283x Filetype XLSX File size 0.03 MB Source: courses.edx.org

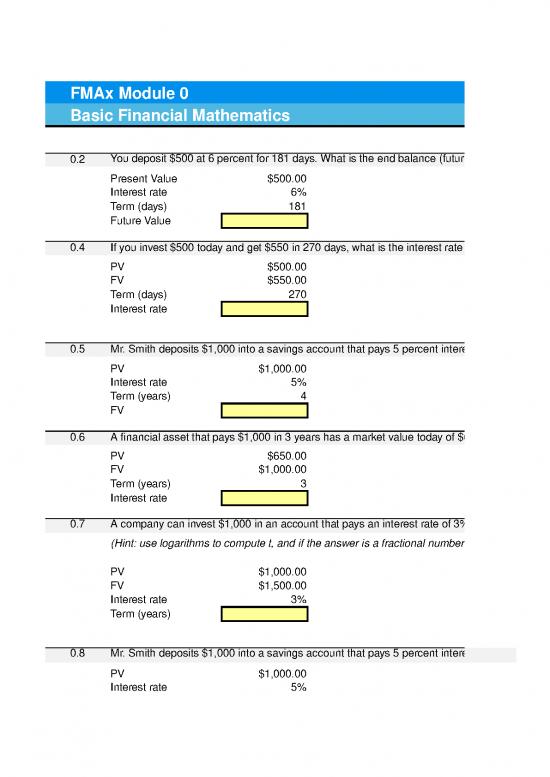

FMAx Module 0

Basic Financial Mathematics

0.2 You deposit $500 at 6 percent for 181 days. What is the end balance (future value) you will have in the account at maturity?

Present Value $500.00

Interest rate 6%

Term (days) 181

Future Value

0.4 If you invest $500 today and get $550 in 270 days, what is the interest rate paid on the account?

PV $500.00

FV $550.00

Term (days) 270

Interest rate

0.5 Mr. Smith deposits $1,000 into a savings account that pays 5 percent interest compounded annually. What will be the balance in the account 4 years from now?

PV $1,000.00

Interest rate 5%

Term (years) 4

FV

0.6 A financial asset that pays $1,000 in 3 years has a market value today of $650. What is the interest rate on this investment assuming annual compounding?

PV $650.00

FV $1,000.00

Term (years) 3

Interest rate

0.7 A company can invest $1,000 in an account that pays an interest rate of 3% compounded annually. How many years will the company need to keep the investment to accumulate at least $1,500.

(Hint: use logarithms to compute t, and if the answer is a fractional number, round up to the next integer: i.e., if answer is 2.2 years round to 3 years, and so on).

PV $1,000.00

FV $1,500.00

Interest rate 3%

Term (years)

0.8 Mr. Smith deposits $1,000 into a savings account that pays 5 percent interest with monthly compounding. What will be the balance in the account 4 years from now?

PV $1,000.00

Interest rate 5%

Term (years) 4

FV

0.9 What is the effective interest rate of an investment that offers a nominal rate of 15 percent compounded monthly?

Nominal interest 15%

Frequency 12

Effective Rate

0.10 What are the interest gains on $100 deposited over 5 years at 6% rate compounded quarterly?

PV $100

Nominal interest 6%

Term (years) 5

Frequency 4

Interest gains

0.11 Which of these two alternatives offers the highest return? a) 13% APR with monthly compounding, or b) 13.3 APR with semi-annual compounding?

Option A Option B

APR 13% 13.30%

Frequency 12 2

Effective interest

She should prefer:

0.12 Ms. Woodhouse is selling her property and has received two offers:

(1) a cash payment of $220,000, or

(2) a payment of $240,000 one year from now.

Which offer should she accept, given that she can invest funds today at an interest rate of 6 percent?

(Hint: compare the present values of the two options)

Offer 1 Offer 2

PV

She should accept:

0.13 If the discount rate is 8 percent, which of the following two options would you prefer to receive?

Option 1: $10,000 today

Option 2: $13,000 in 3 years

Option 1 Option 2

PV

0.14 A company can invest in a new technology that costs $500,000 and will provide yearly cost savings of $40,000 during the next 20 years. Will this investment be

financially profitable if the company finances it with a bank loan at the 5% interest rate?

(Hint: we treat the cost savings in the same way as a positive cash flow and assess the investment’s financial profitability by its NPV).

Investment ($500,000)

Yearly savings Note: CF 1

Time (years) 20 NPV CF * 1

Interest 5.00% 0 i (1i)T

NPV

0.15 What is the net present value of an investment that requires you to pay $4,000 today, then pays back $800 for the next 6 years plus 4,800 at the end of year 7? Use a

discount rate of 5 percent.

Discounted

Year Cash Flow Discount factors cash flows

0

1

2

3

4

5

6

7

Discount rate 5%

NPV

0.16 What is the internal rate of return (IRR) of an investment that offers the following cash flows?

Year Cash Flow

0 -$2,000.00

1 $1,000.00

2 $1,000.00

3 $3,000.00

IRR

0.17 Mr. Ferrari wants to save $4,500 for the down payment to purchase a new car two years from now. How much money does he need to deposit today into a bank account

that pays 4 percent per year compounded monthly?

FV $4,500

Time (years) 2

Interest rate 4%

Frequency 12.00

PV

0.18 Compute the future value of $100 for: (A) 10 years at 5 percent compounded annually; (B) 10 years at 4.5 percent compounded quarterly; (C) 10 years at 4.0 percent

compounded monthly. Which one offers the largest value at the end of the tenth year?

Option A Option B Option C

PV $100 $100 $100

Time (years) 10 10 10

Interest rate 5.00% 4.50% 4.00%

Frequency 1 4 12

FV

Most profitable:

0.19 A company is considering executing a project that requires an investment of $10,000 and would produce yearly flows of $2,500 over the next 8 years. Compute the

internal rate of return of this project.

(Hint: below we provide two methods for calculating the IRR: using the Excel IRR function, or finding through Goal Seek the rate that makes NPV = 0)

Using Goal Seek Using the IRR formula

PV

Cash Flows

Time (years)

NPV

IRR IRR

0.20 Which of the two financial alternatives produces has the highest internal rate of return? A) An investment of $100,000 that pays $10,000 semi-annually during 5 years

plus $20,000 at the end of the fifth year, or B) an investment of $120,000 that pays $30,000 per year durig 5 years.

Period (semi-annual) Alternative A Period (years) Alternative B

0 -$100,000 0 -$120,000

1 $10,000 1 $30,000

2 $10,000 2 $30,000

3 $10,000 3 $30,000

4 $10,000 4 $30,000

5 $10,000 5 $30,000

6 $10,000

7 $10,000

8 $10,000

9 $10,000

10 $30,000

IRR

IRR annual

no reviews yet

Please Login to review.