321x Filetype XLSX File size 0.04 MB Source: www.byron.nsw.gov.au

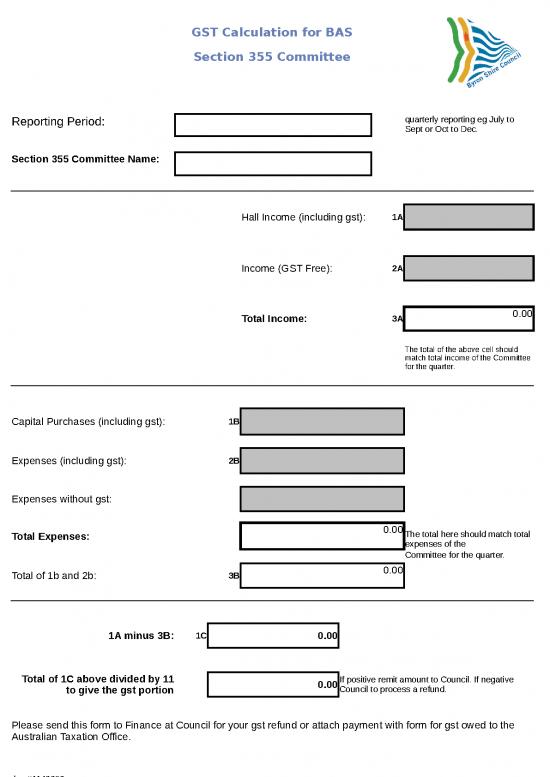

GST Calculation for BAS

Section 355 Committee

Reporting Period: quarterly reporting eg July to

Sept or Oct to Dec.

Section 355 Committee Name:

Hall Income (including gst): 1A

Income (GST Free): 2A

Total Income: 3A 0.00

The total of the above cell should

match total income of the Committee

for the quarter.

Capital Purchases (including gst): 1B

Expenses (including gst): 2B

Expenses without gst:

Total Expenses: 0.00The total here should match total

expenses of the

Committee for the quarter.

Total of 1b and 2b: 3B 0.00

1A minus 3B: 1C 0.00

Total of 1C above divided by 11 0.00If positive remit amount to Council. If negative

to give the gst portion Council to process a refund.

Please send this form to Finance at Council for your gst refund or attach payment with form for gst owed to the

Australian Taxation Office.

doc #1143359

no reviews yet

Please Login to review.