244x Filetype XLSX File size 0.05 MB Source: www.sanofi.com

Sheet 1: Business Net Income Q4

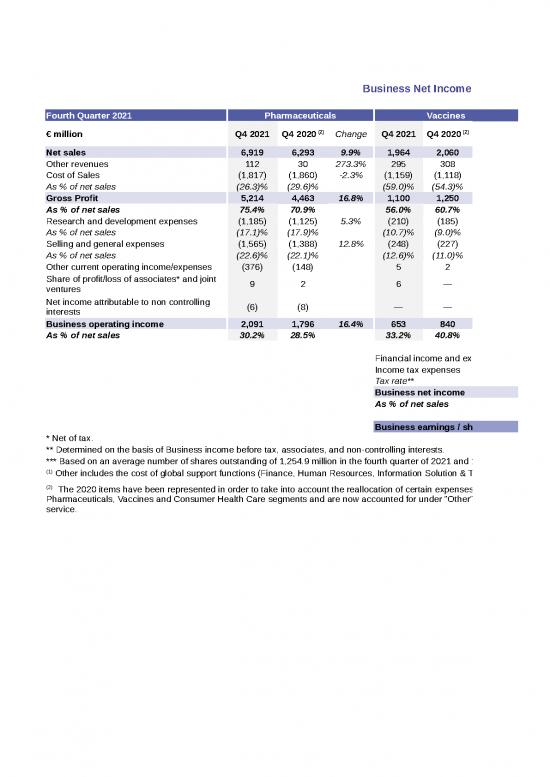

| Business Net Income Statement Fourth Quarter 2021 | ||||||||||||||||

| Fourth Quarter 2021 | Pharmaceuticals | Vaccines | Consumer Healthcare | Other(1) | Total Group | |||||||||||

| € million | Q4 2021 | Q4 2020 (2) | Change | Q4 2021 | Q4 2020 (2) | Change | Q4 2021 | Q4 2020 (2) | Change | Q4 2021 | Q4 2020 (2) | Change | Q4 2021 | Q4 2020 (2) | Change | |

| Net sales | 6,919 | 6,293 | 9.9% | 1,964 | 2,060 | -4.7% | 1,111 | 1,029 | 8.0% | — | — | —% | 9,994 | 9,382 | 6.5% | |

| Other revenues | 112 | 30 | 273.3% | 295 | 308 | -4.2% | 14 | 16 | -12.5% | — | — | —% | 421 | 354 | 18.9% | |

| Cost of Sales | (1,817) | (1,860) | -2.3% | (1,159) | (1,118) | 3.7% | (431) | (386) | 11.7% | (64) | (75) | -14.7% | (3,471) | (3,439) | 0.9% | |

| As % of net sales | (26.3)% | (29.6)% | (59.0)% | (54.3)% | (38.8)% | (37.5)% | (34.7)% | (36.7)% | ||||||||

| Gross Profit | 5,214 | 4,463 | 16.8% | 1,100 | 1,250 | -12.0% | 694 | 659 | 5.3% | (64) | (75) | -14.7% | 6,944 | 6,297 | 10.3% | |

| As % of net sales | 75.4% | 70.9% | 56.0% | 60.7% | 62.5% | 64.0% | 69.5% | 67.1% | ||||||||

| Research and development expenses | (1,185) | (1,125) | 5.3% | (210) | (185) | 13.5% | (49) | (47) | 4.3% | (141) | (159) | -11.3% | (1,585) | (1,516) | 4.6% | |

| As % of net sales | (17.1)% | (17.9)% | (10.7)% | (9.0)% | (4.4)% | (4.6)% | (15.9)% | (16.2)% | ||||||||

| Selling and general expenses | (1,565) | (1,388) | 12.8% | (248) | (227) | 9.3% | (361) | (345) | 4.6% | (584) | (642) | -9.0% | (2,758) | (2,602) | 6.0% | |

| As % of net sales | (22.6)% | (22.1)% | (12.6)% | (11.0)% | (32.5)% | (33.5)% | (27.6)% | (27.7)% | ||||||||

| Other current operating income/expenses | (376) | (148) | 5 | 2 | 11 | 35 | 4 | (12) | (356) | (123) | ||||||

| Share of profit/loss of associates* and joint ventures | 9 | 2 | 6 | — | 3 | 2 | — | — | 18 | 4 | ||||||

| Net income attributable to non controlling interests | (6) | (8) | — | — | — | — | (1) | — | (7) | (8) | ||||||

| Business operating income | 2,091 | 1,796 | 16.4% | 653 | 840 | -22.3% | 298 | 304 | -2.0% | (786) | (888) | -11.5% | 2,256 | 2,052 | 9.9% | |

| As % of net sales | 30.2% | 28.5% | 33.2% | 40.8% | 26.8% | 29.5% | 22.6% | 21.9% | ||||||||

| Financial income and expenses | (83) | (93) | ||||||||||||||

| Income tax expenses | (443) | (432) | ||||||||||||||

| Tax rate** | 20.5% | 22.0% | ||||||||||||||

| Business net income | 1,730 | 1,527 | 13.3% | |||||||||||||

| As % of net sales | 17.3% | 16.3% | ||||||||||||||

| Business earnings / share(in euros)*** | 1.38 | 1.22 | 13.1% | |||||||||||||

| * Net of tax. | ||||||||||||||||

| ** Determined on the basis of Business income before tax, associates, and non-controlling interests. | ||||||||||||||||

| *** Based on an average number of shares outstanding of 1,254.9 million in the fourth quarter of 2021 and 1,255.1 million in the fourth quarter of 2020. | ||||||||||||||||

| (1) Other includes the cost of global support functions (Finance, Human Resources, Information Solution & Technologies, Sanofi Business Services, etc…). | ||||||||||||||||

| (2) The 2020 items have been represented in order to take into account the reallocation of certain expenses, in particular the IT costs related to the new Digital organization, which were previously allocated to the Pharmaceuticals, Vaccines and Consumer Health Care segments and are now accounted for under "Other". It includes also the impacts of the IFRIC final agenda decision of April 2021 on the attribution of benefits to periods of service. | ||||||||||||||||

| Business Net Income Statement 2021 | |||||||||||||||

| Full year 2021 | Pharmaceuticals | Vaccines | Consumer Healthcare | Other(1) | Total Group | ||||||||||

| € million | FY 2021 | FY 2020 (2) | Change | FY 2021 | FY 2020 (2) | Change | FY 2021 | FY 2020 (2) | Change | FY 2021 | FY 2020 (2) | Change | FY 2021 | FY 2020 (2) | Change |

| Net sales | 26,970 | 25,674 | 5.0% | 6,323 | 5,973 | 5.9% | 4,468 | 4,394 | 1.7% | — | — | —% | 37,761 | 36,041 | 4.8% |

| Other revenues | 264 | 128 | 106.3% | 1,095 | 1,141 | -4.0% | 55 | 59 | -6.8% | — | — | —% | 1,414 | 1,328 | 6.5% |

| Cost of Sales | (6,965) | (6,982) | -0.2% | (3,430) | (3,312) | 3.6% | (1,606) | (1,528) | 5.1% | (250) | (284) | -12.0% | (12,251) | (12,106) | 1.2% |

| As % of net sales | (25.8)% | (27.2)% | (54.2)% | (55.4)% | (35.9)% | (34.8)% | (32.4)% | (33.6)% | |||||||

| Gross Profit | 20,269 | 18,820 | 7.7% | 3,988 | 3,802 | 4.9% | 2,917 | 2,925 | -0.3% | (250) | (284) | -12.0% | 26,924 | 25,263 | 6.6% |

| As % of net sales | 75.2% | 73.3% | 63.1% | 63.7% | 65.3% | 66.6% | 71.3% | 70.1% | |||||||

| Research and development expenses | (4,330) | (4,171) | 3.8% | (712) | (682) | 4.4% | (153) | (153) | —% | (497) | (524) | -5.2% | (5,692) | (5,530) | 2.9% |

| As % of net sales | (16.1)% | (16.2)% | (11.3)% | (11.4)% | (3.4)% | (3.5)% | (15.1)% | (15.3)% | |||||||

| Selling and general expenses | (5,326) | (4,927) | 8.1% | (805) | (789) | 2.0% | (1,388) | (1,419) | -2.2% | (2,036) | (2,256) | -9.8% | (9,555) | (9,391) | 1.7% |

| As % of net sales | (19.7)% | (19.2)% | (12.7)% | (13.2)% | (31.1)% | (32.3)% | (25.3)% | (26.1)% | |||||||

| Other current operating income/expenses | (1,172) | (487) | 128 | 3 | 111 | 53 | (13) | (130) | (946) | (561) | |||||

| Share of profit/loss of associates* and joint ventures | 17 | 5 | 11 | 2 | 11 | 9 | — | — | 39 | 16 | |||||

| Net income attributable to non controlling interests | (49) | (33) | (1) | — | (5) | (5) | (1) | — | (56) | (38) | |||||

| Business operating income | 9,409 | 9,207 | 2.2% | 2,609 | 2,336 | 11.7% | 1,493 | 1,410 | 5.9% | (2797) | (3194) | -12.4% | 10,714 | 9,759 | 9.8% |

| As % of net sales | 34.9% | 35.9% | 41.3% | 39.1% | 33.4% | 32.1% | 28.4% | 27.1% | |||||||

| Financial income and expenses | (328) | (335) | |||||||||||||

| Income tax expenses | (2173) | (2,078) | |||||||||||||

| Tax rate** | 20.9% | 22.0% | |||||||||||||

| Business net income | 8,213 | 7,346 | 11.8% | ||||||||||||

| As % of net sales | 21.7% | 20.4% | |||||||||||||

| Business earnings / share(in euros)*** | 6.56 | 5.86 | 11.9% | ||||||||||||

| * Net of tax. | |||||||||||||||

| ** Determined on the basis of Business income before tax, associates, and non-controlling interests. | |||||||||||||||

| *** Based on an average number of shares outstanding of 1,252.5 million in the full year of 2021 and 1,253.6 million in the full year of 2020. | |||||||||||||||

| (1) Other includes the cost of global support functions (Finance, Human Resources, Information Solution & Technologies, Sanofi Business Services, etc…). | |||||||||||||||

| (2) The 2020 items have been represented in order to take into account the reallocation of certain expenses, in particular the IT costs related to the new Digital organization, which were previously allocated to the Pharmaceuticals, Vaccines and Consumer Health Care segments and are now accounted for under "Other". It includes also the impacts of the IFRIC final agenda decision of April 2021 on the attribution of benefits to periods of service. | |||||||||||||||

| Consolidated Income Statements | ||||

| € million | Q4 2021 | Q4 2020 (1) | FY 2021 | FY 2020 (1) |

| Net sales | 9,994 | 9,382 | 37,761 | 36,041 |

| Other revenues | 421 | 354 | 1,414 | 1,328 |

| Cost of sales | (3,475) | (3,439) | (12,255) | (12,159) |

| Gross profit | 6,940 | 6,297 | 26,920 | 25,210 |

| Research and development expenses | (1,585) | (1,516) | (5,692) | (5,530) |

| Selling and general expenses | (2,758) | (2,602) | (9,555) | (9,391) |

| Other operating income | 192 | 174 | 859 | 697 |

| Other operating expenses | (548) | (297) | (1,805) | (1,415) |

| Amortization of intangible assets | (420) | (394) | (1,580) | (1,681) |

| Impairment of intangible assets (2) | (15) | (5) | (192) | (330) |

| Fair value remeasurement of contingent consideration | (5) | 48 | (4) | 124 |

| Restructuring costs and similar items | (326) | (214) | (820) | (1,089) |

| Other gains and losses, and litigation (3) | (1) | — | (5) | 136 |

| Gain on Regeneron investment as result of transaction completed on May 29th, 2020 (4) | — | — | — | 7,382 |

| Operating income | 1,474 | 1,491 | 8,126 | 14,113 |

| Financial expenses | (93) | (100) | (368) | (388) |

| Financial income | 10 | 7 | 40 | 53 |

| Income before tax and associates and joint ventures | 1,391 | 1,398 | 7,798 | 13,778 |

| Income tax expense | (268) | (326) | (1,558) | (1,807) |

| Share of profit/(loss) of associates and joint ventures | 18 | 4 | 39 | 359 |

| Net income | 1,141 | 1,076 | 6,279 | 12,330 |

| Net income attributable to non-controlling interests | 10 | 9 | 56 | 36 |

| Net income attributable to equity holders of Sanofi | 1,131 | 1,067 | 6,223 | 12,294 |

| Average number of shares outstanding (million) | 1,254.9 | 1,255.1 | 1,252.5 | 1,253.6 |

| IFRS Earnings per share (in euros) | 0.90 | 0.85 | 4.97 | 9.81 |

| (1) It Includes the impacts of the IFRIC final agenda decisions of March 2021 on the costs of configuring or customising application software used in a Software as a Service (SaaS) arrangement) and of April 2021 on the attribution of benefits to periods of service | ||||

| (2) In 2021 and 2020, mainly related to Sutimlimab impairments. | ||||

| (3) In 2020, includes mainly the gain on the sale of operations related to the Seprafilm product to Baxter. | ||||

| (4) In 2020, this line includes the pre-tax income from the sale of Regeneron shares following the public offer for sale and Regeneron's repurchase on May 29, 2020. This amount includes the gain related to the remeasurement at fair value of the 400,000 retained shares that could be used to finance the R&D collaboration under the letter of agreement dated 2018. | ||||

no reviews yet

Please Login to review.