232x Filetype XLSX File size 0.02 MB Source: kshousingcorp.org

Sheet 1: Monthly I&E

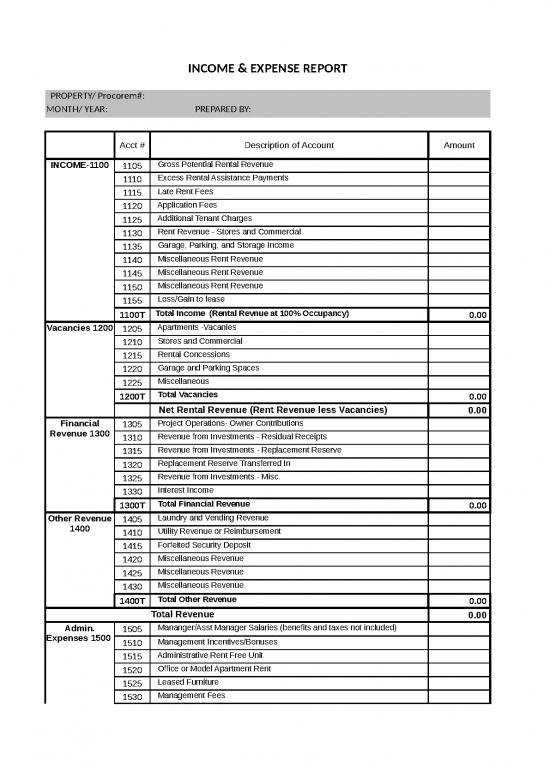

| INCOME & EXPENSE REPORT | |||||

| PROPERTY/ Procorem#: | |||||

| MONTH/ YEAR: | PREPARED BY: | ||||

| Acct # | Description of Account | Amount | |||

| INCOME-1100 | 1105 | Gross Potential Rental Revenue | |||

| 1110 | Excess Rental Assistance Payments | ||||

| 1115 | Late Rent Fees | ||||

| 1120 | Application Fees | ||||

| 1125 | Additional Tenant Charges | ||||

| 1130 | Rent Revenue - Stores and Commercial | ||||

| 1135 | Garage, Parking, and Storage Income | ||||

| 1140 | Miscellaneous Rent Revenue | ||||

| 1145 | Miscellaneous Rent Revenue | ||||

| 1150 | Miscellaneous Rent Revenue | ||||

| 1155 | Loss/Gain to lease | ||||

| 1100T | Total Income (Rental Revnue at 100% Occupancy) | 0.00 | |||

| Vacancies 1200 | 1205 | Apartments -Vacanies | |||

| 1210 | Stores and Commercial | ||||

| 1215 | Rental Concessions | ||||

| 1220 | Garage and Parking Spaces | ||||

| 1225 | Miscellaneous | ||||

| 1200T | Total Vacancies | 0.00 | |||

| Net Rental Revenue (Rent Revenue less Vacancies) | 0.00 | ||||

| Financial Revenue 1300 | 1305 | Project Operations- Owner Contributions | |||

| 1310 | Revenue from Investments - Residual Receipts | ||||

| 1315 | Revenue from Investments - Replacement Reserve | ||||

| 1320 | Replacement Reserve Transferred In | ||||

| 1325 | Revenue from Investments - Misc. | ||||

| 1330 | Interest Income | ||||

| 1300T | Total Financial Revenue | 0.00 | |||

| Other Revenue 1400 | 1405 | Laundry and Vending Revenue | |||

| 1410 | Utility Revenue or Reimbursement | ||||

| 1415 | Forfeited Security Deposit | ||||

| 1420 | Miscellaneous Revenue | ||||

| 1425 | Miscellaneous Revenue | ||||

| 1430 | Miscellaneous Revenue | ||||

| 1400T | Total Other Revenue | 0.00 | |||

| Total Revenue | 0.00 | ||||

| Admin. Expenses 1500 | 1505 | Mananger/Asst Manager Salaries (benefits and taxes not included) | |||

| 1510 | Management Incentives/Bonuses | ||||

| 1515 | Administrative Rent Free Unit | ||||

| 1520 | Office or Model Apartment Rent | ||||

| 1525 | Leased Furniture | ||||

| 1530 | Management Fees | ||||

| 1535 | Advertising and Marketing | ||||

| 1540 | Application Fees - Expense | ||||

| 1545 | Conventions, Meetings, Training, and Travel Expenses | ||||

| 1550 | Office Supplies/Expenses | ||||

| 1555 | Accounting/Bookkeeping Services | ||||

| 1560 | Legal Expenses/ Eviction Costs | ||||

| 1565 | Audit Expenses | ||||

| 1570 | Bad Debts | ||||

| 1575 | Petty Cash | ||||

| 1580 | Compliance Fees | ||||

| 1585 | Misc. Administrative Expenses | ||||

| 1590 | Misc. Administrative Expenses | ||||

| 1595 | Misc. Administrative Expenses | ||||

| 1500T | Total Administrative Expenses | 0.00 | |||

| Utilities 1600 | 1605 | Telephone/Fax - Office Lines | |||

| 1610 | Electricity | ||||

| 1615 | Water | ||||

| 1620 | Gas | ||||

| 1625 | Sewer | ||||

| 1630 | Cell Phones/ Pagers | ||||

| 1635 | Garbage and Trash Removal | ||||

| 1640 | Cable TV / Internet Access | ||||

| 1600T | Total Utilities Expense | 0.00 | |||

| Operating & Maintenance Expenses 1700-1800 | 1705 | Maintenance Salaries (benefits and taxes not included) | |||

| 1710 | Maintenance Rent Free Unit | ||||

| 1715 | Security Payroll / Contract | ||||

| 1720 | Security Rent Free Unit | ||||

| 1725 | Maintenance Supplies | ||||

| 1730 | Maintenance Tools and Equipment | ||||

| 1735 | Floor Replacements (Carpet, Tile, Etc.) | ||||

| 1740 | HVAC Equipment | ||||

| 1745 | Heating / Cooling Repairs and Maintenance | ||||

| 1750 | Plumbing | ||||

| 1755 | Appliance Replacement | ||||

| 1760 | Electrical | ||||

| 1765 | Painting Supplies | ||||

| 1770 | Cleaning Supplies | ||||

| 1775 | Carpet Cleaning | ||||

| 1780 | Janitor/Cleaning Contract | ||||

| 1785 | Extermination/Pest Control | ||||

| 1790 | Snow Removal | ||||

| 1795 | Landscaping | ||||

| 1800 | Pool Supplies and Pool Maintenance/Contracts | ||||

| 1805 | Elevator Maintenance/Contracts | ||||

| 1810 | Misc. Operating & Maintenance Exp. | ||||

| 1815 | Misc. Operating & Maintenance Exp. | ||||

| 1820 | Misc. Operating & Maintenance Exp. | ||||

| 1700T | Total Operating & Maintenance Expenses | 0.00 | |||

| Payroll Taxes, Insurance & Reserves 4100 | 4110 | Payroll Taxes | |||

| 4115 | Property and Liability Insurance (Hazard) | ||||

| 4120 | Fidelity Bond Insurance | ||||

| 4125 | Workmen's Compensation | ||||

| 4130 | Health Insurance & Other Employee Benefits | ||||

| 4135 | Reserve Replacement Deposits | ||||

| 4140 | Misc. Taxes, Licenses, Permits & Ins. | ||||

| 4100T | Total Taxes, Insurance, & Reserves | 0.00 | |||

| Mortgage & Property Tax Expenses 5100 | 5105 | Principal Payments Required | |||

| 5110 | Interest on Mortgage Payable | ||||

| 5120 | Real Estate Taxes | ||||

| 5125 | Interest on Notes Payable (Long-Term) * | ||||

| 5130 | Interest on Notes Payable (Short-Term) * | ||||

| 5135 | Mortgage Insurance Premium / Service Charge | ||||

| 5140 | Miscellaneous Financial Expenses | ||||

| 5100T | Total Financial Expenses | 0.00 | |||

| Total Cost of Operations | $0.00 | ||||

| Total Revenue | 0.00 | ||||

| Net Operating Income | 0.00 | ||||

| Debt Coverage Ratio | #DIV/0! | ||||

| Acct # | Description of Account | Account Detail/Description |

| 1105 | Gross Potential Rental Revenue | 100% Occuipied Rent |

| 1110 | Excess Rental Assistance Payments | Rental Assistance payment amounts over allowable gross rent. Ie. RD Utility Pmts, Section 8 voucher pmts. |

| 1205 | Apartments -Vacanies | Total Rental Incone loss due to vacany of units |

| 1210 | Stores and Commercial | Total Rental Incone loss due to vacany of commerical space |

| 1215 | Rental Concessions | 1 time or monthly Consessions |

| 1410 | Utility Revenue or Reimbursement | Ex. Cable is paid by the owner and the tenants pay the property cable fees with the rent |

| 1415 | Forfeited Security Deposit | Security/Pet Deposits Forfeited by resident upon move out. |

| 1505 | Mananger/Asst Manager Salaries (benefits and taxes not included) | Property Manager, Asst Manager and Leasing Staff Salaries- do not include benefits or payroll taxes in this acct. |

| 1540 | Application Fees - Expense | Property's cost for background and credit screening |

| 1560 | Legal Expenses/ Eviction Costs | Attorney's Fees, Court fees, etc. direct relation to the property operations |

| 1570 | Bad Debts | Income written off due to non-reciept |

| 1580 | Compliance Fees | State Monitoring Fees |

| 1705 | Maintenance Salaries (benefits and taxes not included) | Maintenance staff salaries- do not include benefits or payroll taxes in this acct. |

| 4135 | Reserve Replacement Deposits | Money Transferred to Reserve Replacement Acct |

| 5105 | Principal Payments Required | Debt Service/Mortgage Principal Payments |

| 5110 | Interest on Mortgage Payable | Debt Service/Mortgage Interest |

| 5120 | Real Estate Taxes | Property Taxes |

| 5125 | Interest on Notes Payable (Long-Term) * | Ex. General Partnership Loans to the property |

| 5130 | Interest on Notes Payable (Short-Term) * | Ex. General Partnership Loans to the property |

| Net Operating Income | Net operating income is the property's gross rental income plus any other income, such as late fees or parking income, less vacancies and rental expenses. Essentially, NOI is the net cash generated before mortgage payments and taxes. | |

| Debt Coverage Ratio | The Debt Coverage Ratio (DCR) is calculated by dividing the property's annual net operating income (NOI) by a property's annual debt service. Annual debt service is annual total of your mortgage payments (i.e. the principal and accrued interest, Property Taxes are not included). |

no reviews yet

Please Login to review.