328x Filetype XLSX File size 0.46 MB Source: www.qao.qld.gov.au

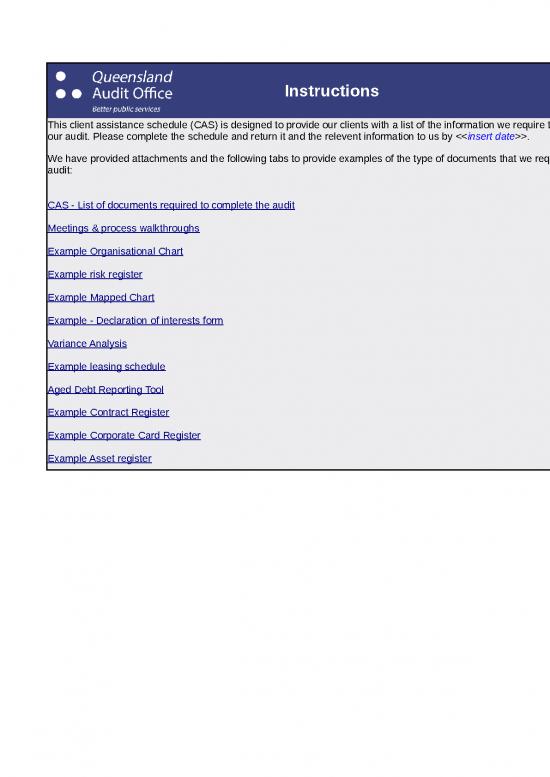

Instructions

This client assistance schedule (CAS) is designed to provide our clients with a list of the information we require to undertake

our audit. Please complete the schedule and return it and the relevent information to us by <>.

We have provided attachments and the following tabs to provide examples of the type of documents that we require for our

audit:

CAS - List of documents required to complete the audit

Meetings & process walkthroughs

Example Organisational Chart

Example risk register

Example Mapped Chart

Example - Declaration of interests form

Variance Analysis

Example leasing schedule

Aged Debt Reporting Tool

Example Contract Register

Example Corporate Card Register

Example Asset register

Example: Health foundation client assistance schedule—20XX–XX

Audit area Title/item requested Examples of supporting What do we use this information for?

documents/guidance

Operational budget for 20XX–20XX The operational budget provides a forecast of the financial operations of the

General financial year foundation for the financial year and allows us to focus on expected areas of

higher risk.

The organisational chart gives an overview of the foundation's structure and

Organisational chart Organisational Chart where accountabilities lie within the foundation. If this hasn't changed since last

year, please just confirm this.

Financial Management Practice Manual The FMPM tells us how the foundation's transactions are to be approved and

(FMPM) processed.

Financial Accountability HandboGokuidance: Queensland Treasury issues the Financial Reporting Requirements

and the financial accountability handbook, which can assist foundations in

developing their FMPM.

Board charter The charter defines the responsibilities and accountabilities of the board. It

helps us to understand how the foundation operates.

Example risk register

A Guide to Risk Management The risk register informs us where the foundation considers its high risks lie

Risk register and what actions it is undertaking to mitigate those risks.

Guidance: links are provided to help with developing a risk framework and risk

register.

Risk Management Framework template Hospital Foundations (Issued by Queensland Health)

QAO Risk management maturity model

This gives us an understanding of how the financial statement disclosures will

be derived.

Mapping list (or matrix) of GL codes to Example: Mapped TB chart Where the trial balance is mapped to the financial statements, this provides a

financial statement line items. workpaper on how the financial statement disclosures were established.

Where this is not completed, it will take additional audit time to check the

completeness of the financial statement balances.

Conflicts of interest are a high risk consideration for an audit. The register of

Example: Declaration of interest form

Public interest/conflict of interest register. interests provides us information to focus our audit testing.

Guidance: the Department of the Premier and Cabinet issued guidance on

declarations of interest.

Declarations of interest

As a normal part of our audit program, we review the foundation board's

Minutes and agendas of board meetings agenda and minutes. This informs us of significant decisions made by the

held board, such as recruitment, purchase of major property, plant and equipment,

significant contracts, and so on. It allows us to proactively address accounting

and audit issues.

This is only applicable to foundations with audit committees. We either attend

Audit and risk committee agenda and the audit committee meetings or review the minutes of the meetings. It gives

minutes held us an understanding of the key risks to the foundation and the board's direction

to minimise risk.

Accounting position papers are to be prepared by the foundation on matters

that could have a significant impact of the financial statement disclosures.

Accounting position papers Fact sheet on Preparing positionT hpeaspee rws ilflo br ea cpcriomuanrtiilnyg c hmaantgteerss iann adc vcaoluunattiinogn standards.

Guidance: the linked fact sheet provides guidance on how to prepare a position

paper. Audit teams will discuss the need for position papers with you.

Proforma financial statements: can relieve some of the end of year

pressures. Proforma financial statements are prepared in May/June.

Proforma financial statements and final Effectively, they are your financial statements without the current year figures.

Your audit team will review the proforma statements and provide feedback on

draft financial statements Future Bay Regional Health Foundation (Tier 2) illustrative financial statements, example from Queensland Treasury

any necessary changes by the agreed target date.

Final draft financial statements: should be provided at the start of the final

audit visit. These statements should have a quality assurance review before

providing them to audit. A good quality review should correct errors/omissions

prior to the final audit. The aim of this is to reduce the foundation's time to

rework financial statements, and audit time to fix errors and omissions and

Understanding general purpose financial statements (QAO blog)

review of additional review of the financial statements. It aims to save time and

money.

Guidance: the Future Bay Regional Health Foundation has been established

Focused financial reporting (QAO blog)

by Queensland Treasury as sample financial statements for small state

entities. This provides guidance on format and layout. It also provides

references to the applicable accounting standards.

The QAO blogs are additional guidance material on preparing financial

Assessing financial statement preparation for state government entities 2019 (QAO blog)

statements.

Variance analysis—explanation for As part of the audit, we look at the variance between the current and prior year

movements from prior year to current year Variance analysis and reasons for material variances. We request the foundation report on the

for the income statement and balance variances in the first instances. We will verify this through our audit and our

sheet understanding of the financial transactions for the year.

Variance analysis—explanation for As part of the audit, we look at the variances between the current and prior

movements from budget to current year for year and reasons for material variances. We request from the Foundation a

the income statement and balance sheet. Variance analysis report on the variances in the first instance. We will verify this this through our

Compare to budget or prior year to identify audit and our understanding of the financial transactions for the year. This

risk analysis will be similar to the year to year analysis, but it will be the Current

year results compared to the budget.

Supporting workpapers for each disclosure

note including:

-commitments and contingencies Workpapers to support the disclosures in the financial statements.

-financial instruments

-key management personnel (KMPs)

-related party transactions

Related party declarations for KMPs Declaration of interest form Workpapers to support the disclosures in the financial statements.

Listing of manual journals posted from Jul Workpapers to support the disclosures in the financial statements.

20XX to Jun 20XX

Cash and Cash Equivalents Bank reconciliation for month ending 30 Workpapers to support the disclosures in the financial statements and identify

June long outstanding reconciling items.

We use this as part of our audit to ensure banking transactions are only

List of current bank account signatories conducted by those authorised as bank account signatories. Authorised bank

signatories is a form of internal control over bank transactions.

Cash flow statement workings

(reconciliation of operating surplus to net Workpapers to support the disclosures in the financial statements.

cash from operating activities note)

Payroll/Employee entitlements Payroll masterfile data for the entire year We use this data to perform audit analytics and to inform our audit sample

testing.

Human resources (HR) delegations We use this to audit approvals for HR transactions.

Long service leave and annual leave Workpapers to support the disclosures in the financial statements.

accrual calculations

Revenue/Receivables Accounts receivable age analysis as at 30 Aged debtors analysis Workpapers to support the disclosures in the financial statements and identify

June 20XX receivables that may be impaired.

Copy of provision for impairment of

receivables and bad debt write offs for 1 Workpapers to support the disclosures in the financial statements.

Jul 20XX to 30 June 20XX, if any

Gifts and donations register, which should We look at gift and benefits in terms of:

include an estimated value for each item Gifts and Benefits (Directive 22/-0 t9h)e probity of matters associated with the stewardship of public sector entities

- compliance with relevant acts, regulations and government policies.

Listing of all major fund-raising activities to

date with the total cost and funds raised for Workpapers to support the disclosures in the financial statements and to target

each. our audit testing.

A listing of events planned for the period to

30 June 20XX

General ledger transaction listing by event Workpapers to support the disclosures in the financial statements.

Accrual revenue supporting working paper Workpapers to support the disclosures in the financial statements.

This provides a listing of all leases the foundation has in place. This schedule

Expenditure and Payables Leasing schedule for July XX to June XX Example leasing schedule should include the purpose of the lease, duration, amounts payable over time

for the duration of the lease.

Financial delegations We use the financial delegations to test that the appropriate level of approval is

given for transactions.

Current corporate card register if If the foundation has issued corporate cards, a register of issued corporate

Example corporate card register

applicable cards should be maintained.

This is similar to the aged analysis of debtors. This provides us with an insight

Aging analysis for account payables as at into how well the foundation is paying its outstanding obligations. Long-term

30 June 20XX payables without reasonable explanations may indicate going concern or legal

dispute issues.

General ledger transaction listing of Workpapers to support the disclosures in the financial statements.

supplies and services

Accrual expenditure supporting working Workpapers to support the disclosures in the financial statements.

paper

All significant contracts should be maintained in a contract register that details,

at a minimum, the following five elements:

1. start and end date of the contract

Copy of the contracts register Example contract register 2. total contracted amount and annual amounts

3. contract manager assigned to the contract

4. link to or reference to a copy of the contract

5. trigger date for renewal to ensure an appropriate procurement process can

be followed.

Listing of prepayments Workpapers to support the disclosures in the financial statements.

Property, plant and equipment Property, plant and equipment Workpapers to support the disclosures in the financial statements.

(PPE) reconciliation as at 30 June 20XX

Copy of the fixed asset register Sample asset register Workpapers to support the disclosures in the financial statements.

Portable and attractive items are those items of equipment that are more

Copy of the portable and attractive assets suspectable to theft, for example cameras. Most of the time, they are below

register the asset recognition threshold but are maintained on a register to monitor their

location.

If relevant, supporting workpapers for the Provide information on how often valuations are undertaken, the

property, plant and equipment movement process/approach adopted including quality assurance process and how the

reconciliation (that is, additions listing, information is used. Please ensure all working papers are adequately cross

disposal listings, assessment of useful life, referenced to each applicable balance.

and so on)

Management review of useful lives and Workpapers to support the disclosures in the financial statements. The useful

impairment lives of assets should be assessed annually. As part of this assessment, the

condition of the asset should be assessed for any potential impairment.

Valuation report and evidence of This is applicable to assets held at fair value where fair value is not cost.

managements assessment/endorsement

Other Inventory reconciliation for 30 June 20XX Workpapers to support the disclosures in the financial statements.

Business activity statement (BAS) for 30 Workpapers to support the disclosures in the financial statements.

June

Equity Any equity movements and relevant Workpapers to support the disclosures in the financial statements.

supporting documents

* QAO Contact List

Initials Name

Example: Health foundation client assistance schedule—20XX–XX

Category Date

1

2

3

4

5

6

Example: Health foundation client assistance schedule—20XX–XX

Officer responsible for this area

no reviews yet

Please Login to review.