223x Filetype XLSX File size 0.03 MB Source: s3.eu-central-1.amazonaws.com

Sheet 1: Car calculator

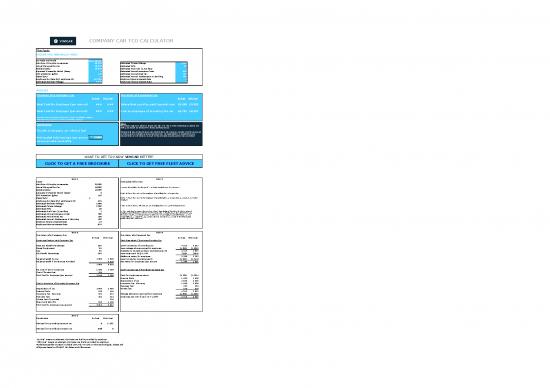

| COMPANY CAR TCO CALCULATOR | ||||||||

| The Facts | ||||||||

| INSERT THE VARIABLES HERE: | ||||||||

| Car Make and Model | Enter details | |||||||

| List Price of Car plus Accessories | 20,000 | Estimated Private Mileage | 7,000 | |||||

| Actual Price paid for Car | 18,000 | Estimated MPG | 60 | |||||

| Residual Value | 10,000 | Estimated Fuel Cost ( £ per litre) | 1 | |||||

| Expected Ownership Period (Years) | 3 | Estimated Annual Insurance Costs | 500 | |||||

| CO2 Emissions (g/km) | 110 | Estimated Annual Road Tax | 100 | |||||

| Diesel (y/n) | n | Estimated Annual Maintenance & Servicing | 400 | |||||

| Employee Tax Rate (incl. employee NI) | 42.00% | Employer Finance Interest Rate | 0 | |||||

| Estimated Business Mileage | 4,000 | Employee Finance Interest Rate | 0 | |||||

| RESULTS | ||||||||

| Provision of a company car | Provision of a personal car | |||||||

| No Fuel | With Fuel | No Fuel | With Fuel | |||||

| Total Cost for Employee (per annum) | £2,126.00 | £3,367.56 | Salary that could be paid (neutral cost to the employer) | £2,386 | £3,363 | |||

| Total Cost for Employer (per annum) | £4,515.33 | £5,627.33 | Cost to employee of providing the car | £2,715 | £2,097 | |||

| "No Fuel" means no element of private use fuel is provided by employer | ||||||||

| "With Fuel" means private use fuel is provided by employer | ||||||||

| Conclusion | Notes Worksheet applies to petrol or diesel cars only. For LPG or other technologies, please ask. All figures based on 2016/17 Tax Rates and Allowances. Professional advice should always be taken before any decision is made as to the provision or otherwise of an employer provided motor car. No responsibilty is accepted for any actions taken or not taken as a result of the information produced on this worksheet. |

|||||||

| Provide a company car without fuel | ||||||||

| Anticipated total savings (per annum) | £589 | |||||||

| versus private ownership | ||||||||

| WANT TO GET TO KNOW VIMCAR BETTER? | ||||||||

| CLICK TO GET A FREE BROCHURE | CLICK TO GET FREE FLEET ADVICE | |||||||

| BOX 1 | BOX 2 | |||||||

| Facts | Instructions for Use | |||||||

| List Price of Car plus Accessories | 20,000 | |||||||

| Actual Price paid for Car | 18,000 | 1. Insert all variables for the specific car in the shaded areas in "The Facts". | ||||||

| Residual Value | 10,000 | |||||||

| Expected Ownership Period (Years) | 3 | 2. Box 3 shows the costs to the employer of providing the car in question. | ||||||

| CO2 Emissions (g/km) | 110 | |||||||

| Diesel (y/n) | n | 3. Box 4 shows the costs to the employee of providing the car in question at a neutral cost to the employer. | ||||||

| Employee Tax Rate (incl. employee's NI) | 42% | |||||||

| Estimated Business Mileage | 4,000 | |||||||

| Estimated Private Mileage | 7,000 | 4. Box 5 shows the tax efficient answer including the taxes saved (in broad terms). | ||||||

| Estimated MPG | 60 | |||||||

| Estimated Fuel Cost ( £ per litre) | 1 | 5. This worksheet assumes the user has a basic knowledge of the rules for the taxation of employer provided motor vehicles. Professional advice should always be taken before any decision is made as to the provision or otherwise of an employer provided motor car. No responsibilty is accepted for any actions taken or not taken as a result of the information produced on this worksheet. | ||||||

| Estimated Annual Insurance Costs | 500 | |||||||

| Estimated Annual Road Tax | 100 | |||||||

| Estimated Annual Maintenance & Servicing | 400 | |||||||

| Employer Finance Interest Rate | 1% | |||||||

| Employee Finance Interest Rate | 10% | |||||||

| BOX 3 | BOX 4 | |||||||

| Provision of a Company Car | Provision of a Personal Car | |||||||

| No Fuel | With Fuel | No Fuel | With Fuel | |||||

| Employee Position with Company Car | Cash Equivalent if Employee Provides Car | |||||||

| Base Car Benefit Percentage | 19% | Cost to employer of providing car | 4,515 | 5,627 | ||||

| Diesel Supplement | 0% | Less mileage allowance paid to employee | (1,800) | (1,800) | ||||

| Cap | 0% | Available to be paid as salary and employers NI | 2,715 | 3,827 | ||||

| Car Benefit Percentage | 19% | Less employers' NI @ 13.8% | (329) | (464) | ||||

| Additional salary for employee | 2,386 | 3,363 | ||||||

| Taxable Benefit for Car | 3,800 | 3,800 | Less Income tax & employees NI | (1,002) | (1,412) | |||

| Taxable Benefit if Private Fuel Provided | 4,218 | Net Salary for Employee (per annum) | 1,384 | 1,951 | ||||

| 3,800 | 8,018 | |||||||

| Tax Cost of Car to Employee | 1,596 | 3,368 | Cost to Employee of Providing the Same Car | |||||

| Cost of Private Fuel | 530 | |||||||

| Total Cost for Employee (per annum) | 2,126 | 3,368 | Cash for Employee as above | (1,384) | (1,951) | |||

| Finance Costs | 1,400 | 1,400 | ||||||

| Depreciation of car | 2,666 | 2,666 | ||||||

| Cost to Employer of Providing Company Car | Insurance, Tax, Servicing | 1,000 | 1,000 | |||||

| Business fuel | 303 | 252 | ||||||

| Depreciation of car | 2,666 | 2,666 | Private fuel | 530 | 530 | |||

| Finance Costs | 140 | 140 | 4,515 | 3,897 | ||||

| Insurance, Tax, Servicing | 933 | 933 | Mileage allowance received from employer | (1,800) | (1,800) | |||

| Business Fuel | 252 | 252 | Employee net cost of car (-ve = profit) | 2,715 | 2,097 | |||

| Private Fuel if provided | 530 | |||||||

| Class 1A NI @13.8% | 524 | 1,106 | ||||||

| Total Cost for Employer (per annum) | 4,515 | 5,627 | ||||||

| BOX 5 | ||||||||

| Conclusion | No Fuel | With Fuel | ||||||

| Savings from providing personal car | 0 | 1,271 | ||||||

| Savings from providing company car | 589 | 0 | ||||||

| "No Fuel" means no element of private use fuel is provided by employer | ||||||||

| "With Fuel" means an element of private use fuel is provided by employer | ||||||||

| Worksheet applies to petrol or diesel cars only. For LPG or other technologies, please ask | ||||||||

| All figures based on 2016/17 Tax Rates and Allowances | ||||||||

no reviews yet

Please Login to review.