241x Filetype XLS File size 0.07 MB Source: www.prosolution.com.au

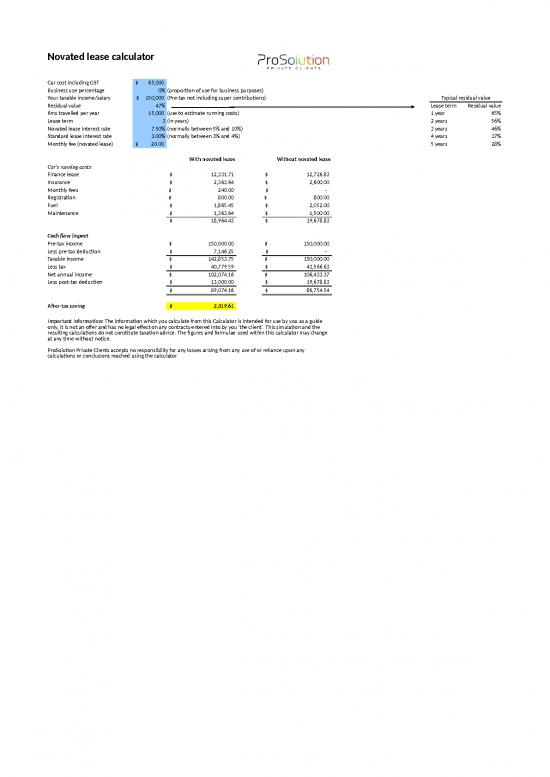

Novated lease calculator

Car cost including GST $ 65,000 59,091

Business use percentage 0% (proportion of use for business purposes) 59,091

Your taxable income/salary $ 150,000 (Pre-tax not including super contributions) Typical residual value

Residual value 47% Lease term Residual value

Kms travelled per year 15,000 (use to estimate running costs) 1 year 65%

Lease term 3 (in years) 2 years 56%

Novated lease interest rate 7.50% (normally between 5% and 10%) 3 years 46%

Standard lease interest rate 3.00% (normally between 3% and 4%) 4 years 37%

Monthly fee (novated lease) $ 20.00 5 years 28%

With novated lease Without novated lease

Car's running costs

Finance lease $ 12,331.71 $ 12,726.83

Insurance $ 2,363.64 $ 2,600.00

Monthly fees $ 240.00 $ -

Registration $ 800.00 $ 800.00

Fuel $ 1,865.45 $ 2,052.00

Maintenance $ 1,363.64 $ 1,500.00

$ 18,964.43 $ 19,678.83

Cash flow impact

Pre-tax income $ 150,000.00 $ 150,000.00

Less pre-tax deduction $ 7,146.25 $ -

Taxable income $ 142,853.75 $ 150,000.00

Less tax $ 40,779.59 $ 43,566.63

Net annual income $ 102,074.16 $ 106,433.37

Less post-tax deduction $ 13,000.00 $ 19,678.83

$ 89,074.16 $ 86,754.54

After-tax saving $ 2,319.61

Important information: The information which you calculate from this Calculator is intended for use by you as a guide

only, it is not an offer and has no legal effect on any contracts entered into by you 'the client'. This simulation and the

resulting calculations do not constitute taxation advice. The figures and formulae used within this calculator may change

at any time without notice.

ProSolution Private Clients accepts no responsibility for any losses arising from any use of or reliance upon any

calculations or conclusions reached using the calculator.

no reviews yet

Please Login to review.