163x Filetype PDF File size 0.11 MB Source: www.iam.uni-bonn.de

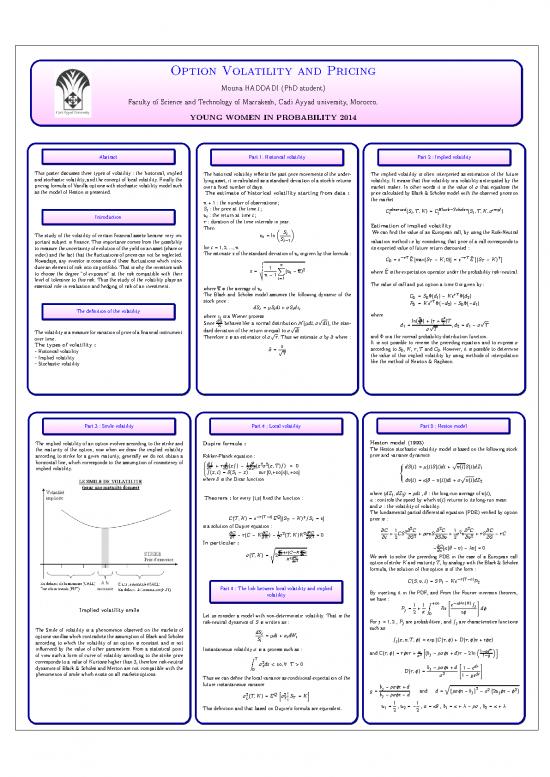

Option Volatility and Pricing

Mouna HADDADI (PhD student)

Faculty of Science and Technology of Marrakesh, Cadi Ayyad university, Morocco.

YOUNGWOMENINPROBABILITY2014

Abstract Part 1. Historical volatility Part 2 : Implied volatility

This poster discusses three types of volatility : the historical, implied Thehistorical volatility reflects the past price movements of the under- The implied volatility is often interpreted as estimation of the future

and stochastic volatility, and the concept of local volatility. Finally the lying asset, it is calculated as a standard deviation of a stock’s returns volatility. It means that this volatility is a volatility anticipated by the

pricing formula of Vanilla options with stochastic volatility model such over a fixed number of days. market maker. In other words it is the value of σ that equalizes the

as the model of Heston is presented. The estimate of historical volatility starting from data : price calculated by Black & Scholes model with the observed prices on

n+1:thenumberof observations; the market

S : the price at the time t; observed Black−Scholes impl

t C (S ;T;K) = C (S ;T;K;σ )

u : the return at time t; t t t t

Introduction t

τ : duration of the time intervals in year.

Then Estimation of implied volatility

S Wecan find the value of an European call, by using the Risk-Neutral

The study of the volatility of certain financial assets became very im- u =ln t

t S

portant subject in finance. This importance comes from the possibility t−1 valuation method i.e by considering that price of a call corresponds to

to measuretheuncertaintyofevolutionoftheyieldonanasset(shareor for t = 1;2;:::;n its expected value of future return discounted :

Theestimate s of the standard deviation of u is given by this formula :

index) and the fact that the fluctuations of prices can not be neglected. t −rT b −rT b +

C0 = e E[max(S −K;0)]=e E (S −K)

Nowadays, any investor is conscious of these fluctuations which intro- v T T

u n

duce an element of risk into its portfolio. That is why the investors wish u 1 X 2

s = t (u −u) b

to choose the degree ”of exposure” at the risk compatible with their n−1 t where E is the expectation operator under the probability risk–neutral.

level of tolerance to this risk. Thus the study of the volatility plays an t=1

essential role in evaluation and hedging of risk of an investment. where u is the average of u The value of call and put option a time 0 is given by :

t

The Black and Scholes model assumes the following dynamic of the C = S Φ(d )−KerTΦ(d )

0 0 1 2

stock price : P = KerTΦ(−d )−S Φ(−d )

dS =µSdt+σSdz 0 2 0 1

The definition of the volatility t t t t

where z is a Wiener process where

t √ S σ2

dS ln( 0) + (r + )T √

Since t behaves like a normal distribution N(µdt;σ dt), the stan- d = K √ 2 ,d =d −σ T

St √ 1 2 1

Thevolatilityisameasureforvariationofpriceofafinancialinstrument dard deviation of the return is equal to σ dt σ T

over time. Therefore s is an estimator of σ√τ. Thus we estimate σ by σb where : and Φ is a the normal probability distribution function.

The types of volatility : s It is not possible to reverse the preceding equation and to express σ

σb = √ according to S , K, r, T and C . However, it is possible to determine

–Historical volatility τ 0 0

–Implied volatility the value of this implied volatility by using methods of interpolation

–Stochastic volatility like the method of Newton & Raphson.

Part 3 : Smile volatility Part 4 : Local volatility Part 5 : Heston model

The implied volatility of an option evolves according to the strike and Dupire formula : Heston model (1993)

the maturity of the option, now when we draw the implied volatility The Heston stochastic volatility model is based on the following stock

according to strike for a given maturity, generally we do not obtain a Fokker-Planck equation : price and variance dynamics

horizontal line, which corresponds to the assumption of consistency of (∂f + r ∂ (xf) − 1 ∂2 (x2σ2(x;T)f) = 0 dS(t) = µ(t)S(t)dt+pv(t)S(t)dZ

implied volatility. ∂T ∂x 2∂x2 1

f(x;t) = δ(S −x) sur [0,+∞]x[t,+∞]

t p

where δ is the Dirac function dv(t) = κ(θ −v(t))dt +σ v(t)dZ

2

where hdZ ;dZ i = ρdt , θ : the long-run average of v(t),

Theorem : for every (t,s) fixed the function : 1 2

κ : controls the speed by which v(t) returns to its long-run mean

and σ : the volatility of volatility.

Thefundamental partial differential equation (PDE) verified by option

−r(T−t) Q +

C(T;K)=e E [(S −K) =S =s] price is :

T t

is a solution of Dupire equation : ∂C 1 ∂2C ∂2C 1 ∂2C ∂C

∂C ∂C 1 2 2∂2C + CS2 +ρσvS + σ2v +rS −rC

∂T −r(C −K∂K)−2σ (T;K)K ∂K2 =0 ∂t 2 ∂S2 ∂S∂v 2 ∂v2 ∂S

In particular : s ∂C

∂C+r(C−K∂C) −∂v[κ(θ−v)−λv]=0

σ(T;K) = 2∂T ∂K

K2∂2C We seek to solve the preceding PDE in the case of a European call

∂K2 option of strike K and maturity T, by analogy with the Black & Scholes

formula, the solution of this option is of the form :

C(S;v;t) = SP −Ke−r(T−t)P

1 2

Part 4 : The link between local volatility and implied

volatility By injecting it in the PDF, and From the Fourier inversion theorem,

we have : Z " #

P =1+1 +∞Re e−iφln(K)fj dφ

Implied volatility smile j 2 π iφ

Let us consider a model with non-deterministic volatility. That is the 0

risk-neutral dynamics of S is written as : For j = 1;2 , P are probabilities , and f are characteristics functions

j j

The Smile of volatility is a phenomenon observed on the markets of such as

dS

options vanillas which contradicts the assumption of Black and Scholes t = µdt +σ dW

S t t f (x;v;T;φ) = exp(C(τ;φ)+D(τ;φ)v +iφx)

according to which the volatility of an option is constant and is not t j

influenced by the value of other parameters. From a statistical point Instantaneous volatility σ is a process such as : h dri

and C(τ;φ) = rφiτ + a (b −ρσφi+d)τ −2ln 1−ge

of view such a form of curve of volatility according to the strike price Z σ2 j 1−g

corresponds to a value of Kurtosis higher than 3, therefore risk-neutral T

σ2ds < ∞;∀ T > 0 " #

dynamics of Black & Scholes and Merton are not compatible with the s bj −ρσφi+d 1−edr

0 D(τ;φ) =

phenomenon of smile which exists on all markets options. σ2 1−gedr

Thus we can define the local variance as conditional expectation of the

future instantaneous variance bj −ρσφi+d q� �

h

i g = and d = ρσφi−b 2−σ2 2u φi−φ2

2 Q 2

b −ρσφi−d j j

σ (T;K) = E σ

S =K j

L T T

u = 1 , u = −1 , a = κθ , b = κ+λ−ρσ , b = κ+λ

This definition and that based on Dupire’s formula are equivalent. 1 2 2 2 1 2

no reviews yet

Please Login to review.