288x Filetype XLSX File size 0.04 MB Source: www.revenue.wi.gov

Sheet 1: Instr

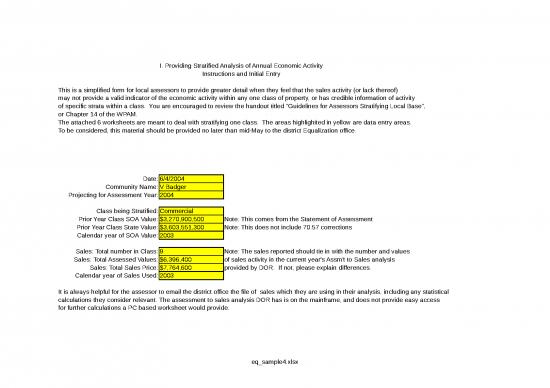

| I. Providing Stratified Analysis of Annual Economic Activity | ||

| Instructions and Initial Entry | ||

| This is a simplified form for local assessors to provide greater detail when they feel that the sales activity (or lack thereof) | ||

| may not provide a valid indicator of the economic activity within any one class of property, or has credible information of activity | ||

| of specific strata within a class. You are encouraged to review the handout titled "Guidelines for Assessors Stratifying Local Base", | ||

| or Chapter 14 of the WPAM. | ||

| The attached 6 worksheets are meant to deal with stratifying one class. The areas highlighited in yellow are data entry areas. | ||

| To be considered, this material should be provided no later than mid-May to the district Equalization office. | ||

| Date: | 6/4/2004 | |

| Community Name: | V Badger | |

| Projecting for Assessment Year: | 2004 | |

| Class being Stratified: | Commercial | |

| Prior Year Class SOA Value: | $3,270,900,500 | Note: This comes from the Statement of Assessment |

| Prior Year Class State Value: | $3,603,551,300 | Note: This does not include 70.57 corrections |

| Calendar year of SOA Value: | 2003 | |

| Sales: Total number in Class: | 9 | Note: The sales reported should tie in with the number and values |

| Sales: Total Assessed Values: | $6,396,400 | of sales activity in the current year's Assm't to Sales analysis |

| Sales: Total Sales Price: | $7,764,600 | provided by DOR. If not, please explain differences. |

| Calendar year of Sales Used: | 2003 | |

| It is always helpful for the assessor to email the district office the file of sales which they are using in their analysis, including any statistical | ||

| calculations they consider relevant. The assessment to sales analysis DOR has is on the mainframe, and does not provide easy access | ||

| for further calculations a PC based worksheet would provide. |

| II. Stratification of Total Assessed Value of Class From Roll | ||||

| Date: | 6/4/2004 | SOA Year of Assessed Value: | 2003 | |

| Community: | V Badger | |||

| Property Class: | Commercial | Reported Totals: | $3,270,900,500 | |

| Calculated (below) Totals: | $3,270,801,515 | 100.00% | ||

| Stratum | Stratum | Stratum | Value on Roll | Strata as |

| Name | Code | Description | % of Class | |

| Apartments | 1 | $228,963,035 | 7.00% | |

| Banks | 2 | $65,418,010 | 2.00% | |

| Food Stores | 3 | $32,709,005 | 1.00% | |

| General Retail | 4 | $490,635,090 | 15.00% | |

| Hotels | 5 | $196,254,030 | 6.00% | |

| Miscellaneous | 6 | $65,418,010 | 2.00% | |

| Office | 7 | $1,471,905,225 | 45.00% | |

| Restaurants | 8 | $65,418,010 | 2.00% | |

| Shopping Centers | 9 | $457,926,070 | 14.00% | |

| Service Stations | 10 | $32,705,005 | 1.00% | |

| Wharehouse | 11 | $163,450,025 | 5.00% | |

| 0.00% | ||||

| 0.00% | ||||

| 0.00% | ||||

| 0.00% | ||||

| 0.00% | ||||

| STRATUM NAME: Whatever convienient short reference the assessor uses for the specific grouping of similar properties | ||||

| STRATUM CODE: Not necessary, however this is a handy reference if the assessor maintains a code on the roll. | ||||

| STRATUM DESCRIPTION: Not necessary, however allows for further explaination if the 'name' isn't fully descriptive. | ||||

| REPORTED v. CALCULATED TOTALS: Compare the numbers on page 1 to the sum of the detail on this page. They should match. | ||||

| NOTE: In instances where there is a large % of the class value associated with one entity, it would be helpful to treat that entity as | ||||

| a separate stratum. Examples might be smaller communities with landfill sites, golf courses, regional shopping malls, | ||||

| or large valued headquarter office complexes. |

| III. Sales Ratio Analysis by Stratum | |||||||

| Date: | 6/4/2004 | ||||||

| Community: | V Badger | ||||||

| Reported Totals: | 9 | $6,396,400 | $7,764,600 | ||||

| Calculated (below) Totals: | 9 | $6,396,400 | $7,764,600 | 82.38% | |||

| Stratum | Stratum | # of | # Adequate? | Assessed | Sale | Aggregate | Useable |

| Name | Code | Sales | No=1 | Value | Price | Ratio | Agg Ratio |

| Apartments | 1 | 1 | 1 | $270,900 | $410,000 | 66.07% | 0.00% |

| Banks | 2 | 1 | 1 | $519,700 | $530,000 | 98.06% | 0.00% |

| Food Stores | 3 | 1 | 0.00% | 0.00% | |||

| General Retail | 4 | 2 | 1 | $1,687,700 | $1,715,000 | 98.41% | 0.00% |

| Hotels | 5 | 1 | 1 | $708,000 | $1,200,000 | 59.00% | 0.00% |

| Miscellaneous | 6 | 1 | 0.00% | 0.00% | |||

| Office | 7 | 1 | 1 | $190,000 | $212,600 | 89.37% | 0.00% |

| Restaurants | 8 | 1 | 0.00% | 0.00% | |||

| Shopping Centers | 9 | 1 | 0.00% | 0.00% | |||

| Service Stations | 10 | 1 | 1 | $940,000 | $1,097,000 | 85.69% | 0.00% |

| Wharehouse | 11 | 2 | 1 | $2,080,100 | $2,600,000 | 80.00% | 0.00% |

| 0 | 0 | 0.00% | 0.00% | ||||

| 0 | 0 | 0.00% | 0.00% | ||||

| 0 | 0 | 0.00% | 0.00% | ||||

| 0 | 0 | 0.00% | 0.00% | ||||

| 0 | 0 | 0.00% | 0.00% | ||||

| This page allows for the assessor to summarize assessed value totals, sales value totals and number of sales by each of their stratum. | |||||||

| # ADEQUATE?, NO=1, In this column the assessor should report their judgement of whether the number of sales is adequate | |||||||

| to reflect the assessment level of that specific stratum. | |||||||

| NOTE: For the formulas to work, if there are any sales in the stratum, and the number is not adequate, | |||||||

| the entry in this column MUST BE THE NUMBER '1'. | |||||||

| REPORTED v. CALCULATED TOTALS: Compare the numbers on page 1 to the sum of the detail on this page. They should match. | |||||||

| AGGREGATE RATIO: The aggregate ratio is the relationship between all the reported assessments and sales. | |||||||

| USEABLE RATIO: The ratios only reflect those strata in which the assessor felt there was an adequate quantity of sales. |

no reviews yet

Please Login to review.