235x Filetype XLSX File size 0.09 MB Source: www.assetmanagement.hsbc.co.in

Sheet 1: HMSM

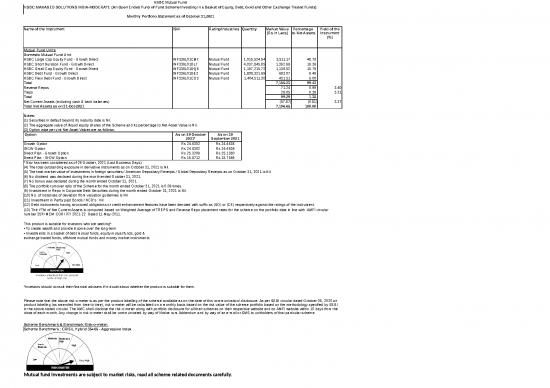

| HSBC Mutual Fund | ||||||

| HSBC MANAGED SOLUTIONS INDIA-MODERATE (An Open Ended Fund of Fund Scheme Investing in a Basket of Equity, Debt, Gold and Other Exchange Traded Funds) | ||||||

| Monthly Portfolio Statement as of October 31,2021 | ||||||

| Name of the Instrument | ISIN | Rating/Industries | Quantity | Market Value (Rs in Lacs) |

Percentage to Net Assets | Yield of the Instrument (%) |

| Mutual Fund Units | ||||||

| Domestic Mutual Fund Unit | ||||||

| HSBC Large Cap Equity Fund - Growth Direct | INF336L01CM7 | Mutual Fund | 1,015,524.94 | 3,511.17 | 48.79 | |

| HSBC Short Duration Fund - Growth Direct | INF336L01DL7 | Mutual Fund | 4,037,845.85 | 1,392.96 | 19.36 | |

| HSBC Small Cap Equity Fund - Growth Direct | INF336L01DQ6 | Mutual Fund | 1,197,215.72 | 1,136.52 | 15.79 | |

| HSBC Debt Fund - Growth Direct | INF336L01DE2 | Mutual Fund | 1,808,321.69 | 683.07 | 9.49 | |

| HSBC Flexi Debt Fund - Growth Direct | INF336L01CO3 | Mutual Fund | 1,404,511.30 | 431.51 | 6.00 | |

| Total | 7,155.23 | 99.43 | ||||

| Reverse Repos | 71.24 | 0.99 | 3.40 | |||

| Treps | 28.05 | 0.39 | 3.31 | |||

| Total | 99.29 | 1.38 | ||||

| Net Current Assets (including cash & bank balances) | (57.87) | (0.81) | 3.37 | |||

| Total Net Assets as on 31-Oct-2021 | 7,196.65 | 100.00 | ||||

| Notes: | ||||||

| (1) Securities in default beyond its maturity date is Nil. | ||||||

| (2) The aggregate value of illiquid equity shares of the Scheme and its percentage to Net Asset Value is Nil. | ||||||

| (3) Option wise per unit Net Asset Values are as follows: | ||||||

| Option | As on 29 October 2021* | As on 30 September 2021 | ||||

| Growth Option | Rs 24.6302 | Rs 24.4636 | ||||

| IDCW Option | Rs 24.6302 | Rs 24.4636 | ||||

| Direct Plan - Growth Option | Rs 25.3209 | Rs 25.1380 | ||||

| Direct Plan - IDCW Option | Rs 15.8712 | Rs 15.7569 | ||||

| * Nav has been considered as of 29 October, 2021 (Last Business Days). | ||||||

| (4) The total outstanding exposure in derivative instruments as on October 31, 2021 is Nil. | ||||||

| (5) The total market value of investments in foreign securities / American Depositary Receipts / Global Depositary Receipts as on October 31, 2021 is Nil. | ||||||

| (6) No dividend was declared during the month ended October 31, 2021. | ||||||

| (7) No bonus was declared during the month ended October 31, 2021. | ||||||

| (8) The portfolio turnover ratio of the Scheme for the month ended October 31, 2021 is 0.09 times. | ||||||

| (9) Investment in Repo in Corporate Debt Securities during the month ended October 31, 2021 is Nil. | ||||||

| (10) No. of instances of deviation from valuation guidelines is Nil | ||||||

| (11) Investment in Partly paid Bonds / NCD’s : Nil | ||||||

| (12) Debt instruments having structured obligations or credit enhancement features have been denoted with suffix as (SO) or (CE) respectively against the ratings of the instrument. | ||||||

| (13) The YTM of Net Current Assets is computed based on Weighted Average of TREPS and Reverse Repo placement rates for the scheme on the portfolio date in line with AMFI circular number 35P/ MEM-COR/ 07/ 2021-22 Dated 11-May-2011. | ||||||

| This product is suitable for investors who are seeking*: | ||||||

| • To create wealth and provide income over the long-term | ||||||

| • Investments in a basket of debt mutual funds, equity mutual funds, gold & | ||||||

| exchange traded funds, offshore mutual funds and money market instruments | ||||||

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | ||||||

| Please note that the above risk-o-meter is as per the product labelling of the scheme available as on the date of this communication/ disclosure. As per SEBI circular dated October 05, 2020 on product labelling (as amended from time to time), risk-o-meter will be calculated on a monthly basis based on the risk value of the scheme portfolio based on the methodology specified by SEBI in the above stated circular. The AMC shall disclose the risk-o-meter along with portfolio disclosure for all their schemes on their respective website and on AMFI website within 10 days from the close of each month. Any change in risk-o-meter shall be communicated by way of Notice cum Addendum and by way of an e-mail or SMS to unitholders of that particular scheme. | ||||||

| Scheme Benchmark & Benchmark Risk-o-meter: | ||||||

| Scheme Benchmark : CRISIL Hybrid 35+65 - Aggressive Index | ||||||

| Mutual fund investments are subject to market risks, read all scheme related documents carefully. | ||||||

no reviews yet

Please Login to review.