219x Filetype XLSX File size 0.26 MB Source: mortgage.archgroup.com

Sheet 1: Tax Return Income (Main)

| Arch MI Tax Return Analysis Calculator (AMITRAC) | |||||||||||||

| for Tax Years 2021 and Prior | |||||||||||||

| 01.31.22 | |||||||||||||

| Borrower(s) Name: | Loan Number: | ||||||||||||

| Please Note: DO NOT enter ANY numbers as negative (-), even if the indicated integer on the tax return is negative (-). The calculator will automatically subtract when indicated; simply be sure to enter data on the correct AMITRAC line. DO NOT enter ZERO unless indicated by pop-up message (leave blank). |

|||||||||||||

| Unless specified, enter ONLY recurring income and losses. | |||||||||||||

| Annual Trends are calculated by AVERAGING BOTH YEARS if income increases and using MOST RECENT YEAR if income decreases. | |||||||||||||

| Are you analyzing two years of tax returns? | YES | If analyzing one year only, enter data in "Most Recent Year" column. | |||||||||||

| Is this a Freddie Mac loan with corporate (1120) returns? | NO | click here for guidance | |||||||||||

| Prior Year | Most Recent Year | ||||||||||||

| I | Individual Tax Return (1040), including Schedule 1 | 2020 | 2021 | ||||||||||

| 1 | Variable Income not requiring year-to-date earnings | click here for guidance | + | $ | + | $ | |||||||

| 2 | Tax-Exempt Interest | click here for guidance | + | $ | + | $ | |||||||

| 3 | Alimony Received | click here for guidance | + | $ | + | $ | |||||||

| Complete Both Lines 4 AND 5 of AMITRAC or Leave Both Lines Blank — See Guidance & Help tab. | |||||||||||||

| click here for guidance | |||||||||||||

| 4 | Received IRAs, Pensions and/or Annuities | click here for guidance | $ | $ | |||||||||

| 5 | Taxable IRAs, Pensions and/or Annuities | click here for guidance | $ | $ | |||||||||

| 6 | IRAs, Pensions and Annuities Qualifying Total | click here for guidance | + | $ | 0.00 | + | $ | 0.00 | |||||

| 7 | Unemployment Compensation | click here for guidance | + | $ | + | $ | |||||||

| Complete Both Lines 8 AND 9 of AMITRAC or Leave Both Blank — See Guidance & Help tab. | |||||||||||||

| click here for guidance | |||||||||||||

| 8 | Received Social Security Benefits | click here for guidance | $ | $ | |||||||||

| 9 | Taxable Social Security Benefits | click here for guidance | $ | $ | |||||||||

| 10 | Social Security Benefits Qualifying Total | click here for guidance | + | $ | 0.00 | + | $ | 0.00 | |||||

| 11 | 1040 / Schedule 1 Totals | $ | 0.00 | $ | 0.00 | Amount of Change | $0.00 | ||||||

| 12 | Total 1040/Schedule 1 Annual Trend | $0.00 | Percentage of Change | 0.00% | |||||||||

| II | Employee Business Expenses (Form 2106) | 2020 | 2021 | ||||||||||

| 13 | Unreimbursed Expenses | click here for guidance | - | $ | - | $ | |||||||

| Complete Line 14 OR Line 16, NOT BOTH — See Guidance & Help tab. | |||||||||||||

| click here for guidance | |||||||||||||

| 14 | Form 2106 Business Miles (Enter only if Standard Mileage Rate was claimed.) |

click here for guidance | |||||||||||

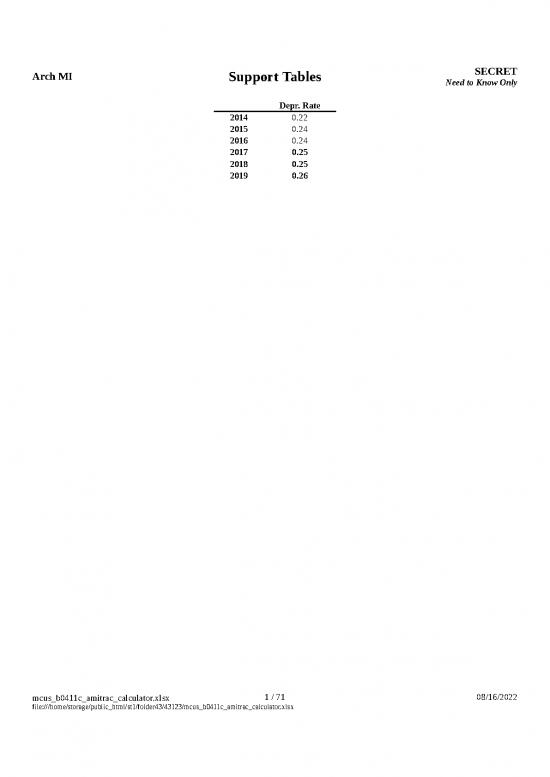

| Depreciation Rate per Mile | Year 2020 | 0.27 | Year 2021 | 0.26 | |||||||||

| 15 | Depreciation — Standard Mileage Rate | click here for guidance | + | $ | 0.00 | + | $ | 0.00 | |||||

| 16 | Depreciation — Actual Expenses | click here for guidance | + | $ | + | $ | |||||||

| 17 | Form 2106 Totals | $ | 0.00 | $ | 0.00 | ||||||||

| 18 | Total Unreimbursed Expenses Annual Trend | $0.00 | |||||||||||

| III | Interest and Dividends (Schedule B) | 2020 | 2021 | ||||||||||

| 19 | Taxable Interest | click here for guidance | + | $ | + | $ | |||||||

| 20 | Ordinary Dividends | click here for guidance | + | $ | + | $ | |||||||

| 21 | Schedule B Totals | $ | 0.00 | $ | 0.00 | Amount of Change | $0.00 | ||||||

| 22 | Total Interest and Dividends Annual Trend | $0.00 | Percentage of Change | 0.00% | |||||||||

| IV | Profit or Loss from Business (Schedule C) | 2020 | 2021 | ||||||||||

| 23 | Business Name | Enter name of business here. | click here to enter Additional Schedules C | ||||||||||

| 24 | Net Business Profit | click here for guidance | + | $ | + | $ | |||||||

| 25 | Net Business Loss | click here for guidance | - | $ | - | $ | |||||||

| 26 | Non-Recurring Income | click here for guidance | - | $ | - | $ | |||||||

| 27 | Depletion | click here for guidance | + | $ | + | $ | |||||||

| 28 | Depreciation | click here for guidance | + | $ | + | $ | |||||||

| 29 | Non-Deductible Portion of Meals (Exclusion) (See Guidance tab for 2021/2022 Temporary IRS Rule.) |

click here for guidance | - | $ | - | $ | |||||||

| 30 | Business Use of Home | click here for guidance | + | $ | + | $ | |||||||

| 31 | Schedule C Business Miles (Enter only if Standard Mileage Rate was claimed.) |

click here for guidance | |||||||||||

| Depreciation Rate per Mile | Year 2020 | 0.27 | Year 2021 | 0.26 | |||||||||

| 32 | Depreciation — Standard Mileage Rate | click here for guidance | + | $ | 0.00 | + | $ | 0.00 | |||||

| 33 | Amortization | click here for guidance | + | $ | + | $ | |||||||

| 34 | Casualty Losses | click here for guidance | + | $ | + | $ | |||||||

| 35 | One-Time Expenses | click here for guidance | + | $ | + | $ | |||||||

| 36 | Schedule C Totals | $ | 0.00 | $ | 0.00 | Amount of Change | $0.00 | ||||||

| 37 | Total Sole Proprietorship Annual Trend | $0.00 | Percentage of Change | 0.00% | |||||||||

| V | Capital Gains or Loss (Schedule D) | 2020 | 2021 | ||||||||||

| 38 | Capital Gains | click here for guidance | + | $ | + | $ | |||||||

| 39 | Capital Losses (Enter if required by Investor Guidelines.) | click here for guidance | - | $ | - | $ | |||||||

| 40 | Schedule D Totals | $ | 0.00 | $ | 0.00 | ||||||||

| 41 | Total Capital Gains/Losses Annual Trend | $0.00 | |||||||||||

| VI | Installment Sale Income (Form 6252) | 2020 | 2021 | ||||||||||

| 42 | Principal Payments | click here for guidance | + | $ | + | $ | |||||||

| 43 | Form 6252 Totals | $ | 0.00 | $ | 0.00 | Amount of Change | $0.00 | ||||||

| 44 | Total Installment Sale Annual Trend | $0.00 | Percentage of Change | 0.00% | |||||||||

| VII | Royalty Income (Schedule E) | 2020 | 2021 | ||||||||||

| 45 | Royalty Income | click here for guidance | + | $ | + | $ | |||||||

| 46 | Total Expenses | click here for guidance | - | $ | - | $ | |||||||

| 47 | Depletion | click here for guidance | + | $ | + | $ | |||||||

| 48 | Schedule E Totals | $ | 0.00 | $ | 0.00 | Amount of Change | $0.00 | ||||||

| 49 | Total Royalty Annual Trend | $0.00 | Percentage of Change | 0.00% | |||||||||

| Rental Real Estate (Schedule E) — Use the Appropriate Rental Income Calculator. | |||||||||||||

| click here to see rental calculator options | |||||||||||||

| VIII | Farm Income or Loss (Schedule F) | 2020 | 2021 | ||||||||||

| 50 | Net Farm Profit | click here for guidance | + | $ | + | $ | |||||||

| 51 | Net Farm Loss | click here for guidance | - | $ | - | $ | |||||||

| 52 | Non-Tax Portion Ongoing Co-op and Commodity Credit Corporation Payments | + | $ | + | $ | ||||||||

| click here for guidance | |||||||||||||

| 53 | Non-Recurring Income | click here for guidance | - | $ | - | $ | |||||||

| 54 | Depreciation | click here for guidance | + | $ | + | $ | |||||||

| 55 | Depletion (as itemized) | click here for guidance | + | $ | + | $ | |||||||

| 56 | Amortization (as itemized) | click here for guidance | + | $ | + | $ | |||||||

| 57 | Non-Recurring Expenses (as itemized) | click here for guidance | + | $ | + | $ | |||||||

| 58 | Business Use of Home (as itemized) | click here for guidance | + | $ | + | $ | |||||||

| 59 | Schedule F Totals | $ | 0.00 | $ | 0.00 | Amount of Change | $0.00 | ||||||

| 60 | Total Farm Annual Trend | $0.00 | Percentage of Change | 0.00% | |||||||||

| Prior Year | Most Recent Year | ||||||||||||

| IX | Partnership K-1 (Form 1065) <25% Ownership ONLY | 2020 | 2021 | ||||||||||

| 61 | Business Name | Enter name of business here. | click to enter Additional 1065 K-1s <25% | ||||||||||

| 62 | Ordinary Business Income | click here for guidance | $ | $ | |||||||||

| 63 | Ordinary Business Loss (Enter only if deemed significant.) |

click here for guidance | $ | $ | |||||||||

| 64 | Net Rental/Other Real Estate Income | click here for guidance | $ | $ | |||||||||

| 65 | Net Rental/Other Real Estate Loss (Enter only if deemed significant.) |

click here for guidance | $ | $ | |||||||||

| 66 | Subtotal of K-1 Profits/Losses | (calculator lines 62 through 65) | $ | 0.00 | $ | 0.00 | |||||||

| 67 | Distributions | click here for guidance | $ | $ | |||||||||

| Compare Subtotal of Profits/Losses (Line 66) to Distributions (Line 67) to Determine any Qualifying K-1 Income (Line 68). | |||||||||||||

| NOTE: Qualifying Income DOES NOT automatically carry down to Line 68. | |||||||||||||

| click here for guidance | |||||||||||||

| 68 | Amount of Qualifying K-1 Income (See Guidance tab.) | click here for guidance | + | $ | + | $ | |||||||

| 69 | Amount of Qualifying K-1 Loss | click here for guidance | - | $ | 0.00 | - | $ | 0.00 | |||||

| 70 | Guaranteed Payments to Partner | click here for guidance | + | $ | + | $ | |||||||

| 71 | Totals | $ | 0.00 | $ | 0.00 | Amount of Change | $0.00 | ||||||

| 72 | Total Non-Self-Employed Partnership K-1 Annual Trend | $0.00 | Percentage of Change | 0.00% | |||||||||

| Prior Year | Most Recent Year | ||||||||||||

| X | S-Corporation K-1 (Form 1120-S) <25% Ownership ONLY | 2020 | 2021 | ||||||||||

| 73 | Business Name | Enter name of business here. | click to enter Additional 1120-S K-1s | ||||||||||

| 74 | Ordinary Business Income | click here for guidance | $ | $ | |||||||||

| 75 | Ordinary Business Loss (Enter only if deemed significant.) |

click here for guidance | $ | $ | |||||||||

| 76 | Net Rental/Other Real Estate Income | click here for guidance | $ | $ | |||||||||

| 77 | Net Rental/Other Real Estate Loss (Enter only if deemed significant.) |

click here for guidance | $ | $ | |||||||||

| 78 | Subtotal of K-1 Profits/Losses | (calculator lines 74 through 77) | $ | 0.00 | $ | 0.00 | |||||||

| 79 | Distributions | click here for guidance | $ | $ | |||||||||

| Compare Subtotal of Profits/Losses (Line 78) to Distributions (Line 79) to Determine any Qualifying K-1 Income (Line 80). | |||||||||||||

| NOTE: Qualifying Income DOES NOT automatically carry down to Line 80. | |||||||||||||

| click here for guidance | |||||||||||||

| 80 | Amount of Qualifying K-1 Income (See Guidance tab.) | click here for guidance | + | $ | + | $ | |||||||

| 81 | Amount of Qualifying K-1 Loss | click here for guidance | - | $ | 0.00 | - | $ | 0.00 | |||||

| 82 | W-2 Compensation | click here for guidance | + | $ | + | $ | |||||||

| 83 | Totals | $ | 0.00 | $ | 0.00 | Amount of Change | $0.00 | ||||||

| 84 | Total Non-Self-Employed S-Corporation K-1 Annual Trend | $0.00 | Percentage of Change | 0.00% | |||||||||

| Prior Year | Most Recent Year | ||||||||||||

| XI | Partnership Tax Return (1065) Self-Employed | 2020 | 2021 | ||||||||||

| 85 | Business Name | Enter name of business here. | click to enter Additional Partnerships | ||||||||||

| K-1 ANALYSIS 1065 | |||||||||||||

| 86 | Ordinary Business Income | click here for guidance | + | $ | + | $ | |||||||

| 87 | Ordinary Business Loss | click here for guidance | - | $ | - | $ | |||||||

| 88 | Net Rental Real Estate Income | click here for guidance | + | $ | + | $ | |||||||

| 89 | Net Rental Real Estate Loss | click here for guidance | - | $ | - | $ | |||||||

| 90 | Subtotal of K-1 Profits/Losses | (calculator lines 86 through 89) | $ | 0.00 | $ | 0.00 | |||||||

| 91 | Distributions | click here for guidance | $ | $ | |||||||||

| Compare Subtotal of Profits/Losses (Line 90) to Distributions (Line 91) to Determine any Qualifying K-1 Income (Line 92). | |||||||||||||

| NOTE: Qualifying Income DOES NOT automatically carry down to Line 92. | |||||||||||||

| click here for guidance | |||||||||||||

| 92 | Amount of Qualifying K-1 Income (See Guidance tab.) | click here for guidance | + | $ | + | $ | |||||||

| 93 | Amount of Qualifying K-1 Loss | click here for guidance | - | $ | 0.00 | - | $ | 0.00 | |||||

| 94 | Guaranteed Payments to Partner | click here for guidance | + | $ | + | $ | |||||||

| 95 | Borrower's Qualifying K-1 Total | ± | $ | 0.00 | ± | $ | 0.00 | ||||||

| BUSINESS ANALYSIS 1065 | |||||||||||||

| 96 | Non-Recurring Income from other Partnerships, etc. | click here for guidance | - | $ | - | $ | |||||||

| 97 | Non-Recurring Loss from other Partnerships, etc. | click here for guidance | + | $ | + | $ | |||||||

| 98 | Non-Recurring Profit, Gain or Income | click here for guidance | - | $ | - | $ | |||||||

| 99 | Non-Recurring Loss | click here for guidance | + | $ | + | $ | |||||||

| 100 | Depreciation | click here for guidance | + | $ | + | $ | |||||||

| 101 | Depletion | click here for guidance | + | $ | + | $ | |||||||

| 102 | Amortization (as itemized from statement) | click here for guidance | + | $ | + | $ | |||||||

| 103 | Casualty Losses (as itemized from statement) | click here for guidance | + | $ | + | $ | |||||||

| 104 | One-Time Expenses (as itemized from statement) | click here for guidance | + | $ | + | $ | |||||||

| 105 | Mortgages, Notes, Bonds Payable in < One Year | click here for guidance | - | $ | - | $ | |||||||

| 106 | Non-Deductible Portion of Travel, Meals & Entertainment (See Guidance tab for 2021/2022 Temporary IRS Rule.) |

click here for guidance | - | $ | - | $ | |||||||

| 107 | Total of Partnership 1065 Cash Flow | $ | 0.00 | $ | 0.00 | ||||||||

| 108 | Ownership Percentage | click here for guidance | |||||||||||

| 109 | Borrower's Proportionate Share of 1065 Total | ± | $ | 0.00 | ± | $ | 0.00 | ||||||

| PARTNERSHIP TOTALS (COMBINED K-1 ANALYSIS AND BUSINESS ANALYSIS) | |||||||||||||

| 110 | Totals | $ | 0.00 | $ | 0.00 | Amount of Change | $0.00 | ||||||

| 111 | TOTAL 1065 Annual Trend | $0.00 | Percentage of Change | 0.00% | |||||||||

| Prior Year | Most Recent Year | ||||||||||||

| XII | S Corporation Tax Return (1120-S) | 2020 | 2021 | ||||||||||

| 112 | Business Name | Enter name of business here. | click to enter Additional S-Corporations | ||||||||||

| K-1 ANALYSIS 1120-S | |||||||||||||

| 113 | Ordinary Business Income | click here for guidance | + | $ | + | $ | |||||||

| 114 | Ordinary Business Loss | click here for guidance | - | $ | - | $ | |||||||

| 115 | Net Rental/Other Real Estate Income | click here for guidance | + | $ | + | $ | |||||||

| 116 | Net Rental/Other Real Estate Loss | click here for guidance | - | $ | - | $ | |||||||

| 117 | Subtotal of K-1 Profits/Losses | (calculator lines 113 through 116) | $ | 0.00 | $ | 0.00 | |||||||

| 118 | Distributions | click here for guidance | $ | $ | |||||||||

| Compare Subtotal of Profits/Losses (Line 117 to Distributions (Line 118) to Determine any Qualifying Income (Line 119). | |||||||||||||

| NOTE: Qualifying Income DOES NOT automatically carry down to Line 119. | |||||||||||||

| click here for guidance | |||||||||||||

| 119 | Amount of Qualifying K-1 Income (See Guidance tab.) | click here for guidance | + | $ | + | $ | |||||||

| 120 | Amount of Qualifying K-1 Loss | click here for guidance | - | $ | 0.00 | - | $ | 0.00 | |||||

| 121 | W-2 Compensation | click here for guidance | + | $ | + | $ | |||||||

| 122 | Borrower's Qualifying K-1 Total | ± | $ | 0.00 | ± | $ | 0.00 | ||||||

| BUSINESS ANALYSIS 1120-S | |||||||||||||

| 123 | Non-Recurring Income | click here for guidance | - | $ | - | $ | |||||||

| 124 | Non-Recurring Loss | click here for guidance | + | $ | + | $ | |||||||

| 125 | Depreciation | click here for guidance | + | $ | + | $ | |||||||

| 126 | Depletion | click here for guidance | + | $ | + | $ | |||||||

| 127 | Amortization (as itemized from statement) | click here for guidance | + | $ | + | $ | |||||||

| 128 | Casualty Losses (as itemized from statement) | click here for guidance | + | $ | + | $ | |||||||

| 129 | One-Time Expenses (as itemized from statement) | click here for guidance | + | $ | + | $ | |||||||

| 130 | Mortgages, Notes, Bonds Payable in < One Year | click here for guidance | - | $ | - | $ | |||||||

| 131 | Non-Deductible Portion of Travel, Meals & Entertainment (See Guidance tab for 2021/2022 Temporary IRS Rule.) |

click here for guidance | - | $ | - | $ | |||||||

| 132 | Total of S-Corporation Cash Flow | $ | 0.00 | $ | 0.00 | ||||||||

| 133 | Ownership Percentage | click here for guidance | |||||||||||

| 134 | Borrower's Proportionate Share of 1120-S Total | ± | $ | 0.00 | ± | $ | 0.00 | ||||||

| S-CORPORATION TOTALS (K-1 ANALYSIS AND BUSINESS ANALYSIS) | |||||||||||||

| 135 | Totals | $ | 0.00 | $ | 0.00 | Amount of Change | $0.00 | ||||||

| 136 | TOTAL 1120-S Annual Trend | $0.00 | Percentage of Change | 0.00% | |||||||||

| Prior Year | Most Recent Year | ||||||||||||

| XIII | Corporation Tax Return (1120) | 2020 | 2021 | ||||||||||

| 137 | Business Name | Enter name of business here. | click to enter Additional Corporations | ||||||||||

| 138 | Taxable Income | click here for guidance | + | $ | + | $ | |||||||

| 139 | Taxable Loss | click here for guidance | - | $ | - | $ | |||||||

| 140 | Total Tax | click here for guidance | - | $ | - | $ | |||||||

| 141 | Non-Recurring Gains | click here for guidance | - | $ | - | $ | |||||||

| 142 | Non-Recurring Losses | click here for guidance | + | $ | + | $ | |||||||

| 143 | Non-Recurring Income | click here for guidance | - | $ | - | $ | |||||||

| 144 | Non-Recurring Loss | click here for guidance | + | $ | + | $ | |||||||

| 145 | Depreciation | click here for guidance | + | $ | + | $ | |||||||

| 146 | Depletion | click here for guidance | + | $ | + | $ | |||||||

| 148 | Amortization (as itemized from statement) | click here for guidance | + | $ | + | $ | |||||||

| 148 | Casualty Losses (as itemized from statement) | click here for guidance | + | $ | + | $ | |||||||

| 149 | One-Time Expenses (as itemized from statement) | click here for guidance | + | $ | + | $ | |||||||

| 150 | Net Operating Loss | click here for guidance | + | $ | + | $ | |||||||

| 151 | Mortgages, Notes, Bonds Payable in < One Year | click here for guidance | - | $ | - | $ | |||||||

| 152 | Non-Deductible Portion of Meals (Exclusion) (See Guidance tab for 2021/2022 Temporary IRS Rule.) |

click here for guidance | - | $ | - | $ | |||||||

| 153 | Subtotal | $ | 0.00 | $ | 0.00 | ||||||||

| 154 | Ownership Percentage | ||||||||||||

| For Fannie Mae, AMITRAC considers "Borrower's Proportionate Share" only if 100% ownership. For Freddie Mac, Borrower's legal right to the business income must be verified if ownership interest is <100%. |

click here for guidance | % | % | ||||||||||

| 155 | Borrower's Proportionate Share of Subtotal | ± | $ | 0.00 | ± | $ | 0.00 | ||||||

| 156 | W-2 Compensation from Corporation | click here for guidance | + | $ | + | $ | |||||||

| 157 | Dividends Paid from this 1120 | click here for guidance | - | $ | - | $ | |||||||

| 158 | Totals | $ | 0.00 | $ | 0.00 | Amount of Change | $0.00 | ||||||

| 159 | TOTAL 1120 Annual Trend | $0.00 | Percentage of Change | 0.00% | |||||||||

| Annual Trend | Monthly Trend | ||||||||||||

| GRAND TOTAL | |||||||||||||

| 1040 Page 1 | $0.00 | 0.00 | |||||||||||

| Form 2106 | $0.00 | 0.00 | |||||||||||

| Schedule B | $0.00 | 0.00 | |||||||||||

| Schedule C | $0.00 | 0.00 | |||||||||||

| Schedule D | $0.00 | 0.00 | |||||||||||

| Form 6252 | $0.00 | 0.00 | |||||||||||

| Schedule E (Royalty) | $0.00 | 0.00 | |||||||||||

| Schedule F | $0.00 | 0.00 | |||||||||||

| Partnerships K-1 (<25%) | $0.00 | 0.00 | |||||||||||

| S-Corporations K-1 (<25%) | $0.00 | 0.00 | |||||||||||

| Partnerships Self-Employed | $0.00 | 0.00 | |||||||||||

| S-Corporations Self-Employed | $0.00 | 0.00 | |||||||||||

| Corporations | $0.00 | 0.00 | |||||||||||

| Total Annual Trend | $0.00 | ||||||||||||

| Total Monthly Qualifying Income/Loss | $0.00 | ||||||||||||

| COMMENTS/NOTES: | |||||||||||||

| This Income Analysis Worksheet is provided by Arch MI for training and information purposes only. It is not intended to and should not be relied upon for any other purpose, including mortgage loan underwriting or preparation of tax forms or other documents, and should be reviewed by your own independent legal and compliance advisors. Please direct any questions you may have about this or any other Arch MI training publication to your Arch MI representative. | |||||||||||||

| ARCH MORTGAGE INSURANCE COMPANY® | 230 NORTH ELM STREET GREENSBORO NC 27401 | ARCHMI.COM MCUS-B0411C-0122 | |||||||||||||

| © 2022 Arch Mortgage Insurance Company. All Rights Reserved. Arch MI is a marketing term for Arch Mortgage Insurance Company and United Guaranty Residential Insurance Company. Arch Mortgage Insurance Company is a registered mark of Arch Capital Group (U.S.) Inc. or its affiliates. | |||||||||||||

| (AMITRAC) Guidance and Help | ||||

| Part I | ||||

| Individual Tax Return (1040) | click here to return to Main tab - Part I | |||

| HELP | Enter the borrower name(s) and loan number, as applicable. | |||

| Indicate if you will be utilizing one or two years of tax returns/data for qualifying. (Note the AMITRAC defaults/assumes two years unless “NO” is chosen from the drop-down menu.) | ||||

| Indicate if you will be applying Freddie Mac/similar guidelines to the Corporate Returns Section. (Note the AMITRAC defaults/assumes Fannie Mae/similar guidelines unless “YES” is chosen from the drop-down menu.) | ||||

| Fannie Mae Guidelines — The cash flow analysis can only consider the borrower’s share of the business income or loss, taking into consideration adjustments to business income provided in Section XIII of this Calculator, if the borrower owns 100% of the business. | ||||

| Freddie Mac Guidelines — The borrower’s right to the business income must be verified if ownership interest is less than 100%. | ||||

| Indicate “Prior Year” and “Most Recent Year.” (Note the AMITRAC defaults/assumes 2020 and 2021 unless alternative choices are indicated utilizing the drop-down menu.) If completing only one year, it must be the “Most Recent Year” column. | ||||

| Line 1 | Enter W-2 Wages from Variable Income (typically from Box 5 of applicable W-2s), 1099s or other Variable Income sources for which you do not need to provide proof of year-to-date (YTD) earnings. Do not include W-2 Wages earned from Salaried Employment or Self-Employment for S-Corporation/or Corporations. (Self-Employed Earnings will be entered elsewhere on the AMITRAC. Salaried Wages and other Wages where YTD pay must be considered should be calculated outside of the AMITRAC.) Enter only earnings for which you are reviewing an historical average. | The amount entered will be added to the Cash Flow (Part I Totals, Line 11 of the AMITRAC). | ||

| Line 2 | Enter recurring Tax-Exempt Interest Income from: 2019, 2020, 2021 — Line 2a of the 1040, page 1. 2018 — Line 2a of the 1040, page 2. 2017 & Prior Years — Line 8b of the 1040, page 1. |

The amount entered will be added to the Cash Flow (Part I Totals, Line 11 of the AMITRAC). | ||

| Line 3 | Enter recurring Alimony Received from: 2019, 2020, 2021 — Line 2a of the Schedule 1. 2018 — Line 11 of the Schedule 1. 2017 & Prior Years — Line 11 of the 1040, page 1. |

The amount entered will be added to the Cash Flow (Part I Totals, Line 11 of the AMITRAC). | ||

| Line 4 | Enter the recurring amounts of Received IRAs, Pensions and Annuities from: | |||

| 2020, 2021 — Line 4a and 5a (combined) of the 1040, page 1 | ||||

| 2019 — Line 4a and 4c (combined) of the 1040, page 1. | ||||

| 2018 — Line 5a of the 1040, page 2. | ||||

| 2017 & Prior Years — Line 15a and 16a (combined) of the 1040, page 1. | ||||

| NOTE: If the above indicted lines are blank, enter the amount(s) from Line 5 of the AMITRAC (below) to effectively indicate that the IRAs, Pensions and/or Annuities are 100% taxable. | ||||

| Line 5 | Enter the recurring amounts of Taxable IRAs, Pensions and Annuities from: | |||

| 2020, 2021 — Line 4b and 5b (combined) of the 1040, page 1 | ||||

| 2019 — Line 4b and 4d (combined) of the 1040, page 1. | ||||

| 2018 — Line 5b of the 1040, page 2. | ||||

| 2017 & Prior Years — Line 15b and 16b (combined) of the 1040, page 1. | ||||

| NOTE: If you enter an amount on Line 5 of the AMITRAC, you must enter an amount on Line 4 that is ≥ the amount entered on Line 5. | ||||

| Line 6 | The AMITRAC will determine the Total Value of the IRAs, Pensions and Annuities by grossing up the non-taxable portion and adding it to the amount received. Remember, in order for the AMITRAC to be accurate, you must enter an amount on both Lines 4 and 5 of the AMITRAC. If there is no amount in column “a” of the tax returns OR, if you do not wish to gross up the IRAs, Pensions or Annuities, enter the amount from column “b” onto Line 4 of the AMITRAC. | The amount entered will be added to the Cash Flow (Part I Totals, Line 11 of the AMITRAC). | ||

| Line 7 | Enter the amount of recurring Unemployment Compensation from: | The amount entered will be added to the Cash Flow (Part I Totals, Line 11 of the AMITRAC). | ||

| 2019, 2020, 2021 — Line 7 of the Schedule 1. | ||||

| 2018 — Line 19 of the Schedule 1. | ||||

| 2017 & Prior Years — Line 19 of the 1040. | ||||

| Line 8 | Enter the recurring amounts of Received Social Security from: | |||

| 2020, 2021 — Line 6a of the 1040, Page 1 | ||||

| 2019 — Line 5a of the 1040, Page 1 | ||||

| 2018 — Line 5a of the 1040, Page 2. | ||||

| 2017 & Prior Years — Line 20a of the 1040, Page 1. |

||||

| NOTE: If the above indicated lines are blank, enter the amount(s) from AMITRAC Line 9 (below), to effectively indicate that the Social Security Income is 100% taxable. | ||||

| Line 9 | Enter the recurring amounts of Taxable Social Security from: | |||

| 2020, 2021 — Line 6b of the 1040, Page 1 | ||||

| 2019 — Line 5b of the 1040, Page 1 | ||||

| 2018 — Line 5b of the 1040, Page 2. | ||||

| 2017 & Prior Years — Line 20b of the 1040, Page 2. | ||||

| NOTE: If you enter an amount on Line 9 of the AMITRAC, you must enter an amount on Line 8 that is ≥ Line 9. | ||||

| Line 10 | The AMITRAC will determine the Total Value of the Social Security Benefits by grossing up the non-taxable portion and adding it to the amount received. Remember, in order for the AMITRAC to be accurate, you must enter an amount on both Lines 8 and 9 of the AMITRAC. If there is no amount on the "Received Social Security" Line or you do not wish to gross up the amount of Social Security, enter the amount from AMITRAC Line 8 onto AMITRAC Line 9. | The amount entered will be added to the Cash Flow (Part I Totals, Line 11 of the AMITRAC). | ||

| Line 11 | The AMITRAC will Total the amounts in each column. | |||

| Line 12 | The AMITRAC will provide an annual trend for the two years entered. If the income has increased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If the income has decreased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (lower) amount. Be sure the income has stabilized before using to qualify. | |||

| Part II | ||||

| Employee Business Expenses (Form 2106 and Form 2106 EZ) | click here to return to Main tab - Part II | |||

| Fannie Mae and Freddie Mac Guidelines no longer require the receipt and/or review of Form 2106 or Form 2106 EZ for Commission Income Borrowers. | ||||

| HELP | Effective for the 2018 tax year, Form 2106 is for the following filers only: Armed Forces reservists, qualified performing artists, fee-based state or local government officials and employees with impairment-related work expenses. Check the product/program guidelines to determine whether 2106 expenses must be considered. | |||

| Line 13 | Enter the combined amounts of Unreimbursed Expenses on Lines 8a and 8b.* If reviewing Form 2106 EZ, enter the combined amounts on Lines 5 and 6. If no 2106 was filed, enter the amount claimed: 2021 — Line 12 of the Schedule 1.* 2019, 2020 — Line 11 of the Schedule 1.* 2018 — Line 24 of the Schedule 1.* |

The amount entered will be subtracted from the Cash Flow (Part II Totals, Line 17 of the AMITRAC). | ||

| NOTE: Form 2106 EZ was retired in 2018. | ||||

| *only if required by Guidelines. | ||||

| Vehicle Expenses — determine the method of vehicle expenses claimed by the taxpayer. | ||||

| — Form 2106, review Line 22. If Line 22 is complete, the Standard Mileage Rate was claimed. If Line 22 is blank (or $0), Actual Expenses were claimed. Complete Line 14 of the AMITRAC if the Standard Mileage Rate was claimed. Complete Line 16 the AMITRAC if Actual Expenses were claimed. Do not complete both lines. | ||||

| — Form 2106 EZ, the taxpayer can only claim the Standard Mileage Rate (no Actual Expenses); if mileage is entered on Line 8a and there is an amount on Line 1, the Standard Mileage Rate was claimed. NOTE: Form 2106-EZ was retired in 2018. |

||||

| Line 14 | Enter the combined amounts of Business Miles on Lines 13a and 13b if the taxpayer claimed the Standard Mileage Rate (as indicated above). | |||

| If reviewing Form 2106 EZ, enter the Business Miles on Line 8a only if Vehicle Expenses were claimed on Line 1. NOTE: Form 2106 EZ was retired in 2018. |

||||

| Line 15 | The AMITRAC will determine the (Standard Mileage Rate) Depreciation add back, based upon the amount of Business Miles entered on Line 17 and the Prior and Most Recent Years indicated on the top of the AMITRAC. |

The amount entered will be added to the Cash Flow (Part II Totals, Line 17 of the AMITRAC). | ||

| Line 16 | Enter the combined amounts of Actual Depreciation on Lines 28a and 28b if the taxpayer claimed Actual Expenses (as indicated above). | The amount entered will be added to the Cash Flow (Part II Totals, Line 17 of the AMITRAC). | ||

| Line 17 | The AMITRAC will Total the amounts in each column. | |||

| Line 18 | The AMITRAC will provide an annual trend for the two years entered. If the expenses decreased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If they increased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (higher) amount. | |||

| Part III | ||||

| Interest and Dividends (Schedule B) | click here to return to Main tab - Part III | |||

| Line 19 | Enter the amount of recurring Taxable Interest from Line 4 of Schedule B. If the amount is less than $1,500 and there is no Schedule B, enter the amount from: 2019, 2020, 2021 — Line 2b of the 1040, Page 1 (as supported by 1099 INT forms). 2018 — Line 2a of the 1040, Page 2 (as supported by 1099 INT forms). 2017 & Prior — Line 20b 1040, Page 2 (as supported by 1099 INT forms). |

The amount entered will be added to the Cash Flow (Part III Totals, Line 21 of the AMITRAC). | ||

| Line 20 | Enter the amount of recurring Dividends from Line 6 of Schedule B. If the amount is less than $1,500 and there is no Schedule B, enter the amount from: 2019, 2020, 2021 — Line 3a and 3b of the 1040, Page 1 (as supported by 1099 DIV forms). 2018 — Line 3a and 3b of the 1040, Page 2 (as supported by 1099 DIV forms). 2017 & Prior — Lines 3a and 3b of the 1040, Page 2 (as supported by 1099 DIV forms). |

The amount entered will be added to the Cash Flow (Part III Totals, Line 21 of the AMITRAC). | ||

| Line 21 | The AMITRAC will Total the amounts in each column. | |||

| Line 22 | The AMITRAC will provide an annual trend for the two years entered. If the income has increased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If the income has decreased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (lower) amount. Be sure the income has stabilized before using to qualify. | |||

| Part IV | ||||

| Profit or Loss from Business (Schedule C) | click here to return to Main tab - Part IV | |||

| Line 23 | Enter the Name of the Business for which you are entering data. | The amount entered will be added to the Cash Flow (Part IV Totals, Line 36 of the AMITRAC). | ||

| Line 24 | Enter the amount of Profit from Line 31 of Schedule C. | The amount entered will be added to the Cash Flow (Part IV Totals, Line 36 of the AMITRAC). | ||

| Line 25 | Enter the amount of Loss from Line 31 of Schedule C. | The amount entered will be subtracted from the Cash Flow (Part IV Totals, Line 36 of the AMITRAC). | ||

| Line 26 | Enter the amount of Non-Recurring Income from Line 6 of Schedule C. NOTE: All “other” income is considered non-recurring unless (1) it can be identified, (2) there is a history and (3) it can be documented as ongoing. |

The amount entered will be subtracted from the Cash Flow (Part IV Totals, Line 36 of the AMITRAC). | ||

| Line 27 | Enter the amount of Depletion from Line 12 of Schedule C. | The amount entered will be added to the Cash Flow (Part IV Totals, Line 36 of the AMITRAC). | ||

| Line 28 | Enter the amount of Depreciation from Line 13 of Schedule C. | The amount entered will be added to the Cash Flow (Part IV Totals, Line 36 of the AMITRAC). | ||

| Line 29 | Enter the amount of Meals (2018, 2019,2020 & 2021) or the amount of Meals and Entertainment (2017) claimed on Line 24b. For these tax years, the taxpayer can claim one-half of the amount spent. The entire amount must be considered. The AMITRAC will ultimately subtract the one-half the taxpayer was unable to claim for tax purposes (enter exactly the amount on Line 24b, which is one-half of the amount spent). NOTE: A temporary IRS policy was implemented for Tax Years 2021 and 2022 allowing 100% of Meals expenses to be claimed under certain circumstances. As of the publication date of this form, FNMA and FHLMC have yet to formally address how this will affect qualifying income, but the expectation is that NO meals exclusion will be required for the 2021 and 2022 tax years. |

The amount entered will be subtracted from the Cash Flow (Part IV Totals, Line 36 of the AMITRAC). | ||

| Line 30 | Enter the amount of Business Use of Home expenses from Line 30. | The amount entered will be added to the Cash Flow (Part IV Totals, Line 36 of the AMITRAC). | ||

NOTE: Form 8829 must be attached to the Tax Return unless the simplified method was claimed. |

||||

| Vehicle Expenses — determine if the taxpayer claimed the Standard Mileage Rate on Schedule C or Schedule C-EZ. | ||||

| — Schedule C: If there are business miles on Line 44a AND vehicle expenses on either Line 9 of the Schedule C or Line 30 of Form 4562, verify that the Standard Mileage Rate was claimed. Multiply the mileage listed by the approriate Standard Mileage Rates below. If your calculated amount matches the amount on Line of the Schedule C, the Standard Mileage Rate was claimed. | ||||

| HELP | ||||

| — Schedule CZ: If there are business miles on Line 5a and vehicle expenses on Line 2, the taxpayer claimed the Standard Mileage Rate on the Schedule C-EZ. NOTE: The Schedule C-EZ was retired in tax year 2019. |

||||

| Line 31 | Enter the amount of business miles from Line 44a of Schedule C or Line 30 of Form 4562 (all columns) only if the taxpayer claimed the Standard Mileage Rate (as indicated above, HELP). Enter the Business Miles from Line 5a if reviewing Form Schedule C-EZ and Vehicle Expenses were claimed on Line 2. NOTE: Schedule C-EZ was retired in tax year 2019. |

This amount is used to calculate the Depreciation add back on Line 32 | ||

| Line 32 | The AMITRAC will determine the Depreciation Portion (Standard Mileage Rate) add back, based upon the amount of Business Miles entered on Line 31 and the Prior and Most Recent Years indicated. | The amount is calculated by multipiying the Business Miles by the appropriate Depreciation Rate, which is a portion of the Standard Mileage Rate. The calculated amount will be added to the Cash Flow (Part IV Totals, Line 36 of the AMITRAC). |

||

| Line 33 | Enter any Amortization itemized on Page 2, Part V of the Schedule C. NOTE: Do not enter the entire amount from Part V. Enter only the amounts (if any) that can be determined to be Amortization. |

The amount entered will be added to the Cash Flow (Part IV Totals, Line 36 of the AMITRAC). | ||

| Line 34 | Enter any Casualty Losses that have been identified on Page 2, Part V of the Schedule C, that can be determined as non-recurring. NOTE: Do not enter the entire amount from Part V. Enter only the amounts (if any) that can be determined to be non-recurring Casualty Losses. |

The amount entered will be added to the Cash Flow (Part IV Totals, Line 36 of the AMITRAC). | ||

| Line 35 | Enter any One-Time Expenses that have been identified on Page 2, Part V of the Schedule C. NOTE: Do not enter the entire amount from Part V. Enter only the amounts (if any) that can be verified to be non-recurring. |

The amount entered will be added to the Cash Flow (Part IV Totals, Line 36 of the AMITRAC). | ||

| Line 36 | The AMITRAC will Total the amounts in each column. | |||

| Line 37 | The AMITRAC will provide an annual trend for the two years entered. If the income has increased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If the income has decreased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (lower) amount. Be sure the income has stabilized before using to qualify. | |||

| Part V | ||||

| Capital Gains or Loss (Schedule D) | click here to return to Main tab - Part V | |||

| Line 38 | Enter the amount of recurring Capital Gains from Line 16 of Schedule D. | The amount entered will be added to the Cash Flow (Part V Totals, Line 40 of the AMITRAC). | ||

| Line 39 | Enter the amount of recurring Capital Losses (if required by Investor Guidelines) from Line 16 of Schedule D.* * only if required by the investor. |

The amount entered will be subtracted from the Cash Flow (Part V Totals, Line 40 of the AMITRAC). | ||

| Line 40 | The AMITRAC will Total the amounts in each column. | |||

| Line 41 | The AMITRAC will provide an annual trend for the two years entered. If the income has increased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If the income has decreased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (lower) amount. Be sure the income has stabilized before using to qualify. | |||

| Part VI | ||||

| Installment Sale Income (Form 6252) | click here to return to Main tab - Part VI | |||

| Line 42 | Enter the amount of recurring Principal Payments from Line 21 of Form 6252. | The amount entered will be added to the Cash Flow (Part VI Totals, Line 43 of the AMITRAC). | ||

| Line 43 | The AMITRAC will Total the amounts in each column. | |||

| Line 44 | The AMITRAC will provide an annual trend for the two years entered. If the income has increased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If the income has decreased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (lower) amount. Be sure the income has stabilized before using to qualify. | |||

| Part VII | ||||

| Royalty Income (Schedule E) | click here to return to Main tab - Part VII | |||

| Line 45 | Enter the amount of Royalty Income from Line 4 of Schedule E. | The amount entered will be added to the Cash Flow (Part VII Totals, Line 48 of the AMITRAC). | ||

| Line 46 | Enter the amount of Total Expenses from Line 20 of Schedule E. | The amount entered will be subtracted from the Cash Flow (Part VII Totals, Line 48 of the AMITRAC). | ||

| Line 47 | Enter the amount of Depreciation from Line 18 of Schedule E. | The amount entered will be added to the Cash Flow (Part VII Totals, Line 48 of the AMITRAC). | ||

| Line 48 | The AMITRAC will Total the amounts in each column. | |||

| Line 49 | The AMITRAC will provide an annual trend for the two years entered. If the income has increased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If the income has decreased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (lower) amount. Be sure the income has stabilized before using to qualify. | |||

| Rental Real Estate (Schedule E) | click here to return to Main tab | |||

| Utilize the Appropriate Rental Income Calculator to determine qualifying Rental Income/Loss. Links to Fannie Mae and Freddie Mac Rental Income Calculators can be found on archmi.com and archmicu.com. | https://mortgage.archgroup.com/us/resources/calculators | |||

| Part VIII | ||||

| Farm Income or Loss (Schedule F) | click here to return to Main tab - Part VIII | |||

| Line 50 | Enter the amount of Profit from Line 34 of Schedule F. | The amount entered will be added to the Cash Flow (Part VIII Totals, Line 59 of the AMITRAC). | ||

| Line 51 | Enter the amount of Loss from Line 34 of Schedule F. | The amount entered will be subtracted from the Cash Flow (Part VIII Totals, Line 59 of the AMITRAC). | ||

| Line 52 | Enter the Non-Taxable Amounts of Ongoing Co-op and CCC Payments from Lines 3, 4, 5 and 6 of Schedule F. | The amount entered will be added to the Cash Flow (Part VIII Totals, Line 59 of the AMITRAC). | ||

| NOTE: Non-taxable amounts are the difference between the Amounts Received and the Taxable Amounts (3a-3b)+(4a-4b)+(5b-5c)+(6a-6b). | ||||

| Line 53 | Enter the amount of Non-Recurring Income from Line 8 of Schedule F. Note: All “other” income is considered non-recurring unless (1) it can be identified, (2) there is a history and (3) it can be documented as ongoing. | The amount entered will be subtracted from the Cash Flow (Part VIII Totals, Line 59 of the AMITRAC). | ||

| Line 54 | Enter the amount of Depreciation from Line 14 of Schedule F. | The amount entered will be added to the Cash Flow (Part VIII Totals, Line 59 of the AMITRAC). | ||

| Line 55 | Enter the amount of Depletion as specifically itemized from Line 32 of Schedule F. NOTE: Do not enter the entire amount from Part V. Enter only the amounts (if any) that can be determined to be depletion. |

The amount entered will be added to the Cash Flow (Part VIII Totals, Line 59 of the AMITRAC). | ||

| Line 56 | Enter the amount of Amortization (as specifically itemized) from Line 32 of Schedule F. NOTE: Do not enter the entire amount from Part V. Enter only the amounts (if any) that can be determined to be amortization. |

The amount entered will be added to the Cash Flow (Part VIII Totals, Line 59 of the AMITRAC). | ||

| Line 57 | Enter the amount of Non-Recurring Expenses (as determined) from Line 32 of Schedule F. NOTE: Do not enter the entire amount from Part V. Enter only the amounts (if any) that can be determined to be non-recurring expenses. |

The amount entered will be added to the Cash Flow (Part VIII Totals, Line 59 of the AMITRAC). | ||

| Line 58 | Enter the amount of Business Use of Home Expenses (as specifically itemized) from Line 32 of Schedule F. NOTE: Do not enter the entire amount from Part V. Enter only the amounts (if any) that can be determined to be business use of home expenses. |

The amount entered will be added to the Cash Flow (Part VIII Totals, Line 59 of the AMITRAC). | ||

| Line 59 | The AMITRAC will Total the amounts in each column. | |||

| Line 60 | The AMITRAC will provide an annual trend for the two years entered. If the income has increased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If the income has decreased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (lower) amount. Be sure the income has stabilized before using to qualify. | |||

| Part IX | ||||

| Partnership K-1 (Form 1065) <25% Ownership Only | click here to return to Main tab - Part IX | |||

| Line 61 | Enter the Name of the Partnership for which you are entering data. | |||

| Line 62 | Enter the amount of Ordinary Business Income from Form 1065, Schedule K-1, Line 1. | The amount entered will be added to the Subtotal (Part IX, Line 66 of the AMITRAC). | ||

| Line 63 | Enter the amount of Ordinary Business Loss from Form 1065, Schedule K-1, Line 1 (only if the amount is deemed significant). | The amount entered will be subtracted from the Subtotal (Part IX, Line 66 of the AMITRAC). | ||

| Line 64 | Enter the combined amounts of Net Rental Real Estate and Other Net Rental Income from Form 1065, Schedule K-1, Line 2 and Line 3. | The amount entered will be added to the Subtotal (Part IX, Line 66 of the AMITRAC). | ||

| Line 65 | Enter the combined amounts of Net Rental Real Estate and Other Net Rental Loss from Form 1065, Schedule K-1, Line 2 and Line 3. | The amount entered will be subtracted from the Subtotal (Part IX, Line 66 of the AMITRAC). | ||

| Line 66 | The AMITRAC will Subtotal the amounts in each column (Lines 62–65). | |||

| Line 67 | Enter the amount of the Distributions from Form 1065, Schedule K-1, Line 19a. | The amount entered will NOT automatically be added or subtracted. | ||

| If the amount on Line 66 is positive, compare the Subtotal of Profits (Line 66) to the Distributions (Line 67) to determine the Qualifying K-1 Income (Line 68) that you should enter. If the distributions are less than the profits, you can use the distributions for qualifying income with no further documentation requirements. | ||||

| ADDITIONAL GUIDANCE FOR FURTHER ANALYSIS: | ||||

| In order to consider Profits (Line 66) that are not supported by Distributions (Line 67), business solvency must be determined. | ||||

| HELP | (Solvency means that the business has at least as much in current assets as it has in current liabilities.) | |||

| click here to perform a liquidity analysis | ||||

| Perform a Liquidity Analysis by reviewing the Balance Sheet (Schedule L) from the applicable year Partnership Return (Form 1065) utilizing the Liquidity Analysis tab (Lines 160–172) of the AMITRAC. If the appropriate ratio is ≥ 1, solvency has been determined and Profits can be utilized in lieu of Distributions. NOTE: if the ratio is 0 because there are no current liabilities, this is also generally acceptable. |

||||

| Extreme caution should be exercised before considering the use of distributions in excess of profits, including but not limited to determination that the business is not closing down or being sold. Distributions against losses should generally not be utilized. | ||||

| If the amount on Line 66 is negative, it will be carried down to Qualifying Loss (Line 69). | ||||

| Line 68 | Enter the amount of Qualifying K-1 Income (Profit) based upon the above instructions. | The amount entered will be added to the Cash Flow (Part IX Totals, Line 71 of the AMITRAC). | ||

| Line 69 | If the amount on Line 66 is negative, the amount will carry down to this field. | The amount entered will be subtracted from the Cash Flow (Part IX Totals, Line 71 of the AMITRAC). | ||

| Line 70 | Enter the amount of Guaranteed Payments to Partner from 2019, 2020 — Form 1065, Schedule K-1, Line 4a (note, utilization of Line 4b requires proof of continuance for 3 more years) 2018 & Prior — Form 1065, Schedule K-1, Line 4. |

The amount entered will be added to the Cash Flow (Part IX Totals, Line 71 of the AMITRAC). | ||

| NOTE: Generally, Guaranteed Payments is acceptable qualifying income, provided there is a two-year history of receipt and an absence of negative information (such as a business loss or other indications it will not continue). Use of Guaranteed Payments from Capital requires proof of continuance. | ||||

| Line 71 | The AMITRAC will Total the amounts in each column, Lines 68–70. | |||

| Line 72 | The AMITRAC will provide an annual trend for the two years entered. If the income has increased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If the income has decreased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (lower) amount. Be sure the income has stabilized before using to qualify. | click here to access the Additional Partnership K-1 <25% tab | ||

| If the borrower has multiple Partnerships with less than 25% ownership, enter any additional businesses on the “Additional Partnership K-1s <25%” tab of the AMITRAC. | ||||

| Part X | ||||

| S-Corporation K-1 (Form 1120-S) <25% Ownership Only | click here to return to Main tab - Part X | |||

| Line 73 | Enter the Name of the S-Corporation for which you are entering data. | |||

| Line 74 | Enter the amount of Ordinary Business Income from Form 1120-S, Schedule K-1, Line 1. | The amount entered will be added to the Subtotal (Part X, Line 78 of the AMITRAC). | ||

| Line 75 | Enter the amount of Ordinary Business Loss from Form 1120-S, Schedule K-1, Line 1 (only if the amount is deemed significant). | The amount entered will be subtracted from the Subtotal (Part X, Line 78 of the AMITRAC). | ||

| Line 76 | Enter the combined amounts of Net Rental Real Estate Income from Form 1120-S, Schedule K-1, Line 2 and Line 3. | The amount entered will be added to the Subtotal (Part X, Line 78 of the AMITRAC). | ||

| Line 77 | Enter the combined amounts of Net Rental Real Estate Loss from Form 1120-S, Schedule K-1, Line 2 and Line 3. | The amount entered will be subtracted from the Subtotal (Part X, Line 78 of the AMITRAC). | ||

| Line 78 | The AMITRAC will Subtotal the amounts in each column (Lines 74–77). | |||

| Line 79 | Enter the amount of the Distributions from Form 1120-S, Schedule K-1, Line 16d. | The amount entered will NOT automatically be added or subtracted. | ||

| If the amount on Line 78 is positive, compare the Subtotal of Profits (Line 78) to the Distributions (Line 79) to determine the Qualifying K-1 Income (Line 80) that you should enter. If the distributions are less than the profits, you can use the distributions for qualifying income with no further documentation requirements. | ||||

| ADDITIONAL GUIDANCE FOR FURTHER ANALYSIS: | ||||

| In order to consider Profits (Line 78) that are not supported by Distributions (Line 79), business solvency must be determined. | ||||

| (Solvency means that the business has at least as much in current assets as it has in current liabilities.) | ||||

| click here to perform a liquidity analysis | ||||

| HELP | Perform a Liquidity Analysis by reviewing the Balance Sheet (Schedule L) from the applicable year S-Corporation Return (Form 1120-S) utilizing the Liquidity Analysis tab (Lines 160–172) of the AMITRAC. If the appropriate ratio is ≥ 1, solvency has been determined and Profits can be utilized in lieu of Distributions. Note: If the ratio is 0 because there are no current liabilities, this is also generally acceptable. | |||

| Extreme caution should be exercised before considering the use of distributions in excess of profits, including but not limited to determination that the business is not closing down or being sold. Distributions against losses should generally not be utilized. | ||||

| If the amount on Line 78 is negative, it will be carried down to Qualifying Loss (Line 81). | ||||

| Line 80 | Enter the amount of Qualifying K-1 Income (Profit) based upon the above instructions. | The amount entered will be added to the Cash Flow (Part X Totals, Line 83 of the AMITRAC). | ||

| Line 81 | If the amount on Line 78 is negative, the amount will carry down to this field. | The amount entered will be subtracted from the Cash Flow (Part X Totals, Line 83 of the AMITRAC). | ||

| Line 82 | Enter the amount of the borrower’s W-2 Wages attributable to this S-Corporation typically from Box 5 of the W-2 (Self-Employment Wages from Subject business). | The amount entered will be added to the Cash Flow (Part X Totals, Line 83 of the AMITRAC). | ||

| Line 83 | The AMITRAC will Total the amounts in each column, Lines 80–82. | |||

| Line 84 | The AMITRAC will provide an annual trend for the two years entered. If the income has increased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If the income has decreased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (lower) amount. Be sure the income has stabilized before using to qualify. | click here to access the Additional S-Corp K-1 <25% tab | ||

| If the borrower has multiple S-Corporations with less than 25% ownership, enter any additional businesses on the “Additional S-Corp K-1s <25%” tab of the AMITRAC. | ||||

| Part XI | ||||

| Partnership Tax Return (Form 1065) — Self-Employed | click here to return to Main tab - Part XI | |||

| K-1 Analysis 1065 | ||||

| Line 85 | Enter the Name of the Partnership for which you are entering data. | |||

| Line 86 | Enter the amount of Ordinary Business Income from Form 1065, Schedule K-1, Line 1. | The amount entered will be added to the Subtotal (Part XI, Line 90 of the AMITRAC). | ||

| Line 87 | Enter the amount of Ordinary Business Loss from Form 1065, Schedule K-1, Line 1. | The amount entered will be subtracted from the Subtotal (Part XI, Line 90 of the AMITRAC). | ||

| Line 88 | Enter the combined amounts of Net Rental Real Estate and Other Net Rental Income from Form 1065, Schedule K-1, Line 2 and Line 3. | The amount entered will be added to the Subtotal (Part XI, Line 90 of the AMITRAC). | ||

| Line 89 | Enter the combined amounts of Net Rental Real Estate and Other Net Rental Loss from Form 1065, Schedule K-1, Line 2 and Line 3. | The amount entered will be subtracted from the Subtotal (Part XI, Line 90 of the AMITRAC). | ||

| Line 90 | The AMITRAC will Subtotal the amounts in each column (Lines 86–89). | |||

| Line 91 | Enter the amount of the Distributions from Form 1065, Schedule K-1, Line 19a. | The amount entered will NOT automatically be added or subtracted. | ||

| If the amount on Line 90 is positive, compare the Subtotal of Profits (Line 90) to the Distributions (Line 91) to determine the Qualifying K-1 Income (Line 92) that you should enter. If the distributions are less than the profits, you can use the distributions for qualifying income with no further documentation requirements. | ||||

| ADDITIONAL GUIDANCE FOR FURTHER ANALYSIS: | ||||

| In order to consider Profits (Line 90) that are not supported by Distributions (Line 90), business solvency must be determined. | ||||

| HELP | (Solvency means that the business has at least as much in current assets as it has in current liabilities.) | |||

| click here to perform a liquidity analysis | ||||

| Perform a Liquidity Analysis by reviewing the Balance Sheet (Schedule L) from the applicable year Partnership Return (Form 1065) utilizing the Liquidity Analysis tab (Lines 160–172) of the AMITRAC. If the appropriate ratio is ≥ 1, solvency has been determined and Profits can be utilized in lieu of Distributions. Note: If the ratio is 0 because there are no current liabilities, this is also generally acceptable. | ||||

| Extreme caution should be exercised before considering the use of distributions against losses, including but not limited to determination that the business is not closing down or being sold. The same holds true for distributions in excess of profits. | ||||

| If the amount on Line 90 is negative, it will be carried down to Qualifying Loss (Line 93). | ||||

| Line 92 | Enter the amount of Qualifying K-1 Income (Profit) based upon the instructions above. | The amount entered will be added to the Cash Flow (Part XI Totals, Line 95 of the AMITRAC). | ||

| Line 93 | If the amount on Line 90 is negative, the amount will carry down to this field. | The amount entered will be subtracted from the Cash Flow (Part XI Totals, Line 95 of the AMITRAC). | ||

| Line 94 | Enter the amount of Guaranteed Payments to Partner from 2019, 2020 — Form 1065, Schedule K-1, Line 4a (note, utilization of Line 4b requires proof of continuance for 3 more years). 2018 & Prior — Form 1065, Schedule K-1, Line 4. |

The amount entered will be added to the Cash Flow (Part XI Totals, Line 95 of the AMITRAC). | ||

| NOTE: Generally, Guaranteed Payments is acceptable qualifying income, provided there is a two-year history of receipt and an absence of negative information(such as a business loss or other indications it will not continue). Use of Guaranteed Payments from Capital requires proof of continuance. | ||||

| Line 95 | The AMITRAC will Total the amounts in each column, Lines 92–94. | |||

| Business Analysis 1065 | ||||

| Line 96 | Enter the amount of Non-Recurring Income from Line 4 of Form 1065. NOTE: All “other” income is considered non-recurring unless (1) it can be identified, (2) there is a history and (3) it can be documented as ongoing. |

The amount entered will be subtracted from the Subtotal (Part XI, Line 107 of the AMITRAC). | ||

| Line 97 | Enter the amount of Non-Recurring Loss from Line 4 of Form 1065. Enter only non-recurring loss — loss that isn’t determined to be non-recurring should not be entered. | The amount entered will be added to the Subtotal (Part XI, Line 107 of the AMITRAC). | ||

| Line 98 | Enter the amount of Non-Recurring Income from Lines 5, 6 and/or 7 of Form 1065. NOTE: All of these “other” income sources are considered non-recurring unless (1) there is a history and (2) they can be documented as ongoing. |

The amount entered will be subtracted from the Subtotal (Part XI, Line 107 of the AMITRAC). | ||

| Line 99 | Enter the amount of Non-Recurring Loss from Lines 5, 6 and/or 7 of Form 1065. Enter only non-recurring loss — loss that isn’t determined to be non-recurring should not be entered. | The amount entered will be added to the Subtotal (Part XI, Line 107 of the AMITRAC). | ||

| Line 100 | Enter the amount of Depreciation from Line 16a of Form 1065 and/or Line 14 of Form 8825. | The amount entered will be added to the Subtotal (Part XI, Line 107 of the AMITRAC). | ||

| Line 101 | Enter the amount of Depletion from Line 17 of Form 1065. | The amount entered will be added to the Subtotal (Part XI, Line 107 of the AMITRAC). | ||

| Line 102 | Enter the amount of Amortization as itemized from the statement that carries forward to Line 20. Do not enter the entire amount listed on Line 20, only the amount attributable to Amortization. | The amount entered will be added to the Subtotal (Part XI, Line 107 of the AMITRAC). | ||

| Line 103 | Enter the amount of non-recurring Casualty Losses as itemized from the statement that carries forward to Line 20. Do not enter the entire amount listed on Line 20, only the amount attributable to Casualty Losses. | The amount entered will be added to the Subtotal (Part XI, Line 107 of the AMITRAC). | ||

| Line 104 | Enter the amount of One-Time (non-recurring) Expenses as itemized from the statement that carries forward to Line 20. Do not enter the entire amount listed on Line 20, only the amount attributable to One-Time Expenses. | The amount entered will be added to the Subtotal (Part XI, Line 107 of the AMITRAC). | ||

| Line 105 | Enter the amount of Mortgages, Notes and Bonds Due and Payable in Less Than One Year from Form 1065, Schedule L, Line 16d. Note: These do not have be entered if you have (1) evidence that the debt(s) regularly roll over from year to year OR (2) documentation to support that there are currently sufficient, liquid business assets that could be used to pay off the debt (if it were to become necessary). | The amount entered will be subtracted from the Subtotal (Part XI, Line 107 of the AMITRAC). | ||

| Line 106 | Enter the amount of any Non-Deductible Travel, Meals & Entertainment reported on Schedule M-1, Line 4b. If no Schedule M-1 is filed, review itemized deduction statement for reported meals. Enter the amount of non-deducible meals (this is equal to the amount of deductible meals). NOTE: A temporary IRS policy was implemented for Tax Years 2021 and 2022 allowing 100% of Meals expenses to be claimed under certain circumstances. As of the publication date of this form, FNMA and FHLMC have yet to formally address how this will affect qualifying income, but the expectation is that NO meals exclusion will be required for the 2021 and 2022 tax years. |

The amount entered will be subtracted from the Subtotal (Part XI, Line 107 of the AMITRAC). | ||

| Line 107 | The AMITRAC will Subtotal the amounts in each column (Lines 96–106). | |||

| Line 108 | Enter the Borrower’s Ownership Percentage from Form 1065, Schedule K-1, Line J Ending Capital. | |||

| Line 109 | The AMITRAC will multiply the Subtotal by the Borrower’s Ownership Percentage to determine the Borrower’s Proportionate Share of the Subtotal. | |||

| Line 110 | The AMITRAC will combine the Borrower’s Qualifying K-1 Total (Line 95) with the Borrower’s Proportional Share of 1065 of Total (Line 109). | |||

| Line 111 | The AMITRAC will provide an annual trend for the two years entered. If the income has increased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If the income has decreased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (lower) amount. Be sure the income has stabilized before using to qualify. | click here to access the Additional Partnerships tab | ||

| If the borrower has multiple Partnerships with 25% or greater ownership (self-employed), enter any additional businesses on the “Additional Partnerships (1065)” Tab of the AMITRAC. | ||||

| Part XII | ||||

| S-Corporation Tax Return (Form 1120-S) — Self-Employed | click here to return to Main tab - Part XII | |||

| Line 112 | Enter the Name of the S-Corporation for which you are entering data. | |||

| K-1 Analysis 1120-S | ||||

| Line 113 | Enter the amount of Ordinary Business Income from Form 1120-S, Schedule K-1, Line 1. | The amount entered will be added to the Subtotal (Part XII, Line 117 of the AMITRAC). | ||

| Line 114 | Enter the amount of Ordinary Business Loss from Form 1120-S, Schedule K-1, Line 1. | The amount entered will be subtracted from the Subtotal (Part XII, Line 117 of the AMITRAC). | ||

| Line 115 | Enter the combined amounts of Net Rental Real Estate Income from Form 1120-S, Schedule K-1, Line 2 and Line 3. | The amount entered will be added to the Subtotal (Part XII, Line 117 of the AMITRAC). | ||

| Line 116 | Enter the combined amounts of Net Rental Real Estate Loss from Form 1120-S, Schedule K-1, Line 2 and Line 3. | The amount entered will be subtracted from the Subtotal (Part XII, Line 117 of the AMITRAC). | ||

| Line 117 | The AMITRAC will Subtotal the amounts in each column (Lines 113–116). | |||

| Line 118 | Enter the amount of the Distributions from Form 1120-S, Schedule K-1, Line 16d. | The amount entered will NOT automatically be added or subtracted. | ||

| If the amount on Line 117 is positive, compare the Subtotal of Profits (Line 117) to the Distributions (Line 118) to determine the Qualifying K-1 Income (Line 119) that you should enter. If the distributions are less than the profits, you can use the distributions for qualifying income with no further documentation requirements. | ||||

| ADDITIONAL GUIDANCE FOR FURTHER ANALYSIS: | ||||

| In order to consider Profits (Line 117) that are not supported by Distributions (Line 118), business solvency must be determined. | ||||

| (Solvency means that the business has at least as much in current assets as it has in current liabilities.) | ||||

| click here to perform a liquidity analysis | ||||

| HELP | Perform a Liquidity Analysis by reviewing the Balance Sheet (Schedule L) from the applicable year S-Corporation Return (Form 1120-S) utilizing the Liquidity Analysis tab (Lines 160–172) of the AMITRAC. If the appropriate ratio is ≥ 1, solvency has been determined and Profits can be utilized in lieu of Distributions. Note: If the ratio is 0 because there are no current liabilities, this is also generally acceptable. | |||

| Extreme caution should be exercised before considering the use of distributions in excess of profits, including but not limited to determination that the business is not closing down or being sold. Distributions against losses should generally not be utilized. | ||||

| If the amount on Line 117 is negative, it will be carried down to Qualifying Loss (Line 120). | ||||

| Line 119 | Enter the amount of Qualifying K-1 Income based upon the above instructions. | The amount entered will be added to the Cash Flow (Part XII Totals, Line 122 of the AMITRAC). | ||

| Line 120 | If the amount on Line 117 is negative, the amount will carry down to this field. | The amount entered will be subtracted from the Cash Flow (Part XII Totals, Line 122 of the AMITRAC). | ||

| Line 121 | Enter the amount of the borrower’s W-2 Wages attributable to this S-Corporation typically from Box 5 of the W-2 (Self-Employment Wages from Subject business). | The amount entered will be added to the Cash Flow (Part XII Totals, Line 122 of the AMITRAC). | ||

| Line 122 | The AMITRAC will Total the amounts in each column, Lines 119–121. | |||

| Business Analysis 1120-S | ||||

| Line 123 | Enter the amount of Non-Recurring Income from Lines 4 and/or 5 of Form 1120-S. NOTE: All “other” income is considered non-recurring unless (1) it can be identified, (2) there is a history and (3) it can be documented as ongoing. |

The amount entered will be subtracted from the Subtotal (Part XII, Line 132 of the AMITRAC). | ||

| Line 124 | Enter the amount of Non-Recurring Loss from Lines 4 and/or 5 of Form 1120-S. Enter only non-recurring loss — loss that isn’t determined to be non-recurring should not be entered. | The amount entered will be added to the Subtotal (Part XII, Line 132 of the AMITRAC). | ||

| Line 125 | Enter the amount of Depreciation from Line 14 of Form 1120-S and/or Line 14 of Form 8825. | The amount entered will be added to the Subtotal (Part XII, Line 132 of the AMITRAC). | ||

| Line 126 | Enter the amount of Depletion from Line 15 of Form 1120-S. | The amount entered will be added to the Subtotal (Part XII, Line 132 of the AMITRAC). | ||

| Line 127 | Enter the amount of Amortization as itemized from the statement that carries forward to Line 19 of Form 1120-S. Do not enter the entire amount listed on Line 19, only the amount attributable to Amortization. | The amount entered will be added to the Subtotal (Part XII, Line 132 of the AMITRAC). | ||

| Line 128 | Enter the amount of non-recurring Casualty Losses as itemized from the statement that carries forward to Line 19 of Form 1120-S. Do not enter the entire amount listed on Line 19, only the amount attributable to Casualty Losses. | The amount entered will be added to the Subtotal (Part XII, Line 132 of the AMITRAC). | ||

| Line 129 | Enter the amount of One-Time (non-recurring) Expenses as itemized from the statement that carries forward to Line 19 of Form 1120-S. Do not enter the entire amount listed on Line 19, only the amount attributable to One-Time Expenses. | The amount entered will be added to the Subtotal (Part XII, Line 132 of the AMITRAC). | ||

| Line 130 | Enter the amount of Mortgages, Notes and Bonds Due and Payable in Less Than One Year from Form 1120-S, Schedule L, Line 17d. NOTE: These do not have be entered if you have (1) evidence that the debt(s) regularly roll over from year to year OR (2) documentation to support that there are currently sufficient, liquid business assets that could be used to pay off the debt (if it were to become necessary). |

The amount entered will be subtracted from the Subtotal (Part XII, Line 132 of the AMITRAC). | ||

| Line 131 | Enter the amount of any Non-Deductible Travel, Meals & Entertainment reported on Schedule M-1, Line 3b. If no Schedule M-1 is filed, review itemized deductions statement for reported meals. Enter the amount of non-deducible meals (this is equal to the amount of deductible meals). NOTE: A temporary IRS policy was implemented for Tax Years 2021 and 2022 allowing 100% of Meals expenses to be claimed under certain circumstances. As of the publication date of this form, FNMA and FHLMC have yet to formally address how this will affect qualifying income, but the expectation is that NO meals exclusion will be required for the 2021 and 2022 tax years. |

The amount entered will be subtracted from the Subtotal (Part XII, Line 132 of the AMITRAC). | ||

| Line 132 | The AMITRAC will Subtotal the amounts in each column (Lines 123–131). | |||

| Line 133 | Enter the Borrower’s Ownership Percentage from Form 1120-S, Schedule K-1, Line F | |||

| Line 134 | The AMITRAC will multiply the Subtotal by the Borrower’s Ownership Percentage to determine the Borrower’s Proportionate Share of the Subtotal. | |||

| Line 135 | The AMITRAC will combine the Borrower’s Qualifying K-1 Total (Line 122) with the Borrower’s Proportional Share of 1120-S (Line 134). | |||

| Line 136 | The AMITRAC will provide an annual trend for the two years entered. If the income has increased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If the income has decreased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (lower) amount. Be sure the income has stabilized before using to qualify. | click here to access the Additional S-Corps tab | ||

| If the borrower has multiple S-Corporations with 25% or greater ownership (self-employed), enter any additional businesses on the “Additional S-Corps (1120-S)” tab of the Tax Return Analysis AMITRAC. | ||||

| Part XIII | ||||

| Corporation Tax Return (Form 1120) | click here to return to Main tab - Part XIII | |||

| Line 137 | Enter the Name of the Corporation for which you are entering data. | |||

| Line 138 | Enter the amount of Taxable Income from Line 30 of Form 1120. | The amount entered will be added to the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 139 | Enter the amount of Taxable Loss from Line 30 of Form 1120. | The amount entered will be subtracted from the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 140 | Enter the amount of Total Tax from Line 31 of Form 1120. | The amount entered will be subtracted from the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 141 | Enter the amount of Non-Recurring Gains from Lines 8 and/or 9 of Form 1120. | The amount entered will be subtracted from the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 142 | Enter the amount of Non-Recurring Losses from Lines 8 and/or 9 of Form 1120. Enter only non-recurring losses — losses that aren’t determined to be non-recurring should not be entered. | The amount entered will be added to the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 143 | Enter the amount of Non-Recurring Income from Line 10 of Form 1120. NOTE: All “other” income is considered non-recurring unless (1) it can be identified, (2) there is a history and (3) it can be documented as ongoing. |

The amount entered will be subtracted from the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 144 | Enter the amount of Non-Recurring Loss from Line 10 of Form 1120. Enter only non-recurring loss — loss that isn’t determined to be non-recurring should not be entered. | The amount entered will be added to the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 145 | Enter the Depreciation from Line 20 of Form 1120. | The amount entered will be added to the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 146 | Enter the Depletion from Line 21 of Form 1120. | The amount entered will be added to the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 147 | Enter the amount of Amortization as itemized from the statement that carries forward to Line 26 of Form 1120. Do not enter the entire amount listed on Line 26, only the amount attributable to Amortization. | The amount entered will be added to the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 148 | Enter the amount of non-recurring Casualty Losses as itemized from the statement that carries forward to Line 26 of Form 1120. Do not enter the entire amount listed on Line 26, only the amount attributable to non-recurring Casualty Losses. | The amount entered will be added to the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 149 | Enter the amount of One-Time (non-recurring) Expenses as itemized from the statement that carries forward to Line 26 of Form 1120. Do not enter the entire amount listed on Line 26, only the amount attributable to non-recurring, One-Time Expenses. | The amount entered will be added to the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 150 | Enter the amount of Net Operating Loss from Line 29a of the 1120. | The amount entered will be added to the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 151 | Enter the amount of Mortgages, Notes and Bonds Due and Payable in Less Than One Year from Form 1120, Schedule L, Line 17d. NOTE: These do not have be entered if you have (1) evidence that the debt(s) regularly roll over from year to year OR (2) documentation to support that there are currently sufficient, liquid business assets that could be used to pay off the debt (if it were to become necessary). |

The amount entered will be subtracted from the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 152 | Enter the amount of any Non-Deductible Travel, Meals & Entertainment reported on Schedule M-1, Line 5c. If no Schedule M-1 is filed, review itemized deduction statement for reported meals. Enter the amount of non-deducible meals (this is equal to the amount of deductible meals). NOTE: A temporary IRS policy was implemented for Tax Years 2021 and 2022 allowing 100% of Meals expenses to be claimed under certain circumstances. As of the publication date of this form, FNMA and FHLMC have yet to formally address how this will affect qualifying income, but the expectation is that NO meals exclusion will be required for the 2021 and 2022 tax years. |

The amount entered will be subtracted from the Subtotal (Part XIII, Line 153 of the AMITRAC). | ||

| Line 153 | The AMITRAC will Subtotal the amounts in each column (Lines 139–153). | |||

| Line 154 | Enter the Borrower’s Ownership Percentage from Form 1125E, combined amounts of Common and Preferred Stock.* * NOTE: If Form 1125E was not filed, a source outside of the tax return is required to document ownership percentage. |

|||

| Line 155 | The AMITRAC will multiply the Subtotal by the Borrower’s Ownership Percentage to determine the Borrower’s Proportionate Share of the Subtotal, if the Borrower’s Ownership Percentage is 100%. If the Borrower’s Ownership Interest is <100%, cash flow from the Corporation will NOT be considered UNLESS an indication is made at the top of Page 1 of the AMITRAC that the loan is a Freddie Mac loan (or a loan following Freddie Mac guidelines). Note: For married borrowers who are both a part of the transaction, ownership percentages can be combined for consideration of corporation cash flow — be sure to count only once, either for the borrower OR the co-borrower. | |||

| Line 156 | Enter the amount of the Borrower’s W-2 Wages attributable to this Corporation typically from Box 5 of the W-2 (Self-Employment Wages from Subject business). | The amount entered will be added to the Total (Part XIII, Line 156 of the AMITRAC). | ||

| Line 157 | Enter the amount of Dividends paid to the borrower by the Corporation, as indicated on Schedule B of the 1040. | The amount entered will be subtracted from the Total (Part XIII, Line 156 of the AMITRAC). | ||

| Line 158 | The AMITRAC will Total the amounts in each column (Lines 156–158). If the borrower does not own 100% of the Corporation, only Lines 103 and 104 will be considered UNLESS an indication is made at the top of Page 1 of the AMITRAC that the loan is a Freddie Mac loan (or a loan following Freddie Mac guidelines). | |||

| Line 159 | The AMITRAC will provide an annual trend for the two years entered. If the income has increased from the Prior Year to the Most Recent Year, the AMITRAC will Average the Amounts. If the income has decreased from the Prior Year to the Most Recent Year, the AMITRAC will use the Most Recent Year (lower) amount. Be sure the income has stabilized before using to qualify. | click here to access the Additional Corporations tab | ||

| If the borrower has multiple Corporations for which you are analyzing income, enter any additional businesses on the “Additional Corporations (1120)” tab of the AMITRAC. | ||||

| Liquidity Analysis | click here to access Liquidity Analysis tab | |||

| Line 165 | Applicable "other assets" included assets that can be easily liquidated. Enter only the itemized, applicable amounts, rather than the total. | |||

| Line 169 | Applicable "other liabilities" included liabilities that are due and payable within the next 12 months. Enter only the itemized, applicable amounts rather than the total. | |||