215x Filetype XLSX File size 0.37 MB Source: www.bankofengland.co.uk

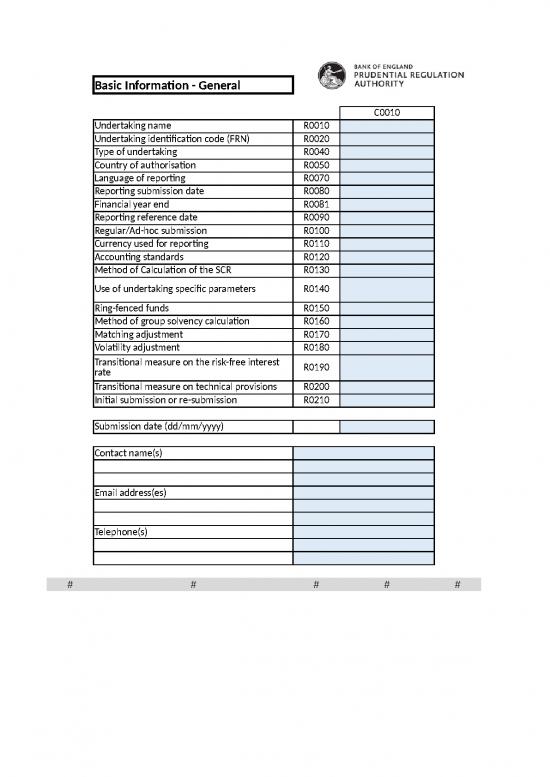

Sheet 1: Basic Information

| # | |||||

| # | |||||

| Basic Information - General | # | ||||

| # | |||||

| C0010 | # | ||||

| Undertaking name | R0010 | # | |||

| Undertaking identification code (FRN) | R0020 | # | |||

| Type of undertaking | R0040 | # | |||

| Country of authorisation | R0050 | # | |||

| Language of reporting | R0070 | # | |||

| Reporting submission date | R0080 | # | |||

| Financial year end | R0081 | # | |||

| Reporting reference date | R0090 | # | |||

| Regular/Ad-hoc submission | R0100 | # | |||

| Currency used for reporting | R0110 | # | |||

| Accounting standards | R0120 | # | |||

| Method of Calculation of the SCR | R0130 | # | |||

| Use of undertaking specific parameters | R0140 | # | |||

| Ring-fenced funds | R0150 | # | |||

| Method of group solvency calculation | R0160 | # | |||

| Matching adjustment | R0170 | # | |||

| Volatility adjustment | R0180 | # | |||

| Transitional measure on the risk-free interest rate | R0190 | # | |||

| Transitional measure on technical provisions | R0200 | # | |||

| Initial submission or re-submission | R0210 | # | |||

| # | |||||

| Submission date (dd/mm/yyyy) | # | ||||

| # | |||||

| Contact name(s) | # | ||||

| # | |||||

| # | |||||

| Email address(es) | # | ||||

| # | |||||

| # | |||||

| Telephone(s) | # | ||||

| # | |||||

| # | |||||

| # | |||||

| # | # | # | # | # | # |

| Solvency II review |

| Qualitative Questionnaire |

| Introductory Guidance Notes |

| The PRA is working closely with HM Treasury to develop a range of potential reforms to Solvency II to achieve three objectives the Government has set for the review: to spur a vibrant, innovative and internationally competitive insurance sector; to protect policyholders and ensure the safety and soundness of firms; and to support insurance firms to provide long-term capital to underpin growth. This Qualitative Questionnaire will complement the Quantitaive Impact Study (QIS), launched on 20 July, by allowing us to undertake a broader analysis of areas for reform, beyond quantitative balance sheet impacts. Specifically, the questionnaire will gather information for three key purposes: • First, to support the development of reforms to make the regime more streamlined and/or flexible – this includes Matching Adjustment (MA) requirements; the internal model approval framework, and the Transitional Measure on Technical Provisions (TMTP). • Second, to understand the business impacts of potential policy design options, particularly how firms might respond to regulatory changes to the Risk Margin, MA and internal model approval framework; and how these changes might support the objectives of the review. • Third, to understand the costs of complying with the current regime, as well as the implementation costs of potential policy design options, for example the calculation of the Risk Margin and the MA. The QIS Qualitative Questionnaire only covers a subset of areas under consideration in the overall review of Solvency II. The QIS Qualitative Questionnaire is relevant to all PRA-regulated insurance firms. All firms are strongly encouraged to participate in the aspects that are relevant to them in order for the PRA to understand the potential impact of reforms on different insurance sectors, as well as the industry as a whole. We have designed the questionnaire to gather relevant information that allows us to analyse a wide range of potential policy options and to understand how these are likely to help achieve the review’s objectives. The qualitative questions asked do not themselves represent reform proposals or decisions. This is consistent with how we approached the QIS. In some instances, we believe it is helpful for the questions to cross-refer to design variants and calibrations described in the QIS. This is to provide illustrative scenarios that can act as a focus to firms’ responses, but enable us to use responses to help analyse the impact of other scenarios not specified in the QIS. We encourage firms to use the questions with ‘free-form’ responses in the questionnaire to help us understand the factors that affect their answers and how they might change with a different regulatory option or calibration. We would like firms to be as evidence-based as possible when answering these questions, for example by referring, wherever possible, to relevant actions that were actually taken or contemplated in past situations. We would also welcome supplementary information from firms to support their responses. |

| The deadline for responses to the QIS Qualitative Questionnaire is Wednesday 20 October 2021. |

| Responses should be submitted via BEEDS. |

| We encourage you to engage with us early with any challenges or queries, and to maintain an open dialogue. We are particularly keen to hear from firms who are facing difficulties in completing all of the requested information, where we might identify bilaterally and/or through surgeries what information they could provide that would be of most value. |

| We will continue to keep the technical Q&A document updated on the QIS section of the PRA website. Will we provide a similar Q&A document covering the qualitative questionnaire. |

| Any queries about the QIS or the Qualitative Questionnaire should be addressed to: |

| InsuranceData@bankofengland.co.uk |

| in the first instance, copying your usual supervisory contacts. |

| Solvency II review | |||||||

| Qualitative Questionnaire | Key | ||||||

| To be completed | |||||||

| No. | Question | Answer | |||||

| 1a | What is the annual cost of running the risk margin calculation currently (£ and FTE) for regulatory purposes (e.g. for QRT, ORSA, solvency monitoring, and other management information etc.)? | £ |

All firms | ||||

| FTE | |||||||

| 1b | Please confirm whether you use one of the simplifications in the EIOPA Guidelines on the valuation of technical provisions (Guideline 62) and which one. | All firms | YES | NO | |||

| Which simplication (if applicable) | Firms using Guideline 62 simplifications | ||||||

| 1c | If you use one of the simplifications in the EIOPA Guidelines, please provide an estimate of the cost saving (£ and FTE) compared to the situation if you calculated the risk margin in full without simplifications. | £ | Firms using Guideline 62 simplifications | ||||

| FTE | |||||||

| 2 | What would be the cost of running the risk margin calculation under a MOCE approach on an annual basis (£ and FTE)? [*] | £ | All firms | ||||

| FTE | |||||||

| 3 | What would be the additional, one-off cost of implementing a MOCE approach (£ and FTE)? | £ |

All firms | ||||

| FTE | |||||||

| 4 | What are the benefits of a MOCE-like approach for calculating the risk margin, relative to the current approach? Please provide relevant comments in respect of the initial implementation and on-going use of this method. | All firms | |||||

| 5 | What are the detriments of a MOCE-like approach for calculating the risk margin, relative to the current approach? Please provide relevant comments in respect of the initial implementation and on-going use of this method. | All firms | |||||

| 6 | What would be the cost of running the risk margin calculation under a Risk Tapering (Lambda) approach on an annual basis (£ and FTE)? [*] | £ |

All firms | ||||

| FTE | |||||||

| 7 | What would be the additional, one-off cost of implementing a Risk Tapering (Lambda) approach (£ and FTE)? | £ | All firms | ||||

| FTE | |||||||

| 8 | What are the benefits of a Risk Tapering (Lambda) approach for calculating the risk margin, relative to the current approach? Please provide relevant comments in respect of the initial implementation and on-going use of this method. | All firms | |||||

| 9 | What are the detriments of a Risk Tapering (Lambda) approach for calculating the risk margin, relative to the current approach? Please provide relevant comments in respect of the initial implementation and on-going use of this method. | All firms | |||||

| [*] | Please see QIS instructions, Annex 1 – Risk Margin (page 23). https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/solvency-ii/solvency-ii-reform-quantitative-impact-survey/qis-instructions-v1-1.pdf. For general background on the Risk Margin designs in the QIS please see Annex A (page 7) in the Government’s response to the Call for Evidence https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/998396/Solvency_II_Call_for_Evidence_Response.pdf | ||||||

no reviews yet

Please Login to review.