|

|

|

|

|

|

|

|

|

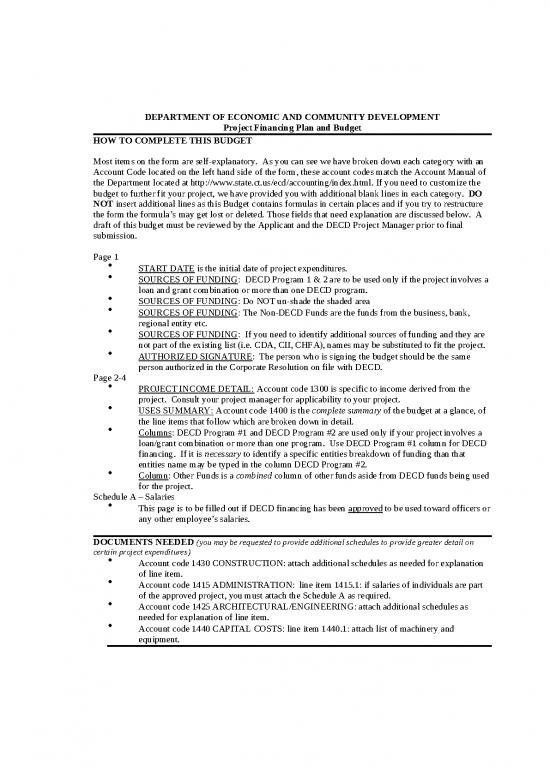

| DEPARTMENT OF ECONOMIC AND COMMUNITY DEVELOPMENT |

|

|

|

|

|

|

|

|

|

|

| PROJECT FINANCING PLAN & BUDGET |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROJECT FINANCING PLAN AND BUDGET |

|

|

|

|

|

| Initial Submission: |

|

|

|

|

|

|

|

|

| Revision #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of entity which DECD will be contracting with.

Applicant: |

|

|

|

|

For Internal Use Only |

|

|

|

| Project Name:

|

Name of program funded under

Program Title: |

|

|

|

|

Number given by the Client Connection System

Project #:

|

|

|

This number is your Federal Employee ID number and may begin with 06

Federal ID #:

|

|

|

| Budget Period

|

Budget Period Approved by DECD |

|

|

|

|

The initial start date of project expenditures.

Start |

|

|

|

|

Start |

|

|

|

|

The end date

of project expenditures.

End

|

|

|

|

End |

|

|

|

| THE FOLLOWING APPLIES TO HOUSING PROJECTS ONLY: |

|

|

|

|

|

|

|

|

| Units Counted By: ( ) Beds ( ) Bedrooms |

|

|

|

|

|

|

|

|

| Total Units: |

Assisted Units: |

|

|

Unit Mix: 0BR 1BR 2BR 3BR 4BR _____ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-DECD FUNDS |

DECD FUNDS |

|

|

| SOURCES OF FUNDING |

|

|

CASH |

IN-KIND |

GRANT |

LOAN |

TOTAL |

|

|

Company investment, Owner investment, stockholders investment

Private Investment |

|

|

|

|

|

|

$- |

|

| Bank Financing |

|

|

|

|

|

|

$- |

|

| CT. Development Authority |

|

|

|

|

|

|

$- |

|

| CT. Innovations, Inc. |

|

|

|

|

|

|

$- |

|

| CHFA |

|

|

|

|

|

|

$- |

|

|

Name of program project is funded under

DECD Program #1 |

|

|

|

|

|

|

$- |

|

|

If the project involves a loan and grant this line item will be used to separate the two funding types or programs

DECD Program #2

|

|

|

|

|

$- |

|

| Other _______________________

|

|

|

|

|

$- |

|

|

|

|

|

|

|

|

$- |

|

|

|

|

|

|

|

$- |

|

|

|

|

|

|

|

|

$- |

|

| TOTAL SOURCES

|

|

$- |

$- |

$- |

$- |

$- |

|

|

|

|

|

|

|

|

|

|

| Approval of the Project Financing Plan and Budget for State Assistance in the amount shown in the |

|

|

|

|

|

|

|

|

| above summary and for the time period indicated is hereby requested. It is understood that the project |

|

|

|

|

|

|

|

|

| will be operated in accordance with the Project Financing Plan and Budget approved by the Connecticut |

|

|

|

|

|

|

|

|

| Department of Economic and Community Development. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Date Submitted: |

|

|

Applicant: |

|

|

|

|

|

|

|

|

| Authorized Signature: |

|

|

|

Title: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR INTERNAL USE ONLY |

|

|

|

|

|

| The Project Financing Plan and Budget is hereby approved in the amounts and for the time period indicated. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Date: |

|

|

Signed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Date: |

|

|

Signed: |

|

|

|

|

|

|

|

|

Submission Date:

|

|

Insert what revision number is applicable to this budget.

Revision #: |

|

|

Applicant Name: |

|

|

|

|

|

Project Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DECD |

DECD |

OTHER |

|

| Acct. |

|

PROGRAM |

PROGRAM |

FUNDS: |

TOTAL |

| Code |

PROJECT INCOME DETAIL |

#1 |

#2 |

|

FUNDS |

| 1310.1 |

All proceeds received from the sale of land or buildings.

SALE OF LAND OR BLDGS |

|

|

|

$- |

| 1310.2 |

All rentals received from tenants or others occupying dwellings on acquired sites.

RENTAL OF LAND OR BLDGS |

|

|

|

$- |

| 1310.3 |

All income received from the sale of salvage or equipment no longer needed for program use.

SALE OF SALVAGE OR EQUIP. |

|

|

|

$- |

| 1310.4 |

All income earned on checking, savings and investment accounts. Not to include interest earned on Reich & Tang bank account.

INVESTMENT INTEREST |

|

|

|

$- |

| 1310.5 |

This account shall be credited with the income from all residential dwelling units in the Project, which are occupied during development of the Project, but prior to completion of the Project, shall be deposited and credited to this account. Costs chargeable to this account shall include costs associated with the maintenance and operation of said occupied untis which are incurred as a result of the occupance of said units, excluding real estate taxes, insurance and any other itmes provided for the Project Financing Plan and Budget. Note: To be used in the MRD and Affordable Housing Programs.

SITE NET INCOME |

|

|

|

$- |

| 1310.6 |

All income for which no specific account has been established.

OTHER PROJECT INCOME |

|

|

|

$- |

|

TOTAL PROJECT INCOME |

$- |

$- |

$- |

$- |

|

|

|

|

|

|

|

|

DECD |

DECD |

OTHER |

|

| Acct. |

|

PROGRAM |

PROGRAM |

FUNDS: |

TOTAL |

| Code |

USES SUMMARY |

#1 |

#2 |

|

FUNDS |

| 1405 |

LAND |

|

|

|

$- |

| 1410 |

OTHER DEVELOP EXPENSES |

|

|

|

$- |

| 1415 |

ADMINISTRATION |

|

|

|

$- |

| 1420 |

CARRYING CHARGES |

|

|

|

$- |

| 1425 |

ARCHITECTURAL & ENGINEERING |

|

|

|

$- |

| 1430 |

CONSTRUCTION |

|

|

|

$- |

| 1435 |

OTHER WORKING CAPITAL |

|

|

|

$- |

| 1440 |

CAPITAL COSTS |

|

|

|

$- |

| 1445 |

RESEARCH & DEVELOPMENT |

|

|

|

$- |

| 1450 |

FURNISHINGS/EQUIPMENT |

|

|

|

$- |

| 1455 |

CONTINGENCY |

|

|

|

$- |

|

TOTAL PROJECT COSTS |

$- |

$- |

$- |

$- |

|

|

|

|

|

|

|

|

DECD |

DECD |

OTHER |

|

|

|

PROGRAM |

PROGRAM |

FUNDS: |

TOTAL |

|

USES |

#1 |

#2 |

|

FUNDS |

| 1405 |

LAND |

|

|

|

|

| 1405.1 |

1. If local agency purchases property, the purchase price paid shall be charged to this account.

2. If local agency donates property, the assessed value at the time of donation shall be charged to this account.

3. If individual donates property, then the value should be either the value to the donor, or the assessed value.

4. For certain programs, if the property is donated, the value should be appraised value at time of transfer.

LAND COST/SITE ACQ |

|

|

|

$- |

| 1405.2 |

Only those fees for appraisals which have been made on land designated as suitable by the DECD.

APPRAISAL FEES |

|

|

|

$- |

| 1405.3 |

Improvements to existing site such as buildings, landscaping, walks etc.

SITE IMPROVEMENTS |

|

|

|

$- |

| 1405.4 |

All costs of water and other utility hookups, such as water line installation, used during development, purchased either by private or municipal water plants.

WATER/UTILITY HOOKUPS |

|

|

|

$- |

|

|

|

|

|

$- |

|

|

|

|

|

$- |

|

|

|

|

|

$- |

|

TOTAL LAND |

$- |

$- |

$- |

$- |

|

|

|

|

|

|

| 1410 |

OTHER DEVELOPMENT EXPENSES |

|

|

|

|

| 1410.1 |

The cost of the resident training and the costs associated with training new employees. It will include the cost of consultants, and any associated expenses directly incurred by the Agency.

TRAINING |

|

|

|

$- |

| 1410.2 |

This account shall be charged with the developer's fee paid. Charges to this account are restricted by State Regulations and limited to the amounts approved in the Project Financing Plan and Budget. Payment restrictions apply and your state project manager must be consulted before any payment of this fee is made.

DEVELOPER'S FEE |

|

|

|

$- |

| 1410.3 |

This account shall be charged with relocation payments to individuals, families or businesses in connection with the program. Note: The source of definition for allowable relocation expenses can be obtained from the Uniform Relocation Act or CDBG Program, depending on the type of program involved. (Specific relocation requirements should be directed to the appropriate program staff)

RELOCATION |

|

|

|

$- |

| 1410.4 |

This account shall be charged with loans disbursed to qualified borrowers, which are to be repaid to the Agency, and redisbursed by the Agency. These funds may only be used for the purposes specified in the Project Financing Plan and Budget.

REVOLVING LOAN FUND |

|

|

|

$- |

|

|

|

|

|

$- |

|

|

|

|

|

$- |

|

TOTAL OTHER DEVELOP EXPENSE |

$- |

$- |

$- |

$- |