218x Filetype XLSX File size 0.04 MB Source: www.michigan.gov

Sheet 1: Instructions

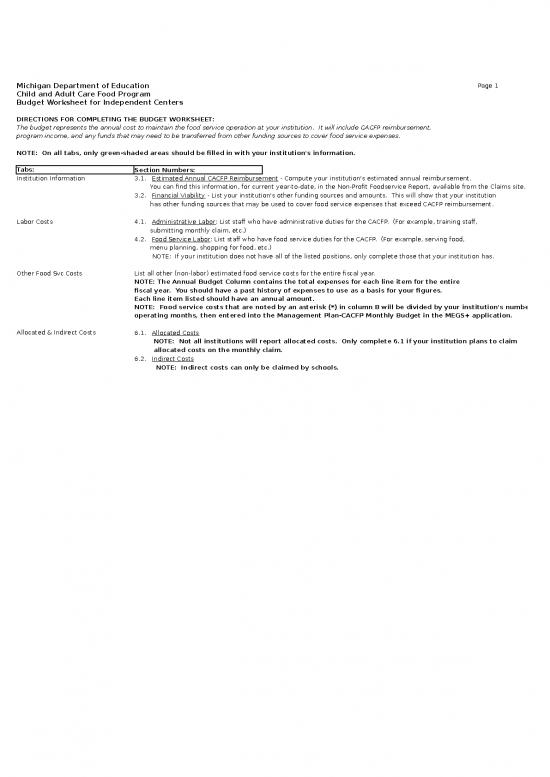

| Michigan Department of Education | Page 1 | ||||||

| Child and Adult Care Food Program | |||||||

| Budget Worksheet for Independent Centers | |||||||

| DIRECTIONS FOR COMPLETING THE BUDGET WORKSHEET: | |||||||

| The budget represents the annual cost to maintain the food service operation at your institution. It will include CACFP reimbursement, | |||||||

| program income, and any funds that may need to be transferred from other funding sources to cover food service expenses. | |||||||

| NOTE: On all tabs, only green-shaded areas should be filled in with your institution's information. | |||||||

| Tabs: | Section Numbers: | ||||||

| Institution Information | 3.1. Estimated Annual CACFP Reimbursement - Compute your institution's estimated annual reimbursement. | ||||||

| You can find this information, for current year-to-date, in the Non-Profit Foodservice Report, available from the Claims site. | |||||||

| 3.2. Financial Viability - List your institution's other funding sources and amounts. This will show that your institution | |||||||

| has other funding sources that may be used to cover food service expenses that exceed CACFP reimbursement. | |||||||

| Labor Costs | 4.1. Administrative Labor: List staff who have administrative duties for the CACFP. (For example, training staff, | ||||||

| submitting monthly claim, etc.) | |||||||

| 4.2. Food Service Labor: List staff who have food service duties for the CACFP. (For example, serving food, | |||||||

| menu planning, shopping for food, etc.) | |||||||

| NOTE: If your institution does not have all of the listed positions, only complete those that your institution has. | |||||||

| Other Food Svc Costs | List all other (non-labor) estimated food service costs for the entire fiscal year. | ||||||

| NOTE: The Annual Budget Column contains the total expenses for each line item for the entire | |||||||

| fiscal year. You should have a past history of expenses to use as a basis for your figures. | |||||||

| Each line item listed should have an annual amount. | |||||||

| NOTE: Food service costs that are noted by an asterisk (*) in column B will be divided by your institution's number of | |||||||

| operating months, then entered into the Management Plan-CACFP Monthly Budget in the MEGS+ application. | |||||||

| Allocated & Indirect Costs | 6.1. Allocated Costs | ||||||

| NOTE: Not all institutions will report allocated costs. Only complete 6.1 if your institution plans to claim | |||||||

| allocated costs on the monthly claim. | |||||||

| 6.2. Indirect Costs | |||||||

| NOTE: Indirect costs can only be claimed by schools. | |||||||

| Income & Budget Summary | 7.1 List estimated program income to the food service program for the entire fiscal year. | ||||||

| NOTE: The Annual Budget Column contains the total income for each line item for the entire | |||||||

| fiscal year. You should have a past history of income to use as a basis for your figures. | |||||||

| Each line item listed should have an annual amount. | |||||||

| 7.2 If necessary, explain your institution's plan for how any profit will be reinvested into the food service program. | |||||||

| 7.3 Include name and phone number of person completing this budget worksheet, and date completed. | |||||||

| Rev 8/2021 |

| Michigan Department of Education | Page 2 | ||||||

| Child and Adult Care Food Program | |||||||

| Budget Worksheet for Independent Centers | |||||||

| Indirect Costs: These charges are only applicable for schools participating in the Child and Adult Care Food Program (CACFP). | |||||||

| Michigan Department of Education (MDE) issues indirect cost rates for schools. On CACFP budget worksheets and claims, indirect | |||||||

| costs are automatically calculated based on costs budgeted/claimed. | |||||||

| Allocated Costs: When programs in the organization share services, the CACFP may be charged a reasonable share based on a cost | |||||||

| allocation plan that must be submitted and approved by MDE. Allocated costs often include a pool of administrative/accounting | |||||||

| functions, occupancy, telephone, data processing, or maintenance of equipment contracts, that cannot be specifically assigned to one | |||||||

| program. Other costs shared between programs may be allowable. Agencies must submit cost allocation plans | |||||||

| to show how expenses are allocated when claiming allocated costs. | |||||||

| NOTE: Institutions are not required to claim allocated costs unless reimbursement exceeds all other food service costs on a year-to-date basis. | |||||||

| Approvals: Budget requests require prior approval by MDE before a sponsor may incur the cost. Certain budget requests require specific prior written | |||||||

| approval granted by MDE (and in some cases, FNS-USDA) before the sponsor may incur the cost. Please refer to the "Items Requiring Prior Approval, | |||||||

| Specific Prior Written Approval, and FNSRO Approval" Chart located at www.michigan.gov/CACFP under Financial Resources. All CACFP costs | |||||||

| must be supported by receipts, invoices, and/or other supporting documentation. Costs that are shared with other programs, such as rent or | |||||||

| telephone, which cannot be specifically identified to CACFP administration, must be prorated on a consistent and rational basis in | |||||||

| accordance with Generally Accepted Accounting Principles (GAAP) appropriate to the circumstances. Shared labor costs must be documented | |||||||

| with daily time records to establish salary allocations. | |||||||

| Approved Budget: The CACFP may be charged only for costs approved by MDE on the annual budget and amendments. | |||||||

| Budget Amendments: Variations from the approved fiscal year budget are allowed only by an amended budget submitted to MDE for approval. | |||||||

| Amendments may be submitted during the year as needed. Submit an amended budget in MEGS+ when the number of facilities increases or decreases, | |||||||

| when participation increases or decreases, or when projected income increases or decreases. Budget items require an amended budget when | |||||||

| there is an increase or decrease of 10% per cost item. | |||||||

| Typical Allowable CACFP Administrative Costs: | |||||||

| Accounting | Purchase of Expendable and Nonexpendable Property* | ||||||

| Advertising | Legal Expenses | ||||||

| Audit Services | Employee Travel Expenses | ||||||

| Bonding Costs (for employees) | Printing and Reproduction of CACFP Materials | ||||||

| Telephone and Communication Costs | Insurance and Indemnification | ||||||

| Personnel Administration | Training of Staff and Facilities | ||||||

| Indirect Costs (schools only) | Standard Banking Fees (including stop-payment fees) | ||||||

| Salaries and Benefits of Administrative Employees | |||||||

| * Nonexpendable property is all property with a useful life of more than one year and an acquisition cost of $5000 or more. |

| Institution Name: | Budget for the period: October 1, | Page 3 | ||||||

| Agreement Number: | to September 30, | |||||||

| Date: | ||||||||

| 3.1. ESTIMATED ANNUAL CACFP REIMBURSEMENT | ||||||||

| (A) Estimated Monthly CACFP Reimbursement X |

(B) Number of Operating Months per Year | = (C) Total Estimated Annual Reimbursement | ||||||

| $- | 0 | $- | ||||||

| 3.2. FINANCIAL VIABILITY | ||||||||

| Each institution must demonstrate that is has adequate financial resources to operate the CACFP on a daily basis, and | ||||||||

| adequate sources of funds to withstand temporary interruptions in CACFP payments, and/or fiscal claims against the institution. | ||||||||

| List other funding sources for the institution and include amounts (i.e. day care tuition, DHS Child Care Subsidies, donations, grant funds, etc.). | ||||||||

| Source of funds | Annual Amount | |||||||

| $- | ||||||||

| $- |

no reviews yet

Please Login to review.