261x Filetype XLSX File size 0.20 MB Source: www.bdo.com

Sheet 1: Instructions

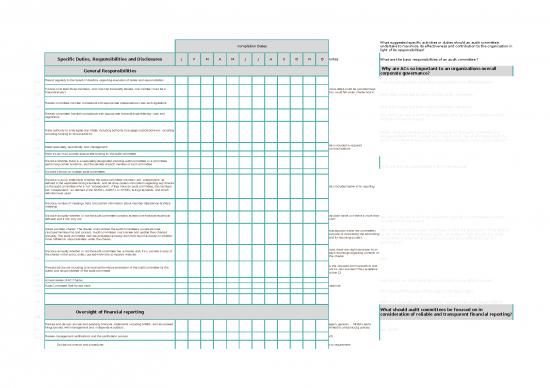

| Audit Committee Duties, Responsibilities, and Disclosures: Instructions for Use | |||||||||||||||||||||

| This practice aid outlines general duties, responsibilities and disclosures to be carried out by public company audit committees (ACs) as determined by regulation and rule-making, U.S. stock exchange listing standards, and evolving corporate governance best practices. Instructions for use are included below along with a KEY denoting current Rules/Regulations/Releases referred to within the practice aid. This practice will continue to evolve over time as rule-making, best practices and resources continue to develop. | |||||||||||||||||||||

| The practice aid is organized by 6 categories that can be expanded ("+") or contracted ("-") to reveal/hide details: - Composition - General Responsibilities - Oversight of Risk Management and Financial Reporting - Oversight of Independent Auditors - Oversight of Internal Auditors - Oversight of Compliance, Ethics, and Controls |

|||||||||||||||||||||

| Rules & Regulations Tab provides a summary by category of the rules, regulations and releases governing specific AC duties, responsibilities and disclosures. Practice Aid Tab aligns the specific AC duties, responsibilities and disclosures with suggested timing and status of completion and as such may be used as a guide in conducting periodic AC meetings, communicating with the various stakeholders in the financial reporting and audit cycles throughout the year, and in preparing documentation that supports the activities of the AC. - Status may be tracked in Col. E by selecting from the drop down in each cell: "Not Started"; "In Process"; "Completed"; or "Not Applicable" - Completion Dates may be inserted in Col. F and used as a guide in conducting and documenting AC meetings and communicating with the various stakeholders throughout the year. - Customization: Columns/rows may be added to document additional activities that may be germane to your industry or for which your organization finds benefit. NOTE: For best results, we recommend expanding the sections you wish to view prior to printing individual Tabs. Practice Aid Expanded Tab can be used instead of the Practice Aid Tab. Col G-Q show requirements contained on the Rules & Regulations Tab aligned with related AC activities. NOTE: When printing this Tab, 8X14 paper should be used. Additional Resources Tab includes related BDO or external resources for your reference within each category. |

|||||||||||||||||||||

| KEY: Rules/Regulations/Releases | |||||||||||||||||||||

| 304 | SEC Regulation S-K Non Financial Statement Requirements - Item 304 Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | ||||||||||||||||||||

| 407 | SEC Regulation S-K Non Financial Statement Requirements - Item 407 Corporate Governance | ||||||||||||||||||||

| Rule 2-07 | SEC Regulation S-X Financial Statements Article 2 Qualification and Report of Accountants Rule 2-07 Communication with Audit Committees | ||||||||||||||||||||

| 10A | SEC Section 10A - Audit Requirements (Rule 10A-2 Audit Independence and Rule 10A-3 Listing- Standards Relating to Audit Committees | ||||||||||||||||||||

| 33-8124 | SEC Release No. 33-8124: Certification of Disclosure in Companies' Quarterly and Annual Reports | ||||||||||||||||||||

| 33-8177A | SEC Release No. 33-8177A: Disclosure Required by Sections 406 and 407 of the Sarbanes Oxley Act of 2002 | ||||||||||||||||||||

| 14A | SEC Regulation 14A - Solicitation of Proxies | ||||||||||||||||||||

| SAB 74 | SEC Staff Accounting Bulletin Topic 11.M, Disclosure of the Impact That Recently Issued Accounting Standards Will Have on the Financial Statements of the Registrant When Adopted in a Future Period | ||||||||||||||||||||

| SAB 118 | SEC Staff Accounting Bulletin Topic 5 Section EE. Income Tax Accounting Implications of the Tax Cuts and Jobs Act | ||||||||||||||||||||

| 5605( c ) | NASDAQ Listing Standards 5605(c) Audit Committee Requirements | ||||||||||||||||||||

| 5610 | NASDAQ Listing Standards 5610 Code of Conduct | ||||||||||||||||||||

| 303A.06/ 303A.07 | NYSE Listing Standards Section 303A.06 Audit Committees and 303A.07 Audit Committees Additional Requirements | ||||||||||||||||||||

| 303A.10 | NYSE Listing Standards Section 303A.10 Code of Business Conduct and Ethics | ||||||||||||||||||||

| 314 | NYSE Listing Standards Section 314 Related Party Transactions | ||||||||||||||||||||

| AS 1305 | PCAOB Auditing Standard (AS 5/AS 1305): Communications About Control Deficiencies in an Audit of Financial Statements | ||||||||||||||||||||

| AS 1301 | PCAOB Auditing Standard (AS 16/AS 1301): Communications with Audit Committees | ||||||||||||||||||||

| AS 2410 | PCAOB Auditing Standard (AS 18/2410): Related Parties | ||||||||||||||||||||

| Rule 3101 | PCAOB Rule 3101, The Auditor's Report on an Audit of Financial Statements when the Auditor Expresses an Unqualified Opinion | ||||||||||||||||||||

| Rule 3524 | PCAOB Rule 3524, Audit Committee Pre-Approval of Certain Tax Services | ||||||||||||||||||||

| Rule 3525 | PCAOB Rule 3525, Audit Committee Pre-Approval of Non-audit Services Related to ICFR | ||||||||||||||||||||

| Rule 3526 | PCAOB Rule 3526, Communication with Audit Committees Concerning Independence | ||||||||||||||||||||

| Audit Committee Duties, Responsibilities, and Disclosures: Rules & Regulations | ||||||||||

| Rules & Regulations | Disclosure(1) | |||||||||

| Duties, Responsibilities and Disclosures | NYSE | NASDAQ | SEC | PCAOB | Best Practice | NYSE | NASDAQ | SEC | PCAOB | Best Practice |

| Composition | ||||||||||

| Consist of at least three members | 303A.07 | 5605(c) -(2)(A) | ||||||||

| Each member of the AC shall be a member of the BOD and shall otherwise be independent in accordance with applicable standards/exceptions | 303A.02 | 5605(c) -(2)(A) | 10A-3(b)(i) | |||||||

| Members must be financially literate | 303A.07 | 5605(c) -(2)(A) | ||||||||

| One member must be a financial expert | 303A.07 | 5605(c) -(2)(A) | ||||||||

| Disclose the name of each member of the AC (or in absence of an AC, the board committee performing equivalent function or the entire board) | 407(D)(3) | |||||||||

| If AC members serve on multiple ACs, disclose determination that such simultaneous service would not impair the ability of such member to serve on the listing company's AC | 303A.07 | |||||||||

| Disclose circumstances of an appointment of an AC member who is not independent | 407(D)(2) | |||||||||

| Disclose annually whether or not the AC contains at least one financial expert and if not, why not. If yes, then disclose name and whether he/she is independent | 5605(c) -(2)(A) | 407(D)(5) | ||||||||

| Consider providing, on a voluntary basis, disclosure about the AC's basis for determining composition and qualifications of AC members | X | |||||||||

| General Responsibilities | ||||||||||

| Report regularly to the board of directors regarding execution of duties and responsibilities | 303A.07 | |||||||||

| Have authority to investigate any matter including authority to engage outside advisors, including providing funding for those advisors | By reference to 10A - 303A.06 | By reference to 10A - 5605(c)(3) | 10A(m) | |||||||

| Review/approve all related party transactions | 314 | 5601 | ||||||||

| Confirm with the full board as to what specific risks and responsibilities the AC shall assume compared to those to be assumed by the full board or other committees of the board | X | |||||||||

| Adopt a written AC Charter | 303A.07 | 5605(c)1) | ||||||||

| Perform annual review of AC Charter; or more frequently as circumstances warrant | 5605 (c)(1) | |||||||||

| Disclose annually whether or not the AC has a charter and, if so, provide a copy of the charter in the proxy, unless posted within the company’s website | 303A.07 | 5605 (c)(1) | 407(D)(1) | |||||||

| Perform an AC performance evaluation | 303A.07 | |||||||||

| Disclose (i) annual performance evaluation of the AC; and (ii) the duties and responsibilities of the AC | 303A.07 | |||||||||

| Disclose any exemptions, as applicable from the SEC minimum listing standards (e.g., independence) | By reference to 10A; 303A.07 | By reference to 10A; 5605 (c)(5) | 407(D) | |||||||

| Oversight of Risk Management and Financial Reporting | ||||||||||

| Meet separately, periodically, with management | 303A.07 | |||||||||

| Review and discuss with management polices related to risk assessment and risk management including fraud risk, and the company's controls related to identified risk | 303A.07 | |||||||||

| If cyber risk is deemed a responsibility of the audit committee, review and discuss with management and the auditor, management's cybersecurity risk management reporting framework | X | X | ||||||||

| Review management Certification of Disclosure including any report to the AC of all significant deficiencies in the design or operation of internal controls, any material weaknesses in internal controls identified, and any fraud involving management or other employees who have a significant role in internal controls, if applicable | 33-8124 | |||||||||

| Review with management the following: | 303A.07 | |||||||||

| Major issues regarding accounting principles and financial statement presentations including significant changes in the company's selection or application of accounting principles | 303A.07 | |||||||||

| Major issues as to the adequacy of the listed company's internal controls and any special audit steps adopted in light of material control deficiencies | 303A.07 | |||||||||

| Analyses prepared by management and/or the independent auditor setting forth significant financial reporting issues and judgments made in connection with the preparation of the financial statements, including analyses of the effects of alternative GAAP methods on the financial statements | 303A.07 | |||||||||

| The effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the financial statements of the listed company | 303A.07 | |||||||||

| The type and presentation of information to be included in earnings press releases (paying particular attention to any use of "pro forma," or "adjusted" non-GAAP information), as well as review any financial information and earnings guidance provided to analysts and rating agencies | 303A.07 | X | ||||||||

| Review and discuss annual and quarterly financial statements including MD&A, and associated filings/proxies with management and independent auditors | 303A.07 | 407 (D)(3)(i) | ||||||||

| Review and discuss earnings releases and financial information and earnings guidance provided to analysts and rating agencies. | 303A.07 | |||||||||

| If applicable, review and discuss with management and legal counsel the company’s selection, calculation, presentation and disclosure of non-GAAP measures and key performance indicators (KPIs) with regard to transparency, consistency, and comparability of such measures. | X | X | ||||||||

| Prepare annual AC Report and include the report in each proxy statement. Required disclosures include: | 303A.07 | 407(D) | ||||||||

| The AC has reviewed and discussed the audited financial statements with management | 303A.07 | 407(D) | ||||||||

| The AC has discussed with the independent auditors the matters required to be discussed by applicable regulations (and any subsequent revisions) | 303A.07 | 407(D) | ||||||||

| The AC has received the written disclosures and the letter from the independent accountant regarding independence which is required by the PCAOB | 303A.07 | 407(D) | ||||||||

| Whether the AC recommended to the board of directors that the audited financial statements be included in the company's Annual Report on Form 10-K | 303A.07 | 407(D) | ||||||||

| The name of each member of the AC; number of meetings attended, and functions performed | 303A.07 | 407(D) | ||||||||

| Oversight of Independent Auditors | ||||||||||

| Appoint and determine compensation of the independent auditor | By reference to 10A - 303A.06 | By reference to 10A - 5605(c)(3) | 10A(m) | X | ||||||

| Set clear hiring policies for employees or former employees of the independent auditors | 303A.07 | |||||||||

| Executive Sessions: Meet separately, periodically, with independent auditors | 303A.07 | |||||||||

| Oversee the performance and qualifications of the independent auditors | 303A.07 | 10A-3 | X | |||||||

| Receive required written communications from the independent auditor concerning independence, and understand process used to arrive at conclusions regarding independence | 303A.07 | By reference to 10A - 5605(c)(3) | 10A-3 | Rule 3526 | ||||||

| Ensure audit partner rotation, as applicable, including all partners assigned to the engagement together with a discussion regarding succession planning | By reference to 10A - 303A.06 | By reference to 10A - 5605(c)(3) | 10A(j) | |||||||

| Perform an independent auditor evaluation and disclose results | 303A.07 | |||||||||

| Review reports submitted by the independent auditor, including, but not limited to: | By reference to 10A - 5605(c)(3) | By reference to 10A - 5605(c)(3) | 10A; 2-07(a)(3) | |||||||

| Auditor's report and critical audit matters (CAMs) 3 | AS 3101 | |||||||||

| Critical accounting policies and practices to be used | By reference to 10A - 5605(c)(3) | By reference to 10A - 5605(c)(3) | 10A; 2-07(a)(3) | |||||||

| All alternative treatments of financial information within GAAP discussed with management and their ramifications, and the auditor’s preferred treatment | By reference to 10A - 5605(c)(3) | By reference to 10A - 5605(c)(3) | 10A; 2-07(a)(3) | |||||||

| The auditor's other material written communications to management, such as management letters or schedules of unadjusted differences | By reference to 10A - 5605(c)(3) | By reference to 10A - 5605(c)(3) | 10A; 2-07(a)(3) | |||||||

| The auditor’s internal control procedures | 303A.07(b)(iii)(A) | |||||||||

| Any material issues raised by the most recent internal quality-control review, peer review or any inquiry or investigation by governmental or professional authorities within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with such issues | 303A.07 | |||||||||

| All relationships between the independent auditor and the company | 303A.07 | 5603-3 | ||||||||

| Pre-approve audit and non-audit services provided by the independent auditor, including certain tax services, non-audit services related to ICFR | By reference to 10A - 303A.06 | By reference to 10A | 10A(I); | Rules 3524, 3525 | By reference to 10A - 303A.06 | By reference to 10A | 10A(i) | |||

| Discuss relevant Audit Quality Indicators (AQIs) with the independent auditor | X | X | ||||||||

| Review required disclosure within annual proxy statement related to independent public accountants including: | 14A | |||||||||

| Name of principal accountant being selected or recommended for ratification | By reference to 10A - 303A.05 | By reference to 10A | 14A Item 9 |

|||||||

| Name of principal accountant for the fiscal year most recently completed if different from the current year | By reference to 10A - 303A.05 | By reference to 10A | 14A Item 9 |

|||||||

| Changes in and disagreements with principal accountant during the two most recent fiscal years or any subsequent interim period | 14A; 304 | |||||||||

| Whether principal accountant will be present an annual shareholders' meeting, whether they will make a statement, and whether they will be available to respond to questions | By reference to 10A - 303A.05 | By reference to 10A | 14A Item 9 |

|||||||

| Fees paid to the independent auditor for each of the two most recent fiscal years is made by management broken out by audit, audit-related, tax, and all other fees | By reference to 10A - 303A.05 | By reference to 10A | 14A Item 9 |

|||||||

| AC preapproval policies and procedures related to audit and non-audit services | By reference to 10A - 303A.05 | By reference to 10A | 14A Item 9 |

|||||||

| Review any audit problems or difficulties and management's response | 303A.07 | |||||||||

| Oversee resolution of disagreements between management and the independent auditor | By reference to 10A | By reference to 10A | 10A-3 | |||||||

| Communication requirements to be made by the independent auditor to the AC with respect to ICFR: | ||||||||||

| All significant deficiencies and material weaknesses identified during the audit. The communication should be written to management and the AC and should be made prior to the issuance of the auditor's report on ICFR | AS 1305 | |||||||||

| If the auditor concludes that the oversight of the company's external financial reporting and ICFR by the company's AC is ineffective, the auditor must communicate that conclusion in writing to the board of directors | AS 1305 | |||||||||

| If the auditor identifies other control deficiencies in ICFR (i.e., those deficiencies in ICFR that are of a lesser magnitude than material weaknesses), the auditor should communicate such matters to management in writing and inform the AC in a timely manner, prior to the issuance of the auditor's report on ICFR. | AS 1305 | |||||||||

| Discuss with the independent auditor PCAOB inspection findings and quality control measures | X | |||||||||

| Communication requirements to be made by the independent auditor to the AC with respect to general oversight of the audit: | AS 1301 | |||||||||

| Establish an understanding of the terms of the audit engagement | AS 1301 | |||||||||

| Significant issues discussed with management in connection with appointment or retention | AS 1301 | |||||||||

| Obtain information from the AC relevant to the audit | AS 1301 | |||||||||

| Overall audit strategy, timing of the audit, and significant risks identified | AS 1301 | |||||||||

| If applicable, nature and extent of specialized skills or knowledge needed related to significant risks | AS 1301 | |||||||||

| If applicable, extent to which the auditor plans to use the work of others and the basis for the auditor’s determination that he/she can serve as the principal auditor | AS 1301 | |||||||||

| Significant changes to planned audit strategy or significant risks initially identified | AS 1301 | |||||||||

| Significant accounting policies and practices | AS 1301 | |||||||||

| Critical accounting policies and practices | AS 1301 | |||||||||

| Adoption of new accounting standards and implementation status of such4 | AS 1301 | SAB 74, SAB 118 | ||||||||

| Critical accounting estimates | AS 1301 | |||||||||

| Significant unusual transactions | AS 1301 | |||||||||

| Auditor’s evaluation of the quality of the company’s financial reporting | AS 1301 | |||||||||

| Difficult or contentious matters for which the auditor consulted outside the engagement team and that the auditor reasonably determined are relevant to the AC’s oversight of the financial reporting process | AS 1301 | |||||||||

| Management consultations with other accountants | AS 1301 | |||||||||

| Corrected misstatements related to accounts and disclosures, other than those that are clearly trivial, brought to the attention of management by the auditor | AS 1301 | |||||||||

| Uncorrected misstatements related to accounts and disclosures, other than those the auditor believes to be trivial | AS 1301 | |||||||||

| Other information in documents containing the company’s audited financial statements | AS 1301 | |||||||||

| Disagreements with management | AS 1301 | |||||||||

| Significant difficulties encountered during the audit | AS 1301 | |||||||||

| If applicable, auditor’s evaluation of the company’s ability to continue as a going concern |

AS 1301 | |||||||||

| Fraud and potential illegal acts involving senior management and those that cause a material misstatement of the financial statements | AS 1301 | |||||||||

| Other material written communications with management | AS 1301 | |||||||||

| If applicable, departure from auditor’s standard report | AS 1301 | |||||||||

| Other matters significant to the oversight of the company’s financial reporting process |

AS 1301 | |||||||||

| Review and discuss the effect of significant events, transactions, and changes in accounting estimates or changes to policies and practices related to such significant matters occurring during the interim period. | AS 1301 | |||||||||

| The auditor has the following communication requirements to be made to the AC with respect to related parties and related party transactions: | AS 2410 | |||||||||

| Evaluation of the company's identification of, accounting for, and disclosure of its relationships and transactions with related parties | AS 2410 | |||||||||

| The identification of related parties or relationships or transactions with related parties that were previously undisclosed to the auditor | AS 2410 | |||||||||

| The identification of significant related party transactions that have not been authorized or approved in accordance with the company's established policies and procedures | AS 2410 | |||||||||

| The identification of significant related party transactions for which exceptions to the company's established policies or procedures were granted | AS 2410 | |||||||||

| The inclusion of a statement in the financial statements that a transaction with a related party was conducted in an arm's length transaction and the evidence obtained by the auditor to support or contradict such as assertion | AS 2410 | |||||||||

| The identification of significant related party transactions that appear to the auditor to lack business purpose | AS 2410 | |||||||||

| If applicable, review and discuss audit procedures performed and the auditor’s perspectives on management’s use and presentation of non-GAAP measures in compliance with SEC requirements. | X | X | ||||||||

| Respond to auditor inquiries regarding the AC's understanding of the entity's relationships and transactions with related parties that are significant to the entity and concerns the AC may have regarding related parties and, if so, the substance of those concerns | AS 2410 | |||||||||

| Consider providing, on a voluntary basis, relevant information about factors considered in the selection/reappointment of independent auditors and lead audit engagement partner; and compensation and evaluation of the independent auditor | X | |||||||||

| Consider providing, on a voluntary basis, relevant information about the processes and/or specific activities employed by the AC in oversight of the independent auditor | X | |||||||||

| Oversight of Internal Auditors | ||||||||||

| Oversee the internal audit function 2 | 303A.07 | |||||||||

| Review and approve the internal audit charter | X | |||||||||

| Approve hiring and retention decisions of the chief audit executive (CAE) | X | |||||||||

| Approve internal audit (IA) annual audit plan and any significant changes to the plan | X | |||||||||

| Executive Sessions: Meet separately, periodically, with IA to discuss an audit plan and review action plans, and findings | 303A.07 | |||||||||

| Discuss IA function responsibilities, budget and staffing with independent auditors | 303A.07 | |||||||||

| Review with IA the effectiveness of the organization's Enterprise Risk Management (ERM) and management's responsibilities for identifying, prioritizing, and managing risk | X | |||||||||

| Review performance of the CAE and approve annual compensation | X | |||||||||

| Oversight of Compliance, Ethics, and Controls | ||||||||||

| Meet periodically with the organization's compliance officers and general counsel | X | |||||||||

| Provide procedures to receive, retain, and treat complaints, as well as procedures to confidentially handle employee complaints (whistle-blower protection) | By reference to 10A - 303A.06 | By reference to 10A | 10A(m) | |||||||

| Adopt and disclose a code of business conduct and ethics and disclose | 303A.10 | 5610 | 33-8177 | 303A.10 | 5610 | 33-8177 | ||||

| Monitor system of compliance with legal and regulatory requirements. Oversee system for compliance with ethical codes | 303A.07 | |||||||||

| Review and discuss codes of conduct applicable to directors, officers and employees and disclosure any waivers of the code for executive offers and directors | 303A.10 | 303A.10 | ||||||||

| Understand the company's risk tolerance and risk appetite and fraud risk factors along with reviewing management's fraud risk assessment process and anti-fraud program, including controls designed to prevent, detect or mitigate fraud | X | |||||||||

| 1 Required disclosures by the audit committee required by Item 407 of Regulation S-K are only required in the proxy or information statement | ||||||||||

| 2 Each listed company must have an internal audit function, which may be outsourced. Section 303A.00 permits certain categories of newly -listed companies to avail themselves of a transition period to comply with the internal audit function requirement. | ||||||||||

| 3 Required changes to auditor reporting per PCAOB AS 1301 will be phased in as follows for fiscal years ending on or after: (1) 12/15/2017 - Changes to report format, disclosure of tenure and certain other information; (2) 6/30/2019 - Communication of Critical Audit Matters (CAMs) for audits of large accelerated filers; (3) 12/15/2020 - Communication of CAMs for audits of all other filers. | ||||||||||

| 4 Audit Committees are reminded of the requirements to disclose the potential effects of the future adoption of recently released accounting standards in interim and annual SEC filings. Consideration given to both qualitative and quantitative disclosure. | ||||||||||

| Audit Committee Duties, Responsibilities, and Disclosures Practice Aid | |||||

| Duties, Responsibilities and Disclosures | Responsibility / Action | Disclosure | Timing | Status | Completion Date |

| Composition | |||||

| Consist of at least three members | X | Continual | |||

| Each member of the AC shall be a member of the BOD and shall otherwise be independent in accordance with applicable standards/exceptions | X | Continual | |||

| Members must be financially literate | X | Continual | |||

| One member must be a financial expert | X | Continual | |||

| Disclose the name of each member of the AC (or in absence of an AC, the board committee performing equivalent function or the entire board) | X | Annual | |||

| If AC members serve on multiple ACs, disclose determination that such simultaneous service would not impair the ability of such member to serve on the listing company's AC | X | Annual | |||

| Disclose circumstances of an appointment of an AC member who is not independent | X | Annual | |||

| Disclose annually whether or not the AC contains at least one financial expert and if not, why not. If yes, then disclose name and whether he/she is independent | X | Annual | |||

| Consider providing, on a voluntary basis, disclosure about the AC's basis for determining composition and qualifications of AC members | X | Annual | |||

| General Responsibilities | |||||

| Report regularly to the board of directors regarding execution of duties and responsibilities | X | Continual | |||

| Have authority to investigate any matter including authority to engage outside advisors, including providing funding for those advisors | X | Continual | |||

| Review/approve all related party transactions | X | Continual | |||

| Confirm with the full board as to what specific risks and responsibilities the AC shall assume compared to those to be assumed by the full board or other committees of the board | X | Annual | |||

| Adopt a written AC Charter | X | Annual | |||

| Perform annual review of AC Charter; or more frequently as circumstances warrant | X | Annual | |||

| Disclose annually whether or not the AC has a charter and, if so, provide a copy of the charter in the proxy, unless posted within the company’s website | X | Annual | |||

| Perform an AC performance evaluation | X | Annual | |||

| Disclose (i) annual performance evaluation of the AC; and (ii) the duties and responsibilities of the AC | X | Annual | |||

| Disclose any exemptions, as applicable from the SEC minimum listing standards (e.g., independence) | X | As Needed | |||

| Oversight of Risk Management and Financial Reporting | |||||

| Meet separately, periodically, with management | X | Continual | |||

| Review and discuss with management polices related to risk assessment and risk management including fraud risk, and the company's controls related to identified risk | X | Annual | |||

| If cyber risk is deemed a responsibility of the audit committee, review and discuss with management and the auditor, management's cybersecurity risk management reporting framework | X | X | Continual | ||

| Review management Certification of Disclosure including any report to the AC of all significant deficiencies in the design or operation of internal controls, any material weaknesses in internal controls identified, and any fraud involving management or other employees who have a significant role in internal controls, if applicable | X | Quarterly | |||

| Review with management the following: | X | As Needed | |||

| Major issues regarding accounting principles and financial statement presentations including significant changes in the company's selection or application of accounting principles | X | As Needed | |||

| Major issues as to the adequacy of the listed company's internal controls and any special audit steps adopted in light of material control deficiencies | X | As Needed | |||

| Analyses prepared by management and/or the independent auditor setting forth significant financial reporting issues and judgments made in connection with the preparation of the financial statements, including analyses of the effects of alternative GAAP methods on the financial statements | X | As Needed | |||

| The effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the financial statements of the listed company | X | As Needed | |||

| The type and presentation of information to be included in earnings press releases (paying particular attention to any use of "pro forma," or "adjusted" non-GAAP information), as well as review any financial information and earnings guidance provided to analysts and rating agencies | X | X | As Needed | ||

| Review and discuss annual and quarterly financial statements including MD&A, and associated filings/proxies with management and independent auditors | X | Quarterly | |||

| Review and discuss earnings releases and financial information and earnings guidance provided to analysts and rating agencies. | X | Quarterly | |||

| If applicable, review and discuss with management and legal counsel the company’s selection, calculation, presentation and disclosure of non-GAAP measures and key performance indicators (KPIs) with regard to transparency, consistency, and comparability of such measures. | X | Continual | |||

| Prepare annual AC Report and include the report in each proxy statement. Required disclosures include: | X | Annual | |||

| The AC has reviewed and discussed the audited financial statements with management | X | Annual | |||

| The AC has discussed with the independent auditors the matters required to be discussed by applicable regulations (and any subsequent revisions) | X | Annual | |||

| The AC has received the written disclosures and the letter from the independent accountant regarding independence which is required by the PCAOB | X | Annual | |||

| Whether the AC recommended to the board of directors that the audited financial statements be included in the company's Annual Report on Form 10-K | X | Annual | |||

| The name of each member of the AC; number of meetings attended, and functions performed | X | Annual | |||

| Oversight of Independent Auditors | |||||

| Appoint and determine compensation of the independent auditor | X | X | Annual | ||

| Set clear hiring policies for employees or former employees of the independent auditors | X | Continual | |||

| Executive Sessions: Meet separately, periodically, with independent auditors | X | Continual | |||

| Oversee the performance and qualifications of the independent auditors | X | X | Continual | ||

| Receive required written communications from the independent auditor concerning independence, and understand process used to arrive at conclusions regarding independence | X | Annual | |||

| Ensure audit partner rotation, as applicable, including all partners assigned to the engagement together with a discussion regarding succession planning | X | Annual | |||

| Perform an independent auditor evaluation and disclose results | X | X | Annual | ||

| Review reports submitted by the independent auditor, including, but not limited to: A4 | X | ||||

| Auditor's report and critical audit matters (CAMs) 3 | X | Annual | |||

| Critical accounting policies and practices to be used | X | Annual | |||

| All alternative treatments of financial information within GAAP discussed with management and their ramifications, and the auditor’s preferred treatment | X | Annual | |||

| The auditor's other material written communications to management, such as management letters or schedules of unadjusted differences | X | Annual | |||

| The auditor’s internal control procedures | X | Annual | |||

| Any material issues raised by the most recent internal quality-control review, peer review or any inquiry or investigation by governmental or professional authorities within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with such issues | X | Annual | |||

| All relationships between the independent auditor and the company | X | Annual | |||

| Pre-approve audit and non-audit services provided by the independent auditor, including certain tax services, non-audit services related to ICFR | X | X | Annual | ||

| Discuss relevant Audit Quality Indicators (AQIs) with the independent auditor | X | Annual | |||

| Review required disclosure within annual proxy statement related to independent public accountants including: | X | Annual | |||

| Name of principal accountant being selected or recommended for ratification | X | Annual | |||

| Name of principal accountant for the fiscal year most recently completed if different from the current year | X | Annual | |||

| Changes in and disagreements with principal accountant during the two most recent fiscal years or any subsequent interim period | X | As Needed | |||

| Whether principal accountant will be present an annual shareholders' meeting, whether they will make a statement, and whether they will be available to respond to questions | X | Annual | |||

| Fees paid to the independent auditor for each of the two most recent fiscal years is made by management broken out by audit, audit-related, tax, and all other fees | X | Annual | |||

| AC preapproval policies and procedures related to audit and non-audit services | X | Annual | |||

| Review any audit problems or difficulties and management's response | X | Continual | |||

| Oversee resolution of disagreements between management and the independent auditor | X | Continual | |||

| Communication requirements to be made by the independent auditor to the AC with respect to ICFR: | X | ||||

| All significant deficiencies and material weaknesses identified during the audit. The communication should be written to management and the AC and should be made prior to the issuance of the auditor's report on ICFR | X | Annual | |||

| If the auditor concludes that the oversight of the company's external financial reporting and ICFR by the company's AC is ineffective, the auditor must communicate that conclusion in writing to the board of directors | X | Annual | |||

| If the auditor identifies other control deficiencies in ICFR (i.e., those deficiencies in ICFR that are of a lesser magnitude than material weaknesses), the auditor should communicate such matters to management in writing and inform the AC in a timely manner, prior to the issuance of the auditor's report on ICFR. | X | Annual | |||

| Discuss with the independent auditor PCAOB inspection findings and quality control measures | Annual | ||||

| Communication requirements to be made by the independent auditor to the AC with respect to general oversight of the audit: | X | Annual | |||

| Establish an understanding of the terms of the audit engagement | X | Annual | |||

| Significant issues discussed with management in connection with appointment or retention | X | Annual | |||

| Obtain information from the AC relevant to the audit | X | Continual | |||

| Overall audit strategy, timing of the audit, and significant risks identified | X | Annual | |||

| If applicable, nature and extent of specialized skills or knowledge needed related to significant risks | X | Annual | |||

| If applicable, extent to which the auditor plans to use the work of others and the basis for the auditor’s determination that he/she can serve as the principal auditor | X | Annual | |||

| Significant changes to planned audit strategy or significant risks initially identified | X | Quarterly | |||

| Significant accounting policies and practices | X | Annual | |||

| Critical accounting policies and practices | X | Annual | |||

| Adoption of new accounting standards | X | X | As needed | ||

| Critical accounting estimates | X | Annual | |||

| Significant unusual transactions | X | Annual | |||

| Auditor’s evaluation of the quality of the company’s financial reporting | X | Annual | |||

| Difficult or contentious matters for which the auditor consulted outside the engagement team and that the auditor reasonably determined are relevant to the AC’s oversight of the financial reporting process | X | Annual | |||

| Management consultations with other accountants | X | Annual | |||

| Corrected misstatements related to accounts and disclosures, other than those that are clearly trivial, brought to the attention of management by the auditor | X | Annual | |||

| Uncorrected misstatements related to accounts and disclosures, other than those the auditor believes to be trivial | X | Annual | |||

| Other information in documents containing the company’s audited financial statements | X | Annual | |||

| Disagreements with management | X | Annual | |||

| Significant difficulties encountered during the audit | X | Annual | |||

| If applicable, auditor’s evaluation of the company’s ability to continue as a going concern |

X | Annual | |||

| Fraud and potential illegal acts involving senior management and those that cause a material misstatement of the financial statements | X | Annual | |||

| Other material written communications with management | X | Annual | |||

| If applicable, departure from auditor’s standard report | X | Annual | |||

| Other matters significant to the oversight of the company’s financial reporting process |

X | Annual | |||

| Review and discuss the effect of significant events, transactions, and changes in accounting estimates or changes to policies and practices related to such significant matters occurring during the interim period. | X | Quarterly | |||

| The auditor has the following communication requirements to be made to the AC with respect to related parties and related party transactions: | |||||

| Evaluation of the company's identification of, accounting for, and disclosure of its relationships and transactions with related parties | X | Annual | |||

| The identification of related parties or relationships or transactions with related parties that were previously undisclosed to the auditor | X | Annual | |||

| The identification of significant related party transactions that have not been authorized or approved in accordance with the company's established policies and procedures | X | Annual | |||

| The identification of significant related party transactions for which exceptions to the company's established policies or procedures were granted | X | Annual | |||

| The inclusion of a statement in the financial statements that a transaction with a related party was conducted in an arm's length transaction and the evidence obtained by the auditor to support or contradict such as assertion | X | Annual | |||

| The identification of significant related party transactions that appear to the auditor to lack business purpose | X | Annual | |||

| If applicable, review and discuss audit procedures performed and the auditor’s perspectives on management’s use and presentation of non-GAAP measures in compliance with SEC requirements. | X | Continual | |||

| Respond to auditor inquiries regarding the AC's understanding of the entity's relationships and transactions with related parties that are significant to the entity and concerns the AC may have regarding related parties and, if so, the substance of those concerns | X | Annual | |||

| Consider providing, on a voluntary basis, relevant information about factors considered in the selection/reappointment of independent auditors and lead audit engagement partner; and compensation and evaluation of the independent auditor | X | Annual | |||

| Consider providing, on a voluntary basis, relevant information about the processes and/or specific activities employed by the AC in oversight of the independent auditor | X | Annual | |||

| Oversight of Internal Auditors | |||||

| Oversee the internal audit function* | X | Continual | |||

| Review and approve the internal audit charter | X | Annual | |||

| Approve hiring and retention decisions of the chief audit executive (CAE) | X | As Needed | |||

| Approve internal audit (IA) annual audit plan and any significant changes to the plan | X | Annual | |||

| Executive Sessions: Meet separately, periodically, with IA to discuss an audit plan and review action plans, and findings | X | Continual | |||

| Discuss IA function responsibilities, budget and staffing with independent auditors | X | Annual | |||

| Review with IA the effectiveness of the organization's Enterprise Risk Management (ERM) and management's responsibilities for identifying, prioritizing, and managing risk | X | Annual | |||

| Review performance of the CAE and approve annual compensation | X | Annual | |||

| Oversight of Compliance, Ethics, and Controls | |||||

| Meet periodically with the organization's compliance officers and general counsel | X | As Needed | |||

| Provide procedures to receive, retain, and treat complaints, as well as procedures to confidentially handle employee complaints (whistle-blower protection) | X | Continual | |||

| Adopt and disclose a code of business conduct and ethics and disclose | X | X | Annual | ||

| Monitor system of compliance with legal and regulatory requirements. Oversee system for compliance with ethical codes | X | Continual | |||

| Review and discuss codes of conduct applicable to directors, officers and employees and disclosure any waivers of the code for executive offers and directors | X | X | Annual | ||

| Understand the company's risk tolerance and risk appetite and fraud risk factors along with reviewing management's fraud risk assessment process and anti-fraud program, including controls designed to prevent, detect or mitigate fraud | Continual | ||||

| 1 Required disclosures by the audit committee required by Item 407 of Regulation S-K are only required in the proxy or information statement | |||||

| 2 Each listed company must have an internal audit function, which may be outsourced. Section 303A.00 permits certain categories of newly -listed companies to avail themselves of a transition period to comply with the internal audit function requirement. | |||||

| 3 Required changes to auditor reporting per PCAOB AS 1301 will be phased in as follows for fiscal years ending on or after: (1) 12/15/2017 - Changes to report format, disclosure of tenure and certain other information; (2) 6/30/2019 - Communication of Critical Audit Matters (CAMs) for audits of large accelerated filers; (3) 12/15/2020 - Communication of CAMs for audits of all other filers. | |||||

| 4 Audit Committees are reminded of the requirements to disclose the potential effects of the future adoption of recently released accounting standards in interim and annual SEC filings. Consideration given to both qualitative and quantitative disclosure. | |||||

no reviews yet

Please Login to review.