309x Filetype XLSX File size 0.03 MB Source: d22bbllmj4tvv8.cloudfront.net

Sheet 1: Summary

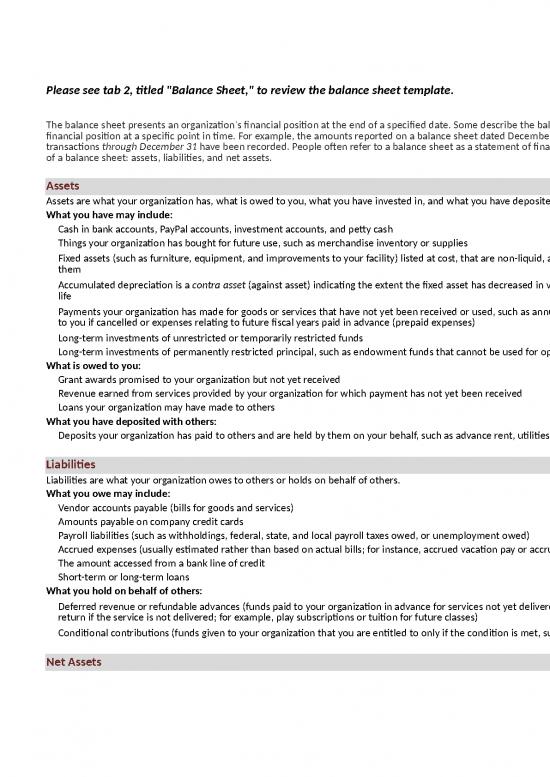

| Please see tab 2, titled "Balance Sheet," to review the balance sheet template. |

| The balance sheet presents an organization's financial position at the end of a specified date. Some describe the balance sheet as a snapshot of the organization's financial position at a specific point in time. For example, the amounts reported on a balance sheet dated December 31, 2021, should reflect that instant when all transactions through December 31 have been recorded. People often refer to a balance sheet as a statement of financial position. There are three main components of a balance sheet: assets, liabilities, and net assets. |

| Assets |

| Assets are what your organization has, what is owed to you, what you have invested in, and what you have deposited with others. |

| What you have may include: |

| Cash in bank accounts, PayPal accounts, investment accounts, and petty cash |

| Things your organization has bought for future use, such as merchandise inventory or supplies |

| Fixed assets (such as furniture, equipment, and improvements to your facility) listed at cost, that are non-liquid, as the cash has already been spent to acquire them |

| Accumulated depreciation is a contra asset (against asset) indicating the extent the fixed asset has decreased in value as it is used up (depreciated) over its useful life |

| Payments your organization has made for goods or services that have not yet been received or used, such as annual insurance premiums that could be refunded to you if cancelled or expenses relating to future fiscal years paid in advance (prepaid expenses) |

| Long-term investments of unrestricted or temporarily restricted funds |

| Long-term investments of permanently restricted principal, such as endowment funds that cannot be used for operations |

| What is owed to you: |

| Grant awards promised to your organization but not yet received |

| Revenue earned from services provided by your organization for which payment has not yet been received |

| Loans your organization may have made to others |

| What you have deposited with others: |

| Deposits your organization has paid to others and are held by them on your behalf, such as advance rent, utilities security deposits, and payroll bonds |

| Liabilities |

| Liabilities are what your organization owes to others or holds on behalf of others. |

| What you owe may include: |

| Vendor accounts payable (bills for goods and services) |

| Amounts payable on company credit cards |

| Payroll liabilities (such as withholdings, federal, state, and local payroll taxes owed, or unemployment owed) |

| Accrued expenses (usually estimated rather than based on actual bills; for instance, accrued vacation pay or accrued interest) |

| The amount accessed from a bank line of credit |

| Short-term or long-term loans |

| What you hold on behalf of others: |

| Deferred revenue or refundable advances (funds paid to your organization in advance for services not yet delivered that your organization would be liable to return if the service is not delivered; for example, play subscriptions or tuition for future classes) |

| Conditional contributions (funds given to your organization that you are entitled to only if the condition is met, such as a matching grant) |

| Net Assets |

| The net assets of a nonprofit organization are equivalent to the net worth of the organization. Net assets can be liquid (such as cash and short-term receivables), fixed (such as furniture, fixtures, equipment, inventories, and land and buildings net of long-term debt), or long-term. Generally accepted accounting principles (GAAP) call for an organization’s net assets to be classified as unrestricted (UR), temporarily restricted (TR), or permanently restricted (PR). Small and midsize nonprofit organizations usually do not have PR net assets (such as endowments), which are typically unadvisable because they tie up a lot of cash the organization then cannot use for operations or program delivery. It is far more advisable for small and midsize nonprofits to build a working capital or operating cash reserve fund before attempting to create an endowment. If a small or midsize nonprofit does have PR net assets, such as an endowment, these net assets usually comprise long-term investments and are not considered liquid. TR net assets comprise contributions received or promised to the organization that carry a donor-imposed restriction as to when (time restriction) or for what purpose (purpose restriction) the funds can be used. Funds that are “carried over” to the subsequent fiscal year for either restriction are shown as TR net assets. All net assets that are not PR or TR are Unrestricted (UR) and can be used by the organization as its board sees fit. It is useful, at least for internal financial management purposes, to separate liquid from non-liquid UR net assets to have a better idea of the organization’s liquidity, the financial resources it can use for day-to-day transactions. |

no reviews yet

Please Login to review.