time, the embedded formula will assign AM/PM; Enter the hour followed by a colon, then enter the minutes. For example, 8:30 a.m. is entered as 08:30 , 12:00 p.m. as 12:00 , 1:00 p.m. as 13:00, 5:00 p.m. as 17:00, etc. Time worked will be rounded to the nearest 15-minute increments per the County’s Rounding Policy. | |||||||||||

| The additional column labeled "EXTRA TIME" should be used ONLY when you physically work additional hours outside of your regular work day. For example, if you work from 8:30 am - 5:00 pm and return for a meeting from 7:00 - 9:00 pm, you would record your nomal work day as usual and then enter 2 hours in the "Extra Time" column along with an explanation in the "Approval/Remarks" column. The additional hours will automatically calculate into your weekly or split week total. | |||||||||||

| MILITARY TIME CONVERSION TABLE | 2021 | ANNUAL LEAVE HOURS EARNED | |||||||||

| Military To Civilian | Military To Civilian | Month | Budget Hrs | Yrs of Service | Hrs Per Month | Annual Hrs | |||||

| 0:00 | 12:00 AM | 13:00 | 1:00 PM | Dec-Jan | 172.50 | 0 - 2 years | 7.50 | 90 | |||

| 1:00 | 1:00 AM | 14:00 | 2:00 PM | Jan-Feb | 157.50 | 2 - 5 years | 9.00 | 108 | |||

| 2:00 | 2:00 AM | 15:00 | 3:00 PM | Feb-Mar | 150.00 | 5 - 10 years | 10.50 | 126 | |||

| 3:00 | 3:00 AM | 16:00 | 4:00 PM | Mar-Apr | 172.50 | 10 - 15 years | 12.50 | 150 | |||

| 4:00 | 4:00 AM | 17:00 | 5:00 PM | Apr-May | 157.50 | 15 - 20 years | 14.50 | 174 | |||

| 5:00 | 5:00 AM | 18:00 | 6:00 PM | May-June | 165.00 | 20 or more | 16.50 | 198 | |||

| 6:00 | 6:00 AM | 19:00 | 7:00 PM | June-Jul | 165.00 | ||||||

| 7:00 | 7:00 AM | 20:00 | 8:00 PM | Jul-Aug | 157.50 | ||||||

| 8:00 | 8:00 AM | 21:00 | 9:00 PM | Aug-Sept | 172.50 | ||||||

| 9:00 | 9:00 AM | 22:00 | 10:00 PM | Sept-Oct | 165.00 | ||||||

| 10:00 | 10:00 AM | 23:00 | 11:00 PM | Oct-Nov | 157.50 | ||||||

| 11:00 | 11:00 AM | 23:59 | 11:59 PM | Nov-Dec | 165.00 | ||||||

| 12:00 | 12:00 PM | 24:00 | 12:00 AM | Total | 1957.50 | ||||||

| RECORDING ON-CALL TIME | |||||||||||

| Please check with your department director to determine if this section applies to your position. Some departments are using the term "on-call" to describe their work schedule coverage; however, the FLSA may not consider the time to be compensable. Hours for on-call time are addressed based on each individual department's unique needs and in accord with the Fair Labor Standards Act (See Fact Sheet #22: Hours Worked Under the Fair Labor Standards Act). | |||||||||||

| "ON-CALL SECTION": Enter dates of on-call time (e.g., 1/07-01/14) and hours in the "On-Call Section" at the bottom of the sheet. All hours will automatically be reflected in the "Total Hours" cell. From the total hours, you will need to enter the number of hours you want added to your comp balance in the "Add to Comp" cell and/or the number of hours to be paid out in the "Pay Out" cell according to your departmental policies. | |||||||||||

| Any time actually worked while in "on-call" status is in addition to those earned for the on-call designation. To record time actually worked, enter the hours in the "Time Worked" (Columns C - F) or "Extra Time" section for the applicable day. Use the "Extra Time" section if you have regular working hours recorded for the same day. For example, if you clock in at 8:30 am, out for lunch between 12:00 pm and 1:00 pm, and clock out again at 5:00 pm, but at 7:00 pm you get called into work for 3 additional hours, enter the 3 hours in the "Extra Time" column and an explanation under the "Approval/Remarks" column. A minimum of 2 hrs is earned for leaving home at any time to cover an emergency. Time on the telephone during On-Call is recorded as actual time and in quarter hours. Both of these should be entered in the same manner explained above. |

|||||||||||

| "OTHER" LEAVE | |||||||||||

| Use the "Other" leave column to enter paid time related to non-working hours, such as county office weather closures, community involvement leave, bereavement leave, etc. These hours are counted toward the 37.5 minimum workweek, but are not eligible for comp time or overtime rate. Always enter an explanation in the "Approval/Remarks" column for these hours. | |||||||||||

| CHECK/CORRECT MESSAGE | |||||||||||

| This worksheet was developed to account for a normal 37.5 hour workweek. Column Y calculates the hours to be paid and whenever those hours equal the 37.5-hours required for the week, it returns a "Correct" in column Z. Variations will display as follows: |

|||||||||||

| (1) | Hours < Budgeted Allowance: When a variation from the 37.5 hour workweek occurs which is under the budgeted allowance, the worksheet will return a dark yellow font/yellow highlight cell in column V and a red font/red highlight "CHECK" message in column Z. If you receive the "CHECK" message, review the calculations carefully to determine if the time you entered should be adjusted (ex, you may need to use comp time or other leave time to cover the shortage of hours). | ||||||||||

| Example of cell < budgeted allowance. | |||||||||||

| (2) | Hours > Budgeted Allowance: When a variation from the 37.5 hour workweek occurs which is over the budgeted allowance that cannot be calculated in the embedded formulas, the worksheet will return a red font/red highlight cell in column V and a red font/red highlight "CHECK" message in column Z. Whenever this occurs, check over the calculations carefully to determine if the time you entered should be adjusted. Under certain conditions, this error message may be ignored. | ||||||||||

| Example of cell > budgeted allowance. | |||||||||||

| ACCRUAL BALANCES | |||||||||||

| Accrual balances should update automatically at the bottom of the worksheet as long as the "Start Here" worksheet tab has been completed properly. New employees transferring in leave or existing employees receiving donated leave should enter those hours in the "Time Rec'd/Transferred In" blue cell. Special cells are found on the 9/16-10/15 and 12/16-1/15 worksheets to accomodate annual leave buyback and end of year 225-hour maximum carryover of annual leave. |

|||||||||||

| PRINTING INSTRUCTIONS | |||||||||||

| The printing format has been set; However, each printer may have different default settings and the print parameters may need to be reset (select "Page Break Preview" under the "View" tab to adjust page parameters). To print select from the Toolbar: File, Print, OK. |

|||||||||||

| DISCLAIMER | |||||||||||

| This worksheet attempts to account for as many scenarios as possible for county staff working a variety of schedules. | |||||||||||

| If you find that it does not accommodate your needs or is not calculating correctly, please notify county administration. | |||||||||||

| Gran27565 | |||||||||||

| GRANVILLE COUNTY | |||||||||||||||||||||||||

| NON-EXEMPT MONTHLY WORK AND LEAVE RECORD | |||||||||||||||||||||||||

| Employee: | EMPLOYEE NAME | Department: | DEPARTMENT | ||||||||||||||||||||||

| Pay Period: | October 16, 2022 | - | November 15, 2022 | Supervisor: | SUPERVISOR | ||||||||||||||||||||

| Record exact time in/out just as an actual timeclock would report; formula will automatically round your time to nearest 15 minutes. This is an official record of the employee's work. | |||||||||||||||||||||||||

| TIME WORKED | COMP TIME | PAID LEAVE & HOLIDAY PAY | LEAVE W/O PAY | FMLA | APPROVAL/REMARKS | ||||||||||||||||||||

| No split week from previous pay period | EXTRA TIME |

Use before annual or sick | Annual | Sick | Other | Holiday | All leave must have prior approval. | ||||||||||||||||||

| DAY | DATE | IN | OUT | IN | OUT | TOTAL | Earned | Taken | Taken | Taken | Taken | ||||||||||||||

| Sun | 16 | 0.00 | TOTAL SPLIT WEEK HOURS |

||||||||||||||||||||||

| Mon | 17 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Tue | 18 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Wed | 19 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Thu | 20 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Fri | 21 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Sat | 22 | 0.00 | |||||||||||||||||||||||

| Weekly Total: | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | CHECK | |||||||||||||

| Sun | 23 | 0.00 | TOTAL SALARIED HOURS | ||||||||||||||||||||||

| Mon | 24 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Tue | 25 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Wed | 26 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Thu | 27 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Fri | 28 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Sat | 29 | 0.00 | |||||||||||||||||||||||

| Weekly Total: | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | CHECK | |||||||||||||

| Sun | 30 | 0.00 | TOTAL SALARIED HOURS | ||||||||||||||||||||||

| Mon | 31 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Tue | 1 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Wed | 2 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Thu | 3 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Fri | 4 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Sat | 5 | 0.00 | |||||||||||||||||||||||

| Weekly Total: | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | CHECK | |||||||||||||

| Sun | 6 | 0.00 | TOTAL SALARIED HOURS | ||||||||||||||||||||||

| Mon | 7 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Tue | 8 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Wed | 9 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Thu | 10 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Fri | 11 | 0.00 | 7.50 | Veteran’s Day | |||||||||||||||||||||

| Sat | 12 | 0.00 | |||||||||||||||||||||||

| Weekly Total: | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 7.50 | 7.50 | 0.00 | 0.00 | 7.50 | CHECK | |||||||||||||

| Sun | 13 | 0.00 | TOTAL SALARIED HOURS | ||||||||||||||||||||||

| Mon | 14 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Tue | 15 | 12:00 AM | 12:00 AM | 12:00 AM | 12:00 AM | 0.00 | |||||||||||||||||||

| Split Week Total: | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | CHECK | ||||||||||||||

| Monthly Total: | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 7.50 | 7.50 | 0.00 | 0.00 | 7.50 | CHECK | |||||||||||||

| ON-CALL SECTION | LEAVE ACCRUALS | FMLA (Count down from 450 hours) | |||||||||||||||||||||||

| Total Hours | Add to Comp | Pay Out |

COMP | ANNUAL | SICK | Previous Balance or Starting Balance > | 0.00 | ||||||||||||||||||

| 0.00 | Previous Balance: | 0.00 | 0.00 | 0.00 | Time Used > | 0.00 | |||||||||||||||||||

| Total hours will calculate based on data in column "D". Employee must assign hours to either "Add to Comp" or "Pay Out". |

Time Earned: | 0.00 | 7.50 | 7.50 | FMLA Balance Forward: | 0.00 | |||||||||||||||||||

| DATE | HOURS | Time Used: | 0.00 | 0.00 | 0.00 | ||||||||||||||||||||

| Time Donated > | Recipient Name > | ||||||||||||||||||||||||

| Time Rec'd/Transferred In > | |||||||||||||||||||||||||

| Balance Forward: | 0.00 | 7.50 | 7.50 | ||||||||||||||||||||||

| Date | Employee Signature (Certfies this is a true & accurate statement of hours worked and leave taken) | ||||||||||||||||||||||||

| Date | Supervisor Signature (Certifies that employee's form is complete & accurate) | ||||||||||||||||||||||||

no reviews yet

Please Login to review.