302x Filetype XLSX File size 0.43 MB Source: www.sebi.gov.in

Report Name

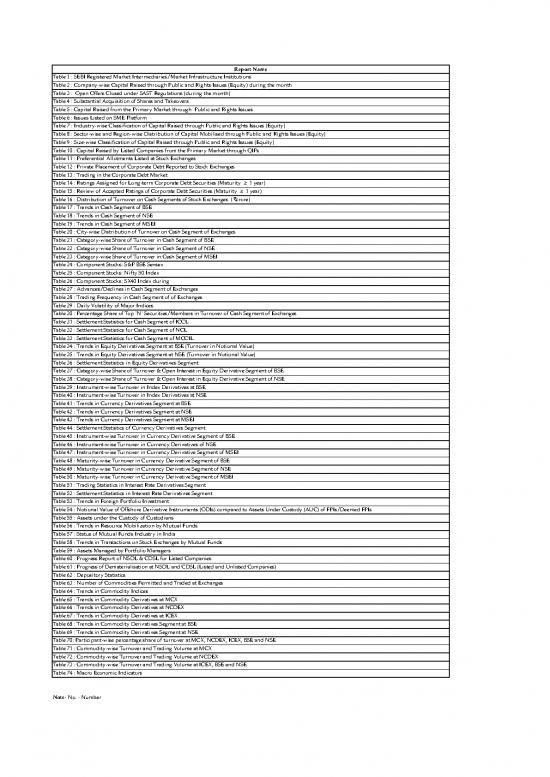

Table 1 : SEBI Registered Market Intermediaries/Market Infrastructure Institutions

Table 2 : Company-wise Capital Raised through Public and Rights Issues (Equity) during the month

Table 3 : Open Offers Closed under SAST Regulations (during the month)

Table 4 : Substantial Acquisition of Shares and Takeovers

Table 5 : Capital Raised from the Primary Market through Public and Rights Issues

Table 6 : Issues Listed on SME Platform

Table 7 : Industry-wise Classification of Capital Raised through Public and Rights Issues (Equity)

Table 8 : Sector-wise and Region-wise Distribution of Capital Mobilised through Public and Rights Issues (Equity)

Table 9 : Size-wise Classification of Capital Raised through Public and Rights Issues (Equity)

Table 10 : Capital Raised by Listed Companies from the Primary Market through QIPs

Table 11 : Preferential Allotments Listed at Stock Exchanges

Table 12 : Private Placement of Corporate Debt Reported to Stock Exchanges

Table 13 : Trading in the Corporate Debt Market

Table 14 : Ratings Assigned for Long-term Corporate Debt Securities (Maturity ≥ 1 year)

Table 15 : Review of Accepted Ratings of Corporate Debt Securities (Maturity ≥ 1 year)

Table 16 : Distribution of Turnover on Cash Segments of Stock Exchanges (₹crore)

Table 17 : Trends in Cash Segment of BSE

Table 18 : Trends in Cash Segment of NSE

Table 19 : Trends in Cash Segment of MSEI

Table 20 : City-wise Distribution of Turnover on Cash Segment of Exchanges

Table 21 : Category-wise Share of Turnover in Cash Segment of BSE

Table 22 : Category-wise Share of Turnover in Cash Segment of NSE

Table 23 : Category-wise Share of Turnover in Cash Segment of MSEI

Table 24 : Component Stocks: S&P BSE Sensex

Table 25 : Component Stocks: Nifty 50 Index

Table 26 : Component Stocks: SX40 Index during

Table 27 : Advances/Declines in Cash Segment of Exchanges

Table 28 : Trading Frequency in Cash Segment of of Exchanges

Table 29 : Daily Volatility of Major Indices

Table 30 : Percentage Share of Top ‘N’ Securities/Members in Turnover of Cash Segment of Exchanges

Table 31 : Settlement Statistics for Cash Segment of ICCL

Table 32 : Settlement Statistics for Cash Segment of NCL

Table 33 : Settlement Statistics for Cash Segment of MCCIL

Table 34 : Trends in Equity Derivatives Segment at BSE (Turnover in Notional Value)

Table 35 : Trends in Equity Derivatives Segment at NSE (Turnover in Notional Value)

Table 36 : Settlement Statistics in Equity Derivatives Segment

Table 37 : Category-wise Share of Turnover & Open Interest in Equity Derivative Segment of BSE

Table 38 : Category-wise Share of Turnover & Open Interest in Equity Derivative Segment of NSE

Table 39 : Instrument-wise Turnover in Index Derivatives at BSE

Table 40 : Instrument-wise Turnover in Index Derivatives at NSE

Table 41 : Trends in Currency Derivatives Segment at BSE

Table 42 : Trends in Currency Derivatives Segment at NSE

Table 43 : Trends in Currency Derivatives Segment at MSEI

Table 44 : Settlement Statistics of Currency Derivatives Segment

Table 45 : Instrument-wise Turnover in Currency Derivative Segment of BSE

Table 46 : Instrument-wise Turnover in Currency Derivatives of NSE

Table 47 : Instrument-wise Turnover in Currency Derivative Segment of MSEI

Table 48 : Maturity-wise Turnover in Currency Derivative Segment of BSE

Table 49 : Maturity-wise Turnover in Currency Derivative Segment of NSE

Table 50 : Maturity-wise Turnover in Currency Derivative Segment of MSEI

Table 51 : Trading Statistics in Interest Rate Derivatives Segment

Table 52 : Settlement Statistics in Interest Rate Derivatives Segment

Table 53 : Trends in Foreign Portfolio Investment

Table 54 : Notional Value of Offshore Derivative Instruments (ODIs) compared to Assets Under Custody (AUC) of FPIs/Deemed FPIs

Table 55 : Assets under the Custody of Custodians

Table 56 : Trends in Resource Mobilization by Mutual Funds

Table 57 : Status of Mutual Funds Industry in India

Table 58 : Trends in Transactions on Stock Exchanges by Mutual Funds

Table 59 : Assets Managed by Portfolio Managers

Table 60 : Progress Report of NSDL & CDSL for Listed Companies

Table 61 : Progress of Dematerialisation at NSDL and CDSL (Listed and Unlisted Companies)

Table 62 : Depository Statistics

Table 63 : Number of Commodities Permitted and Traded at Exchanges

Table 64 : Trends in Commodity Indices

Table 65 : Trends in Commodity Derivatives at MCX

Table 66 : Trends in Commodity Derivatives at NCDEX

Table 67 : Trends in Commodity Derivatives at ICEX

Table 68 : Trends in Commodity Derivatives Segment at BSE

Table 69 : Trends in Commodity Derivatives Segment at NSE

Table 70: Participant-wise percentage share of turnover at MCX, NCDEX, ICEX, BSE and NSE

Table 71 : Commodity-wise Turnover and Trading Volume at MCX

Table 72 : Commodity-wise Turnover and Trading Volume at NCDEX

Table 73 : Commodity-wise Turnover and Trading Volume at ICEX, BSE and NSE

Table 74 : Macro Economic Indicators

Note- No. - Number

Table 1: SEBI Recognised/Registered Intermediaries / Market Infrastructure Institutions

Particular 2020-21 2021-22$

Stock Exchanges 7 7

of that have:

Cash Segment # 3 3

Equity Derivatives Segment # 3 3

Currency Derivatives Segment# 3 3

Commodity Derivatives Segment# 5 5

International Exchange (IFSC)#% 0 0

Brokers (Cash Segment) 4,639 4,642

Brokers (Equity Derivatives Segment) 3,582 3,591

Brokers (Currency Derivatives Segment) 2,772 2,771

Brokers (Debt Segment) 445 446

Brokers (Commodity Derivatives Segment) 2,206 2,181

Corporate Brokers(Cash Segment) 3,587 3,587

Clearing Corporation** 5 5

Foreign Portfolio Investors (FPIs) 9,975 9,975

Custodians 18 18

Depositories 2 2

Depository Participants (NSDL) 272 276

Depository Participants (CDSL) 615 617

Merchant Bankers 215 215

Bankers to an Issue 65 65

Underwriters 1 1

Debenture Trustees 30 30

Credit Rating Agencies 7 7

KYC Registration Agencies (KRA) 5 5

Registrars to an Issue & Share Transfer Agents 78 78

Venture Capital Funds 189 189

Foreign Venture Capital Investors 260 260

Alternative Investment Funds 726 726

Portfolio Managers 361 361

Mutual Funds 46 46

Investment Advisors 1,352 1,352

Research Analysts 733 733

Infrastructure Investment Trusts (InvITs) 15 15

Real estate investment trust (REITs) 4 4

Collective Investment Schemes 1 1

Approved Intermediaries (Stock Lending Schemes) 2 2

STP (Centralised Hub) 1 1

STP Service Providers 3 3

Notes:

$ indicates as on May 31, 2021

# SEBI has granted recognition for carrying out operations in the respective segment.

#% IFSC are now under regulatory jurisdiction of

International Financial Services Centres Authority (IFSCA)

w.e.f. October 01, 2020

**Government of India notified the commencement of

Section 13 and Section 33 of the IFSCA Act, 2019 w.e.f. Oct 1,

2020. Pursuant to the same, IFSCA was empowered as the

unified regulator; and the issues relating to GIFT-IFSC no

longer fall under the regulatory purview of SEBI.

Source: SEBI, NSDL.

Table 2: Company-wise Capital Raised through Public and Rights Issues (Equity) during May 2021

Sl.No. Name of the Issuer/Company Date of Listing Type of Issue Type of No. of Shares Face Value (₹ ) Premium Value Issue Price (₹ ) Size of Issue

Instrument Issued (₹ ) ( ₹ crore)

1 Kuberan Global Edu Solutions Limited 5-May-21 Rights Issue Equity 558,000 10 10 20 1

2 KDDL Limited 21-May-21 BSE Start up IPO Equity 1,086,956 10 220 230 25

Notes: All the issues are compiled from the Prospectus of Issuer Companies filed with SEBI.

From April, 2020 onwards the data is being prepared based on the listing date of the issues as against earlier practice of preparing it based on the closing date.

Source: SEBI.

Table 3: Open Offers Closed under SAST Regulations (during May 2021)

Offer Size

Offer Offer Closing as per cent of Offer Price Offer Size

Sl.No Target Company Acquirer Opening Date No. of Equity (₹ ) per share ( ₹ crore)

Date Shares Capital

1 Towa Sakki Limited Sudhir Mehta 19-Apr-21 3-May-21 1,184,248 0.26 0.7 6.0

2 Siel Financial Services Limited Parmeet Singh Sood 22-Apr-21 5-May-21 2,835,938 0.25 0.6 2.3

3 Solex Energy Limited Mr.Chetan Sureshchandra Shah and 16 others along with Ms. Shikha Ayush 7-May-21 21-May-21 2,080,000 0.26 7.3 35.0

Patodia

4 Magma Fincorp Limited Rising Sun Holdings Private Limited 4-May-21 18-May-21 198,832,105 0.26 70.0 1391.8

Source: SEBI.

no reviews yet

Please Login to review.