258x Filetype XLSX File size 0.13 MB Source: www.enterprise-ireland.com

Sheet 1: Instructions

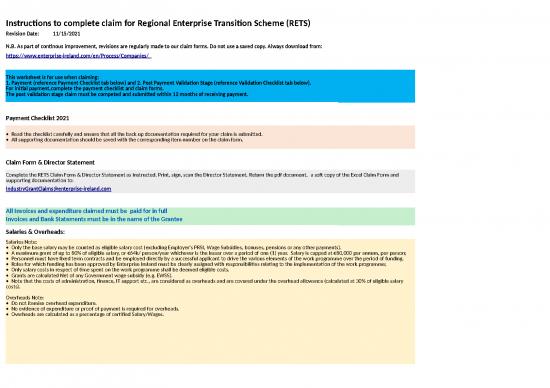

| Instructions to complete claim for Regional Enterprise Transition Scheme (RETS) | ||||||||||||||||

| Revision Date: | 11/15/2021 | |||||||||||||||

| N.B. As part of continous improvement, revisions are regularly made to our claim forms. Do not use a saved copy. Always download from: | ||||||||||||||||

| https://www.enterprise-ireland.com/en/Process/Companies/ | ||||||||||||||||

| This worksheet is for use when claiming: 1. Payment (reference Payment Checklist tab below) and 2. Post Payment Validation Stage (reference Validation Checklist tab below). For initial payment,complete the payment checklist and claim forms. The post validation stage claim must be competed and submitted within 12 months of receiving payment. |

||||||||||||||||

| Payment Checklist 2021 | ||||||||||||||||

| • Read the checklist carefully and ensure that all the back up documentation required for your claim is submitted. • All supporting documentation should be saved with the corresponding item number on the claim form. |

||||||||||||||||

| Claim Form & Director Statement | ||||||||||||||||

| Complete the RETS Claim Form & Director Statement as instructed. Print, sign, scan the Director Statement. Return the pdf document, a soft copy of the Excel Claim Form and supporting documentation to: | ||||||||||||||||

| IndustryGrantClaims@enterprise-ireland.com | ||||||||||||||||

| All Invoices and expenditure claimed must be paid for in full | ||||||||||||||||

| Invoices and Bank Statements must be in the name of the Grantee | ||||||||||||||||

| Salaries & Overheads: | ||||||||||||||||

| Salaries Note: • Only the base salary may be counted as eligible salary cost (excluding Employer's PRSI, Wage Subsidies, bonuses, pensions or any other payments). • A maximum grant of up to 80% of eligible salary, or €64k/ person/year whichever is the lesser over a period of one (1) year. Salary is capped at €80,000 per annum, per person; • Personnel must have fixed term contracts and be employed directly by a successful applicant to drive the various elements of the work programme over the period of funding. • Roles for which funding has been approved by Enterprise Ireland must be clearly assigned with responsibilities relating to the implementation of the work programme; • Only salary costs in respect of time spent on the work programme shall be deemed eligible costs. • Grants are calculated Net of any Government wage subsidy (e.g. EWSS). • Note that the costs of administration, finance, IT support etc., are considered as overheads and are covered under the overhead allowance (calculated at 30% of eligible salary costs). Overheads Note: • Do not itemise overhead expenditure. • No evidence of expenditure or proof of payment is required for overheads. • Overheads are calculated as a percentage of certified Salary/Wages. |

||||||||||||||||

| Consultancy/Fees | ||||||||||||||||

| Note: • Costs of hiring appropriate external experts required to drive key elements of the work programme is set at a maximum grant of €100,000 or 80% of eligible costs whichever is the lesser • Daily rates must be at commercial market rates. Please note that the maximum daily rate allowable is €900 for short assignments. For longer terms, the rates allowed may be reduced. • Consultants daily rate should be inclusive of all travel and subsistence expenses. • Where there is more than one consultancy firm involved on the project, the rate applies to each firm separately. • Enterprise Ireland reserves the right to reduce the daily rate and number of days actually allowed to what is considered to be 'reasonable' and 'required' for the project. • Invoices must contain the rate per day and a description of the service provided. • For each invoice claimed, you must submit a Bank Statement as proof of payment. • Each entry must be given an "Item No." Please ensure that the corresponding invoice and proof of payment i.e. bank statement are clearly marked with the item no. from the Claim Form. |

||||||||||||||||

| Promotional Activities | ||||||||||||||||

| Note: • A maximum grant of €8,000 or 80% of eligible costs, whichever is the lesser, over the period of funding to support communication activities required to implement its work programme by a successful applicant. • This may include awareness events, promotional material and website costs (excluding design). |

||||||||||||||||

| New Build | ||||||||||||||||

| Note: • Refer to your Letter of Offer for eligible expenditure • Eligible costs are construction costs and the related architectural and engineering design costs • All Capital equipment paid for, must be paid for in full • Expenditure incurred must be in the name of the Grantee • Ensure that procurement guidelines are followed • Confirmation of Title • Insurance Brokers Letter |

||||||||||||||||

| Renovation/ Refurbishment | ||||||||||||||||

| Note: • Refer to your Letter of Offer for eligible expenditure • Eligible costs are construction costs and the related architectural and engineering design costs • All Capital equipment paid for, must be paid for in full • Expenditure incurred must be in the name of the Grantee • Ensure that procurement guidelines are followed • Confirmation of Title • Insurance Brokers Letter |

||||||||||||||||

| Progress Report | ||||||||||||||||

| • A Progress Report must be completed with each claim detailing the progress of the project. Reference Progress Report tab below. | ||||||||||||||||

| Details of person responsible for company claim | ||||

| Name: | ||||

| Email Address: | ||||

| Contact Number: | ||||

| Email this completed document and supporting documentation to | ||||

| IndustryGrantClaims@enterprise-ireland.com | ||||

| In the email subject line write: “RETS / Company name / Project number” | ||||

| Failure to submit any of the required documents will result in the claim being returned with the missing items marked. | ||||

| Important Notes on Checklists: There are two checklists for RETS claims: • Payment Checklist 2021 must be completed to receive payment. • Validation Checklist 2022 must be completed in advance of validating your claim post payment in 2022. |

||||

| By submitting this claim to Enterprise Ireland, you are agreeing to supply the supporting information and documentation required at the Post Payment Validation Stage within 12 months. See tab below 'Validation Checklist 2022' for detail required. | ||||

| Payment Checklist 2021 The checklist below begins with the mandatory requirements for all claims and is then broken out into specific detail required for Capital and Training. Complete the categories relevant to your claim. |

||||

| Mandatory for all claims | The Items below must be submitted with your claim | Items Attached to Claim | ||

| Checklist and Claim Form | Completed and returned with all documents by email. | Please confirm… | ||

| Director Statement | The expenditure details from the claim form tab will be copied across to the Director Statement. The Director Statement must be signed by the Managing Director or two Directors. Please print the Director Statement on company headed paper, sign, scan and email back with the claim. |

Please confirm… | ||

| Tax Clearance | Tax Clearance must be valid on submission & payment of grant claim. Please input PPSN/Tax Reference Number (TRN) & Tax Clearance Access Number (TCAN) for verification. | Please confirm… | ||

| PPSN/TRN : | ||||

| TCAN: | ||||

| Bank Details | Enterprise Ireland makes all payments by Electronic Fund Transfer (EFT). Bank details are required if it is the first time to submit a claim, existing Grantee Company EFT details have changed, or if the Grantee Company have not verified their Bank Details to us within the last 2 years. If EFT details are required to be submitted to Enterprise Ireland, please email: |

Ensure that email is forwarded as instructed if applicable | ||

| bank.confirmation@enterprise-ireland.com | ||||

| attaching a redacted bank statement, which clearly shows: 1. Grantee Company Name (as per Letter of Offer) 2. Bank Name 3. IBAN Noting that, a member of our Finance Team may contact you to confirm the last 4 digits of your IBAN. |

||||

| Confirmation of Title – is required for All Capital Grants | Solicitor’s letter confirming that the Grantee company holds clear and valid title to the site and buildings where the grant aided undertaking is being carried on. This applies even if only grant aided for Plant and Machinery. The nature of the title should be specified i.e. Freehold or Leasehold. If Leasehold, refer to the Letter of Offer for the minimum requirement regarding the duration of the lease. Please state the terms of the lease (e.g. start and expiry dates). |

Please confirm… | ||

| Statement of Insurance Cover (insurance policy is not acceptable) |

Insurance Brokers letter confirming that the Grantee company holds an up to date insurance policy on buildings and plant and machinery. Download insurance template from the RETS grant claims webpage that your insurance broker must use. |

Please confirm… | ||

| Progress Report | An overall progress report must be submitted with the claim. The progress report template can be downloaded from the RETS claim page. | Please confirm… | ||

| Salaries | The Items below must be submitted with your claim | Items Attached to Claim | ||

| Employment Contracts/ Payslips |

Copy of the employment contract signed and dated by both parties. The Contract states the Name of the Employee, their title, role, salary and date of commencement of Employment. And if available A copy of the most recent payslip and proof of payment for the employees assigned to the project. |

Please confirm… | ||

| Fees/Promotional Activities/New Build/Renovation & Refurbishment | The Items below must be submitted with your claim | Items Attached to Claim | ||

| Invoices | All Invoices must clearly state the work undertaken and the cost. Invoices for Consultant’s Fees must also clearly state the daily rate and number of days. | Please confirm… | ||

| Confirmation of Payment by the Grantee Company for expenditure items claimed. | For each invoice claimed, you must submit a copy of the Bank Statement as proof of payment. The Bank Statements must clearly show the Company name (as per the Letter of Offer), the address, the bank account Note: Invoices marked paid or suppliers’ statements are not acceptable proof of payment. Note: Numbering of supporting documentation as detailed above. |

Please confirm… | ||

| Proof of Payment | For each invoice claimed, you must submit a copy of the Bank Statement as proof of payment. The Bank Statements must clearly show the Company name (as per the Letter of Offer), the address, the bank account number, payment date and payment details. | Please confirm… | ||

| Planning Permission | Copy of the approved Planning Permission from the relevant Planning Authority | Please confirm… | ||

| Regional Enterprise Transition Scheme | ||||||

| Claim Cost Workbook | ||||||

| Company Name: | ||||||

| Project Number (reference letter of offer): | ||||||

| Final Claim Date: | ||||||

| Claim No: | ||||||

| Claim Period : | From: | To: | ||||

| Claim costs from Claim Details tab(s) | Salaries | Overheads (30% of salaries) |

Consultancy | Promotion | New Build Costs | Renovation/ Refurbishment |

| Total approved expenditure as per Letter of Offer | €- | €- | €- | €- | €- | €- |

| Auto populated from the claim details tabs (do not edit) | €- | €- | €- | €- | €- | €- |

| Total Expenditure: | €- | |||||

| Enter Grant rate as shown in your Letter of Offer | 80% | 80% | 80% | 80% | 80% | 80% |

| Claim amount (auto populated, do not edit) | €- | €- | €- | €- | €- | €- |

| Claim Total: | €- | |||||

no reviews yet

Please Login to review.