236x Filetype XLSX File size 0.10 MB Source: www.seattlehousing.org

Sheet 1: My Spending Plan Budget

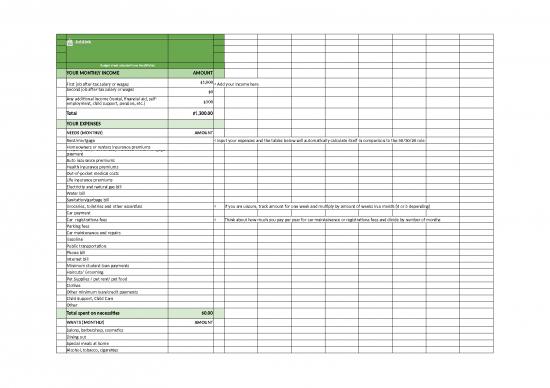

| Budget sheet adapted from NerdWallet | |||||||||||

| YOUR MONTHLY INCOME | AMOUNT | ||||||||||

| First job after-tax salary or wages | $1,000 | < Add your income here | |||||||||

| Second job after-tax salary or wages | $0 | ||||||||||

| Any additional income (rental, financial aid, self-employment, child support, pension, etc.) | $300 | ||||||||||

| Total | $1,300.00 | ||||||||||

| YOUR EXPENSES | |||||||||||

| NEEDS (MONTHLY) | AMOUNT | ||||||||||

| Rent/mortgage | < input your expenses and the tables below will automatically calculate itself in comparison to the 50/30/20 rule | ||||||||||

| Homeowners or renters insurance premiums | |||||||||||

| Property tax (if not already included in the mortgage payment | |||||||||||

| Auto insurance premiums | |||||||||||

| Health insurance premiums | |||||||||||

| Out-of-pocket medical costs | |||||||||||

| Life insurance premiums | |||||||||||

| Electricity and natural gas bill | |||||||||||

| Water bill | |||||||||||

| Sanitation/garbage bill | |||||||||||

| Groceries, toiletries and other essentials | < | If you are unsure, track amount for one week and multiply by amount of weeks in a month (4 or 5 depending) | |||||||||

| Car payment | |||||||||||

| Car registrations fees | < | Think about how much you pay per year for car maintainence or registrations fees and divide by number of months | |||||||||

| Parking fees | |||||||||||

| Car maintenance and repairs | |||||||||||

| Gasoline | |||||||||||

| Public transportation | |||||||||||

| Phone bill | |||||||||||

| Internet bill | |||||||||||

| Minimum student loan payments | |||||||||||

| Haircuts/ Grooming | |||||||||||

| Pet Supplies / pet rent/ pet food | |||||||||||

| Clothes | |||||||||||

| Other minimum loan/credit payments | |||||||||||

| Child Support, Child Care | |||||||||||

| Other | |||||||||||

| Total spent on necessities | $0.00 | ||||||||||

| WANTS (MONTHLY) | AMOUNT | ||||||||||

| Salons, barbershop, cosmetics | |||||||||||

| Dining out | |||||||||||

| Special meals at home | |||||||||||

| Alcohol, tobacco, cigarettes | |||||||||||

| Movie, concerts, or other entertainment | Create a percentage rule for you to stick to with your budget. think about how much money from your income should go to each category of needs, wants, & savings/debt. | ||||||||||

| Gym or club memberships | |||||||||||

| Travel expenses (airline tickets, hotels, rental cars, etc.) | NEEDS | 85% | <Change these percentages according to how much you want to allocate your pay (ex. 70% needs, 20% wants, 10% savings or debt repayment) | ||||||||

| Streaming services (Spotify, hulu, Netflix, etc.) | WANTS | 10% | |||||||||

| Home decor items | SAVINGS | 5% | |||||||||

| Other | |||||||||||

| Total spent on wants | $0.00 | Once you've created your percentage rule, the numbers below will update and reflect the maximum amount you would want to spend in each category below according to your rule | |||||||||

| SAVINGS & DEBT REPAYMENT (MONTHLY) | AMOUNT | NEEDS | $1,105.00 | < The numbers here will change depending on the percentage rule you choose. Example: if you decided to allocate 70% of your income going to needs, it will appear here in a $dollar amount for you to be aware. | |||||||

| Emergency fund contributions | WANTS | $130.00 | |||||||||

| Savings account contributions | SAVINGS & DEBT REPAYMENT | $65.00 | |||||||||

| Individual retirement account contributions | $0.00 | ||||||||||

| Other investments | |||||||||||

| Credit card payments | |||||||||||

| Excess payments on student loans | |||||||||||

| Excess payments on car loan | |||||||||||

| Other | |||||||||||

| Total spent on savings and paying off debt | $0.00 | The numbers below reflect the total amount of money you have left to spend for each category of needs, wants, & savings/debt. The numbers will appear after listing out your monthly expenses in column C | |||||||||

| Total expenses | $0.00 | NEEDS | $1,105.00 | < If you have a negative number it will turn to red and show that you are overspending in this category. If the text is a positive green number, it tells you are well within your percentage rule for this category and can spend more (or choose to save) | |||||||

| Income remaining (surplus or deficit) | $1,300.00 | WANTS | $130.00 | ||||||||

| SAVINGS & DEBT REPAYMENT | $65.00 | ||||||||||

no reviews yet

Please Login to review.