141x Filetype XLSX File size 0.04 MB Source: fmx.cpa.texas.gov

Sheet 1: Table of Contents

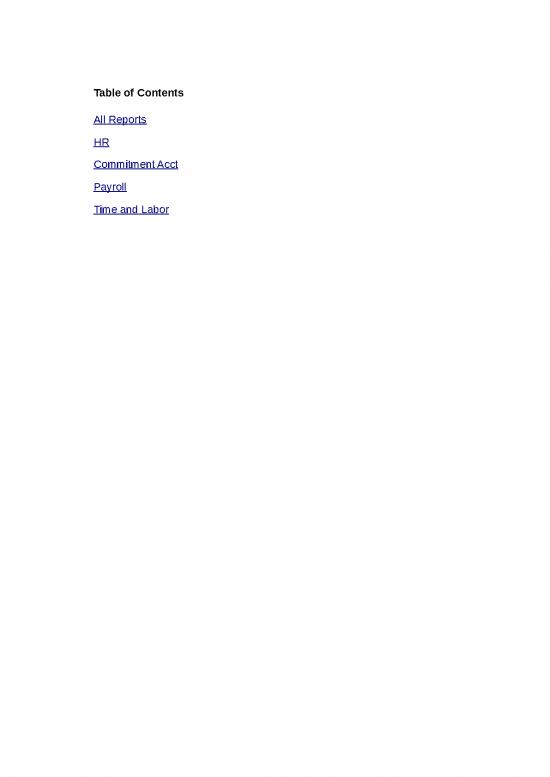

| Table of Contents |

| All Reports |

| HR |

| Commitment Acct |

| Payroll |

| Time and Labor |

| End of Worksheet |

| Name of Report | Module | Last Updated |

| TX Predistribution Audit Report | CA | 12/20/2016 |

| TX Pyrl Actuals by Project Id | CA | 12/20/2016 |

| TX Pyrl Actuals Class Summary | CA | 12/20/2016 |

| TX Pyrl Actuals Fund Summary | CA | 12/20/2016 |

| TX Pyrl by Approp/PCA | CA | 12/20/2016 |

| Active Employee Report | HR | 12/20/2016 |

| Active Position Report | HR | 12/20/2016 |

| Audit– Position Exceptions | HR | 12/20/2016 |

| Employees on LOA | HR | 12/20/2016 |

| ERS Inbound Report | HR | 12/20/2016 |

| ERS/CAPPS Insurance Reconciliation Report | HR | 12/20/2016 |

| FMLA/Parental Leave History Report | HR | 12/20/2016 |

| FTE Information Report | HR | 12/20/2016 |

| HIR/REH Report (Hire/Rehire) | HR | 12/20/2016 |

| List - Employee Comp Changes | HR | 12/20/2016 |

| Mgmt/Staff Ratio Report | HR | 12/20/2016 |

| New Hires and Transfers Report | HR | 12/20/2016 |

| Notification of Termination (Letter) | HR | 12/20/2016 |

| Notification of Termination (Report) | HR | 12/20/2016 |

| Pay Impacting Forms for MON | HR | 12/20/2016 |

| Pay Impacting Forms for SMI | HR | 12/20/2016 |

| Personnel Changes Report | HR | 12/20/2016 |

| Staffing Forecast Report | HR | 12/20/2016 |

| TX FMLA ER Insurance Rpt | HR | 12/20/2016 |

| Balance Adjustment Report | PY | 12/20/2016 |

| Deduction Register | PY | 12/20/2016 |

| Deductions Not Taken Report | PY | 12/20/2016 |

| Employees Not Processed Report | PY | 12/20/2016 |

| Federal Liability by State | PY | 12/20/2016 |

| Multiple Worksite | PY | 12/20/2016 |

| Other Earnings Register | PY | 12/20/2016 |

| Payroll Error Messages | PY | 12/20/2016 |

| Payroll Register Report | PY | 12/20/2016 |

| Payroll Summary Report | PY | 12/20/2016 |

| Precalculation Audit Report | PY | 12/20/2016 |

| Preconfirm Audit Report | PY | 12/20/2016 |

| PreSheet Audit Report | PY | 12/20/2016 |

| Tax Deposit Summary | PY | 12/20/2016 |

| TX 941 Quarterly Fed Tax | PY | 12/20/2016 |

| TX Deceased Employee Tax Rpt | PY | 12/20/2016 |

| TX EE/ER Tax Difference | PY | 12/20/2016 |

| TX Employee Count | PY | 12/20/2016 |

| TX Employees Not Paid | PY | 12/20/2016 |

| TX Error Listing | PY | 12/20/2016 |

| TX Fed Tax Summary - Detail | PY | 12/20/2016 |

| TX Federal Tax Summary | PY | 12/20/2016 |

| TX Federal W-2 File Audit | PY | 12/20/2016 |

| TX Federal W-2c File Audit | PY | 12/20/2016 |

| TX Local Tax Deposit | PY | 12/20/2016 |

| TX Local Tax Summary | PY | 12/20/2016 |

| TX Local W-2 File Audit | PY | 12/20/2016 |

| TX Local W-2 Tax Totals Report | PY | 12/20/2016 |

| TX Monthly Longevity Report | PY | 12/20/2016 |

| TX Negative Tax Balance | PY | 12/20/2016 |

| TX Payroll CY Audit Report | PY | 12/20/2016 |

| TX PaySheet Manager Audit | PY | 12/20/2016 |

| TX Position Payment Posting | PY | 12/20/2016 |

| TX SPRS Audit Rpt | PY | 12/20/2016 |

| TX State Matching Contribution | PY | 12/20/2016 |

| TX State Tax Summary | PY | 12/20/2016 |

| TX State Tax Summary - Detail | PY | 12/20/2016 |

| TX State W-2 File Audit | PY | 12/20/2016 |

| TX State W-2 Tax Totals Report | PY | 12/20/2016 |

| Tx Tax Balance Audit | PY | 12/20/2016 |

| TX Vendor Remittance | PY | 12/20/2016 |

| TX W-3/W-3SS Transmittal Report | PY | 12/20/2016 |

| TX W-4 Exemptions | PY | 12/20/2016 |

| TX Warrant Register | PY | 12/20/2016 |

| TX Year End Consent Status Rpt | PY | 12/20/2016 |

| TX Year End Data Audit | PY | 12/20/2016 |

| TX Year End Record Error | PY | 12/20/2016 |

| Comp Time Expiration Report | TL | 12/20/2016 |

| Comp Time/Overtime Earned Rpt | TL | 12/20/2016 |

| Comp Time/Overtime Threshld Rpt | TL | 12/20/2016 |

| Comp Time/Overtime Threshold Rpt | TL | 12/20/2016 |

| Comptime/Overtime Earned Rpt | TL | 12/20/2016 |

| Employee Monthly T&L Rpt | TL | 12/20/2016 |

| Employee Monthly Time & Leave | TL | 12/20/2016 |

| Employees Without Accruals Rpt | TL | 12/20/2016 |

| Employees Without Accruals Rpt | TL | 12/20/2016 |

| Full Month of LWOP Time Rpt | TL | 12/20/2016 |

| Leave Liability Report | TL | 12/20/2016 |

| Military Leave FFYE Report | TL | 12/20/2016 |

| Optional Holiday Owed Report | TL | 12/20/2016 |

| Optional Holiday Owed Report | TL | 12/20/2016 |

| Positive Time Rptrs Without Hrs | TL | 12/20/2016 |

| Positive Time Rptrs Without Hrs | TL | 12/20/2016 |

| Sched Hrs Not Equal to Std Hrs | TL | 12/20/2016 |

| Sick Leave Pool/Extended Sick | TL | 12/20/2016 |

| Time Certification Report | TL | 12/20/2016 |

| Time Certification Report | TL | 12/20/2016 |

| TRCs by Date Report | TL | 12/20/2016 |

| End of Worksheet |

| Module | Report Title | Process Name | Navigation | Long Description |

| HR | Active Employee Report | TXACTEMP | Workforce Administration > CAPPS Reports > Active Employee Report | This report displays each employee's primary assignment personnel and payroll information such as address, salary and employment data. |

| HR | Active Position Report | TXACTPOS | Organizational Development> Position Management> CAPPS Reports> Active Position Report | This is an adhoc report that provides a listing of active positions as of the date indicated for the agen-cy on the run control. Active positions include positions in the Approved status and provides certain information about both vacant and filled positions with limited incumbent (the person filling the po-sition) details. The report excludes contingent workers. |

| HR | Audit– Position Exceptions | HSAS0206 | Organizational Development> Position Management> CAPPS Reports> Audit - Position Exceptions | The Audit - Position Exceptions is an adhoc report that should be run to ensure that Job and Position data match. The report will identify conditions where position and job data are out of sync. Non pay impacting changes to position data will not update job data if the position and job data are out of sync with one another. |

| HR | Employees on LOA | TX_EMPL_LOA | Workforce Administration> CAPPS Reports> Employees on LOA | This report provides a list of employees who are on a Leave of Absence (per their Job Data) as of the date indicated in the run control prompt. |

| HR | ERS Inbound Report | TXERSREP | CAPPS Interfaces> Benefits> Reports> ERS Inbound Report | The daily ERS Inbound Report displays the benefit activity (deltas) from ERS OnLine that were sent to CAPPS HR/Payroll system. The report can be requested to Print the A, AC and/or FA section, to print all data, only print inserts and updates and/or print errors. In addition, the agency may wish to use the online ERS Inbound Results page. This online view func-tionality is available at the following navigation: CAPPS Interfaces>Benefits>Inquire>ERS Inbound Results. Deferred Compensation changes sent to CAPPS are also available to view online. The monthly Tex-Saver changes are sent on the 3rd business day of each month and can be viewed at the following navigation: CAPPS Interfaces>Benefits>Inquire>Texas Saver Results |

| HR | ERS/CAPPS Insurance Reconciliation Report | TXERS100 | CAPPS Interfaces> Benefits> Reports> ERS/CAPPS Insurance Recon | The ERS/CAPPS Insurance Reconciliation is an adhoc report that uses the ERS monthly snapshot file to identify discrepancies between ERS (the Benefits Administrator) and CAPPS (the HR/Payroll sys-tem). The report must be used as a reconciliation tool to care for discrepancies to benefit elections and/or deductions to ensure CAPPS is appropriately deducting employee benefits and that the em-ployee has paid for those benefits. This report has multiple ways it compares ERS to CAPPS and in-cludes great detail. |

| HR | FMLA/Parental Leave History Report | TX_RC_FMLRPT | Benefits> Track FMLA> Track FMLA> FMLA/Parental Leave History Report | The track FMLA or Parental History report can be run adhoc for all employees or an individual em-ployee to help reconcile leave recorded on the time sheet and Leave of Absence hours recorded in the FMLA Activity page for the event. The run control is used to specify whether to run FMLA or Pa-rental History. |

| HR | FTE Information Report | TXFTERPT | Workforce Administration> CAPPS Reports> FTE Information Report | This adhoc report is designed as a tool to assist agencies in satisfying the State Auditor's Office (SAO) FTE state employee quarterly reporting requirements. The report produces values based on agency data entry, payroll processing, and position control procedures. Therefore, agencies should verify the correctness of their data before using the figures for SAO reporting requirements. This report is a snapshot of information as of the last day of the fiscal quarter. All payment information with pay-ment dates within the quarter and all assignment information as of the last day of the quarter are included. |

| HR | HIR/REH Report (Hire/Rehire) | ASHR1051 | CAPPS Interfaces> Benefits> Reports> Benefits HIR/REH Report | An adhoc report showing Hires and Rehires for the Agency. The report can be used to open an event in ERS OnLine for the employee to enroll in their benefits. If no hires and/or rehires were added for the date or date range requested, the report will indicate that no data exists. Note: The report should be run timely to ensure the employee is promptly enrolled in benefits. For a large agency, this might be needed daily. For a smaller agency, the report can be run for the day the employee(s) were onboarded into CAPPS. |

| HR | List - Employee Comp Changes | HSAS0405 | Workforce Administration > CAPPS Reports > List - Employee Comp Changes | This report displays all employees who have had any salary impacting actions during a specified date range. |

| HR | Mgmt/Staff Ratio Report | TXMSRRPT | Workforce Administration> CAPPS Reports> Mgmt/Staff Ratio Report | This report displays information required by the State Auditor's Office (SAO) regarding the manage-ment to staff ratios based on FTE's in addition to employee count. This report can be used as a tool and agencies should verify the correctness of the data before submitting figures for SAO reporting requirements. |

| HR | New Hires and Transfers Report | TX_NEW_HIRES | Workforce Administration> CAPPS Reports> New Hire and Transfers Report | This adhoc report displays the latest new hire record on employees that might have terminated and been rehired. If the newly hired employee terminates within the time period requested the termina-tion date should be displayed on the report. |

| HR | Notification of Termination (Letter) | TXTRMLTR | Workforce Administration> CAPPS Reports> Notification of Termination | The Notification of Termination report is an adhoc report that generates a letter notifying the Courts or Obligees (e.g. IRS, TGSLC, etc.) of the termination of an employee with an active garnishment for Child Support, Administrative Wage Garnishment (AWG), Student Loan, Tax Levy, Bankruptcy and Spousal Maintenance. |

| HR | Notification of Termination (Report) | TXTRMRPT | Workforce Administration> CAPPS Reports> Notification of Termination | The notification of termination report is an adhoc report that can be run to identify employees that were terminated with an active garnishment. The report displays by garnishment ID type (i.e. CHI), provides the employee name, SSN and term date along with a total number of employees for each garnishment ID type. This is different from the Notification of Termination letter, because it is not intended to be distributed outside of the agency and can be used as a report to ensure all relevant agencies have been notified. |

| HR | Pay Impacting Forms for MON | ASPY1022 | CAPPS Interfaces>Benefits>Reports>Payimpacting forms for MON | The Pay Impacting Forms for MON is an adhoc report that can be used to make benefit adjustments for late hires. The employees identified are current pay period hires where payroll has processed without their deductions. After verification the form can be printed and given to the payroll adminis-trator to make the appropriate additional deduction on the employee’s next paycheck. |

| HR | Pay Impacting Forms for SMI | ASPY1023 | CAPPS Interfaces> Benefits> Reports> Pay impacting forms for SMI | The Pay Impacting Forms for SMI is an adhoc report that can be used to make benefit adjustments for late hires. The employees identified are current pay period hires where payroll has processed without their deductions. After verification the form can be printed and given to the payroll adminis-trator to make the appropriate additional deduction on the employee’s next paycheck. Note: If your agency does not pay employees on a semi-monthly basis, you do not need to run this report. |

| HR | Personnel Changes Report | TX_PERS_CHG | Workforce Administration > CAPPS Reports > Personnel Changes Report | This report displays all employees who have had any of the following reason codes: 001-003, 008-009, 020-031, A23, 034, and 040-049. |

| HR | Staffing Forecast Report | TX_STAFFING & TX_STSUMM | Workforce Administration > CAPPS Reports > Staffing Forecaste Report | This report displays your agency's filled, vacant, and closed positions for the requested fiscal year. The budget information includes budgeted annual salary, expenditures-to-date, projected expenditures, and projected lapse. The report lists the position records assigned to each organization code, followed by activity, program, and division totals. Agency totals are also provided. |

| HR | TX FMLA ER Insurance Rpt | TXPYFMLA | Benefits> Track FMLA> Track FMLA> TX FMLA ER Insurance Rpt | FMLA ER Insurance Report is an adhoc report that can be used to assist in reconciling if an adjust-ment is needed to care for the health insurance state match for an employee on Family Medical Leave. |

| End of Worksheet |

no reviews yet

Please Login to review.