291x Filetype XLSX File size 0.03 MB Source: www.cbic.gov.in

Sheet 1: Audit-1

| DGA-CE-1 | |||||||||||||||||||

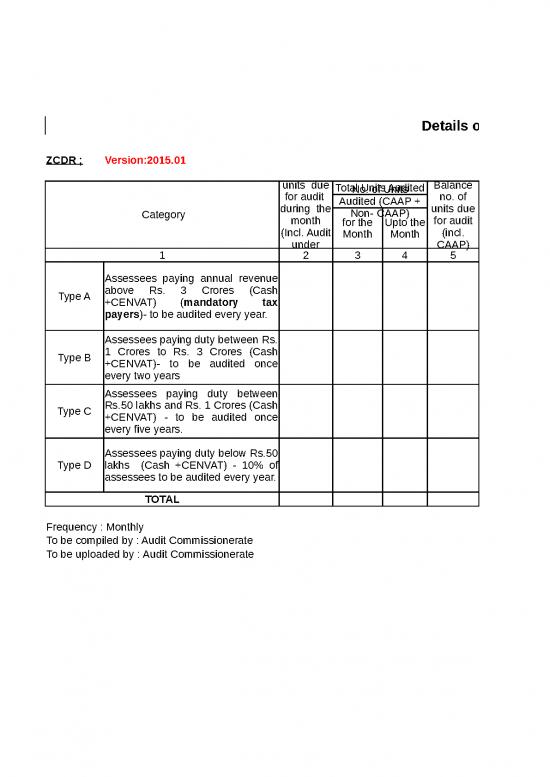

| Details of Internal Audits conducted [Audit-1] | |||||||||||||||||||

| ZCDR ; | Version:2015.01 | Month : | |||||||||||||||||

| (Rs. in Lakhs) | |||||||||||||||||||

| Category | No. of units due for audit during the month (Incl. Audit under CAAP) |

Total Units Audited | Balance no. of units due for audit (incl. CAAP) | Amount of Total Short-levy detected (Rs.) | Amount of Recovery made at the time of audit (Spot-Recovery) (Success indicator A.2.1 of RFD) | Amount of Subsequent Recovery (Recovery in pending paras) | Amount of Total Recovery (at the time of audit and subseqently) | CAAP Audits | |||||||||||

| No. of Units Audited (CAAP + Non- CAAP) | CAAP Audits conducted | Amount of Total Short-levy detected | Amount of Recovery | ||||||||||||||||

| for the Month | Upto the Month | For the Month | Upto the Month | For the Month | Upto the Month | For the Month | Upto the Month | For the Month | Upto the Month | For the Month | Upto the Month | For the Month | Upto the Month | For the Month | Upto the Month | ||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | |

| Type A | Assessees paying annual revenue above Rs. 3 Crores (Cash +CENVAT) (mandatory tax payers)- to be audited every year. | ||||||||||||||||||

| Type B | Assessees paying duty between Rs. 1 Crores to Rs. 3 Crores (Cash +CENVAT)- to be audited once every two years | ||||||||||||||||||

| Type C | Assessees paying duty between Rs.50 lakhs and Rs. 1 Crores (Cash +CENVAT) - to be audited once every five years. | ||||||||||||||||||

| Type D | Assessees paying duty below Rs.50 lakhs (Cash +CENVAT) - 10% of assessees to be audited every year. | ||||||||||||||||||

| TOTAL | |||||||||||||||||||

| Frequency : Monthly | |||||||||||||||||||

| To be compiled by : Audit Commissionerate | |||||||||||||||||||

| To be uploaded by : Audit Commissionerate | Contd.…2/- | ||||||||||||||||||

| DGA-CE-1A | ||||||||||||||||||||||||

| Details of Internal Audits conducted[Internal Audit-1] | ||||||||||||||||||||||||

| ZCDR | Month : | |||||||||||||||||||||||

| (Rs. in Lakhs) | ||||||||||||||||||||||||

| Category | Master files | Desk Review | Audit Plans | Verification | Revenue Paras raised | Revenue Paras not approved by MCM | Revenue Paras closed after re-examination by MCM | No of pending paras | No. of paras pending for more than one year at the end of month | |||||||||||||||

| No. of Master File prepared | No. of Desk Review conducted | No. of Audit Plans prepared | No. of Verification reports prepared | For the month | Upto the month | For the month | Upto the month | For the month | Upto the month | |||||||||||||||

| For the Month | Upto the Month | For the Month | Upto the Month | For the Month | Upto the Month | For the Month | Upto the Month | No. | Amt. | No. | Amt. | No. | Amt. | No. | Amt. | No. | Amt. | No. | Amt. | For the Month | Upto the Month | |||

| 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | ||

| Type A | Assessees paying annual revenue above Rs. 3 Crores (Cash +CENVAT) (mandatory tax payers)- to be audited every year. | |||||||||||||||||||||||

| Type B | Assessees paying duty between Rs. 1 Crores to Rs. 3 Crores (Cash +CENVAT)- to be audited once every two years | |||||||||||||||||||||||

| Type C | Assessees paying duty between Rs.50 lakhs and Rs. 1 Crores (Cash +CENVAT) - to be audited once every five years. | |||||||||||||||||||||||

| Type D | Assessees paying duty below Rs.50 lakhs (Cash +CENVAT) - 10% of assessees to be audited every year. | |||||||||||||||||||||||

| TOTAL | ||||||||||||||||||||||||

| Frequency : Monthly | ||||||||||||||||||||||||

| To be compiled by : Audit Commissionerate | ||||||||||||||||||||||||

| To be uploaded by : Audit Commissionerate | ||||||||||||||||||||||||

| DGA-CE-2 | |||||||||

| Internal Audit-2 | |||||||||

| ZCDR : | Month : | ||||||||

| (Rs. In Lakhs) | |||||||||

| Opening Balance | Audit Paras accepted during the month for action | No. of Audit Paras closed during the month | |||||||

| SCN issued | Amount recovered and paras closed | Other reasons like closure on merit / Transfer to AE | |||||||

| No.of paras | Amount | No.of paras | Amount | No.of paras | Amount | No.of paras | Amount | No.of paras | Amount |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Closing Balance | Age-wise pendency | ||||||||

| Less than 3 months | 3 to 6 months | 6 to 12 months | More than 1 year | ||||||

| No.of paras | Amount | No.of paras | Amount | No.of paras | Amount | No.of paras | Amount | No.of paras | Amount |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| Frequency : Monthly | |||||||||

| To be compiled by : Division / Commissionerate | |||||||||

| To be uploaded by : Commissionerate | |||||||||

no reviews yet

Please Login to review.