181x Filetype XLSX File size 0.07 MB Source: www.santos.com

Sheet 1: Income statement

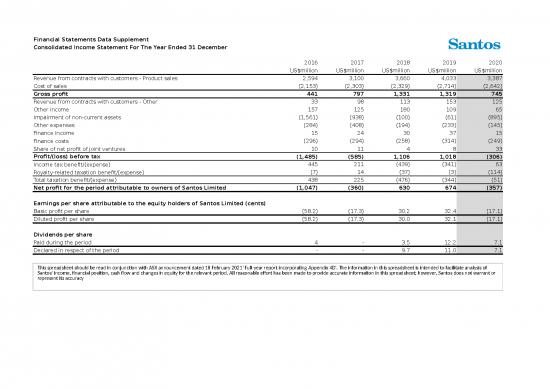

| Financial Statements Data Supplement | ||||||

| Consolidated Income Statement For The Year Ended 31 December | ||||||

| 2016 | 2017 | 2018 | 2019 | 2020 | ||

| US$million | US$million | US$million | US$million | US$million | ||

| Revenue from contracts with customers - Product sales | 2,594 | 3,100 | 3,660 | 4,033 | 3,387 | |

| Cost of sales | (2,153) | (2,303) | (2,329) | (2,714) | (2,642) | |

| Gross profit | 441 | 797 | 1,331 | 1,319 | 745 | |

| Revenue from contracts with customers - Other | 33 | 98 | 113 | 153 | 125 | |

| Other income | 157 | 125 | 180 | 109 | 65 | |

| Impairment of non-current assets | (1,561) | (938) | (100) | (61) | (895) | |

| Other expenses | (284) | (408) | (194) | (233) | (145) | |

| Finance income | 15 | 24 | 30 | 37 | 15 | |

| Finance costs | (296) | (294) | (258) | (314) | (249) | |

| Share of net profit of joint ventures | 10 | 11 | 4 | 8 | 33 | |

| Profit/(loss) before tax | (1,485) | (585) | 1,106 | 1,018 | (306) | |

| Income tax benefit/(expense) | 445 | 211 | (439) | (341) | 63 | |

| Royalty-related taxation benefit/(expense) | (7) | 14 | (37) | (3) | (114) | |

| Total taxation benefit/(expense) | 438 | 225 | (476) | (344) | (51) | |

| Net profit for the period attributable to owners of Santos Limited | (1,047) | (360) | 630 | 674 | (357) | |

| Earnings per share attributable to the equity holders of Santos Limited (cents) | ||||||

| Basic profit per share | (58.2) | (17.3) | 30.2 | 32.4 | (17.1) | |

| Diluted profit per share | (58.2) | (17.3) | 30.0 | 32.1 | (17.1) | |

| Dividends per share | ||||||

| Paid during the period | 4 | - | 3.5 | 12.2 | 7.1 | |

| Declared in respect of the period | - | - | 9.7 | 11.0 | 7.1 | |

| Financial Statements Data Supplement | ||||||

| Financial Position Statement For The Year Ended 31 December | ||||||

| 2016 | 2017 | 2018 | 2019 | 2020 | ||

| US$million | US$million | US$million | US$million | US$million | ||

| Current assets | ||||||

| Cash and cash equivalents | 2,026 | 1,231 | 1,316 | 1,067 | 1,319 | |

| Trade and other receivables | 367 | 440 | 521 | 554 | 560 | |

| Prepayments | 34 | 28 | 32 | 40 | 39 | |

| Contract assets | - | - | 28 | 23 | 23 | |

| Inventories | 321 | 266 | 288 | 301 | 288 | |

| Other financial assets | 7 | - | 28 | 195 | 29 | |

| Tax receivable | 15 | 7 | 13 | - | - | |

| Assets held for sale | 180 | - | - | - | 438 | |

| Total current assets | 2,950 | 1,972 | 2,226 | 2,180 | 2,696 | |

| Non-current assets | ||||||

| Receivables | 5 | - | - | - | ||

| Prepayments | 17 | 17 | 16 | - | 2 | |

| Contract assets | - | - | 157 | 130 | 106 | |

| Investment in associate | 56 | 43 | 31 | 13 | 413 | |

| Other financial assets | 152 | 134 | 31 | 29 | 24 | |

| Exploration and evaluation assets | 495 | 459 | 981 | 1,187 | 1,818 | |

| Oil and gas assets | 10,398 | 9,536 | 11,283 | 11,396 | 10,925 | |

| Other land, buildings, plant and equipment | 135 | 126 | 119 | 223 | 248 | |

| Deferred tax assets | 1,054 | 1,419 | 1,486 | 870 | 1,041 | |

| Goodwill | - | - | 481 | 481 | 383 | |

| Total non-current assets | 12,312 | 11,734 | 14,585 | 14,329 | 14,960 | |

| Total assets | 15,262 | 13,706 | 16,811 | 16,509 | 17,656 | |

| Current liabilities | ||||||

| Trade and other payables | 520 | 495 | 661 | 719 | 558 | |

| Deferred income | 23 | - | - | - | - | |

| Other liabilities | - | - | 3 | - | - | |

| Contract liabilities | - | 8 | 38 | 125 | 64 | |

| Lease liabilities | - | - | 1 | 114 | 121 | |

| Interest-bearing loans and borrowings | 420 | 207 | 966 | 196 | 234 | |

| Current tax liabilities | 3 | 17 | 63 | 38 | 31 | |

| Provisions | 121 | 142 | 116 | 122 | 176 | |

| Other financial liabilities | 366 | 82 | 6 | 5 | 39 | |

| Liabilities directly associated with assets held for sale | 103 | - | - | - | 312 | |

| Total current liabilities | 1,556 | 951 | 1,854 | 1,319 | 1,535 | |

| Non-current liabilities | ||||||

| Deferred income | 99 | - | - | - | - | |

| Contract liabilities | - | 113 | 335 | 233 | 281 | |

| Lease liabilities | - | - | 61 | 311 | 336 | |

| Interest-bearing loans and borrowings | 4,819 | 3,736 | 3,891 | 3,800 | 4,309 | |

| Deferred tax liabilities | 221 | 240 | 1,206 | 811 | 904 | |

| Provisions | 1,464 | 1,494 | 2,159 | 2,329 | 3,039 | |

| Other liabilities | - | 1 | 2 | 1 | 1 | |

| Other financial liabilities | 23 | 20 | 24 | 29 | 24 | |

| Total non-current liabilities | 6,626 | 5,604 | 7,678 | 7,514 | 8,894 | |

| Total liabilities | 8,182 | 6,555 | 9,532 | 8,833 | 10,429 | |

| Net assets | 7,080 | 7,151 | 7,279 | 7,676 | 7,227 | |

| Equity | ||||||

| Issued capital | 8,883 | 9,034 | 9,031 | 9,010 | 9,013 | |

| Reserves | (510) | 51 | 607 | 759 | 1,107 | |

| Accumulated losses | (1,293) | (1,934) | (2,359) | (2,093) | (2,893) | |

| Total equity | 7,080 | 7,151 | 7,279 | 7,676 | 7,227 | |

| Financial Statements Data Supplement | ||||||

| Cash Flow Statement For The Year Ended 31 December | ||||||

| 2016 | 2017 | 2018 | 2019 | 2020 | ||

| US$million | US$million | US$million | US$million | US$million | ||

| Cash flows from operating activities | ||||||

| Receipts from customers | 2,708 | 3,217 | 3,740 | 4,266 | 3,503 | |

| Interest received | - | - | 30 | 37 | 15 | |

| Dividends received | 12 | 12 | 6 | 15 | 41 | |

| Pipeline tarrifs and other receipts | 60 | 66 | 106 | 146 | 218 | |

| Payments to suppliers and employees | (1,600) | (1,611) | (1,816) | (1,892) | (1,899) | |

| Restoration expenditure | (17) | (37) | (36) | (24) | (37) | |

| Exploration and evaluation seismic and studies | (68) | (71) | (98) | (83) | (48) | |

| Royalty and excise paid | (34) | (57) | (85) | (90) | (59) | |

| Proceeds from commodity hedging | - | - | - | - | 54 | |

| Borrowing costs paid | (226) | (254) | (194) | (227) | (176) | |

| Income tax paid | (17) | (28) | (69) | (30) | (5) | |

| Income tax received | - | - | - | - | - | |

| Royalty-related taxes paid | (4) | (15) | (13) | (97) | (154) | |

| Insurance proceeds | - | - | 4 | 28 | 13 | |

| Other operating activities | 26 | 26 | 3 | (3) | 10 | |

| Net cash from operating activities | 840 | 1,248 | 1,578 | 2,046 | 1,476 | |

| Cash flows used in investing activities | ||||||

| Payments for: | ||||||

| Exploration and evaluation assets | (128) | (146) | (66) | (222) | (130) | |

| Oil and gas assets | (500) | (483) | (490) | (619) | (584) | |

| Other land, buildings, plant and equipment | (4) | (5) | (10) | (18) | (47) | |

| Acquisitions of exploration and evaluation assets | - | - | (10) | (18) | (9) | |

| Acquisitions of oil and gas assets | (18) | (49) | - | - | - | |

| Acquisition of subsidary, net of cash acquired | - | - | (1,933) | (177) | (695) | |

| Costs associated with acquisition of subsidaries | - | - | (10) | (5) | (19) | |

| Proceeds from disposal of non-current assets | 447 | 145 | 26 | 10 | - | |

| Proceeds from disposal of subsidaries | - | - | 126 | - | - | |

| Net (payments)/proceeds associated with disposal | - | - | - | 18 | (11) | |

| Borrowing costs paid | (20) | (6) | (6) | (15) | (29) | |

| Other investing activities | 18 | 10 | - | - | - | |

| Return of capital - investment in joint ventures | - | - | - | 13 | 63 | |

| Net cash used in investing activities | (205) | (534) | (2,373) | (1,033) | (1,461) | |

| Cash flows from/(used in) financing activities | ||||||

| Dividends paid | (43) | - | (73) | (251) | (136) | |

| Drawdown of borrowings | - | 783 | 1,193 | 592 | 1,492 | |

| Repayment of borrowings | (147) | (2,442) | (220) | (1,474) | (960) | |

| Repayment of lease liabilities | - | - | - | (87) | (119) | |

| Purchase of shares on-market (Treasury shares) | - | (8) | (10) | (31) | (31) | |

| Proceeds/costs from ordinary shares | 733 | 149 | - | - | - | |

| Net cash used in financing activities | 543 | (1,518) | 890 | (1,251) | 246 | |

| Net (decrease)/increase in cash and cash equivalents | 1,178 | (804) | 95 | (238) | 261 | |

| Cash and cash equivalents at the beginning of the period | 839 | 2,026 | 1,231 | 1,316 | 1,067 | |

| Effects of exchange rate changes on the balances of cash held in foreign currencies | 9 | 9 | (10) | (11) | (9) | |

| Cash and cash equivalents at the end of the period | 2,026 | 1,231 | 1,316 | 1,067 | 1,319 | |

no reviews yet

Please Login to review.