263x Filetype XLSX File size 0.02 MB Source: am.jpmorgan.com

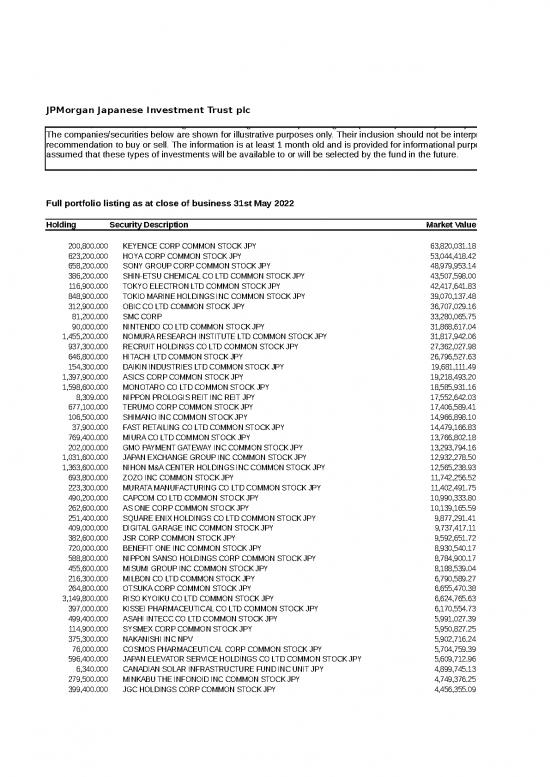

JPMorgan Japanese Investment Trust plc

client basis, and as such, J.P. Morgan Asset Management accepts no legal responsibility or liability for any such data manipulation.

The companies/securities below are shown for illustrative purposes only. Their inclusion should not be interpreted as a

recommendation to buy or sell. The information is at least 1 month old and is provided for informational purposes only. It cannot be

assumed that these types of investments will be available to or will be selected by the fund in the future.

Full portfolio listing as at close of business 31st May 2022

Holding Security Description Market Value

200,800.000 KEYENCE CORP COMMON STOCK JPY 63,820,031.18

623,200.000 HOYA CORP COMMON STOCK JPY 53,044,418.42

658,200.000 SONY GROUP CORP COMMON STOCK JPY 48,979,953.14

386,200.000 SHIN-ETSU CHEMICAL CO LTD COMMON STOCK JPY 43,507,598.00

116,900.000 TOKYO ELECTRON LTD COMMON STOCK JPY 42,417,641.83

848,900.000 TOKIO MARINE HOLDINGS INC COMMON STOCK JPY 39,070,137.48

312,900.000 OBIC CO LTD COMMON STOCK JPY 36,707,029.16

81,200.000 SMC CORP 33,280,065.75

90,000.000 NINTENDO CO LTD COMMON STOCK JPY 31,868,617.04

1,455,200.000 NOMURA RESEARCH INSTITUTE LTD COMMON STOCK JPY 31,817,942.06

937,300.000 RECRUIT HOLDINGS CO LTD COMMON STOCK JPY 27,362,027.98

646,800.000 HITACHI LTD COMMON STOCK JPY 26,796,527.63

154,300.000 DAIKIN INDUSTRIES LTD COMMON STOCK JPY 19,681,111.49

1,397,900.000 ASICS CORP COMMON STOCK JPY 19,218,493.20

1,598,600.000 MONOTARO CO LTD COMMON STOCK JPY 18,585,931.16

8,309.000 NIPPON PROLOGIS REIT INC REIT JPY 17,552,642.03

677,100.000 TERUMO CORP COMMON STOCK JPY 17,406,589.41

106,500.000 SHIMANO INC COMMON STOCK JPY 14,966,898.10

37,900.000 FAST RETAILING CO LTD COMMON STOCK JPY 14,479,166.83

769,400.000 MIURA CO LTD COMMON STOCK JPY 13,766,802.18

202,000.000 GMO PAYMENT GATEWAY INC COMMON STOCK JPY 13,293,794.16

1,031,600.000 JAPAN EXCHANGE GROUP INC COMMON STOCK JPY 12,932,278.50

1,363,600.000 NIHON M&A CENTER HOLDINGS INC COMMON STOCK JPY 12,565,238.93

693,800.000 ZOZO INC COMMON STOCK JPY 11,742,256.52

223,300.000 MURATA MANUFACTURING CO LTD COMMON STOCK JPY 11,402,491.75

490,200.000 CAPCOM CO LTD COMMON STOCK JPY 10,990,333.80

262,600.000 AS ONE CORP COMMON STOCK JPY 10,139,165.59

251,400.000 SQUARE ENIX HOLDINGS CO LTD COMMON STOCK JPY 9,877,291.41

409,000.000 DIGITAL GARAGE INC COMMON STOCK JPY 9,737,417.11

382,600.000 JSR CORP COMMON STOCK JPY 9,592,651.72

720,000.000 BENEFIT ONE INC COMMON STOCK JPY 8,930,540.17

588,800.000 NIPPON SANSO HOLDINGS CORP COMMON STOCK JPY 8,784,900.17

455,600.000 MISUMI GROUP INC COMMON STOCK JPY 8,188,539.04

216,300.000 MILBON CO LTD COMMON STOCK JPY 6,790,589.27

264,800.000 OTSUKA CORP COMMON STOCK JPY 6,655,470.38

3,149,800.000 RISO KYOIKU CO LTD COMMON STOCK JPY 6,624,765.63

397,000.000 KISSEI PHARMACEUTICAL CO LTD COMMON STOCK JPY 6,170,554.73

499,400.000 ASAHI INTECC CO LTD COMMON STOCK JPY 5,991,027.39

114,900.000 SYSMEX CORP COMMON STOCK JPY 5,950,827.25

375,300.000 NAKANISHI INC NPV 5,902,716.24

76,000.000 COSMOS PHARMACEUTICAL CORP COMMON STOCK JPY 5,704,759.39

596,400.000 JAPAN ELEVATOR SERVICE HOLDINGS CO LTD COMMON STOCK JPY 5,609,712.96

6,340.000 CANADIAN SOLAR INFRASTRUCTURE FUND INC UNIT JPY 4,899,745.13

279,500.000 MINKABU THE INFONOID INC COMMON STOCK JPY 4,749,376.25

399,400.000 JGC HOLDINGS CORP COMMON STOCK JPY 4,456,355.09

250,000.000 MEDLEY INC COMMON STOCK JPY 4,137,079.27

184,800.000 MONEY FORWARD INC COMMON STOCK JPY 4,103,341.18

436,700.000 CYBERAGENT INC COMMON STOCK JPY 3,746,653.09

279,200.000 RAKSUL INC COMMON STOCK JPY 3,674,878.54

145,700.000 M3 INC COMMON STOCK JPY 3,346,589.05

173,400.000 FREEE KK COMMON STOCK JPY 3,071,614.36

969,300.000 INFOMART CORP COMMON STOCK JPY 2,941,416.18

474,200.000 NIPPON PAINT HOLDINGS CO LTD COMMON STOCK JPY 2,799,024.17

1,435,500.000 YAMASHIN-FILTER CORP COMMON STOCK JPY 2,718,158.22

22,300.000 LASERTEC CORP COMMON STOCK JPY 2,581,679.32

220,300.000 WEALTHNAVI INC COMMON STOCK JPY 2,489,276.43

456,000.000 RAKUTEN GROUP INC COMMON STOCK JPY 2,036,275.66

182,400.000 YAPPLI INC COMMON STOCK JPY 1,632,395.57

470,500.000 SPIDERPLUS & CO COMMON STOCK JPY 1,358,121.55

400,000.000 HEALIOS KK COMMON STOCK JPY 831,424.95

34,300.000 BENGO4.COM INC COMMON STOCK JPY 766,893.92

Total portfolio 864,247,244.11

Actual gearing as at 31st May 2022

client basis, and as such, J.P. Morgan Asset Management accepts no legal responsibility or liability for any such data manipulation.

The companies/securities below are shown for illustrative purposes only. Their inclusion should not be interpreted as a

recommendation to buy or sell. The information is at least 1 month old and is provided for informational purposes only. It cannot be

assumed that these types of investments will be available to or will be selected by the fund in the future.

% of FundSecurity No.

7.38% 6490995

6.14% 6441506

5.67% 6821506

5.03% 6804585

4.91% 6895675

4.52% 6513126

4.25% 6136749

3.85% 6763965

3.69% 6639550

3.68% 6390921

3.17% BQRRZ00

3.10% 6429104

2.28% 6250724

2.22% 6057378

2.15% B1GHR88

2.03% B98BC67

2.01% 6885074

1.73% 6804820

1.68% 6332439

1.59% 6597777

1.54% B06CMQ9

1.50% 6743882

1.45% B1DN466

1.36% B292RC1

1.32% 6610403

1.27% 6173694

1.17% 6480929

1.14% 6309262

1.13% 6309422

1.11% 6470986

1.03% B02JV67

1.02% 6640541

0.95% 6595179

0.79% 6586117

0.77% 6267058

0.77% 6187491

0.71% 6494061

0.69% B019MQ5

0.69% 6883807

0.68% 6271071

0.66% B036QP1

0.65% BF0QWT5

0.57% BD7Y6L8

0.55% BJNFRC5

0.52% 6473468

0.48% BK93ZN7

0.47% BD5ZWW6

0.43% 6220501

0.43% BFM1K61

0.39% B02K2M3

0.36% BKLFVR7

0.34% B18RC03

0.32% 6640507

0.31% BQQD1C3

0.30% 6506267

0.29% BMC6VV7

0.24% 6229597

0.19% BN133H6

0.16% BN10849

0.10% BY4JZZ0

0.09% BSLTDM4

100.00%

11.1%

no reviews yet

Please Login to review.