233x Filetype XLSX File size 0.03 MB Source: dpi.wi.gov

Sheet 1: Instructions & Example

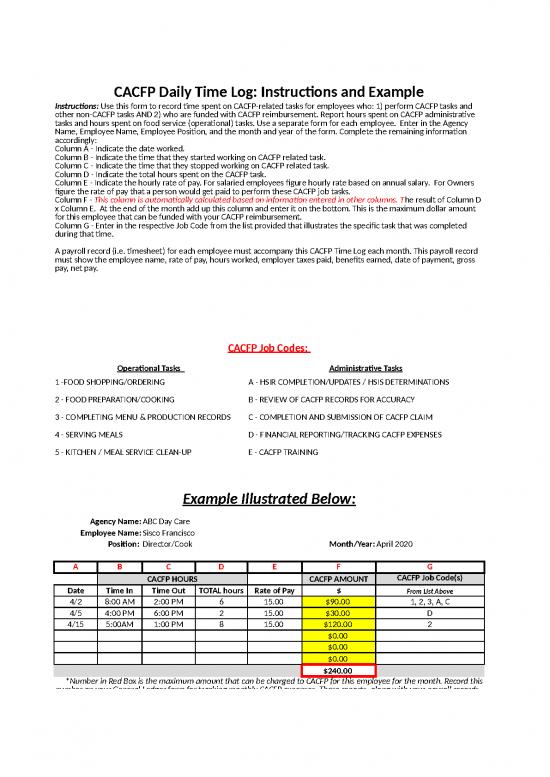

| CACFP Daily Time Log: Instructions and Example | ||||||

| Instructions: Use this form to record time spent on CACFP-related tasks for employees who: 1) perform CACFP tasks and other non-CACFP tasks AND 2) who are funded with CACFP reimbursement. Report hours spent on CACFP administrative tasks and hours spent on food service (operational) tasks. Use a separate form for each employee. Enter in the Agency Name, Employee Name, Employee Position, and the month and year of the form. Complete the remaining information accordingly: Column A - Indicate the date worked. Column B - Indicate the time that they started working on CACFP related task. Column C - Indicate the time that they stopped working on CACFP related task. Column D - Indicate the total hours spent on the CACFP task. Column E - Indicate the hourly rate of pay. For salaried employees figure hourly rate based on annual salary. For Owners figure the rate of pay that a person would get paid to perform these CACFP job tasks. Column F - This column is automatically calculated based on information entered in other columns. The result of Column D x Column E. At the end of the month add up this column and enter it on the bottom. This is the maximum dollar amount for this employee that can be funded with your CACFP reimbursement. Column G - Enter in the respective Job Code from the list provided that illustrates the specific task that was completed during that time. A payroll record (i.e. timesheet) for each employee must accompany this CACFP Time Log each month. This payroll record must show the employee name, rate of pay, hours worked, employer taxes paid, benefits earned, date of payment, gross pay, net pay. |

||||||

| CACFP Job Codes: | ||||||

| Operational Tasks | Administrative Tasks | |||||

| 1 -FOOD SHOPPING/ORDERING | A - HSIR COMPLETION/UPDATES / HSIS DETERMINATIONS | |||||

| 2 - FOOD PREPARATION/COOKING | B - REVIEW OF CACFP RECORDS FOR ACCURACY | |||||

| 3 - COMPLETING MENU & PRODUCTION RECORDS | C - COMPLETION AND SUBMISSION OF CACFP CLAIM | |||||

| 4 - SERVING MEALS | D - FINANCIAL REPORTING/TRACKING CACFP EXPENSES | |||||

| 5 - KITCHEN / MEAL SERVICE CLEAN-UP | E - CACFP TRAINING | |||||

| Example Illustrated Below: | ||||||

| Agency Name: | ABC Day Care | |||||

| Employee Name: | Sisco Francisco | |||||

| Position: | Director/Cook | Month/Year: | April 2020 | |||

| A | B | C | D | E | F | G |

| CACFP HOURS | CACFP AMOUNT | CACFP Job Code(s) | ||||

| Date | Time In | Time Out | TOTAL hours | Rate of Pay | $ | From List Above |

| 4/2 | 8:00 AM | 2:00 PM | 6 | 15.00 | $90.00 | 1, 2, 3, A, C |

| 4/5 | 4:00 PM | 6:00 PM | 2 | 15.00 | $30.00 | D |

| 4/15 | 5:00AM | 1:00 PM | 8 | 15.00 | $120.00 | 2 |

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $240.00 | ||||||

| *Number in Red Box is the maximum amount that can be charged to CACFP for this employee for the month. Record this number on your General Ledger form for tracking monthly CACFP expenses. These reports, along with your payroll records, will support the number that you report on Line #10 on the Annual CACFP Financial Report. | ||||||

| CACFP Daily Time Log - Independent | ||||||

| Agency Name: | ||||||

| Employee Name: | ||||||

| Position: | Month/Year: | |||||

| CACFP HOURS | CACFP AMOUNT | CACFP Job Code(s) | ||||

| Date | Time In | Time Out | TOTAL hours | Rate of Pay | $ | From Instructions |

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| *Number in Red Box is the maximum amount that can be charged to CACFP for this employee for the month. Record this number on your General Ledger form for tracking monthly CACFP expenses. These reports, along with your payroll records, will support the number that you report on Line #10 on the Annual CACFP Financial Report. | ||||||

| CACFP Daily Time Log - Independent | ||||||

| Agency Name: | ||||||

| Employee Name: | ||||||

| Position: | Month/Year: | |||||

| CACFP HOURS | CACFP AMOUNT | CACFP Job Code(s) | ||||

| Date | Time In | Time Out | TOTAL hours | Rate of Pay | $ | From Instructions |

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| $0.00 | ||||||

| *Number in Red Box is the maximum amount that can be charged to CACFP for this employee for the month. Record this number on your General Ledger form for tracking monthly CACFP expenses. These reports, along with your payroll records, will support the number that you report on Line #10 on the Annual CACFP Financial Report. | ||||||

no reviews yet

Please Login to review.