217x Filetype XLSX File size 0.02 MB Source: sptf.info

Sheet 1: Draft Standards

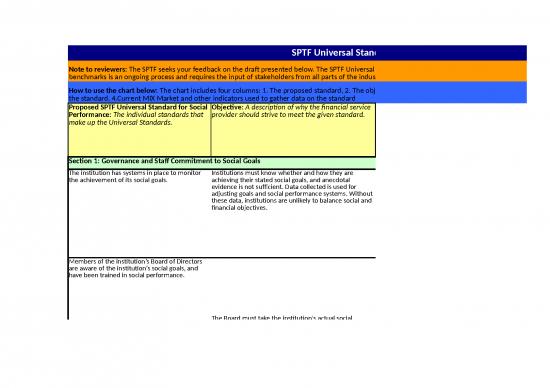

| SPTF Universal Standards for Social Performance DRAFT FOR REVIEW | |||

| Note to reviewers: The SPTF seeks your feedback on the draft presented below. The SPTF Universal Standards are expectations that any institution with a double or triple bottom line should meet. Development of standards and benchmarks is an ongoing process and requires the input of stakeholders from all parts of the industry. | |||

| How to use the chart below: The chart includes four columns: 1. The proposed standard, 2. The objective for an institution in meeting the standard, 3. The proposed benchmark(s) or guideline(s) for evaluating whether an institution meets the standard, 4.Current MIX Market and other indicators used to gather data on the standard | |||

| Proposed SPTF Universal Standard for Social Performance: The individual standards that make up the Universal Standards. | Objective: A description of why the financial service provider should strive to meet the given standard. | Benchmark/ Guidelines: Specific targets that measure the financial service provider's achievement of the given standard. NOTE: Brackets [ ] appear where benchmarks are undefined or preliminary. | SPS Report Indicator or Other Existing Indicator: Indicators currently in use to measure the given standard. Most come from MIX Market's Social Performance Standards Report (http://www.themix.org/social-performance/Indicators). MIX indicators are identified below by "(question #)," noted after the indicator name. |

| Section 1: Governance and Staff Commitment to Social Goals | |||

| The institution has systems in place to monitor the achievement of its social goals. | Institutions must know whether and how they are achieving their stated social goals, and anecdotal evidence is not sufficient. Data collected is used for adjusting goals and social performance systems. Without these data, institutions are unlikely to balance social and financial objectives. | *The institution is clear about its social goals and has indicators to measure performance against those goals. *The institution sets measurable targets and regularly reviews progress at internal management meetings. *The institution integrates social performance indicators into its management information system (MIS). |

1. Does your Board of Directors have a formal committee that monitors social performance? (question 2) 2. See client monitoring section below |

| Members of the institution’s Board of Directors are aware of the institution’s social goals, and have been trained in social performance. | The Board must take the institution's actual social performance into account when setting strategy for the institution. To do this, the Board must understand and monitor progress toward social goals. | *Every Board member has been trained at least once on social performance. *At least once per year, the Board reviews the institution's specific goals, as well as the systems (such as data collection, MIS, reporting, etc.) for monitoring these goals. |

1. Have members of your Board of Directors ever been trained on social performance management? (question 2) |

| Members of the institution’s Board of Directors monitor the institution’s social performance through a formal mechanism. | *The Board has a "social performance committee" or an "audit committee" that reviews social performance, including: mission compliance, performance results, human resource policies, and profit allocation, as they relate to the social goals of the institution. *This this information is reviewed quarterly. |

1. Does your Board of Directors have a formal committee that monitors social performance? (question 2) | |

| Staff is trained on the institution’s social goals and systems for monitoring achievement of social goals. | Staff must understand how their work helps the institution achieve its social mission and know how to monitor the institution’s progress toward, and achievement of, social goals. Social performance monitoring should be integrated into normal work flows rather than positioned as a "special project." |

*Social performance monitoring is included in the formal job description and workplace training of pertinent staff. For these staff, performance evaluation includes their social performance monitoring duties. *Staff at all levels are trained on the institution's social goals at entry, and at least [X] hours per year. |

|

| If the institution uses a staff incentive scheme, the staff incentive scheme includes criteria related to the institution’s social goals. | Incentive systems affect how staff prioritize and perform their work, and how they interact with clients. Staff should place high value on good customer service, reaching the institution's target clients, client retention, and accurate collection of social data. | *At least [25%] of the criteria used to judge staff performance is based on the institution's social goals, these criteria may include: ability to attract new clients from target market; outreach to remote/rural communities; outreach to women; quality of interaction with clients, based on formal client feedback mechanism; quality of social data collected; client retention/dropout rate; portfolio quality; or other factors specific to the institution's social mission. | 1. Please indicate whether your institution has staff incentives related to any of the following areas (ability to attract new clients from target market; outreach to remote/rural communities; outreach to women; quality of interaction with clients, based on formal client feedback mechanism; quality of social data collected; client retention/dropout rate; portfolio quality; other) (question 6) |

| Section 2: Client Protection | |||

| The financial institution protects clients by following the minimum standards for client protection certification, as established by the Smart Campaign. These standards will be finalized by the end of the year. | Financial products and services must not harm clients. All financial service providers should uphold at least minimum standards for client protection. | Will refer users to forthcoming Smart Campaign benchmarks for client protection. | Will refer users to forthcoming indicators for client protection (question 4). |

| Section 3: Products and Services that Meet Client Needs | |||

| The institution bases product and service offerings on the needs and constraints of target clients. | The design of client-centered products and services requires the institution to know client needs through regular market research, gathering of client feedback, and analysis of client performance. | *Regular market research includes social performance goals such as avoiding over-indebtedness, increasing client satisfaction, and outreach to target client. *At minimum, the institution offers different repayment terms on loan products, based on client business and family needs. *Ideally, the institution offer multiple financial products, based on client needs. *Institutions strive to offer non-financial services or partner with non-financial service providers that to do so. |

1. Please indicate which credit products your institution offers (question 3) 2. Does your institution take deposits? If yes, please indicate which savings products your institution offers (question 3) 3. Does your institution require compulsory insurance? If yes, please indicate which insurance products your institution requires (question 3) 4. Does your institution offer voluntary insurance (question 3) 5. Please indicate any other financial services your institution offers (question 3) 6. Does your institution offer enterprise services? If yes, please indicate which services your institution offers (question 3) 7. Does your institution offer education services? If yes, please indicate which services your institution offers (question 3) 8. Does your institution offer health service? If yes, please indicate which services your institution offers (question 3) 9. Does your institution offer women's empowerment service? If yes, please indicate which services your institution offers (question 3) 10. The financial institution offers multiple or flexible loan products that address different business and family needs. (Smart Campaign, Getting Started Questionnaire, Principle 1.) |

| Section 4: Social Responsibility to Staff | |||

| The institution's human resource policies are transparent and protect staff. | Human resource policies are important to ensure that employees are treated fairly. Beyond treating employees with respect, human resources policies that protect staff rights can also have a positive affect on how employees treat clients. Respected employees may be more likely to treat clients with respect. | *All staff have access to the institution's formal human resource policies. *The institution's human resource policies formally and transparently address all of the following: staff benefits (including at least, a clear salary scale, medical insurance, pension contribution); how the institution protects staff at work (including, at least, safety and anti harassment); the institution's policies related to equality (including at least, antidiscrimination and equal pay for men and women with equivalent skill levels); and all others required by local law. *At minimum, staff compensation complies with local law. *Ideally, compensation is on par with local standards for similar institutions. |

1. Please indicate which of the following, if any, are included in your human resources policy: (transparency on salary (a clear salary scale based on market salaries); benefits (medical insurance, pension contribution); protection at work (safety, anti harassment); equality (anti-discrimination, equal pay for men and women with equivalent skill level); other - please specify) (question 6) |

| The institution regularly assesses staff needs and satisfaction. | Even with strong human resource policies in place, institutions should monitor employee satisfaction to understand employees concerns and needs. | *The institution collects staff satisfaction either on an ongoing basis or at least [once per year]. *The institution provides staff with a mechanism for making complaints at any time. *Staff privacy is maintained during the process and staff are not punished for making complaints or providing negative feedback. *Staff attrition is [20] percent or less per annum. |

1. Staff rotation rate (= Exit during the period / average (Number of employees at the end of the reporting period + Staff employed for one year or more)) (question 6b) |

| Section 5: Client Monitoring | |||

| The institution regularly calculates its client retention rate and surveys exiting clients. | The client retention rate is an important indicator of social performance, in particular, customer service and products that meet clients needs. Retention rates are most useful when supplemented with client exit interviews, which help identify problems that lead to client dropout. | *The institution tracks client retention using their MIS. *The institution calculates the retention rate at least [quarterly]. *The client retention rate is greater than [70] percent on average, for the time period used by the institution. *The institution collects client exit surveys on an ongoing basis. |

1. Client retention rate (= Active borrowers at the end of the period / (active borrowers at the beginning of the period + new borrowers during the period)) (question 11) |

| The institution regularly collects feedback on client satisfaction and uses it to understand clients' experiences with products, services, and staff. | In addition to market research mentioned in Section 3, specific monitoring of client satisfaction is essential to understanding the institution's ability to deliver quality products and services using means that are reliable and convenient for the client. | *The institution surveys clients on at least: reliability of services and product delivery, convenience of using services, affordability of products, understanding of terms and conditions, and customer service. *Confidentiality is maintained and clients are not discouraged from providing negative feedback. |

1. Optional - submit Assessment of Client Satisfaction Surveys |

| If poverty outreach is an explicit social goal of the institution, the institution measures poverty of incoming clients. | Institutions must know whether and how they are achieving their stated poverty-related goals, and anecdotal evidence is not sufficient. Data collected is used for adjusting goals and improving systems to achieve poverty outreach and/or alleviation. | *The institution sets clear targets for poverty outreach and/or change in poverty status. *The institution uses a trustworthy tool to systematically measure poverty. *Data gathered are stored in the institution's MIS and are reported within the institution. *The data are used to compare poverty-related targets with actual performance. |

1.What is the poverty level of the clients that your institution aims to reach? (question 1) |

| If poverty alleviation is an explicit social goal of the institution, the institution systematically measures the change in client poverty status. | 1. Which development objectives does your institution specifically pursue through its provision of financial and non-financial products and services? Please rank them in order of importance. Select only those that apply: [list of options provided, one of which is "poverty reduction"] (question 1) 2. Does your institution measure the poverty levels of your clients? If yes, which method(s) does your institution use? (Check all that apply): [list of options follows] (question 8) 3. Please list any product(s) or service(s) (financial or non-financial) offered by your institution that is specifically designed to target the poor: (question 8) |

||

| If outreach to women is an explicit social goal of the institution, the institution systematically measures number of women clients. | Institutions must know whether and how they are achieving their stated gender-related goals, and anecdotal evidence is not sufficient. Data collected is used for adjusting goals and improving systems to achieve gender outreach. | *The institution sets clear targets for outreach to women. *Data gathered are stored in the institution's MIS and are reported within the institution. *The data are used to compare targets for outreach to women with actual performance. |

1. Which of the following clients represent your target market? Please rank them in order of importance. Select only those that apply: [list of options provided, one of which is "women"] (question 1) |

| If the institution has any the following explicit social goals, the institution has systems in place to monitor the achievement of these goals: | Institutions must know whether and how they are achieving their stated social goals, and anecdotal evidence is not sufficient. Data collected is used for adjusting goals and improving systems to social goals. |

*The institution sets clear targets for any of the social goals below, and has indicators to measure performance against these targets. *The institution sets measurable targets and regularly reviews progress at management meetings. *The institution integrates into its MIS the data collected on these goals. |

|

| o Women’s empowerment / gender equality | 1. Which development objectives does your institution specifically pursue through its provision of financial and non-financial products and services? Please rank them in order of importance. Select only those that apply: [list of options provided, one of which is "gender equality and women's empowerment"] (question 1) 2. Does your institution offer women's empowerment service? If yes, please indicate which services your institution offers (question 3) |

||

| o Employment creation | 1. Number of microenterprises financed (question 10) 2. Number of people employed in the financed enterprises (question 10) |

||

| o Rural outreach | 1. Which of the following clients represent your target market? Please rank them in order of importance. Select only those that apply: [list of options provided, one of which is "Clients living in rural areas"] (question 1) 2. Which development objectives does your institution specifically pursue through its provision of financial and non-financial products and services? Please rank them in order of importance. Select only those that apply: [list of options provided, one of which is "increased access to financial services"] (question 1) |

||

| o Development of start-up businesses | 1. Number of start-up microenterprises financed (question 10) | ||

| o Growth of existing business | 1. Number of microenterprises financed (question 10) 2. Number of start-up microenterprises financed (question 10) (subtract "Number of start-up microenterprises financed" from "Number of microenterprises financed" to arrive at number of existing enterprises financed) |

||

| o Other social goals | 1. Which development objectives does your institution specifically pursue through its provision of financial and non-financial products and services? Please rank them in order of importance. Select only those that apply: (increased access to financial services; poverty reduction; employment generation; development of start-up enterprises; growth of existing businesses; improvement of adult education; youth opportunities; children's schooling; health improvement; gender equality and women's empowerment; water and sanitation; housing; other - please specify) (question 1) | ||

| Section 6: Responsible Financial Performance | |||

| The institution earns a profit that allows sustainability without exploiting clients. | Institutions must balance the drive for profit with the need to "invest" profits into improving products and services, financing growth, and increasing benefits to staff – while endeavoring when possible to lower interest rates for clients. | *Adjusted ROA and ROE are positive. *ROA is slightly above the equivalent for the local banking sector, to allow for additional risk- may differ by country. If high, then clear rationale and evidence of allocation that benefits clients. *Institutions with a profit margin above [X percent] should allocate profits to: decrease interest rates, offer more services, increase pay to staff, etc. *Yield on portfolio is comparable to the national average, taking into account operating and financial costs. |

1. Return on Equity 2. Return on Assets 3. Yield on portfolio 4. How does your institution state the interest rate of its most representative microcredit product? (declining balance interest method; flat interest method) (question 5a) |

| The institution grows at a rate that is sustainable and does not put clients at risk. | Irresponsibly high growth rates can lead to client over-indebtedness, client poaching from other institutions, careless lending methods, and mistrust from clients. | * The maximum annual growth rate should be less than [X] percent for Tier 1 institutions [X] percent for Tier 2, and [X] percent for Tier 3 institutions. * Growth rates are adjusted for market saturation and are comparable to growth rates of similar local institutions. |

1. Annual portfolio growth rate |

| The institution pursues operational efficiency that keeps costs as low as possible and allows for increased outreach, but without sacrificing quality service delivery, rigorous lending methodology, and responsible staff compensation. | Efficiency is not an end in itself, but should be viewed as a means to create more value for the client by passing on efficiency gains. Institutions should not pursue efficiency gains at the expense of thorough staff training and compensation, and quality service delivery. | *ROE and Operating Expense Ratio are within [X] percent of average for peer group of similar competitors. | 1. Return on Equity 2. Operating Expense Ratio |

no reviews yet

Please Login to review.