261x Filetype XLSX File size 0.06 MB Source: www.frcs.org.fj

Sheet 1: Weekly

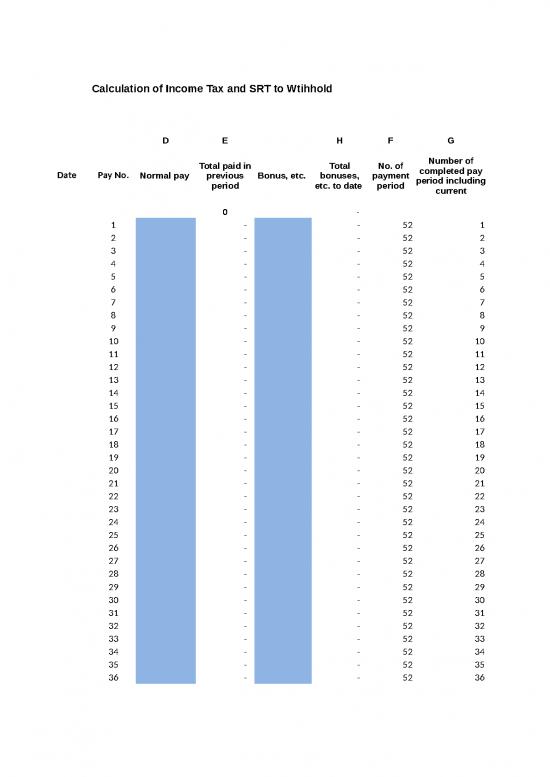

| Calculation of Income Tax and SRT to Wtihhold | |||||||||||||||||||||||||||||

| D | E | H | F | G | C1 | C2 | A1 | A2 | B1 | B2 | |||||||||||||||||||

| Date | Pay No. | Normal pay | Total paid in previous period | Bonus, etc. | Total bonuses, etc. to date | No. of payment period | Number of completed pay period including current | Annual income (normal) |

Annual income (normal plus bonus) |

Total tax on C1 | Tax withheld to date | Tax to withhold | Actual tax to withhold | FNPF deduction | Net salary | ||||||||||||||

| Income Tax | SRT | ECAL | Total | Income Tax | SRT | ECAL | Total | Income Tax | SRT | ECAL | Total | Income Tax | SRT | ECAL | Total | ||||||||||||||

| 0 | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||

| 1 | - | - | 52 | 1 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||

| 2 | - | - | 52 | 2 | - | - | - | - | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 3 | - | - | 52 | 3 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 4 | - | - | 52 | 4 | - | - | - | - | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 5 | - | - | 52 | 5 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 6 | - | - | 52 | 6 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 7 | - | - | 52 | 7 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 8 | - | - | 52 | 8 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 9 | - | - | 52 | 9 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 10 | - | - | 52 | 10 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 11 | - | - | 52 | 11 | - | - | - | - | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 12 | - | - | 52 | 12 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 13 | - | - | 52 | 13 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 14 | - | - | 52 | 14 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 15 | - | - | 52 | 15 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 16 | - | - | 52 | 16 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 17 | - | - | 52 | 17 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 18 | - | - | 52 | 18 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 19 | - | - | 52 | 19 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 20 | - | - | 52 | 20 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | - | #NAME? | #NAME? | |||||

| 21 | - | - | 52 | 21 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 22 | - | - | 52 | 22 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 23 | - | - | 52 | 23 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 24 | - | - | 52 | 24 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 25 | - | - | 52 | 25 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 26 | - | - | 52 | 26 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 27 | - | - | 52 | 27 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 28 | - | - | 52 | 28 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 29 | - | - | 52 | 29 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 30 | - | - | 52 | 30 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 31 | - | - | 52 | 31 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 32 | - | - | 52 | 32 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 33 | - | - | 52 | 33 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 34 | - | - | 52 | 34 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 35 | - | - | 52 | 35 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 36 | - | - | 52 | 36 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 37 | - | - | 52 | 37 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 38 | - | - | 52 | 38 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 39 | - | - | 52 | 39 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 40 | - | - | 52 | 40 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 41 | - | - | 52 | 41 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 42 | - | - | 52 | 42 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 43 | - | - | 52 | 43 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 44 | - | - | 52 | 44 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 45 | - | - | 52 | 45 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 46 | - | - | 52 | 46 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 47 | - | - | 52 | 47 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 48 | - | - | 52 | 48 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 49 | - | - | 52 | 49 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | - | - | - | - | - | - | - | - | #NAME? | #NAME? | |||||

| 50 | - | - | 52 | 50 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | - | - | - | - | - | - | - | - | #NAME? | #NAME? | |||||

| 51 | - | - | 52 | 51 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | - | - | - | - | - | - | - | - | #NAME? | #NAME? | |||||

| 52 | - | - | 52 | 52 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | - | - | - | - | - | - | - | - | #NAME? | #NAME? | |||||

| - | - | - | - | - | - | - | - | ||||||||||||||||||||||

| Gross emoluments including bonuses | - | ||||||||||||||||||||||||||||

| Total tax fpr the year | - | - | - | - | |||||||||||||||||||||||||

| Excess tax deducted | - | - | - | - | |||||||||||||||||||||||||

| [A1 / F x G] - B1 + income tax on C2 - income tax on C1 [if result < 0, then tax to be withhold = 0] | |||||||||||||||||||||||||||||

| [A2 / F x G] - B2 [if result < 0, then tax to be withhold = 0] | |||||||||||||||||||||||||||||

| Income tax payable on C1 | |||||||||||||||||||||||||||||

| SRT payable on C2 | |||||||||||||||||||||||||||||

| Income tax withheld to date | |||||||||||||||||||||||||||||

| SRT withheld to date | |||||||||||||||||||||||||||||

| Number of payment periods in the tax year | |||||||||||||||||||||||||||||

| Number of completed pay periods including current period | |||||||||||||||||||||||||||||

| Tax withheld to date | |||||||||||||||||||||||||||||

| [D x (F - G + 1)] + E [however, if the pay period is the same as the previous, then C1 = C1 in the previous pay period] | |||||||||||||||||||||||||||||

| C1 + H | |||||||||||||||||||||||||||||

| Amount of employment income paid by the employer to the employee in the current payment period | |||||||||||||||||||||||||||||

| Total amount of employment income paid by the employer to the employee in the previous payment periods in the tax year | |||||||||||||||||||||||||||||

| Total bonuses paid to date including that paid in the current period | |||||||||||||||||||||||||||||

| Calculation of Income Tax and SRT to Wtihhold | |||||||||||||||||||||||||||||

| D | E | H | F | G | C1 | C2 | A1 | A2 | B1 | B2 | |||||||||||||||||||

| Date | Pay No. | Normal pay | Total paid in previous period | Bonus, etc. | Total bonuses, etc. to date | No. of payment period | Number of completed pay period including current | Annual income (normal) |

Annual income (normal plus bonus) |

Total tax on C1 | Tax withheld to date | Tax to withhold | Actual tax to withhold | FNPF deduction | Net salary | ||||||||||||||

| Income Tax | SRT | ECAL | Total | Income Tax | SRT | ECAL | Total | Income Tax | SRT | ECAL | Total | Income Tax | SRT | ECAL | Total | ||||||||||||||

| 0 | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||

| 1 | - | - | 26 | 1.00 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||

| 2 | - | - | 26 | 2.00 | - | - | - | - | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | |||||

| 3 | - | - | 26 | 3.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 4 | - | - | 26 | 4.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 5 | - | - | 26 | 5.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 6 | - | - | 26 | 6.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | - | #NAME? | #NAME? | |||||

| 7 | - | - | 26 | 7.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 8 | - | - | 26 | 8.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 9 | - | - | 26 | 9.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 10 | - | - | 26 | 10.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 11 | - | - | 26 | 11.00 | - | - | - | - | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 12 | - | - | 26 | 12.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 13 | - | - | 26 | 13.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 14 | - | - | 26 | 14.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 15 | - | - | 26 | 15.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 16 | - | - | 26 | 16.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 17 | - | - | 26 | 17.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 18 | - | - | 26 | 18.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 19 | - | - | 26 | 19.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 20 | - | - | 26 | 20.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 21 | - | - | 26 | 21.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 22 | - | - | 26 | 22.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 23 | - | - | 26 | 23.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 24 | - | - | 26 | 24.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 25 | - | - | 26 | 25.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 26 | - | - | 26 | 26.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| - | - | - | - | - | - | - | - | ||||||||||||||||||||||

| Gross emoluments including bonuses | - | ||||||||||||||||||||||||||||

| Total tax fpr the year | - | - | - | - | |||||||||||||||||||||||||

| Excess tax deducted | - | - | - | - | |||||||||||||||||||||||||

| Income tax to withhold = | [A1 / F x G] - B1 + income tax on C2 - income tax on C1 [if result < 0, then tax to be withhold = 0] | ||||||||||||||||||||||||||||

| SRT to withhold = | [A2 / F x G] - B2 [if result < 0, then tax to be withhold = 0] | ||||||||||||||||||||||||||||

| A1 = | Income tax payable on C1 | ||||||||||||||||||||||||||||

| A2 = | SRT payable on C2 | ||||||||||||||||||||||||||||

| B1 = | Income tax withheld to date | ||||||||||||||||||||||||||||

| B2 = | SRT withheld to date | ||||||||||||||||||||||||||||

| F = | Number of payment periods in the tax year | ||||||||||||||||||||||||||||

| G = | Number of completed pay periods including current period | ||||||||||||||||||||||||||||

| B = | Tax withheld to date | ||||||||||||||||||||||||||||

| C1 = | [D x (F - G + 1)] + E [however, if the pay period is the same as the previous, then C1 = C1 in the previous pay period] | ||||||||||||||||||||||||||||

| C2 = | C1 + H | ||||||||||||||||||||||||||||

| D = | Amount of employment income paid by the employer to the employee in the current payment period | ||||||||||||||||||||||||||||

| E = | Total amount of employment income paid by the employer to the employee in the previous payment periods in the tax year | ||||||||||||||||||||||||||||

| H = | Total bonuses paid to date including that paid in the current period | ||||||||||||||||||||||||||||

| Calculation of Income Tax and SRT to Wtihhold | |||||||||||||||||||||||||||||

| D | E | H | F | G | C1 | C2 | A1 | A2 | B1 | B2 | |||||||||||||||||||

| Date | Pay No. | Normal pay | Total paid in previous period | Bonus, etc. | Total bonuses, etc. to date | No. of payment period | Number of completed pay period including current | Annual income (normal) |

Annual income (normal plus bonus) |

Total tax on C1 | Tax withheld to date | Tax to withhold | Actual tax to withhold | FNPF deduction | Net salary | ||||||||||||||

| Income Tax | SRT | ECAL | Total | Income Tax | SRT | ECAL | Total | Income Tax | SRT | ECAL | Total | Income Tax | SRT | ECAL | Total | ||||||||||||||

| 0 | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||

| 1 | - | - | - | 12 | 1.00 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | ||||

| 2 | - | - | - | 12 | 2.00 | - | - | - | - | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | ||||

| 3 | - | - | - | 12 | 3.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | ||||

| 4 | - | - | - | 12 | 4.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | ||||

| 5 | - | - | - | 12 | 5.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | ||||

| 6 | - | - | - | 12 | 6.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | ||||

| 7 | - | - | 12 | 7.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | |||||

| 8 | - | - | - | 12 | 8.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | ||||

| 9 | - | - | - | 12 | 9.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | ||||

| 10 | - | - | - | 12 | 10.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | ||||

| 11 | - | - | - | 12 | 11.00 | - | - | - | - | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | ||||

| 12 | - | - | - | 12 | 12.00 | - | - | - | - | - | - | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | - | - | #NAME? | #NAME? | #NAME? | ||||

| - | - | - | - | - | - | - | - | ||||||||||||||||||||||

| Gross emoluments including bonuses | - | ||||||||||||||||||||||||||||

| Total tax fpr the year | - | - | - | - | |||||||||||||||||||||||||

| Excess tax deducted | - | - | - | - | |||||||||||||||||||||||||

| Income tax to withhold = | [A1 / F x G] - B1 + income tax on C2 - income tax on C1 [if result < 0, then tax to be withhold = 0] | ||||||||||||||||||||||||||||

| SRT to withhold = | [A2 / F x G] - B2 [if result < 0, then tax to be withhold = 0] | ||||||||||||||||||||||||||||

| A1 = | Income tax payable on C1 | ||||||||||||||||||||||||||||

| A2 = | SRT payable on C2 | ||||||||||||||||||||||||||||

| B1 = | Income tax withheld to date | ||||||||||||||||||||||||||||

| B2 = | SRT withheld to date | ||||||||||||||||||||||||||||

| F = | Number of payment periods in the tax year | ||||||||||||||||||||||||||||

| G = | Number of completed pay periods including current period | ||||||||||||||||||||||||||||

| B = | Tax withheld to date | ||||||||||||||||||||||||||||

| C1 = | [D x (F - G + 1)] + E [however, if the pay period is the same as the previous, then C1 = C1 in the previous pay period] | ||||||||||||||||||||||||||||

| C2 = | C1 + H | ||||||||||||||||||||||||||||

| D = | Amount of employment income paid by the employer to the employee in the current payment period | ||||||||||||||||||||||||||||

| E = | Total amount of employment income paid by the employer to the employee in the previous payment periods in the tax year | ||||||||||||||||||||||||||||

| H = | Total bonuses paid to date including that paid in the current period | ||||||||||||||||||||||||||||

no reviews yet

Please Login to review.