195x Filetype XLSX File size 0.03 MB Source: charlestondiocese.org

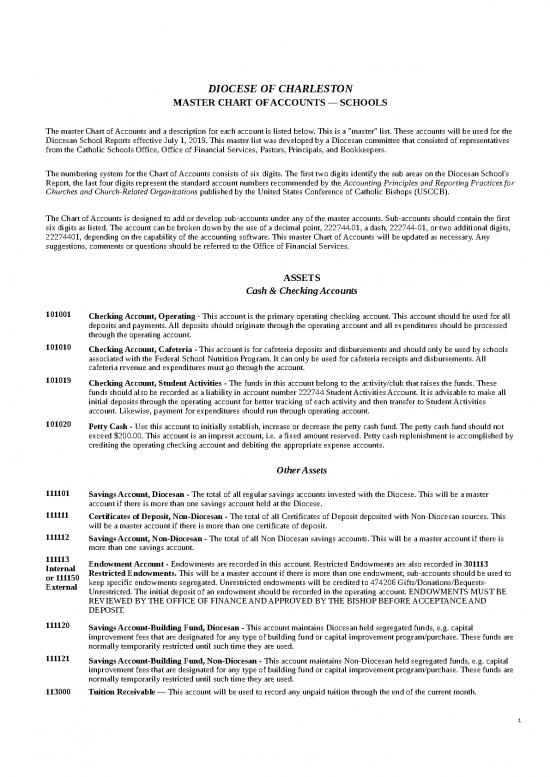

DIOCESE OF CHARLESTON

MASTER CHART OF ACCOUNTS — SCHOOLS

The master Chart of Accounts and a description for each account is listed below. This is a "master" list. These accounts will be used for the

Diocesan School Reports effective July 1, 2019. This master list was developed by a Diocesan committee that consisted of representatives

from the Catholic Schools Office, Office of Financial Services, Pastors, Principals, and Bookkeepers.

The numbering system for the Chart of Accounts consists of six digits. The first two digits identify the sub areas on the Diocesan School's

Report, the last four digits represent the standard account numbers recommended by the Accounting Principles and Reporting Practices for

Churches and Church-Related Organizations published by the United States Conference of Catholic Bishops (USCCB).

The Chart of Accounts is designed to add or develop sub-accounts under any of the master accounts. Sub-accounts should contain the first

six digits as listed. The account can be broken down by the use of a decimal point, 222744.01, a dash, 222744-01, or two additional digits,

22274401, depending on the capability of the accounting software. This master Chart of Accounts will be updated as necessary. Any

suggestions, comments or questions should be referred to the Office of Financial Services.

ASSETS

Cash & Checking Accounts

101001 Checking Account, Operating - This account is the primary operating checking account. This account should be used for all

deposits and payments. All deposits should originate through the operating account and all expenditures should be processed

through the operating account.

101010 Checking Account, Cafeteria - This account is for cafeteria deposits and disbursements and should only be used by schools

associated with the Federal School Nutrition Program. It can only be used for cafeteria receipts and disbursements. All

cafeteria revenue and expenditures must go through the account.

101019 Checking Account, Student Activities - The funds in this account belong to the activity/club that raises the funds. These

funds should also be recorded as a liability in account number 222744 Student Activities Account. It is advisable to make all

initial deposits through the operating account for better tracking of each activity and then transfer to Student Activities

account. Likewise, payment for expenditures should run through operating account.

101020 Petty Cash - Use this account to initially establish, increase or decrease the petty cash fund. The petty cash fund should not

exceed $200.00. This account is an imprest account, i.e. a fixed amount reserved. Petty cash replenishment is accomplished by

crediting the operating checking account and debiting the appropriate expense accounts.

Other Assets

111101 Savings Account, Diocesan - The total of all regular savings accounts invested with the Diocese. This will be a master

account if there is more than one savings account held at the Diocese.

111111 Certificates of Deposit, Non-Diocesan - The total of all Certificates of Deposit deposited with Non-Diocesan sources. This

will be a master account if there is more than one certificate of deposit.

111112 Savings Account, Non-Diocesan - The total of all Non Diocesan savings accounts. This will be a master account if there is

more than one savings account.

111113 Endowment Account - Endowments are recorded in this account. Restricted Endowments are also recorded in 301113

Internal Restricted Endowments. This will be a master account if there is more than one endowment; sub-accounts should be used to

or 111150 keep specific endowments segregated. Unrestricted endowments will be credited to 474206 Gifts/Donations/Bequests-

External Unrestricted. The initial deposit of an endowment should be recorded in the operating account. ENDOWMENTS MUST BE

REVIEWED BY THE OFFICE OF FINANCE AND APPROVED BY THE BISHOP BEFORE ACCEPTANCE AND

DEPOSIT.

111120 Savings Account-Building Fund, Diocesan - This account maintains Diocesan held segregated funds, e.g. capital

improvement fees that are designated for any type of building fund or capital improvement program/purchase. These funds are

normally temporarily restricted until such time they are used.

111121 Savings Account-Building Fund, Non-Diocesan - This account maintains Non-Diocesan held segregated funds, e.g. capital

improvement fees that are designated for any type of building fund or capital improvement program/purchase. These funds are

normally temporarily restricted until such time they are used.

113000 Tuition Receivable — This account will be used to record any unpaid tuition through the end of the current month.

1

116000 High School FACTS Clearing — High schools use this accounts as a clearing account for FACTS Advanced Accounting

entries. This account must be reconciled.

Fixed Assets

121522 Land - The value of the land owned by the school.

121523 Buildings - The value of all school buildings. This may be used as master account and sub-accounts created for each major

structure.

121524 Furnishings and Contents - The value of all furnishings and contents of all school property. This may be used as master

account and sub-accounts created for different categories of furnishings and content.

121564 Vehicles - The value of all vehicles owned by the school. This may be used aa a master account and sub-accounts created if

the school owns more than one vehicle.

121600 Construction in Progress (CIP) — The costs associated with constructing an asset which is not yet complete, or if complete,

before it is placed in service. Once construction is complete and/or in service, the CIP account should be credited and long

term fixed assets debited for the full amount of the project cost. This may be used as a master account and sub-accounts

created for each project.

LIABILITIES

202201 Accounts Payable - Total value of accounts payable. This account records only normal day to day routine payments.

202202 FICA/Medicare Withholding Tax Payable - This account records amounts withheld from employees but not yet remitted to

the Internal Revenue Service.

202203 Federal Withholding Tax Payable - This account records amounts withheld from employees but not yet remitted to the

Internal Revenue Service.

202204 State Withholding Tax Payable - This account records amounts withheld from employees but not yet remitted to remitted to

the State Revenue Service.

202205 Health Insurance Withheld Payable - This account records the amount withheld from employees but not yet remitted to the

health care provider. This account is also used for life and disability insurance withholdings.

202206 Garnishments — This account records the total amount withheld from employees, as required by court order or judgment,

but not remitted to the garnishment agency; e.g. child support, alimony, and student loans.

202207 Retirement Withheld Payable - This account records amounts withheld from employees but to be withdrawn by the

retirement custodian.

202214 Healthcare Flexible spending account (FSA) - This is the amount withheld from employees to be withdrawn by custodian.

202215 Hartford Combined Billing Clearing - This account replaces the liability accounts 202212 and 202213. Additionally, it is a

holding place for employer provided life and long term disability insurance expense. This account is to be used as a clearing

account for all. As a clearing account, it should be reduced to $0 monthly.

202225 Retainage Payable - Record amount withheld to ensure quality of contractor’s work is adequate. The retainage is a portion of

contractors total price of project, typically 10% withheld until final completion, to ensure the project is completed in

accordance with specifications of project and client satisfaction. This amount will be withheld until any/all issues of project is

rectified.

202500 Advanced Registration Fees — This account records registration fees for the next school year. It is also to include other

types of fees received in advance and associated with the registration process, e.g. technology fees, book fees, diocesan fees,

etc. If such fees are not included in a student's FACTS payment plan for monthly billing, then once the new fiscal year has

begun, it is debited and revenue recorded on July 1.

212001 Advanced Tuition - Payment of tuition that has been received in advance of the period in which the tuition is earned.

212010 Advanced Tuition — Scholarship/Donations from Outside Sources - Funds received for the next school year that are

restricted. These funds can only be used for the year that they are applicable to.

221010 Capital Improvement Reserve — This account records receipt of Capital Improvement Fees and should be used in

concurrence with 111120 Savings Account, Building Fund. Capital improvement income will be recognized when posted to

the appropriate fixed asset account.

221500 Tuition Insurance Reserve — This account records payment of tuition insurance fees only if school tuition insurance

program is self-insured.

222744 Student Activities Account - This account records student activity funds and is used in conjunction with account number

101019 Checking Account, Student Activities. The two accounts should always have the same balance.

2

231305 Loans - This account records loans, not to include the Payroll Protection Program.

231450 Loans - Payroll Protection Program - This account records only Payroll Protection Program loans.

260100

Unearned Income — This account records unearned revenue (does not include advanced tuition payments/fees or restricted

gifts/donations) received in the current fiscal year but to be spent in the next fiscal year(s); i.e. monies associated with

exchange transactions, multi-year grants, etc. Contact the Office of Financial Services if an entry to this account is necessary.

EQUITY

301113

Restricted Endowments - This account records the restricted endowments as equity. Endowments that are not restricted are

placed in the 111113 Endowment Account. This will be a master account if there is more than one endowment account.

301115 Restricted Gifts/Donations/Bequests - This account records and tracks the restricted gifts/donations/bequests as equity. This

will be a master account there is one or more restricted gift/donations/bequests.

303101 Prior Years Fund Balance - At fiscal year end, the Prior Year fund Balance (PYFB) will be updated automatically for Fiscal

Year End (FYE) net income/loss. This account should not have entries made to it throughout the fiscal year. If an adjusting

entry is necessary at any time during the year, contact the Office of Financial Services for approval. In summary, the PYFB

from one year to the next should equal the FYE net income/loss.

303102 Retained Surplus - Net profit or loss for the reporting period.

REVENUE

School Operating Revenue

Cost to Educate & Published Differentials

412010 Cost to Educate - Record the revenue required to equal the total budgeted annual expense. This account is not impacted by

adjustments to the budget nor by Accounts Receivable. Once calculated, it remains the same (one-twelfth of budgeted

expense) each month.

412405 Published Parishioner Tuition Differential - Record the difference between the cost to educate and the published rate for

parishioners multiplied by the number of students in this category. This total should be recorded over 12 months with

appropriate monthly adjustments as reflected in the monthly FACTS adjustment report.

412410 Published Catholic Non-parishioner Tuition Differential - Record the difference between the cost to educate and the

published rate for Catholic non-parishioners multiplied by the number of students in this category. This total should be

recorded over 12 months with appropriate monthly adjustments as reflected in the monthly FACTS adjustment report.

412415 Published Non-Catholic Tuition Differential - Record the difference between the cost to educate and the published rate for

Non-Catholics. This total should be recorded over 12 months with appropriate monthly adjustments as reflected in the

monthly FACTS adjustment report.

412420 Published Other Status Tuition Differential — Record the difference between the cost to educate and the published rate for

any other category of rates published. This total should be recorded over 12 months with appropriate monthly adjustments as

reflected in the monthly FACTS adjustment report.

412505 Tuition Discounts - Record the value of tuition discounts, (i.e. multiple students, staff dependents, etc.).

Fees

414005 Tuition-Prior Year - Record any prior year tuition received that had been previously written out of Tuition Receivable.

414006 Tuition - Summer School - Record receipts from summer school programs. Account is for academic programs not camps or

enrichment programs.

414007 Registration & Other Fees, Current Year - Record current year registration fees and other fees associated with the

registration process otherwise not listed, such as resource technology fees, capital improvement fees and Diocesan student fees

as assessed by the Catholic Schools Office.

414008 Student Accident Insurance Fee - Record the receipts for the mandatory Diocesan student accident insurance.

414009 Book Fee - Record receipts for book fees for rental or sale of textbooks.

3

414010 Tuition - Scholarship/Donation from Outside Sources - Record deposit of tuition scholarships/donations, from outside

sources for students attending the school. Examples are scholarships from SC Exceptional, Knights of Columbus and

donations from an individual donor, company, or organization.

414011 Tuition Insurance Fees - Record tuition insurance fees if school has a tuition insurance program and only if self-insured.

414013 Other Fees - Record any incidental fees charged to students, (that is; graduation fees, fines, parking permits, etc.).

Income Reduction Accounts (Contra-Revenue)

434010 Tuition Scholarships/Donations from Outside Sources - Record tuition scholarships or donations distributed to students

from outside sources that reduce the total tuition for particular student/s. Examples are scholarships from SC Exceptional,

Knights of Columbus and donations from an individual donor, company, or organization.

434011 Diocesan Tuition Assistance Reduction Grants — Record tuition grants distributed to students received from the Diocese

that reduce the gross amount of Tuition due for a student. Examples are the Bishop's Grant (high schools), St. Elizabeth Ann

Seton (SEAS) Grant, and the Jenkins Trust Grant.

434012 Tuition Assistance from Parish — Record funds received from a parish used for the reduction of tuition or fees for an

individual student or group. This account is a contra-revenue for the purpose of ensuring tuition revenue is not overstated by

the tuition assistance received from a parish.

434014 Tuition Reduction - Record any decrease in tuition granted by the Pastor, Pastoral Administrator, or Principal to a student.

These amounts will be a debit to the revenue reduction account and a credit to Tuition Receivable.

434016 Tuition Refunds - Record net tuition refunds. Net tuition is calculated by reversing proportional reductions and discounts that

had been applied to the student's account.

434017 Tuition Unrecoverable - Record tuition that is determined to be unrecoverable (write-off). Net tuition is calculated by

reversing (proportionally) the original reductions and discounts that had been applied to the student's account.

Subsidies

454018

School Support from Parishes - Record deposit of school support received from any parish regardless of the use of the

funds. Use sub-accounts if there are more than one parish subsidizing the school. Record all other expenses paid by the parish

that should have been paid by the school in this account also. If a parish wishes to help a school with certain items, the parish

should write a check to the school. This enables the school to properly account for funds as School Support and make the

corresponding payment. If payment is made directly by the parish, a journal entry will be required because the cash does not

flow through the school's checking account (account 454100 Parish Tuition Assistance has been eliminated).

454201 Bishops Annual Appeal (BAA) - Record deposit of BAA funding received here.

454203 Black and Indian Home Missions - Record deposit of Black and Indian Home Missions funding received here.

Fund Raising Development

474206 Gifts/Donations/Bequests - Unrestricted -- Record gifts/donations/bequests that are not restricted in use. The Finance Office

should be notified of any unrestricted gift if over $10,000. Fifty-percent of gift is required to be deposited into Diocesan

Deposit and Loan.

474211 Gifts/Donations/Bequests - Restricted - Record gifts/donations/bequests that are restricted in use. The Finance Office should

be notified and "approval by the Bishop to accept" the restricted gift is required before accepted. Use this as a master account

and use subaccounts for each restricted deposit to provide better control.

474230 Parents Organizations - Record funds received from parents' organizations here. These funds should also be identified on the

"Affiliated School Organization Report."

474231 Student Fund Raising (Net) - Record net profits from student fund raising. Use this as a master account and create separate

sub-accounts for each fund raising project.

474232 Special Fund Raising Events (Net) - Record net profits from special fund raising events. Use this as a master account and

create separate sub-accounts for each fund raising event.

474270 School Development - Record any revenue received for school development i.e.donations from alumni drive or annual appeal

pledges. Revenue received for school development may be restricted or designated and used for that purpose only.

474414 Income from Endowments - Record income received from endowment accounts. These funds may or may not be restricted

based on the endowment.

474505 Realized Gain (Loss) on Sale of Investments - Record realized gain (loss) on the sales of investments.

4

no reviews yet

Please Login to review.