235x Filetype XLSX File size 0.22 MB Source: www.screenaustralia.gov.au

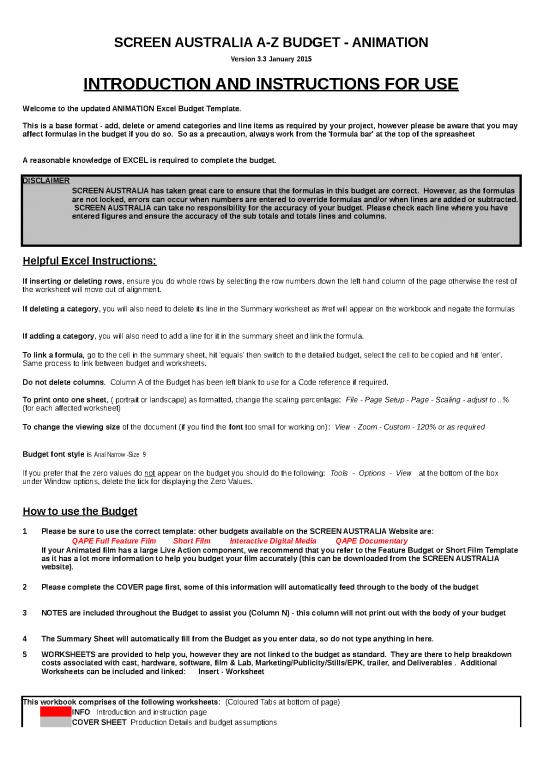

SCREEN AUSTRALIA A-Z BUDGET - ANIMATION

Version 3.3 January 2015

INTRODUCTION AND INSTRUCTIONS FOR USE

Welcome to the updated ANIMATION Excel Budget Template.

This is a base format - add, delete or amend categories and line items as required by your project, however please be aware that you may

affect formulas in the budget if you do so. So as a precaution, always work from the 'formula bar' at the top of the spreasheet

A reasonable knowledge of EXCEL is required to complete the budget.

DISCLAIMER

SCREEN AUSTRALIA has taken great care to ensure that the formulas in this budget are correct. However, as the formulas

are not locked, errors can occur when numbers are entered to override formulas and/or when lines are added or subtracted.

SCREEN AUSTRALIA can take no responsibility for the accuracy of your budget. Please check each line where you have

entered figures and ensure the accuracy of the sub totals and totals lines and columns.

Helpful Excel Instructions:

If inserting or deleting rows, ensure you do whole rows by selecting the row numbers down the left hand column of the page otherwise the rest of

the worksheet will move out of alignment.

If deleting a category, you will also need to delete its line in the Summary worksheet as #ref will appear on the workbook and negate the formulas

If adding a category, you will also need to add a line for it in the summary sheet and link the formula.

To link a formula, go to the cell in the summary sheet, hit 'equals' then switch to the detailed budget, select the cell to be copied and hit 'enter'.

Same process to link between budget and worksheets.

Do not delete columns. Column A of the Budget has been left blank to use for a Code reference if required.

To print onto one sheet, ( portrait or landscape) as formatted, change the scaling percentage: File - Page Setup - Page - Scaling - adjust to ..%

(for each affected worksheet)

To change the viewing size of the document (if you find the font too small for working on): View - Zoom - Custom - 120% or as required

Budget font style is Arial Narrow -Size 9

If you prefer that the zero values do not appear on the budget you should do the following: Tools - Options - View at the bottom of the box

under Window options, delete the tick for displaying the Zero Values.

How to use the Budget

1 Please be sure to use the correct template: other budgets available on the SCREEN AUSTRALIA Website are:

QAPE Full Feature Film Short Film Interactive Digital Media QAPE Documentary

If your Animated film has a large Live Action component, we recommend that you refer to the Feature Budget or Short Film Template

as it has a lot more information to help you budget your film accurately (this can be downloaded from the SCREEN AUSTRALIA

website).

2 Please complete the COVER page first, some of this information will automatically feed through to the body of the budget

3 NOTES are included throughout the Budget to assist you (Column N) - this column will not print out with the body of your budget

4 The Summary Sheet will automatically fill from the Budget as you enter data, so do not type anything in here.

5 WORKSHEETS are provided to help you, however they are not linked to the budget as standard. They are there to help breakdown

costs associated with cast, hardware, software, film & Lab, Marketing/Publicity/Stills/EPK, trailer, and Deliverables . Additional

Worksheets can be included and linked: Insert - Worksheet

This workbook comprises of the following worksheets: (Coloured Tabs at bottom of page)

INFO Introduction and instruction page

COVER SHEET Production Details and budget assumptions

BUDGET A-Z detail

SUMMARY

1. CAST Worksheet - Budget Categories E (a) and E(b)

2. SOFTWARE Worksheet - Budget Category H

3. HARDWARE Worksheet - Budget Category H

4. Marketing, Publicity, Stills and/or EPK Worksheet - Budget Category X

5.Trailer or Making of Doco Worksheet

6. Deliverables Worksheet - Budget Category X

Fringes (should be calculated on both PAYG and ABN staff)

Crew & Cast Fringes are the expenses associated with employment. For a budget assume that at least 80% of your crew and cast are

employees (PAYG or ABN). By law the nature of the relationship that you have with them is that of an employer rather than a

contractor. If a crew member is contracted through a Pty Ltd company fringes are usually not payable but they may want to

negotiate a higher fee that compensates them for holiday pay and superannuation so at the budgeting stage you could even assume

fringes on all crew and cast.

Holiday Pay Payable to any crew member employed on a weekly basis. Per the award it is one-twelfth of the contracted wage or 8.33%,

representing a pro-rata payment of four weeks annual holiday. For Cast refer BNF calculations. For preliminary budgeting include

calculation on overtime estimates.

Super- A percentage set by Federal Superannuation Guarantee legislation and payable on the contracted wage and allowances of any

annuation employee who earns in excess of $450 per month. It is not paid on Holiday Pay or overtime. At the time of budgeting check the rate

that may be expected to be current when you expect to go into production. As at July 2013 the rate is 9.25% for crew and10% for

cast. The rate will increase again on 1 July 2014 to 9.5%

Payroll Tax & The rates for both payroll tax and workers compensation are determined by each State so check the rates appropriate to the

Workers State in which you expect to shoot, as they will apply at the time that you expect to go into production. They may be calculated on

Comp. the contracted wage plus Holiday Pay, Overtime, Superannuation and allowances including per diems, kilometerage and vehicle

allowances. These inclusions vary from State to State.

Payroll tax is payable when the Company Payroll exceed a nominated threshold per month. This threshold varies from State to

State. If your budget is tight include a credit or negative cost in the budget for the appropriate threshold x the number of months from

employment of the first person to termination of the last person. If the film is to be produced by an existing production company, that

threshold or part thereof may be used already, in which case the production can not take the full credit.

NB. Workers Compensation estimates are included in Fringes Category D, not with Insurances Category O.

Please refer to MEAA and SPAA for current Crew and Cast rates and agreements before completing the budget

G.S.T

No matter how small the budget every film maker is advised to register the entity through which they produce their film for GST. In all likelihood they

would be legally required to register. Once registered you may claim back all the GST that has been included in payments made. This being the

case always budget the production expenses net of GST.

Invariably the funding that you achieve for your film is considered a taxable supply and you are required to invoice the funding body, network,

distributor etc for your cashflow + GST. This is not a reason to put a line in the budget for GST

Do not include GST in your budget. GST will be dealt with contractually and by invoice

UPDATES

Please Check the SCREEN AUSTRALIA website regularly for updates or corrections to this budget

If you discover any formula errors in the budget, please email us at a-zbudget@screenaustralia.gov.au so that we can inform other

users.

v3.3

TITLE: " ..film title ... "

PRODUCTION TYPE: ANIMATION: Short Film/Pilot/Short Feature/Feature/Television Series

No. of Episodes (if applicable):

PRODUCTION COMPANY:

ABN: TFN:

Address: T'phone: Fax:

E-mail:

DIRECTOR:

PRODUCER:

D.O.P:

LEAD ANIMATOR:

PRODUCTION DESIGNER:

FINAL BUDGET DATE:

THIS BUDGET IS BASED ON THE FOLLOWING ASSUMPTIONS:

Running Time estimate: mins.

Shoot / Production Gauge:

Finish on:

Ratio:

SCHEDULE

PREPRODUCTION: Start: Finish: Weeks: Days:

PRODUCTION(…. hr days/ ….day weeks. Start: Finish: Weeks: Days:

Statutory Holidays:

POSTPRODUCTION: Start: Finish: Weeks: Days:

SHOOTING LOCATIONS (or Episode shoot periods, if applicable)

Studio 1 From: To: Weeks: Days:

Studio 2 From: To: Weeks: Days:

Studio 3 From: To: Weeks: Days:

Location 1 From: To: Weeks: Days:

Workshop/s (if applicable) From: To: Weeks: Days:

FRINGES & INSURANCE - RATES APPLIED:

Payroll Tax State: …………….. % Note: If payroll tax is applicable to your budget, check the threshold in your state.

Superannuation Year: ……………… % Note: Check the current rate of superannuation (this is consistent across the states)

Fringe Benefits Tax %

Workers Compensation State: …………….. % Note: This tax amount varies from state to state. Check the rate in your state.

CURRENCY: (list exchange rate and effective date where foreign currency rates have been used)

Currency: as at:

Currency: as at:

FINANCING:

Source 1 0

Source 2 0

Source 3 0

TOTAL 0

DEVELOPMENT FUNDS/LOANS: Repayments due:

Source 1 0 (date to which buyouts are calculated)

Source 2 0

Any other notes on assumptions made in this budget :

Contingency: 10%of Below Line costs

List any quotations that are attached:

Budget prepared by: ………………………………….

Date: ………………………………….

AFC Budget-a_z_animation_budget.xlsx-Production Summary Printed: 08/14/2022 17:23:04 Page 3

BUDGET SUMMARY " ..film title ... "

v3.3 as at: (insert date) $Australian

Prepared by…………………………………. Trf.from A-Z TOTALS

"ABOVE THE LINE" COSTS

A.1 STORY & SCRIPT Fees & Expenses 0

A.2 DEVELOPMENT Fees & Expenses 0 0

B.1 PRODUCER(S) Fees & Expenses 0

B.2 DIRECTOR(S) Fees & Expenses 0 0

E(a) PRINCIPAL CAST Fees & Expenses 0

TOTAL "ABOVE THE LINE" COSTS 0

"BELOW THE LINE" COSTS

PRODUCTION COSTS

C. #NAME?

C.1 #NAME? 0

C.2 #NAME? 0

C.3 #NAME? 0

C.4 #NAME? 0

C.5 #NAME? 0

C.6 #NAME? 0

C.7 #NAME? 0

C.8 #NAME? 0

C.9 #NAME? 0

C.10 #NAME? 0

C.11 #NAME? 0

C.12 #NAME? 0

C.13 #NAME? 0

C.14 #NAME? 0

C.15 #NAME? 0

C.16 #NAME? 0

C.17 #NAME? 0

C.18 #NAME? 0

C.19 #NAME? 0

C.20 #NAME? 0

Total Unit Fees & Salaries 0

D. #NAME? 0

E(b) #NAME? 0

F. #NAME?

F.1 #NAME? 0

F.2 #NAME? 0

F.3 #NAME? 0

F.4 #NAME? 0

F.5 #NAME? 0

Total Materials 0

G. #NAME?

G.1 #NAME?Studio & Workshop Rentals 0

Total Locations & Studios 0

H. #NAME?

H.1 #NAME?Software 0

H.2 #NAME?Computer Hardware 0

Total Computers - Software & Hardware 0

I. #NAME? 0

J. #NAME? 0

K. #NAME?

K.1 #NAME? 0

K.2 #NAME? 0

K.3 #NAME? 0

K.4 #NAME? 0

K.5 #NAME? 0

K.6 #NAME? 0

K.7 #NAME? 0

K.8 #NAME? 0

Total Equipment & Stores 0

L. #NAME? 0

M. #NAME? 0

N. #NAME? 0

O. #NAME? 0

P. #NAME? 0

Q. #NAME? 0

TOTAL PRODUCTION COSTS 0

a_z_animation_budget.xlsx-Budget Summary-08/14/2022 Page 4/26

no reviews yet

Please Login to review.