279x Filetype XLSX File size 0.03 MB Source: www.dhltaiwanconnects.com

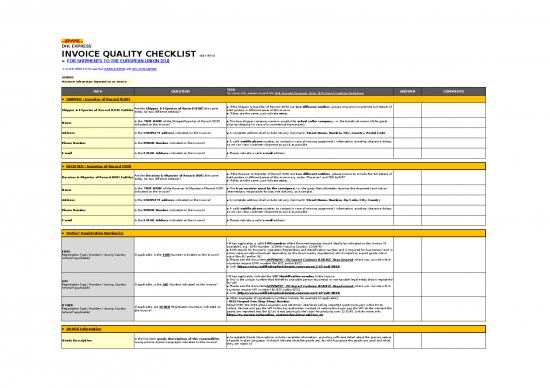

DHL EXPRESS

INVOICE QUALITY CHECKLIST (KEY INFO)

► FOR SHIPMENTS TO THE EUROPEAN UNION (EU)

◄ CLICK HERE (+) to see the INSTRUCTIONS and DHL DISCLAIMER

LEGEND

Minimum Information Expected on an Invoice

INFO QUESTION TIPS ANSWER COMMENTS

For more info, please consult the DHL Express European Union (EU) Import Customs Guidelines

► SHIPPER / Exporter of Record (EOR)

Are the Shipper & EXporter of Record (EOR) the same ▪ If the Shipper & Exporter of Record (EOR) are two different entities, please ensure to include the full details of

Shipper & EXporter of Record (EOR) Entities entity (or two different entities)? both parties in different areas of the invoice.

▪ If they are the same, just indicate once.

Name Is the TRUE NAME of the Shipper/Exporter of Record (EOR) ▪ The true shipper company name is usually the actual seller company, i.e. the beneficial owner of the goods

indicated on the Invoice? prior to shipping (in case of a commercial transaction).

Address Is the COMPLETE address indicated on the Invoice? ▪ A complete address shall include (at very minimum): Street Name, Number, City, Country, Postal Code

Phone Number Is the PHONE Number indicated on the Invoice? ▪ A valid mobile phone number, to contact in case of missing paperwork / information, avoiding clearance delays

so we can clear customer shipment as quick as possible.

E-mail Is the E-MAIL Address indicated on the Invoice? ▪ Please indicate a valid e-mail address.

. . . . .

► RECEIVER / Importer of Record (IOR)

Are the Receiver & IMporter of Record (IOR) the same ▪ If the Receiver & IMporter of Record (IOR) are two different entities, please ensure to include the full details of

Receiver & IMporter of Record (IOR) Entities entity (or two different entities)? both parties in different areas of the invoice e.g. under "Receiver" and "Bill to/IOR".

▪ If they are the same, just indicate once.

Name Is the TRUE NAME of the Receiver & IMporter of Record (IOR) ▪ The true receiver must be the consignee, i.e. the party that ultimately receives the shipment (and not an

indicated on the Invoice? intermediary responsible for last mile delivery, as example).

Address Is the COMPLETE address indicated on the Invoice? ▪ A complete address shall include (at very minimum): Street Name, Number, Zip Code, City, Country

Phone Number Is the PHONE Number indicated on the Invoice? ▪ A valid mobile phone number, to contact in case of missing paperwork / information, avoiding clearance delays

so we can clear customer shipment as quick as possible.

E-mail Is the E-MAIL Address indicated on the Invoice? ▪ Please indicate a valid e-mail address.

. . . . .

► Parties’ Registration Number(s)

▪ When applicable, a valid EORI number of the Receiver/Importer should ideally be indicated on the Invoice (if

available), e.g.: EORI Number: 123456 / Issuing Country: COUNTRY

EORI ▪ EORI stands for Economic Operators Registration and Identification number and is required for businesses (and in

Registration Type / Number / Issuing Country If applicable, is the EORI Number indicated on the Invoice? some cases private individuals depending on the local country regulations) which import or export goods into or

(when/if applicable) out of the EU and/or UK.

▪ Please see the document APPENDIX - EU Import Customs B2B/B2C Requirement where you can see which

countries require EORI number (for B2C and/or B2C).

▪ Link: https://www.certifiedreplenishment.com/course/2-22-exit-3843/

▪ When applicable, indicate the VAT identification number in the Invoice.

VAT ▪ This is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered

Registration Type / Number / Issuing Country If applicable, is the VAT Number indicated on the Invoice? for VAT.

(when/if applicable) ▪ Please see the document APPENDIX - EU Import Customs B2B/B2C Requirement where you can see which

countries require VAT number (for B2C and/or B2C).

▪ Link: https://www.certifiedreplenishment.com/course/2-22-exit-3843/

▪ Other examples of registration numbers include, for example (if applicable):

- IOSS (Import One-Stop Shop) Number

OTHER About IOSS: the IOSS allows suppliers and electronic interfaces selling imported goods to buyers in the EU to

Registration Type / Number / Issuing Country If applicable, are OTHER Registration Numbers indicated on collect, declare and pay the VAT to the tax authorities, instead of making the buyer pay the VAT at the moment the

(when/if applicable) the Invoice? goods are imported into the EU as it was previously the case (for products over 22 EUR). Link for more info:

https://ec.europa.eu/taxation_customs/business/vat/ioss_en

. . . . .

► GOODS Information

Is the line item goods descriptions of the commodities ▪ Acceptable Goods Descriptions include complete information, providing sufficient detail about the precise nature

Goods Description (using precise & plain language) indicated on the Invoice? of goods in plain language. It should indicate what the goods are, for which purpose the goods are used and what

they are made of.

HS Code for Export / Import Is the line item HS Codes (preferably the complete Import ▪ In the European Union (EU), please refer to TARIC (the Integrated Tariff of the European Union) - please provide

(Full Import HS Code preferred) tariff code) indicated on the Invoice? the Line Item HS Code (preferably the complete Import tariff codes).

▪ Link to TARIC: https://ec.europa.eu/taxation_customs/dds2/taric/taric_consultation.jsp?Lang=en

▪ The Country of Origin is the country in which the goods have been produced or manufactured, according to the

criteria laid down for the purposes of application of the Customs tariff, of quantitative restrictions or of any other

Country of Origin Is the line item Country of Origin indicated on the Invoice? measure related to trade.

▪ Please consider that for application of tariff preferences indication of origin on the invoice is not sufficient, the

country of origin must be proven (e.g. declaration on origin).

. . . . .

► VALUE Information

▪ Invoice (Commercial or Pro Forma) values must be compliant with WTO Customs Valuation rules.

▪ Typically, the value of goods reflect the transaction value of the goods, i.e. purchasing price of the goods

PAID or PAYABLE between a buyer and seller. 0/zero values are not acceptable.

▪ The goods values in the Invoice and Waybill must be reconcilable, as well as the Proof of Purchase (when/if

requested by Customs Authorities to compare the price paid by the buyer vs. Invoice).

Goods Value Is the line item breakdown of the value of goods indicated on ▪ For example: in order to validate the goods value, please check the website of the seller of goods, and compare

the Invoice? the declared value on the Invoice versus the product price on the website.

→ IMPORTANT: Undervaluation of goods (to avoid duties/taxes payment) is a tax evasion crime,

therefore not acceptable.

▪ In case of a DDP Invoice, please include the pre-calculated Import Customs Duties & Taxes

In the case of a DDP Invoice, is the pre-calculated Import itemized/separately (and not summed-up as part of the Goods Value), to provide transparency to Customs

Duties & Taxes Duties & Taxes itemized (and not summed-up as part of the Authorities when/ if required.

(when/if applicable) Goods Value) indicated on the Invoice? ▪ Please note that deductibility may be subject to local conditions such as tax registration, and accuracy of the pre-

calculated Duties & Taxes.

▪ Please also include the additional cost elements, if applicable, which are part of the Customs Value, i.e.:

Other Values Are there OTHER applicable cost elements (e.g. insurance, Insurance, Freight Charge, Other Costs, e.g. Royalty Payments

(when/if applicable) freight charge, etc.) indicated on the Invoice? ▪ Please ensure that the other values indicated in the invoice are aligned with INCOTERMS® (e.g. freight charge,

insurance, etc.).

Currency Is the currency in which the transaction occurred indicated on ▪ Indicate the currency code, e.g. USD (US Dollars), EUR (Euros), etc.

the Invoice?

. . . . .

► QUANTITY & WEIGHT Information

Quantity Is the line item quantity (e.g. 2 items) indicated on the ▪ This information is essential, and a legal requirement for security filing.

Invoice? ▪ Indicate the quantity on Invoice line item.

Weight / Unit of Measure Is the gross/net weight and unit of measure (e.g. KG) ▪ This information is essential, and a legal requirement for security filing.

indicated on the Invoice?

. . . . .

► OTHER Invoice Information (Non-Exhaustive)

▪ INCOTERMS® are trade terms defined between the Buyer & Seller of the goods.

▪ INCOTERMS® and DHL Billing Services are two independent topics which should not be confused.

INCOTERMS® & Place Is the INCOTERMS® & place (as required under the ▪ Please see the DHL Express European Union (EU) Import Customs Guidelines for more info.

applicable term) indicated on the Invoice? ▪ Please mention the INCOTERMS® in the Invoice only once (and do not refer to multiple terms in the same

invoice), and please ensure that the values indicated in the invoice are aligned with INCOTERMS® (e.g. freight

charge, insurance, etc.)

Reason for Export Is the Reason of Export indicated on the Invoice? ▪ Please indicate the reason for export, e.g. permanent, repair & return, temporary, gifts.

(if different than 'permanent') ▪ If no reason for export indicated, DHL will default to 'permanent'.

Export and/or Import Licence Number If applicable ins the Export and/or Import Licence Number ▪ Export Licence Number: if goods require an Export Licence, the number must be inserted.

(when/if applicable) indicated on the Invoice? ▪ Import Licence Number: if applicable, and if this information is available from the Importer, the details must be

added as it will help with the clearance process.

▪ Preferential origin is conferred on goods from particular countries, which have fulfilled certain criteria, and

confers certain tariff benefits (entry at a reduced or zero rate of duty) on goods traded between countries which

have agreed such an arrangement or where one side has granted it autonomously. The EU-UK Trade & Cooperation

If applicable, is the Proof of Origin statement indicated on Agreement is one example.

Proof of Origin Statement the Invoice (to qualify for preferential customs duty rates) or ▪ Please note that it is the exporter’s responsibility to determine the Country of Origin of goods accurately and

(when/if applicable) other Proof of Origin document is attached to the provide the relevant paperwork to DHL if the goods qualify for Preferential Duty.

paperwork? ▪ Origin Statements have to be mentioned - preferably in BOLD letters - below the list of items (and not on a

separate page/packing list).

▪ In case Certificates of Origin/other proof of origins are required (e.g.EUR1) please ensure to include them to the

paperwork.

Invoice Reference: Date & Number Is the Invoice Date & Invoice Identification Number ▪ This is Legally required for a compliant customs declaration.

indicated on the Invoice?

IMPORTANT

▪ Hand-written invoices are NOT acceptable

▪ Providing your Commercial invoice document and data electronically to DHL, together with the shipment

data, enables the customs clearance process to start immediately from the moment the data is available,

resulting in a fast customs clearance process.

no reviews yet

Please Login to review.