177x Filetype XLS File size 0.08 MB Source: www.cpva.lt

Sheet 1: Financial report

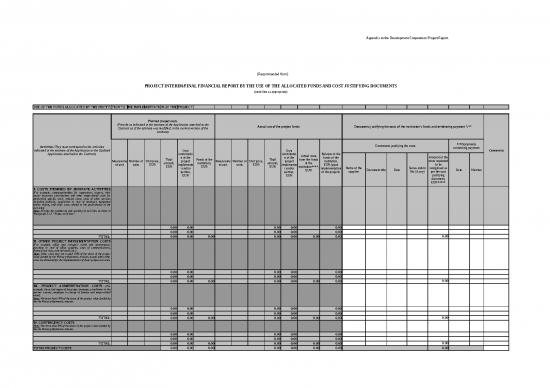

| Appendix to the Development Cooperation Project Report |

|||||||||||||||||||||

| (Recommended form) | |||||||||||||||||||||

| PROJECT INTERIM/FINAL FINANCIAL REPORT BY THE USE OF THE ALLOCATED FUNDS AND COST JUSTIFYING DOCUMENTS | |||||||||||||||||||||

| (underline as appropriate) | |||||||||||||||||||||

| USE OF THE FUNDS ALLOCATED BY THE INSTITUTION TO THE IMPLEMENTATION OF THE PROJECT | |||||||||||||||||||||

| Activities (They must correspond to the activities indicated in the estimate of the Application or the Updated Application attached to the Contract) | Planned project costs (Provide as indicated in the estimate of the Application attached to the Contract or, if the estimate was modified, in the current version of the estimate) |

Actual use of the project funds | Documents justifying the costs of the institution’s funds and evidencing payment *,** | Comments | |||||||||||||||||

| Measurement unit | Number of units | Unit price, EUR | Total amount, EUR | Own contribution of the project implementer and/or partner, EUR | Funds of the institution, EUR | Measurement unit | Number of units | Unit price, EUR | Total amount, EUR | Own contribution of the project implementer and/or partner, EUR | Actual costs from the funds of the institution****, EUR | Balance of the funds of the institution, EUR (upon implementation of the project) | Documents justifying the costs | ***Documents evidencing payment | |||||||

| Name of the supplier | Document title | Date | Series and/or No (if any) | Amount of the costs requested to be recognised as per the cost justifying document, EUR***** | Date | Number | |||||||||||||||

| I. COSTS ITEMISED BY SEPARATE ACTIVITIES (For example, compensation/fees for rapporteurs, experts, their social insurance contributions and other wage-related costs for performing specific work; mission costs; costs of other services including publicity, acquisition or rent of necessary equipment and/or means, and other costs related to the performance of the activities) Note: Provide the numbering and wording of activities as those in Paragraph 3.1.3 “Project activities”. |

|||||||||||||||||||||

| 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||||

| 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||||

| TOTAL: | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||

| II. OTHER PROJECT IMPLEMENTATION COSTS (For example, office and transport rental and maintenance, purchase or rent of office supplies, costs of communications, financial services, external audit, etc.) Note: Other costs may not exceed 10% of the share of the project value funded by the Ministry/diplomatic mission, except when other costs are allocated for the implementation of direct project activities. |

|||||||||||||||||||||

| 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||||

| 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||||

| TOTAL: | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||

| III. PROJECT ADMINISTRATION COSTS (For example, the actual wages of the project manager, coordinator in the partner country, employee in charge of finance and wage-related costs). Note: Not more than 10% of the share of the project value funded by the the Ministry/diplomatic mission. |

|||||||||||||||||||||

| 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||||

| 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||||

| TOTAL: | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||

| IV. CONTINGENCY COSTS Note: Not more than 5% of the share of the project value funded by the the Ministry/diplomatic mission. | |||||||||||||||||||||

| 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||||

| 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||||

| TOTAL: | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||

| TOTAL PROJECT COSTS | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||

| Note: The Financial Report shall include only costs incurred and paid during the implementation of the project. | |||||||||||||||||||||

| *If the document justifying costs is not in the Lithuanian language, or if the financial operation was performed in a currency other than euro, the type(s) of costs shall be stated in Lithuanian (or in English in the case of a foreign implementer) on the justifying document. The document shall also state the amount of costs in euros and the official exchange rate of the currency applied by the Bank of Lithuania on the day of payment. If the currency was exchanged in a bank institution, a document evidencing the currency exchange operation shall be attached. | |||||||||||||||||||||

| **Documents justifying costs shall be numbered in sequence, in the same order as they are attached to the Project Implementation Report. | |||||||||||||||||||||

| ***All incurred costs shall be justified by payment documents: bank statements, e-bank account statements, copies of payment orders, cash register orders, receipts, or others. | |||||||||||||||||||||

| ****Each cost justifying document shall state the amount to be covered from the funds of the Ministry/diplomatic mission. If only a part of the costs indicated in the report being submitted or in another cost justifying document is to be covered from the funds of the Ministry/diplomatic mission, the part to be covered from the funds allocated by the Ministry/diplomatic mission shall be marked on that document. For example, when submitting documents justifying the costs of rent, communications, or similar services and/or evidencing the fact of their payment, only a part of the costs stated therein are directly related to project implementation. Therefore, the share of those costs attributable to the project shall be reasonably indicated, i.e. it is recommended that the costs of the rent of the premises used in the project be calculated on the basis of the area of the premises – the part of the area used for project implementation activities versus the total area of the premises. It is also recommended taking into account the time of using the premises for the needs of the project: for example, if they are used only 6 months per year, only 1/2 of the rent costs of the premises used can be attributed to the project; telephone communication costs can be distributed according to the time worked, or else telephone communication costs can be expressed in an actual amount, with indication of the telephone number(s) that would be used only for the needs of the project, etc. | |||||||||||||||||||||

| *****The total amount of the column “Amount of the costs requested to be recognised as per the cost justifying document, EUR”must coincide with the total amount of the column “Actual costs from the funds of the institution, EUR”(both according to separate items of the estimate and according to the total amount). | |||||||||||||||||||||

| ATTACHMENTS: | |||||||||||||||||||||

| 1. Documents evidencing the implementation of the activities indicated in the Project Application (or in the Updated Project Application) (copies of reports, publications, media releases, | |||||||||||||||||||||

| digital text, audio and video information, etc.), ___ pcs. (pages). | |||||||||||||||||||||

| 2. Certified copies of documents substantiating costs,_____ page(s). | |||||||||||||||||||||

| Full name and signature of the employee of the project implementer in charge of financial control | |||||||||||||||||||||

| ___________________________________________________________________________________________________________________________________________________________________________________________________________________________________ | |||||||||||||||||||||

no reviews yet

Please Login to review.