256x Filetype XLSX File size 0.33 MB Source: cfocoach.co.zm

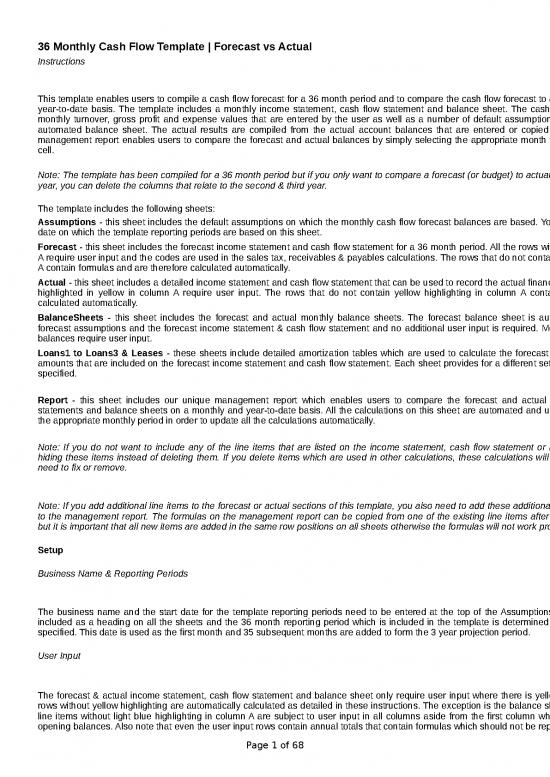

36 Monthly Cash Flow Template | Forecast vs Actual

Instructions

This template enables users to compile a cash flow forecast for a 36 month period and to compare the cash flow forecast to actual results on a monthly and

year-to-date basis. The template includes a monthly income statement, cash flow statement and balance sheet. The cash flow projections are based on

monthly turnover, gross profit and expense values that are entered by the user as well as a number of default assumptions which are used to create an

automated balance sheet. The actual results are compiled from the actual account balances that are entered or copied into the template. Our unique

management report enables users to compare the forecast and actual balances by simply selecting the appropriate month from a list box in a single input

cell.

Note: The template has been compiled for a 36 month period but if you only want to compare a forecast (or budget) to actual results for the current financial

year, you can delete the columns that relate to the second & third year.

The template includes the following sheets:

Assumptions - this sheet includes the default assumptions on which the monthly cash flow forecast balances are based. You also need to specify the start

date on which the template reporting periods are based on this sheet.

Forecast - this sheet includes the forecast income statement and cash flow statement for a 36 month period. All the rows with yellow highlighting in column

A require user input and the codes are used in the sales tax, receivables & payables calculations. The rows that do not contain yellow highlighting in column

A contain formulas and are therefore calculated automatically.

Actual - this sheet includes a detailed income statement and cash flow statement that can be used to record the actual financial results. All the rows that are

highlighted in yellow in column A require user input. The rows that do not contain yellow highlighting in column A contain formulas and are therefore

calculated automatically.

BalanceSheets - this sheet includes the forecast and actual monthly balance sheets. The forecast balance sheet is automatically calculated from the

forecast assumptions and the forecast income statement & cash flow statement and no additional user input is required. Most of the actual balance sheet

balances require user input.

Loans1 to Loans3 & Leases - these sheets include detailed amortization tables which are used to calculate the forecast interest and capital repayment

amounts that are included on the forecast income statement and cash flow statement. Each sheet provides for a different set of loan repayment terms to be

specified.

Report - this sheet includes our unique management report which enables users to compare the forecast and actual income statements, cash flow

statements and balance sheets on a monthly and year-to-date basis. All the calculations on this sheet are automated and users are only required to select

the appropriate monthly period in order to update all the calculations automatically.

Note: If you do not want to include any of the line items that are listed on the income statement, cash flow statement or balance sheet, we recommend

hiding these items instead of deleting them. If you delete items which are used in other calculations, these calculations will result in errors which you then

need to fix or remove.

Note: If you add additional line items to the forecast or actual sections of this template, you also need to add these additional items to the other section and

to the management report. The formulas on the management report can be copied from one of the existing line items after you have added the new rows

but it is important that all new items are added in the same row positions on all sheets otherwise the formulas will not work properly.

Setup

Business Name & Reporting Periods

The business name and the start date for the template reporting periods need to be entered at the top of the Assumptions sheet. The business name is

included as a heading on all the sheets and the 36 month reporting period which is included in the template is determined based on the start date that is

specified. This date is used as the first month and 35 subsequent months are added to form the 3 year projection period.

User Input

The forecast & actual income statement, cash flow statement and balance sheet only require user input where there is yellow highlighting in column A. All

rows without yellow highlighting are automatically calculated as detailed in these instructions. The exception is the balance sheet for actual results where all

line items without light blue highlighting in column A are subject to user input in all columns aside from the first column which contains the balance sheet

opening balances. Also note that even the user input rows contain annual totals that contain formulas which should not be replaced with values.

Page 1 of 68

36 Monthly Cash Flow Template | Forecast vs Actual

Instructions

Cash Flow Forecast

Income Statement

All monthly income statement projections need to be entered exclusive of any sales tax that may be applicable.

Turnover & Gross Profits

Monthly turnover values need to be entered on the Forecast sheet for all 36 months (excluding the annual totals in the columns with dark blue column

headings). The projected monthly gross profit percentages also need to be entered on this sheet and are used in order to calculate the gross profit values.

The monthly cost of sales projections are calculated by simply deducting the gross profit values from the monthly turnover values.

The template includes two default lines in each of these sections - one for a typical product based item and one for a typical service based item. The

template can therefore be used for both service and trade based businesses. There are no cost of sales and gross profit values in service based businesses

and a gross profit percentage of 100% can therefore be specified. You can also hide the cost of sales and gross profit sections if you do not want to include

them in your cash flow projections.

Note: You can insert as many additional line items as required by inserting the required number of items in each section and then entering the appropriate

values where user input is required or copying the formulas from one of the existing lines. We recommend inserting additional line items between the two

existing default line items.

Note: If you insert additional line items on the Forecast sheet, you also need to insert these additional line items on the Actual sheet and on the Report sheet

in exactly the same row positions.

Note: The codes in column A are used in the sales tax and trade receivables calculations. The first two characters represent the sales tax code and the last

two characters represent the payment status. Refer to the Balance Sheet - Sales Tax and Balance Sheet - Trade Receivables sections for more information

on these codes.

Other Income

Monthly projections of other income should be entered in this row. Other income may consist of items like interest or dividends received and this line item is

not included in trade receivables and sales tax calculations. If you want to include other income in the trade receivables or sales tax calculations, you need

to add the income to the Turnover section as an additional line item.

Operating Expenses

All the monthly operating expense projections need to be entered in the operating expenses section of the income statement. The template contains 22

default operating expense line items but you can add as many additional items as required or delete the line items that you do not need. When adding

additional line items, remember to copy the formulas in the total columns from one of the existing line items.

Note: If you insert additional expense items on the Forecast sheet, you also need to insert these additional expense items on the Actual sheet and on the

Report sheet in exactly the same row positions. Also, if you change the description of operating expenses, you also need to make the same changes on the

other two sheet. We recommend copying the descriptions from the Forecast sheet and pasting the descriptions on the other two sheets once you have

inserted new rows for new expense items.

Note: The codes in column A are used in the sales tax and trade payables calculations. The first two characters represent the sales tax code and the last

two characters represent the payment status. Refer to the Balance Sheet - Sales Tax and Balance Sheet - Trade Payables sections for more information on

these codes.

Staff Costs

Page 2 of 68

36 Monthly Cash Flow Template | Forecast vs Actual

Instructions

All the monthly staff cost projections need to be entered in the staff costs section of the income statement. The template contains 2 default staff cost line

items but you can add as many additional items as required or delete the line items that you do not need. When adding additional line items, remember to

copy the formulas in the total columns from one of the existing line items.

Note: If you insert additional staff cost items on the Forecast sheet, you also need to insert these additional staff cost items on the Actual sheet and on the

Report sheet in exactly the same row positions. Also, if you change the description of staff cost line items, you also need to make the same changes on the

other two sheet. We recommend copying the descriptions from the Forecast sheet and pasting the descriptions on the other two sheets once you have

inserted new rows for new staff cost items.

Note: The codes in column A are used in the sales tax and trade payables calculations. The first two characters represent the sales tax code and the last

two characters represent the payment status. Refer to the Balance Sheet - Sales Tax and Balance Sheet - Trade Payables sections for more information on

these codes.

Note: Staff costs have been included in a separate section on the income statement in order to be able to calculate payroll accruals. If you do not need to

include payroll accruals in your cash flow projections, we recommend entering nil values and hiding these rows. If you delete the section, some of the payroll

accrual formulas may result in errors and you therefore may need to delete them as well.

Depreciation & Amortization

Monthly projections for depreciation and amortization need to be calculated independently of the template and included in this section. We unfortunately

cannot include default depreciation or amortization calculations because some businesses may have very different asset bases than others with existing

assets which may already have been depreciated over a number of years. Any calculation which is based on a percentage of the balance sheet asset value

may therefore not be accurate.

If you already have a sheet which is used for depreciation or amortization calculations, you can include it in this template and add formulas in the

depreciation & amortization section of the income statement to include your calculations in these line items.

We also realize that some users may want to include depreciation and amortization as part of their operating expenses. We have therefore provided for this

in that the depreciation and amortization calculations on the cash flow statement are based on the default code which is included in column A. You can

therefore enter nil values in the depreciation & amortization section on the income statement, hide the section and include these line items in the operating

expenses section and as long as you also include the default codes in column A, the cash flow statement values for depreciation and amortization will be

calculated correctly.

Interest Paid

All interest paid calculations are automated and based on the amortization tables on the Loans1 to Loans3 and Leases sheets. The template

accommodates the inclusion of loans & leases based on four different sets of loan repayment terms which need to be specified on the Assumptions sheet.

Opening loan balances are based on the balance sheet opening balances section on the Assumptions sheet and additional loan amounts can be entered in

the proceeds from loans section of the cash flow statement and will then automatically be included in the appropriate amortization table.

You do not need to use all four loan amortization sheets - if you only need to include loans based on one set of repayment terms, you can delete the other

loan amortization sheets, delete the other interest paid rows on the income statement, delete the other proceeds from loans rows on the cash flow

statement, delete the other repayment of loans rows on the cash flow statement and delete the other loan balances from the balance sheet.

The template provides for four sets of loan repayment terms - the same amortization table can basically be used for all loans with the same repayment terms

by adding additional loan amounts as proceeds to the cash flow statement in order to add new loans to the appropriate amortization table.

Page 3 of 68

36 Monthly Cash Flow Template | Forecast vs Actual

Instructions

If you need to add more than four sets of loan repayment terms, you will need to copy one of the amortization sheets, change it to reflect the appropriate

loan terms and then change the formulas in the amortization table to be based on the correct loan repayment terms at the top of the sheet. This means that

you need to add another set of repayment terms to the Assumptions sheet and link the fields at the top of the new amortization table to the appropriate cells

on the Assumptions sheet.

If there is an opening balance for the required additional loan terms, you need to include a new code in the balance sheet opening balances section on the

Assumptions sheet and base the opening balance calculation in the first period of the amortization schedule on this code. You also need to add new rows to

the interest paid section on the income statement, the loan proceeds section on the cash flow statement, the loan repayment section on the cash flow

statement and the loan balances section on the balance sheet. The appropriate formulas can be copied from one of the existing items and the sheet

reference in the copied formula can then just be replaced by the sheet name of the new amortization table that you've added.

Taxation

The taxation line item on the income statement is automatically calculated based on the profit before tax and the income tax assumptions which are

specified on the Assumptions sheet. If you do not want to include income tax in the cash flow projections, simply enter an income tax rate of 0%. This will

result in no income tax being calculated.

If you do want to include income tax calculations, the income tax percentage needs to be entered in the Income Tax section on the Assumptions sheet. You

can also enter a value for an assessed loss (as a positive value) which may have been carried over from a previous tax year which would result in income

tax only being calculated after profits exceed the value of the assessed loss.

You also need to specify the payment frequency in months and the first calendar month in which a payment needs to be included. The template

automatically provides for income tax based on what is due and includes the income statement amount and a provision for taxation on the balance sheet.

The payment frequency and month of payment assumptions are then used to determine when the income tax liability will be settled which will result in the

appropriate cash outflow being recorded on the cash flow statement and the provision for taxation being reduced.

The template can accommodate income tax calculations based on current and subsequent month payments. If you select the Current option, the income tax

payment amount will be calculated based on all amounts that have accrued up to and including the month of payment. If you select the Subsequent option,

the income tax payment amount will only be calculated based on all amounts which have accrued up to the previous month end.

Example: If you select the Current option in the Income Tax section of the Assumptions sheet, all income tax amounts up to and including the current month

will be included in the income tax payment amount. This means that the provision for taxation at the end of the particular month will be nil. The Current

setting is therefore usually appropriate for provisional taxpayers.

Example: If you select the Subsequent option, all amounts up to and including the previous month end will be included in the income tax payment amount.

The provision for taxation balance on the balance sheet will therefore not be nil at the end of the month of payment and include the current month's income

tax charge.

Dividends

The template also includes automated dividends calculations. If you do not want to include any dividends in your cash flow projections, you can simply

specify a dividend percentage of zero percent.

If you want to include dividend calculations, you need to specify a dividend percentage which will be applied to the profit for the period in order to calculate

the dividend value. You also need to specify the frequency in months of dividend payments and the first payment month. The frequency of dividends

determines when the dividends are included on the income statement and the first month of payment determines when the dividend payment is included on

the cash flow statement (only has an effect if the dividend payment option is Subsequent).

Page 4 of 68

no reviews yet

Please Login to review.