301x Filetype XLS File size 0.06 MB Source: people.stern.nyu.edu

Sheet 1: Instructions

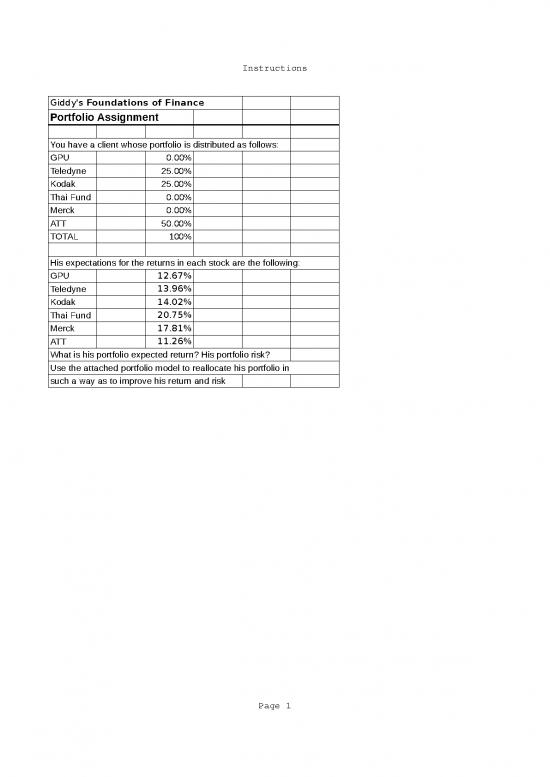

| Giddy's Foundations of Finance | ||

| Portfolio Assignment | ||

| You have a client whose portfolio is distributed as follows: | ||

| GPU | 0.00% | |

| Teledyne | 25.00% | |

| Kodak | 25.00% | |

| Thai Fund | 0.00% | |

| Merck | 0.00% | |

| ATT | 50.00% | |

| TOTAL | 100% | |

| His expectations for the returns in each stock are the following: | ||

| GPU | 12.67% | |

| Teledyne | 13.96% | |

| Kodak | 14.02% | |

| Thai Fund | 20.75% | |

| Merck | 17.81% | |

| ATT | 11.26% | |

| What is his portfolio expected return? His portfolio risk? | ||

| Use the attached portfolio model to reallocate his portfolio in | ||

| such a way as to improve his return and risk |

| Giddy's Foundations of Finance | ||||||||||||

| Portfolio Return and Risk Computation | ||||||||||||

| PORTFOLIO EXPECTED RETURN | PORTFOLIO VARIANCE | |||||||||||

| CORRELATION MATRIX | ||||||||||||

| ASSET | RETURN | WEIGHT | PRODUCT | STD DEV | CAN | FR | GER | JAP | UK | USA | ||

| 1 | GPU | 0.1267 | 0.00% | 0 | 0.1715 | 1 | ||||||

| 2 | Teledyne | 0.1396 | 25.00% | 0.0349 | 0.2893 | 0.4368 | 1 | |||||

| 3 | Kodak | 0.1402 | 25.00% | 0.03505 | 0.3082 | 0.1659 | 0.6453 | 1 | ||||

| 4 | Thai Fund | 0.2075 | 0.00% | 0 | 0.3278 | 0.2239 | 0.4431 | 0.2447 | 1 | |||

| 5 | Merck | 0.1781 | 0.00% | 0 | 0.341 | 0.3496 | 0.1529 | 0.1312 | 0.0346 | 1 | ||

| 6 | ATT | 0.1126 | 50.00% | 0.0563 | 0.1606 | 0.6844 | 0.4029 | 0.4318 | 0.2274 | 0.6327 | 1 | |

| TOTAL | 100% | |||||||||||

| Portfolio Variance | 3.48% | |||||||||||

| Portfolio return | 12.63% | Portfolio Std Deviation | 18.66% | |||||||||

| Weights matrix | Variance-covariance matrix | |||||||||||

| 0 | 0 | 0 | 0 | 0 | 0 | 0.02941225 | 0.02167181016 | 0.00876886017 | 0.01258714303 | 0.0204451324 | 0.01885036076 | |

| 0 | 0.0625 | 0.0625 | 0 | 0 | 0.125 | 0.02167181016 | 0.08369449 | 0.057536406378 | 0.042020298474 | 0.01508378377 | 0.018719370582 | |

| 0 | 0.0625 | 0.0625 | 0 | 0 | 0.125 | 0.00876886017 | 0.057536406378 | 0.09498724 | 0.024721541812 | 0.01378862144 | 0.021372770056 | |

| 0 | 0 | 0 | 0 | 0 | 0 | 0.01258714303 | 0.042020298474 | 0.024721541812 | 0.10745284 | 0.00386758108 | 0.011971400232 | |

| 0 | 0 | 0 | 0 | 0 | 0 | 0.0204451324 | 0.01508378377 | 0.01378862144 | 0.00386758108 | 0.116281 | 0.03464956242 | |

| 0 | 0.125 | 0.125 | 0 | 0 | 0.25 | 0.01885036076 | 0.018719370582 | 0.021372770056 | 0.011971400232 | 0.03464956242 | 0.02579236 | |

| The Efficient Frontier | |||||||||||

| OPTIMAL PORTFOLIOS | |||||||||||

| Given | Best | Composition | |||||||||

| Return | Std. Dev. | GPU | Teledyne | Kodak | Thai Fund | Merck | ATT | ||||

| ALL ATT | 0.1126 | 0.1606 | 0.1126 | 0% | 0% | 0% | 0% | 0% | 100% | ||

| 0.115 | 0.1548 | 0.115 | 17% | 0% | 0% | 0% | 0% | 83% | |||

| 0.12 | 0.1494 | 0.12 | 33% | 0% | 5% | 2% | 0% | 60% | |||

| 0.125 | 0.1475 | 0.125 | 36% | 0% | 6% | 6% | 0% | 52% | |||

| MIN RISK | 0.1283 | 0.1471 | 0.1283 | 38% | 0% | 6% | 9% | 0% | 47% | ||

| 0.13 | 0.1472 | 0.13 | 39% | 0% | 7% | 11% | 0% | 44% | |||

| 0.14 | 0.1509 | 0.14 | 44% | 0% | 9% | 16% | 5% | 25% | |||

| 0.15 | 0.1572 | 0.15 | 50% | 0% | 12% | 20% | 11% | 7% | |||

| 0.16 | 0.168 | 0.16 | 43% | 0% | 11% | 28% | 18% | 0% | |||

| 0.17 | 0.184 | 0.17 | 30% | 0% | 9% | 37% | 24% | 0% | |||

| 0.18 | 0.2045 | 0.18 | 17% | 0% | 7% | 46% | 30% | 0% | |||

| 0.19 | 0.2282 | 0.19 | 4% | 0% | 5% | 55% | 36% | 0% | |||

| MAX RETURN | 0.2075 | 0.3278 | 0.2075 | 0% | 0% | 0% | 100% | 0% | 0% | ||

| ORIGINAL | 12.63% | 18.66% | 0.12625 | 0% | 25% | 25% | 0% | 0% | 50% | ||

no reviews yet

Please Login to review.