263x Filetype XLS File size 1.96 MB Source: www.ofgem.gov.uk

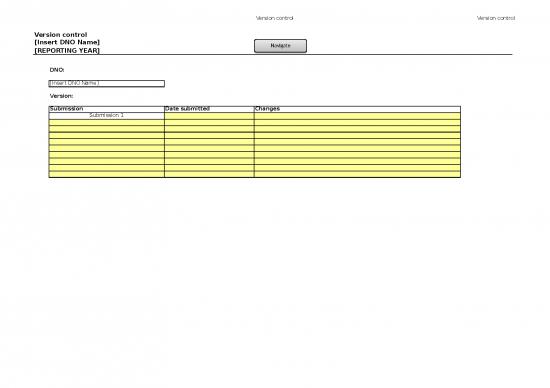

Version control Version control

Version control

[Insert DNO Name] Navigate

Navigate

[REPORTING YEAR]

DNO:

[Insert DNO Name]

Version:

Submission Date submitted Changes

Submission 1

Contents

[Insert DNO Name]

[REPORTING YEAR]

Financials

F1 Profit & Loss / Statement of comprehensive income includes segmental analysis

F2 Balance Sheet / Statement of financial position includes segmental analysis

F3 Cashflow

F4 Net Debt licensee level

F5 Financing costs licensee level

F6 Financing Requirements licensee level

F7 Pension DB scheme costs Licensee level

F8 Pension detail primary DB scheme Sponsoring Group scheme and licensee level

F8.1 Pension detail secondary DB scheme Sponsoring Group scheme and licensee level

F8.2 Pension detail tertiary DB scheme Sponsoring Group scheme and licensee level

F9 Pensions DC schemes

F10 Pension Protection Fund Levies

F11 Pension Scheme Administration costs includes segmental analysis

F12 Tax: expenditure allocations to capital allowance pools licensee level

F12a Tax: CT600 expenditure allocations to capital allowance pools licensee level

F13 Tax capital allowance pools includes segmental analysis

F14 Tax computation licensee level

F15 Reconciliation total costs to regulatory accounts licensee level

F16 Reconciliation net debt to regulatory accounts includes segmental analysis

F17 Reconciliation pension costs to other tables and regulatory accounts

F18 Pension: ex post true up

F19 Tax clawback for excess gearing

F20 RAV depreciation

F21 RAV historic data

ALSO TO BE SUBMITTED Please

indicate if If not submitted please indicate when

submitted submission will take place.

Corporation Tax return (CT600) for the licensee's last statutory

accounting financial year.

Final agreed corporation tax return for all years closed by HMRC in the

regulatory year and up to the date of submission of RRP

Annual audited accounts for each Pension Scheme

Triennial actuarial valuation reports ( or any that might be provided

more frequently)

S224 Pension Act 2004 updated valuations at 31 March each year to

support data in tables F7, F8, F8.1 and F8.2

Copy of the Certification by senior accounting officer that is

prescribed in FA2009, which certifies annually that the accounting

systems for the company and it's subsiduaries are adequate for the

purpose of reporting of "taxes and duties".

Changes Log Changes Log

Changes log

[Insert DNO Name]

Change control

Version Table Reference Changes made in the Financial RIGs

3 F1 Row for disposal of fixed assets added.

3 F1 Links of disposals to fixed assets corrected (signage).

3 F2 Analysis of disposals now includes intangibles.

3 F2 Disposal signage clarified and link to P&L corrected.

3 F5 Terminology revised.

3 F6 Rows for input of Dun & Bradstreet score moved to Table F10 PPF levy.

3 F9 Revision to allow input for additional DC scheme.

3 F9 Stakeholder pensions and personal accounts separated out.

3 F10 Rows for input of Dun & Bradstreet score moved from Table F6.

3 F3 New cashflow table (F3) added and tables renumbered (F3 - F5a)

3 F1 Out of Area Networks segment added

3 F13 Out of Area Networks segment added

3 F6-F11 Out of Area Networks segment added

3 F2 Out of Area Networks segment added

3 F15 Segmentation removed

3 F13 Additional new pools added and hidden

3 F4/F5 Additional rows added and hidden

4 F2 Rows for pension deficit and refundable deposits added to creditors

4 F3 Formula updated - Profit on disposals

4 F1 Formulae (rows 58-71) updated to include all segments

4 F13 Rows 110-127 hidden

4 F2 Row 145 check amended to cost RIGs

4 F3 Linkages in rows 14-16 removed

4 F4 Row 283 linked to row 779

4 F13 Check to table F12 added in rows 496 to 499

4 Ofgem data Pension funding added

4 F7 Segments aligned to include Metering (ES6) & Excluded services (ES7) (additional rows)

4 F9 Segments aligned to include Metering (ES6) & Excluded services (ES7) (additional row)

4 F10 Segments aligned to include Metering (ES6) & Excluded services (ES7) (additional row)

4 F11 Segments aligned to include Metering (ES6) & Excluded services (ES7) (additional row)

4 F7 Formulae corrected rows: 185-187; 157,98,40

4 F15 Row 6 link changed

4 F12 Indirect allocations changed to input

4 F12a Indirect allocations changed to input

4 F12a Segments amalgamated

4 F12a Reduced level of detail now included

5 F12 Formulae rows 222, 223, 226-231 amended

5 F12a Reordered to more closely match F12

5 F12a Formulae rows 226-231 and 242 amended

5 F15 Reconciliation lines added to revenue check

5 F17 inserted new rows 6-9 to bring in direct and indirect DuOS ongoing pension costs

5 F17 Formulae corrected rows: 71-77

F1 - P&L

A B C D E F G H I J K

1 F1 - Profit and Loss / Statement of comprehensive income

2 [Insert DNO Name] Navigation

Navigation

3 [REPORTING YEAR]

4 For the regulatory financial year ending 31 March 2006 2007 2008 2009 2010 2011

5 DPCR4

6 GAAP used - IFRS or UK GAAP (enter "UK" or "IFRS")

7 TOTAL ENTITY

8 Revenue

9 Operating Expenses

10 Operational costs incurred

11 Other operating income (-ve)

12 Depreciation of tangible fixed assets

13 Amortisation of intangible fixed assets

14 Amortisation of customer contributions (-ve)

15 Total Operating Expenses - - - - - -

16

17 Operating Profit before exceptional items - - - - - -

18

19 Exceptional Items

20 (Profit)/ loss on disposal of fixed assets - - - - - -

21 Exceptional Item (1) - overwrite

22 Exceptional Item (2) - overwrite

23 Exceptional Item (3) - overwrite

24

25 Operating profit before Finance costs and tax - - - - - -

26

27 Finance expense & Investment income

28 Interest Payable - - - - - -

29 Other finance costs

30 Interest Receivable (-ve) - - - - - -

31 Fair value (gains) /loss on financial instruments (under IFRS)

32 Other finance income/Investment income (-ve)

33 Net investment income & finance expense - - - - - -

34

35 Profit before taxation - - - - - -

36

37 Tax on profit

38 Current Tax - current year

39 Current Tax - prior year adjustments

40 Deferred Tax - current year

41 Deferred Tax - prior year adjustments

42 Total taxation charge - - - - - -

43

44 Profit for the regulatory financial year - - - - - -

45

46 Statement of Total Recognised Gains and Losses

47 Profit for the financial year - - - - - -

48 Gain/(Loss) on hedging reserve (net of tax)

49 Actuarial (loss)/gain net of deferred tax on defined pension benefits

50 Other (overwrite with details)(+/-ve)

51 Other (overwrite with details)(+/-ve)

52 Dividends actually paid (-ve)

53 Transfer to reserves - - - - - -

54

55 SEGMENTAL ANALYSIS

56

57 Distribution (DUoS)

58 Revenue - - - - - -

59 Operating Expenses

60 Operational costs incurred - - - - - -

61 Depreciation of tangible fixed assets - - - - - -

62 Amortisation of intangible fixed assets - - - - - -

63 Amortisation of customer contributions (-ve) - - - - - -

64 Total Operating Expenses - - - - - -

65

66 Operating Profit before exceptional items - - - - - -

67

68 Exceptional Items

69 Exceptional Item (1) - overwrite - - - - - -

70 Exceptional Item (2) - overwrite - - - - - -

71 Exceptional Item (3) - overwrite - - - - - -

72

73 Operating profit before Finance costs and tax - - - - - -

74

75 Distributed Generation

76 Revenue

77 Operating Expenses

78 Operational costs incurred

79 Depreciation of tangible fixed assets

80 Amortisation of intangible fixed assets

81 Amortisation of customer contributions (-ve)

82 Total Operating Expenses - - - - - -

83

84 Operating Profit before exceptional items - - - - - -

85

86 Exceptional Items

87 Exceptional Item (1) - overwrite

88 Exceptional Item (2) - overwrite

89 Exceptional Item (3) - overwrite

90

91 Operating profit before Finance costs and tax - - - - - -

92

93 Excluded Services (excluding metering)

94 Revenue

95 Operating Expenses

96 Operational costs incurred

97 Depreciation of tangible fixed assets

98 Amortisation of intangible fixed assets

99 Amortisation of customer contributions (-ve)

100 Total Operating Expenses - - - - - -

101

102 Operating Profit before exceptional items - - - - - -

103

16:09:20 financial_issues_reporting_workbook.xls

08/09/2022 file:///home/storage/public_html/st1/folder32/32998/financial_issues_reporting_workbook.xls

no reviews yet

Please Login to review.