333x Filetype XLSX File size 0.03 MB Source: youtube-breakingintowallstreet-com.s3.amazonaws.com

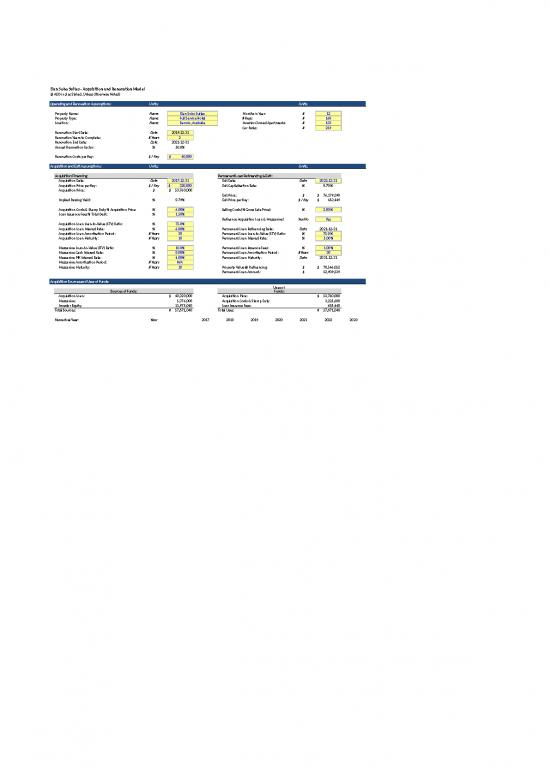

Elan Soho Suites - Acquisition and Renovation Model

($ AUD in $ as Stated, Unless Otherwise Noted)

Operating and Renovation Assumptions: Units: Units:

Property Name: Name Elan Soho Suites Months in Year: # 12

Property Type: Name Full Service Hotel # Keys: # 168

Location: Name Darwin, Australia Investor-Owned Apartments: # 133

Car Parks: # 259

Renovation Start Date: Date 2019-12-31

Renovation Years to Complete: # Years 2

Renovation End Date: Date 2021-12-31

Annual Renovation Factor: % 50.0%

Renovation Costs per Key: $ / Key $ 40,000

Acquisition and Exit Assumptions: Units: Units:

Acquisition Financing: Permanent Loan Refinancing & Exit:

Acquisition Date: Date 2017-12-31 Exit Date: Date 2022-12-31

Acquisition Price per Key: $ / Key $ 320,000 Exit Capitalisation Rate: % 8.70%

Acquisition Price: $ $ 53,760,000

Exit Price: $ $ 76,179,398

Implied Passing Yield: % 8.79% Exit Price per Key: $ / Key $ 453,449

Acquisition Costs & Stamp Duty % Acquisition Price: % 6.00% Selling Costs (% Gross Sale Price): % 2.00%

Loan Issuance Fees % Total Debt: % 1.50%

Refinance Acquisition Loan & Mezzanine? Yes/No Yes

Acquisition Loan Loan-to-Value (LTV) Ratio: % 75.0%

Acquisition Loan Interest Rate: % 6.00% Permanent Loan Refinancing Date: Date 2021-12-31

Acquisition Loan Amortisation Period: # Years 30 Permanent Loan Loan-to-Value (LTV) Ratio: % 75.0%

Acquisition Loan Maturity: # Years 10 Permanent Loan Interest Rate: % 5.00%

Mezzanine Loan-to-Value (LTV) Ratio: % 10.0% Permanent Loan Issuance Fees: % 1.00%

Mezzanine Cash Interest Rate: % 8.00% Permanent Loan Amortisation Period: # Years 30

Mezzanine PIK Interest Rate: % 4.00% Permanent Loan Maturity: Date 2031-12-31

Mezzanine Amortisation Period: # Years N/A

Mezzanine Maturity: # Years 10 Property Value @ Refinancing: $ $ 70,546,052

Permanent Loan Amount: $ 52,909,539

Acquisition Sources and Uses of Funds:

Uses of

Sources of Funds: Funds:

Acquisition Loan: $ 40,320,000 Acquisition Price: $ 53,760,000

Mezzanine: 5,376,000 Acquisition Costs & Stamp Duty: 3,225,600

Investor Equity: 11,975,040 Loan Issuance Fees: 685,440

Total Sources: $ 57,671,040 Total Uses: $ 57,671,040

Numerical Year: Year 2017 2018 2019 2020 2021 2022 2023

Historical: Projected: Stabilised:

Property Pro-Forma: Units: FY17 FY18 FY19 FY20 FY21 FY22 FY23

Revenue:

(+) Rooms: $ $ 9,657,900 $ 8,900,721 $ 8,480,409 $ 4,944,261 $ 5,489,793 $ 11,715,360 $ 12,219,565

(+) Food & Beverage: $ 1,149,750 1,136,873 1,138,452 621,504 664,281 1,403,962 1,464,386

(+) Telecommunications: $ 91,980 90,950 91,076 49,720 53,142 112,317 117,151

(+) Apartment Management Fees: $ 266,000 273,980 282,199 290,665 299,385 308,367 317,618

(+) Parking: $ 291,375 288,112 288,512 157,074 168,345 355,799 371,111

Total Revenue: $ 11,457,005 10,690,635 10,280,648 6,063,224 6,674,947 13,895,805 14,489,831

Departmental Expenses:

(-) Room Operating Expenses: $ (2,173,028) (1,993,761) (1,891,131) (1,097,626) (1,213,244) (2,577,379) (2,688,304)

(-) Food & Beverage: $ (862,313) (852,655) (853,839) (466,128) (498,211) (1,052,972) (1,098,289)

(-) Telecommunications: $ (275,940) (272,849) (273,228) (149,161) (159,427) (336,951) (351,453)

(-) Apartment Management Fees: $ (133,000) (136,990) (141,100) (145,333) (149,693) (154,183) (158,809)

(-) Parking: $ (201,049) (198,797) (199,073) (108,381) (116,158) (245,501) (256,067)

Total Departmental Expenses: $ (3,645,329) (3,455,052) (3,358,371) (1,966,628) (2,136,733) (4,366,986) (4,552,922)

Gross Operating Income: $ 7,811,676 7,235,582 6,922,277 4,096,596 4,538,213 9,528,818 9,936,909

Gross Operating Margin: % 68.2% 67.7% 67.3% 67.6% 68.0% 68.6% 68.6%

Undistributed Expenses:

(-) Administrative & General (A&G): $ (572,850) (534,532) (514,032) (303,161) (333,747) (694,790) (724,492)

(-) Sales & Marketing (S&M): $ (801,990) (748,344) (719,645) (424,426) (467,246) (972,706) (1,014,288)

(-) Repairs & Maintenance (R&M): $ (400,995) (374,172) (359,823) (212,213) (233,623) (486,353) (507,144)

(-) Management Fees: $ (343,710) (320,719) (308,419) (181,897) (200,248) (416,874) (434,695)

(-) Utilities: $ (91,980) (90,950) (91,076) (49,720) (53,142) (112,317) (117,151)

Total Undistributed Expenses: $ (2,211,526) (2,068,717) (1,992,996) (1,171,417) (1,288,008) (2,683,041) (2,797,770)

House Profit: $ 5,600,150 5,166,865 4,929,281 2,925,179 3,250,206 6,845,778 7,139,140

House Profit Margin: % 48.9% 48.3% 47.9% 48.2% 48.7% 49.3% 49.3%

Fixed Expenses:

(-) Insurance: $ (75,600) (77,868) (80,204) (82,610) (85,088) (87,641) (90,270)

(-) Property Taxes: $ - - - - - - -

(-) Renewal & Replacement Reserves: $ (352,800) (363,384) (374,286) (385,514) (397,080) (408,992) (421,262)

(-) Ground Lease: $ - - - - - - -

Total Fixed Expenses: $ (428,400) (441,252) (454,490) (468,124) (482,168) (496,633) (511,532)

Net Operating Income (NOI): $ 5,171,750 4,725,613 4,474,791 2,457,055 2,768,038 6,349,145 6,627,608

NOI Margin: % 45.1% 44.2% 43.5% 40.5% 41.5% 45.7% 45.7%

(-) Renovation Costs: $ - - - (3,360,000) (3,360,000) - -

Adjusted Net Operating Income (NOI): $ 5,171,750 4,725,613 4,474,791 (902,945) (591,962) 6,349,145 6,627,608

Adjusted NOI Margin: % 45.1% 44.2% 43.5% (14.9%) (8.9%) 45.7% 45.7%

(-) Cash Interest Expense on Acquisition Loan: $ (2,419,200) (2,388,600) (2,356,163) (2,321,781) -

(-) Cash Interest Expense on Mezzanine: $ (430,080) (447,283) (465,175) (483,782) -

(-) Acquisition Loan Principal Repayment: $ (510,004) (540,604) (573,041) (607,423) -

(-) Cash Interest Expense on Permanent Loan: $ - - - - (2,645,477)

(-) Permanent Loan Principal Repayment: $ - - - - (796,364)

Cash Flow to Equity Investors: $ 1,366,329 1,098,304 (4,297,324) (4,004,948) 2,907,303

PIK Interest on Mezzanine: $ (215,040) (223,642) (232,587) (241,891) -

(+) Ending Acquisition Loan Balance: $ 40,320,000 39,809,996 39,269,392 38,696,351 - -

(+) Ending Mezzanine Balance: $ 5,376,000 5,591,040 5,814,682 6,047,269 - -

(+) Ending Permanent Loan Balance: $ - - - - 52,909,539 52,113,174

Total Debt Balance: $ $ 45,696,000 $ 45,401,036 $ 45,084,073 $ 44,743,620 $ 52,909,539 $ 52,113,174

Debt Yield: % 10.3% 9.8% 5.4% 6.1% 12.0%

Interest Coverage Ratio - NOI: x 1.54 x 1.46 x 0.80 x 0.91 x 2.40 x

Interest Coverage Ratio - Adjusted NOI: x 1.54 x 1.46 x (0.30 x) (0.19 x) 2.40 x

Debt Service Coverage Ratio (DSCR) - NOI: x 1.32 x 1.24 x 0.68 x 0.76 x 1.84 x

Debt Service Coverage Ratio (DSCR) - Adjusted NOI: x 1.32 x 1.24 x (0.25 x) (0.16 x) 1.84 x

Historical: Projected:

Returns to Equity Investors: Units: FY17 FY18 FY19 FY20 FY21 FY22

Forward NOI: $ 4,474,791 2,457,055 2,768,038 6,349,145 6,627,608

Applicable Capitalisation Rate: % 9.20% 9.50% 9.30% 9.00% 8.70%

Implied Property Value: $ 48,639,034 25,863,736 29,763,848 70,546,052 76,179,398

Cash Flow to Equity Investors (Leveraged IRR):

(-) Investor Equity: $ (11,975,040) - - - - -

(+) Permanent Loan Issued: $ - - - 52,909,539 -

(-) Permanent Loan Financing Fees: $ - - - (529,095) -

(-) Acquisition Loan Refinanced: $ - - - (38,088,928) -

(-) Mezzanine Refinanced: $ - - - (6,289,160) -

(+) Cash Flow to Equity Investors: $ 1,366,329 1,098,304 (4,297,324) (4,004,948) 2,907,303

(+) Proceeds from Sale of Property: $ - - - - 76,179,398

(-) Selling Costs: $ - - - - (1,523,588)

(-) Repayment of Remaining Debt: $ - - - - (52,113,174)

Total Cash Flows to Equity (Leveraged IRR): $ $ (11,975,040) $ 1,366,329 $ 1,098,304 $ (4,297,324) $ 3,997,408 $ 25,449,939

Internal Rate of Return (IRR): % 19.1%

Total Returns to Equity: $ 27,614,656

Invested Equity: $ 11,975,040

Cash-on-Cash Multiple: x 2.3 x

Annual Yield on Initial Investment: % 11.4% 9.2% (35.9%) 33.4% 212.5%

no reviews yet

Please Login to review.