335x Filetype XLSX File size 0.35 MB Source: taxguru.in

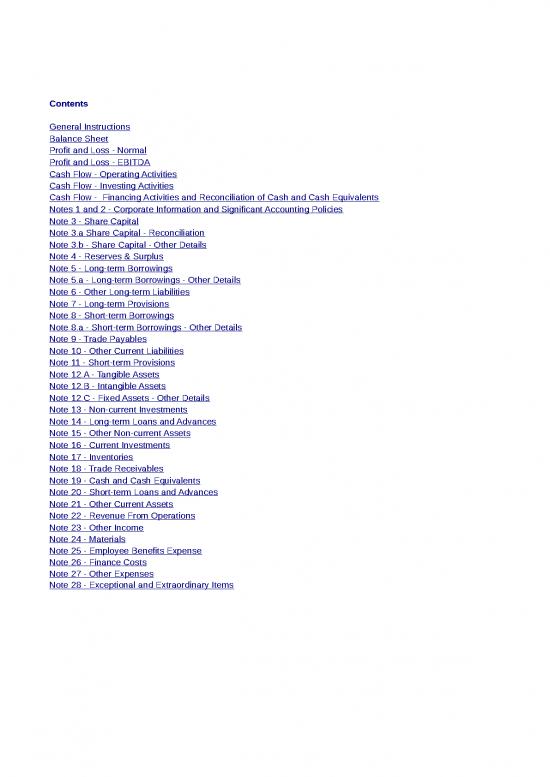

Contents

General Instructions

Balance Sheet

Profit and Loss - Normal

Profit and Loss - EBITDA

Cash Flow - Operating Activities

Cash Flow - Investing Activities

Cash Flow - Financing Activities and Reconciliation of Cash and Cash Equivalents

Notes 1 and 2 - Corporate Information and Significant Accounting Policies

Note 3 - Share Capital

Note 3.a Share Capital - Reconciliation

Note 3.b - Share Capital - Other Details

Note 4 - Reserves & Surplus

Note 5 - Long-term Borrowings

Note 5.a - Long-term Borrowings - Other Details

Note 6 - Other Long-term Liabilities

Note 7 - Long-term Provisions

Note 8 - Short-term Borrowings

Note 8.a - Short-term Borrowings - Other Details

Note 9 - Trade Payables

Note 10 - Other Current Liabilities

Note 11 - Short-term Provisions

Note 12.A - Tangible Assets

Note 12.B - Intangible Assets

Note 12.C - Fixed Assets - Other Details

Note 13 - Non-current Investments

Note 14 - Long-term Loans and Advances

Note 15 - Other Non-current Assets

Note 16 - Current Investments

Note 17 - Inventories

Note 18 - Trade Receivables

Note 19 - Cash and Cash Equivalents

Note 20 - Short-term Loans and Advances

Note 21 - Other Current Assets

Note 22 - Revenue From Operations

Note 23 - Other Income

Note 24 - Materials

Note 25 - Employee Benefits Expense

Note 26 - Finance Costs

Note 27 - Other Expenses

Note 28 - Exceptional and Extraordinary Items

Note 29 - Additional Information to the Financial Statements

Note 30.1 - Disclosures under AS 7 - Construction Contracts

Note 30.2 - Disclosures under AS 12 - Government Grants

Note 30.3 - Disclosures under AS 14 - Accounting for Amalgamations

Note 30.4 - Disclosures under AS 15 - Employee Benefits

Note 30.5 - Disclosures under AS 16 - Borrowing Costs

Note 30.6 - Disclosures under AS 17 - Segment Reporting

Note 30.7 - Disclosures under AS 18 - Related Party Disclosures

Note 30.8 - Disclosures under AS 19 - Leases

Note 30.9 - Disclosures under AS 20 - Earnings per Share

Note 30.10 - Disclosures under AS 22 - Accounting for Taxes on Income

Note 30.11 - Disclosures under AS 24 - Discontinuing Operations

Note 30.12 - Disclosures under AS 26 - Intangible Assets

Note 30.13 - Disclosures under AS 27 - Financial Reporting of Interests in Joint Ventures

Note 30.14 - Disclosures under AS 29 - Provisions, Contingent Liabilities and Contingent Assets

Note 31 - Disclosure on Employee Share Based Payments

Note 32 - Previous Year's Figures

References and abbreviations used in the format of financial statements

The following pattern has been used to highlight items to the readers:

i Implementation guidance provided to facilitate the presentations / disclosures.

? Narrative details to be provided for the relevant account balance / transaction and instructions to the preparers

of the financial statements.

Abbreviations used for references in this format:

GI General Instructions (GI) to the Revised Schedule VI issued by the MCA as part of the notification

BS General Instructions to the Balance Sheet (BS) issued by the MCA as part of the Revised Schedule VI

PL General Instructions to the Statement of Profit and Loss (PL) issued by the MCA as part of the Revised

Schedule VI

GN Guidance Note (GN) on the Revised Schedule VI to the Companies Act, 1956 issued by the ICAI

AS Accounting Standards (AS) notified under the Companies (Accounting Standards) Rules, 2006 (as amended)

Other Ann / Gn Other Announcements (Ann) / Guidance Notes (Gn) of ICAI prescribing accounting and disclosure requirements

Listing Clause Disclosure requirements as specified in the relevant clause of the Listing Agreement

Ref. No. GENERAL INSTRUCTIONS GIVEN BY THE MCA FOR PREPARATION OF

BALANCE SHEET AND STATEMENT OF PROFIT AND LOSS OF A COMPANY

GI 1 Where compliance with the requirements of the Act, including the Accounting Standards as applicable to

companies, requires any change in treatment or disclosure including addition, amendment, substitution or deletion

in the head / sub-head or any changes inter se, in the financial statements or statements forming part thereof, the

same shall be made and the requirements of the Schedule VI shall stand modified accordingly.

GI 2 The disclosure requirements specified in Parts I and II of this Schedule are in addition to and not in substitution of

the disclosure requirements specified in the Accounting Standards prescribed under the Companies Act, 1956.

Additional disclosures specified in the Accounting Standards shall be made in the notes to accounts or by way of

additional statement unless required to be disclosed on the face of the Financial Statements. Similarly, all other

disclosures as required by the Companies Act, 1956 shall be made in the notes to accounts in addition to the

requirements set out in this Schedule.

GI 3 Notes to accounts shall contain information in addition to that presented in the Financial Statements and shall

provide where required :

(a) narrative descriptions or disaggregations of items recognised in those statements and

(b) information about items that do not qualify for recognition in those statements.

Each item on the face of the Balance Sheet and the Statement of Profit and Loss shall be cross-referenced to any

related information in the notes to accounts. In preparing the Financial Statements including the notes to accounts,

a balance shall be maintained between providing excessive detail that may not assist users of financial statements

and not providing important information as a result of too much aggregation.

GI 4 Depending upon the turnover of the company, the figures appearing in the Financial Statements may be rounded

off as below: (emphasis added)

Turnover Rounding off

(i) less than one hundred crore rupees To the nearest hundreds, thousands, lakhs or millions, or

decimals thereof.

(ii) one hundred crore rupees or more To the nearest lakhs, millions or crores, or decimals thereof.

Once a unit of measurement is used, it should be used uniformly in the Financial Statements.

GI 5 Except in the case of the first Financial Statements laid before the Company (after its incorporation), the

corresponding amounts (comparatives) for the immediately preceding reporting period for all items shown in the

Financial Statements including notes shall also be given.

GI 6 For the purpose of this Schedule, the terms used herein shall be as per the applicable Accounting Standards.

Note to This part of Schedule sets out the minimum requirements for disclosure on the face of the Balance Sheet and the

GI Statement of Profit and Loss (hereinafter referred to as “Financial Statements” for the purpose of this Schedule) and

Notes. Line items, sub-line items and sub-totals shall be presented as an addition or substitution on the face of the

Financial Statements when such presentation is relevant to an understanding of the Company’s financial position or

performance or to cater to industry / sector specific disclosure requirements or when required for compliance with

the amendments to the Companies Act, 1956 or under the Accounting Standards.

no reviews yet

Please Login to review.