317x Filetype XLSX File size 0.28 MB Source: cda.gov.ph

Sheet 1: Annex A_GMAR

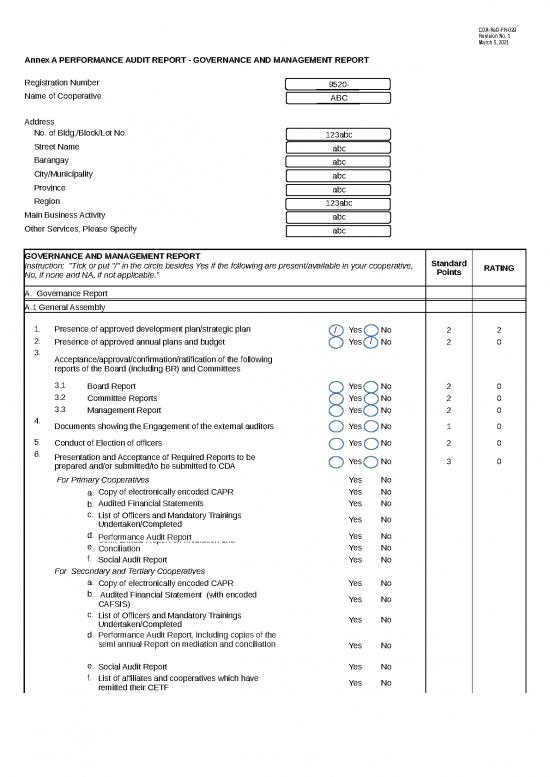

| Annex A PERFORMANCE AUDIT REPORT - GOVERNANCE AND MANAGEMENT REPORT | ||||||||||||||

| Registration Number | 9520- | |||||||||||||

| Name of Cooperative | ABC | |||||||||||||

| Address | ||||||||||||||

| No. of Bldg,/Block/Lot No. | 123abc | |||||||||||||

| Street Name | abc | |||||||||||||

| Barangay | abc | |||||||||||||

| City/Municipality | abc | |||||||||||||

| Province | abc | |||||||||||||

| Region | 123abc | |||||||||||||

| Main Business Activity | abc | |||||||||||||

| Other Services, Please Specify | abc | |||||||||||||

| GOVERNANCE AND MANAGEMENT REPORT | Standard Points | RATING | ||||||||||||

| Instruction: "Tick or put "/" in the circle besides Yes if the following are present/available in your cooperative, No, if none and NA, if not applicable." |

||||||||||||||

| A. Governance Report | ||||||||||||||

| A.1 General Assembly | ||||||||||||||

| 1. | Presence of approved development plan/strategic plan | 2 | 2 | |||||||||||

| 2. | Presence of approved annual plans and budget | Yes | / | No | 2 | 0 | ||||||||

| 3. | Acceptance/approval/confirmation/ratification of the following reports of the Board (including BR) and Committees | |||||||||||||

| 3.1 | Board Report | Yes | No | 2 | 0 | |||||||||

| 3.2 | Committee Reports | Yes | No | 2 | 0 | |||||||||

| 3.3 | Management Report | Yes | No | 2 | 0 | |||||||||

| 4. | Documents showing the Engagement of the external auditors | Yes | 1 | 0 | ||||||||||

| 5. | Conduct of Election of officers | Yes | No | 2 | 0 | |||||||||

| 6. | Presentation and Acceptance of Required Reports to be prepared and/or submitted/to be submitted to CDA | Yes | No | 3 | 0 | |||||||||

| For Primary Cooperatives | Yes | No | ||||||||||||

| a. | Copy of electronically encoded CAPR | Yes | No | |||||||||||

| b. | Audited Financial Statements | Yes | No | |||||||||||

| c. | List of Officers and Mandatory Trainings Undertaken/Completed | Yes | No | |||||||||||

| d. | Performance Audit Report | Yes | No | |||||||||||

| e. | Semi-annual Report on Mediation and Conciliation | Yes | No | |||||||||||

| f. | Social Audit Report | Yes | No | |||||||||||

| For Secondary and Tertiary Cooperatives | ||||||||||||||

| a. | Copy of electronically encoded CAPR | Yes | No | |||||||||||

| b. | Audited Financial Statement (with encoded CAFSIS) | Yes | No | |||||||||||

| c. | List of Officers and Mandatory Trainings Undertaken/Completed | Yes | No | |||||||||||

| d. | Performance Audit Report, including copies of the semi annual Report on mediation and conciliation | Yes | No | |||||||||||

| e. | Social Audit Report | Yes | No | |||||||||||

| f. | List of affiliates and cooperatives which have remitted their CETF | Yes | No | |||||||||||

| g. | Business Consultancy Assistance including the nature, cost and the use of CETF | Yes | No | |||||||||||

| h. | Other training activities undertaken specifying therein the nature, participants and cost of each activity. | Yes | No | |||||||||||

| 7. | Writtten policies/rules and procedures in conducting the General Assembly meeting | Yes | 1 | 0 | ||||||||||

| 8. | Other Resolutions/Policies requiring approval of the GA, including amendments of ACBL, if any | Yes | NA | 1 | 0 | |||||||||

| A.2 Board of Directors (BODs) | ||||||||||||||

| 1. | Duly signed Oath of Office | No | 1 | 0 | ||||||||||

| 2. | Compilation of the minutes of the Board of Director's Meeting | Yes | 1 | 0 | ||||||||||

| 3. | Copies of the followings documents submitted at least 5 days before the meeting or as provided in the policy | Yes | 2 | 0 | ||||||||||

| 3.1 | Management Report | Yes | No | |||||||||||

| 3.2 | Committee Reports | Yes | No | |||||||||||

| 3.3 | Chairperson's Report | Yes | No | |||||||||||

| 3.4 | Treasurer's Report | Yes | No | |||||||||||

| 3.5 | Proposals | Yes | No | |||||||||||

| 3.6 | Reference materials or attachments | Yes | No | |||||||||||

| 3.7 | CDA Assessment/Examination/Investigation Reports | Yes | No | |||||||||||

| 3.8 | Risk Review or Assessment Report | Yes | No | |||||||||||

| 4. | Copies of minutes of meeting with discussions on the following: | Yes | No | 2 | 0 | |||||||||

| 4.1 | Management Reports including the periodic financial statement | Yes | No | |||||||||||

| 4.2 | Budget | Yes | No | |||||||||||

| 4.3 | Policy formulation | Yes | No | |||||||||||

| 4.4 | Policy review and monitoring | Yes | No | |||||||||||

| 4.5 | Product/Service Review | Yes | No | |||||||||||

| 4.6 | Discussion of audit findings or recommendations (internal and external) | Yes | No | |||||||||||

| 4.7 | All unresolved issues identified in the examination/audit/assessment/ investigation reports are resolved by the Board of Directors within the prescribed period. | Yes | No | |||||||||||

| 5. | Copies of Board Resolutions embodying all major decisions of the BOD | Yes | No | 2 | 0 | |||||||||

| 6. | BR specifying the regular schedule of meetings of the Board and the Committees | Yes | No | 1 | 0 | |||||||||

| 7. | Presence of an independent advisors or resource persons to assist in its deliberations, when deemed appropriate. (This would be dependent on the profile, knowledge, skills or expertise of existing BOD. For example, if no BOD has expertise on IT, then invite an IT expert.) | Yes | 1 | 0 | ||||||||||

| 8. | Written Policies/ Rules and Procedures on the following: | |||||||||||||

| 8.1 | Conduct of meeting | Yes | 1 | 0 | ||||||||||

| 8.2 | BOD attendance including sanctions for absences, tardiness and proper decorum | Yes | 1 | 0 | ||||||||||

| 8.3 | Membership acceptance, termination, determination of members entitled to vote | Yes | 1 | 0 | ||||||||||

| 8.4 | Orientation of New Board Members and Other Officers | Yes | 1 | 0 | ||||||||||

| 8.5 | Commmunication Protocols | Yes | No | 1 | 0 | |||||||||

| 8.6 | Submission and Handling of Audit/ Inspection/ Risk Review/ Examination Reports to the BOD | Yes | 1 | 0 | ||||||||||

| 8.70000000000001 | Investments | Yes | No | 1 | 0 | |||||||||

| 8.80000000000001 | Borrowings | Yes | No | 1 | 0 | |||||||||

| 8.90000000000001 | Product/Service Review, Evaluation and Assessment | Yes | No | 1 | 0 | |||||||||

| 8.10 | Performance Assessment of the BOD, Officers, Management and Staff | Yes | 1 | 0 | ||||||||||

| 8.11 | Promotions, Incentives and Rewards | Yes | 1 | 0 | ||||||||||

| 8.12 | Survey, Feedback Mechanisms | Yes | No | 1 | 0 | |||||||||

| 9. | Succession Program of Officers and Management | Yes | No | 2 | 0 | |||||||||

| 10. | The Disciplinary Actions on Late/Absences of the BOD and proper decorum are implemented | Yes | 1 | 0 | ||||||||||

| 11. | The board does not interfere in the day-to-day operations of the cooperative | Yes | 2 | 0 | ||||||||||

| 12. | The new BOD members and other officers have undergone Orientation on ACBL and other regulations, coop policies and programs. | Yes | 1 | 0 | ||||||||||

| 13. | The board has acted on the result of feedbacks which require prompt action. | Yes | 2 | 0 | ||||||||||

| 14. | The Board implements and imposes sanctions in violation of the Confidentiality Agreement Policy. | Yes | 1 | 0 | ||||||||||

| 15. | The election related protest or complaint filed with the cooperative are appropriately acted upon. (Rule 7 Revised IRR of 9520) | Yes | 1 | 0 | ||||||||||

| 16. | Awareness through policies and training/orientation of the members of the Board of Director’s are aware of their duties & responsibilities under the following: | |||||||||||||

| 16.1 | RA9520 | 2 | 0 | |||||||||||

| 16.2 | Truth in Lending Act (for cooperatives with credit operations only) | Yes | 1 | 0 | ||||||||||

| 16.3 | Philippine Competition Law | Yes | No | NA | 1 | 0 | ||||||||

| 16.4 | Taxation | Yes | No | 1 | 0 | |||||||||

| 16.5 | Trade Practices Act | Yes | No | 1 | 0 | |||||||||

| 16.6 | Environmental Protection | Yes | No | 1 | 0 | |||||||||

| 16.7 | Workplace Health and Safety Act | Yes | No | 1 | 0 | |||||||||

| 16.8 | Labor Law - Minimum Wage | Yes | No | 1 | 0 | |||||||||

| 16.9 | Banking laws (for cooperative banks only) | Yes | No | NA | 1 | 0 | ||||||||

| 16.10 | AMLA | Yes | No | 1 | 0 | |||||||||

| 16.11 | Credit Information System Act (for cooperatives with credit operations only) | Yes | NA | 1 | 0 | |||||||||

| 16.12 | Data Privacy Act | Yes | No | 1 | 0 | |||||||||

| 16.13 | Magna Carta on Women, Solo Parent Act, Magna Carta for Senior Citizens, Magna Carta for PWD | Yes | 1 | 0 | ||||||||||

| A.3 Election Committee | ||||||||||||||

| 1. | Compilation of the Minutes and Committee Reports and Recommendations | Yes | 2 | 0 | ||||||||||

| 2. | Duly signed Oath of Office | Yes | 1 | 0 | ||||||||||

| 3. | Duly approved election rules and guidelines | Yes | No | 2 | 0 | |||||||||

| 4. | Certified List of Members entitled to vote as determined by the BOD | Yes | 1 | 0 | ||||||||||

| 5. | Results of Election | Yes | 1 | 0 | ||||||||||

| A.4 Audit Committee | ||||||||||||||

| 1. | Compilation of the Minutes and Committee Reports and Recommendations | Yes | 2 | 0 | ||||||||||

| 2. | Duly signed Oath of Office | Yes | No | 1 | 0 | |||||||||

| 3. | Audit Manual | Yes | 1 | 0 | ||||||||||

| 4. | Audit Program | Yes | No | 1 | 0 | |||||||||

| 5. | Internal Audit Report/Audit Committee Report | Yes | 2 | 0 | ||||||||||

| 6. | Monitoring report on the compliance of internal and audit recommendations | Yes | 1 | 0 | ||||||||||

| A.5 Education Committee | ||||||||||||||

| 1. | Compilation of the Minutes and Committee Reports and Recommendations | Yes | 2 | 0 | ||||||||||

| 2. | Board Resolution appointing the members of the Education Committee | Yes | 1 | 0 | ||||||||||

| 3. | Duly signed Oath of Office | Yes | No | 1 | 0 | |||||||||

| 4. | Capacity Building Program/Training Plan/Program with budget | Yes | 1 | 0 | ||||||||||

| 5. | Training Report | Yes | 1 | 0 | ||||||||||

| 6. | Training modules conducted by the coop e.g. PMES, Ownership Serminar, Audio visual presentations | Yes | 2 | 0 | ||||||||||

| 7. | Compilation of Training materials/ paraphernalia | Yes | No | 1 | 0 | |||||||||

| 8. | List of pool of trainers | Yes | No | 1 | 0 | |||||||||

| 9. | Feedback/evaluation tool | Yes | 1 | 0 | ||||||||||

| A.6 GAD Committee | ||||||||||||||

| 1. | Compilation of the Minutes and Committee Reports and Recommendations | Yes | 2 | 0 | ||||||||||

| 2. | Written duties and responsibilities | Yes | No | 1 | 0 | |||||||||

| 3. | Board Resolution appointing the members of the GAD Committee | Yes | 1 | 0 | ||||||||||

| 4. | Duly signed Oath of Office | Yes | 1 | 0 | ||||||||||

| 5. | GAD Plan with Budget | Yes | No | 2 | 0 | |||||||||

| 6. | Sex disaggregated data of members, officers and staff | Yes | 2 | 0 | ||||||||||

| 7. | GAD Assessment Report | Yes | 1 | 0 | ||||||||||

| A.7 Mediation and Conciliation Committee (Medcon) | ||||||||||||||

| 1. | Compilation of the Minutes and Committee Reports and Recommendations | Yes | 2 | 0 | ||||||||||

| 2. | Written duties and responsibilities | Yes | No | 1 | 0 | |||||||||

| 3. | Board Resolution appointing the members of the Mediation and Conciliation Committee | Yes | 1 | 0 | ||||||||||

| 4. | Duly signed Oath of Office | Yes | No | 1 | 0 | |||||||||

| 5. | Conflict resolution policies and procedures | Yes | No | 2 | 0 | |||||||||

| 6. | Medcon Plan/program | Yes | No | 1 | 0 | |||||||||

| 7. | Pool of Mediators/Conciliators, if any | Yes | NA | 1 | 0 | |||||||||

| 8. | Medcon Semi-annual Report submitted to CDA | Yes | No | 2 | 0 | |||||||||

| A.8 Ethics Committee | ||||||||||||||

| 1. | Compilation of the Minutes and Committee Reports and Recommendations | Yes | 2 | 0 | ||||||||||

| 2. | Board Resolution appointing the members of the Ethics Committee | Yes | 1 | 0 | ||||||||||

| 3. | Duly signed Oath of Office | Yes | No | 1 | 0 | |||||||||

| 4. | Code of Governance and Ethical Standards (CGES) | Yes | No | 2 | 0 | |||||||||

| 5. | Policies and Procedures in the conduct of investigation/inquiry involving violations of CGES | Yes | 2 | 0 | ||||||||||

| 6. | Ethics Committee Plans and Programs | Yes | 1 | 0 | ||||||||||

| A.9 Other Committees, specify: __________________________ | Yes | NA | 2 bonus point | 0 | ||||||||||

| 1. | Compilation of the Minutes and Committee Reports and Recommendations | Yes | NA | |||||||||||

| 2. | Written duties and responsibilities | Yes | NA | |||||||||||

| 3. | Board Resolution creating the committee/s as prescribed in its by-laws | Yes | NA | |||||||||||

| 4. | Board Resolution appointing the members of the other committees | Yes | ||||||||||||

| 5. | Duly signed Oath of Office | Yes | No | NA | ||||||||||

| 6. | Program of Work | Yes | No | NA | ||||||||||

| 7. | Accomplishment Report | Yes | No | NA | ||||||||||

| A.10 Secretary | ||||||||||||||

| 1. | Book of Minutes of meetings of GA and the BOD | Yes | 1 | 0 | ||||||||||

| 2. | Appointment Paper/Renewal of Appointment supported by Board Resolution | Yes | 1 | 0 | ||||||||||

| 3. | Duly signed Oath of Office | Yes | No | 1 | 0 | |||||||||

| 4. | Registry of Members | Yes | 2 | 0 | ||||||||||

| 5. | Share and transfer book | Yes | 2 | 0 | ||||||||||

| 6. | Cooperative copy of Certificate of Registration, Articles of Cooperation and By-Laws, Certificate of Compliance | Yes | 1 | 0 | ||||||||||

| 7. | Compilation of Board Resolutions | Yes | No | 2 | 0 | |||||||||

| 8. | Treasurer's and Other Periodic Report | Yes | 1 | 0 | ||||||||||

| 9. | Certified List of Members entitled to vote as determined by the BOD | Yes | 1 | 0 | ||||||||||

| 10. | Cooperative Seal | Yes | 1 | 0 | ||||||||||

| 11. | The BOD's decisions are disseminated in written form within 7 days or as stated in the policy. | Yes | 1 | 0 | ||||||||||

| 12. | Contracts, MOA, other docs (specify) ______ | Yes | 1 | 0 | ||||||||||

| A.11 Treasurer | ||||||||||||||

| 1. | Appointment Paper/Renewal of Appointment supported by Board Resolution | Yes | 1 | 0 | ||||||||||

| 2. | Duly signed Oath of Office | Yes | 1 | 0 | ||||||||||

| 3. | Cash Book | Yes | 2 | 0 | ||||||||||

| 4. | Bank Books | Yes | 1 | 0 | ||||||||||

| 5. | Cooperative securities (investment, titles, and other negotiable instruments) | Yes | 1 | 0 | ||||||||||

| 6. | Cash Position Report | Yes | 2 | 0 | ||||||||||

| 7. | Petty Cash Book | Yes | No | 1 | 0 | |||||||||

| A.12 General Manager / C.E.O. / or its equivalent | ||||||||||||||

| 1. | Appointment paper | Yes | No | 1 | 0 | |||||||||

| 2. | Policy Implementation Files | Yes | No | 1 | 0 | |||||||||

| 3. | Monthly and Annual Management report | Yes | No | 2 | 0 | |||||||||

| 4. | Implementation of the following: | |||||||||||||

| a. | Board's Decisions | Yes | No | 1 | 0 | |||||||||

| b. | Risk Management Plan | Yes | No | 1 | 0 | |||||||||

| c. | Communication Protocol | Yes | No | 1 | 0 | |||||||||

| B. Management Reports/Record | ||||||||||||||

| B.1 Organizational/Operational Structure | ||||||||||||||

| 1. | Organizational Chart | Yes | No | 1 | 0 | |||||||||

| 2. | Management Structure | Yes | No | 1 | 0 | |||||||||

| 3. | Functional Statement of each unit/ departments/sections | Yes | No | 1 | 0 | |||||||||

| B.2 Systems and Procedures | ||||||||||||||

| 1. | Complete BIR registered books of accounts or loose leaf or computerized accounting system and Copy of Certificate of Registration from BIR, if using Computerized Recording System | Yes | No | 2 | 0 | |||||||||

| 2. | Internal Control Systems | |||||||||||||

| 2.1 | Codified Approving and Signing Authority (CASA) | Yes | No | 1 | 0 | |||||||||

| 2.2 | Imprest System | Yes | No | 1 | 0 | |||||||||

| 2.3 | Bond of accountable officers | Yes | No | 1 | 0 | |||||||||

| 2.4 | Record preservation (maintenance and disposal/archiving plan | Yes | No | 1 | 0 | |||||||||

| 2.5 | Risk Assessment System | Yes | No | 1 | 0 | |||||||||

| 3. | Manual of Operation and Policies, which included among others, the following: | |||||||||||||

| 3.1 | Business Operation Manual | Yes | No | 2 | 0 | |||||||||

| 3.2 | Accounting Manual | Yes | No | 2 | 0 | |||||||||

| 3.3 | Human Resource Policy Manual | Yes | No | 2 | 0 | |||||||||

| 3.4 | Access of documents/books/records as required under Art. 52 and 83 of RA9520 by the members | Yes | No | 1 | 0 | |||||||||

| 3.5 | Business Continuity/Contingency Manual | Yes | No | 1 | 0 | |||||||||

| 4. | Copies of Guidelines implementing the approved policies | Yes | No | 1 | 0 | |||||||||

| 5. | Business Continuity/contingency Plan | Yes | No | 1 | 0 | |||||||||

| 6. | Communication and Feedback Mechanism | Yes | No | 1 | 0 | |||||||||

| B.3 Human Resource Records | ||||||||||||||

| 1. | Contract/Certificate of employment | Yes | No | 1 | 0 | |||||||||

| 2. | Job Description | Yes | No | 1 | 0 | |||||||||

| 3. | Qualification Standards | Yes | No | 1 | 0 | |||||||||

| 4. | Personnel File | Yes | No | 1 | 0 | |||||||||

| B.4 Performance Evaluation | ||||||||||||||

| 1. | Standards of measurement | Yes | No | 1 | 0 | |||||||||

| 2. | Rating of all officers and management staff | Yes | No | 1 | 0 | |||||||||

| B.5 Compensation and Benefits | ||||||||||||||

| 1. | Salary scaling program | Yes | No | 1 | 0 | |||||||||

| 2. | Incentive and Reward Program | Yes | No | 1 | 0 | |||||||||

| 3. | Leave Incentives Program | Yes | No | 1 | 0 | |||||||||

| 4. | Retirement Plan/Program/Package | Yes | No | 1 | 0 | |||||||||

| B.6 Compliance to Government Requirements | ||||||||||||||

| 1. | Certificate of Compliance (CDA) | Yes | No | 2 | 0 | |||||||||

| 2. | Certificate of Tax Exemption (BIR) | Yes | No | 2 | 0 | |||||||||

| 3. | Annual Registration with BIR | Yes | No | 1 | 0 | |||||||||

| 4. | Registration (SSS) | Yes | No | 1 | 0 | |||||||||

| 5. | Registration (PHILHEALTH) | Yes | No | 1 | 0 | |||||||||

| 6. | Registration (PAG-IBIG) | Yes | No | 1 | 0 | |||||||||

| 7. | Business Permit (LGU) | Yes | No | 1 | 0 | |||||||||

| 8. | Annual Tax Incentive Report (CDA) | Yes | No | NA | 1 | 0 | ||||||||

| 9. | Other agencies, specify the document, if applicable _________ | Yes | No | NA | 0 | |||||||||

| C. | Partnership, Networking and Linkaging | |||||||||||||

| 1. | The cooperative is a member of the following: | |||||||||||||

| a. | Cooperative federation/union | Yes | No | 2 | 0 | |||||||||

| b. | Local special bodies (Not applicable if there are no Local Special Bodies in the locality) | Yes | No | NA | 1 | 0 | ||||||||

| c. | Cooperative Development Councils | Yes | No | 1 | 0 | |||||||||

| 2. | The board participates and supports the activities of the cooperative federation/union/local special bodies (LGU) and Civic Organizations or Peoples Organizations | Yes | No | 1 | 0 | |||||||||

| D. | Membership Participation | |||||||||||||

| 1. | Presence of at least 10% in new set of officers yearly. | Yes | No | 1 | 0 | |||||||||

| 2. | At least 50% of the total membership attended/participated in at least one activity of the cooperative, such as seminars/ trainings, community programs and activities, etc. except GA Meetings. | Yes | No | 2 | 0 | |||||||||

| TOTAL POINTS | 100 | 1 | ||||||||||||

| ANNEX B - FINANCIAL PERFORMANCE STANDARDS FOR PRIMARY AND OTHER SPECIAL TYPE COOPERATIVES |

||||||||||||||

| Source/Notes | ||||||||||||||

| Summary of fields to be supplied by coop | ||||||||||||||

| Formula | Account | Amount | ||||||||||||

| 1.2 Quick Asset | Legal Policy Reserves | *this account is for Insurance Cooperatives only | To be provided by the coop | |||||||||||

| 1.3 Solvency | Impaired Assets | To be provided by the coop | ||||||||||||

| 1.5 Capital Adequacy Rate | Unbooked Allowance for Impairment of Assets | To be provided by the coop | ||||||||||||

| 2.1 Asset turn over, 3.1 Administrative Efficiency, 4.1 Return on Assets |

Total Assets, previous year | To be provided by the coop | ||||||||||||

| 2.2.1 Accounts Receivable turn-over | Accounts Receivable, previous year | To be provided by the coop | ||||||||||||

| 2.2.2 Loan Receivable Turn Over | Loans Receivable previous year | To be provided by the coop | ||||||||||||

| 2.2.3 Service Receivable Turn Over | Service Receivable previous year | To be provided by the coop | ||||||||||||

| 3.2 Cost of External Borrowing Rate | Loans Payable, previous year | To be provided by the coop | ||||||||||||

| 3.3 Cost of Borrowings from Members | Other Financing Charges-Interest on Revolving Capital Payable | To be provided by the coop | ||||||||||||

| 3.3 Cost of Borrowings from Members | Deposit Liabilities, previous year | To be provided by the coop | ||||||||||||

| 3.3 Cost of Borrowings from Members | Revolving Capital Payable, previous year | To be provided by the coop | ||||||||||||

| 3.6 Growth in Members' Contribution, 4.2 Return on Member's share |

Paid up Capital-Common, previous year | To be provided by the coop | ||||||||||||

| 3.6 Growth in Members' Contribution, 4.2 Return on Member's share |

Paid up Capital- Preferred, previous year | To be provided by the coop | ||||||||||||

| 3.6 Growth in Members' Contribution, 4.2 Return on Member's share |

Deposit for Share Capital Subcription, previous year | To be provided by the coop | ||||||||||||

| 4.2 Return on Member's share | Treasury Shares - Common, previous year | To be provided by the coop | ||||||||||||

| 4.2 Return on Member's share | Treasury Shares - Preferred, previous year | To be provided by the coop | ||||||||||||

| 5.1 Percentage of non-earning asset over total assets | Other Non-Earning Assets | To be provided by the coop | ||||||||||||

| INDICATORS | FORMULA/RATIO | STANDARD POINT | Total Pts. | Accounts under CAFSIS | Amount | Coop's Point | PURPOSE | |||||||

| 1 | STABILITY | |||||||||||||

| 1.1 Liquidity | Current Assets | Above 500% | 0 | 4 | Total Current Assets | 8,000,000 | Measures the cooperative's ability to meet its short term obligations as it falls due | taken from AFS - SFC Schedule | ||||||

| Current Liabilities | Above 400% to 500% | 1 | ||||||||||||

| Above 300% to 400% | 2 | Total Current Liabilities | 10,000,000 | taken from AFS - SFC Schedule | ||||||||||

| Above 150% to 300% | 3 | |||||||||||||

| 100% to 150% | 4 | |||||||||||||

| Below 100% to 95% | 3 | Liquidity Rate | 80% | 0 | final answer for rating | formula | ||||||||

| Below 95% to 90% | 2 | |||||||||||||

| Below 90% to 85% | 1 | |||||||||||||

| Below 85% | 0 | |||||||||||||

| 1.2 Quick Asset | Liquid assets | 200% and above | 3 | 3 | Liquid Assets: | Measures the cooperative's ability to pay its current liabilities using its quick assets. | ||||||||

| Current Liabilities - Legal Policy Reserves | 150% to below 200% | 2 | Cash and Cash Equivalents | 500,000 | taken from AFS - SFC | |||||||||

| 100% to below 150% | 1 | Financial Assets | 10,500,000 | taken from AFS - SFC | ||||||||||

| Below 100% | 0 | Total Liquid Assets | 11,000,000 | formula | ||||||||||

| Current Liabilities | 11,000,000 | taken from AFS - SFC | ||||||||||||

| Less: Legal Policy Reserves | - | =D8 | from new table above required to be supplied by coop | |||||||||||

| Net | 11,000,000 | formula | ||||||||||||

| Quick Ratio | 100% | 1 | final answer for rating | formula | ||||||||||

| 1.3 Solvency | (Assets + Allowances for probable losses+Allowance for Impaired Assets) - [ (Total liabilities - Deposit liabilities)+(Past due receivables+restructured receivables + receivables under litigation+ Impaired Assets) ] | 110 and above | 5 | 5 | Total Assets | Measures the degree of protection that the cooperative has for members savings and share capital contribution in the event of liquidation of the cooperative's assets and liabilities | taken from AFS - SFC | |||||||

| 100 to below 110 | 3 | Allowance for Probable Losses on Accounts Receivable | taken from AFS - SFC Schedule | |||||||||||

| Below 100 | 1 | Allowance for Probable Losses on Loans Receivable | taken from AFS - SFC Schedule | |||||||||||

| Deposit liabilities + Share capital + Deposit for SC Subscription | Allowance for Impaired Assets | taken from AFS - SFC Schedule | ||||||||||||

| Sub-total | - | formula | ||||||||||||

| Total Liabilities | taken from AFS - SFC | |||||||||||||

| Less: Deposit Liabilities | taken from AFS - SFC | |||||||||||||

| Add: Past Due Accounts Receivable | taken from AFS - SFC Schedule | |||||||||||||

| Past Due Loans Receivable | taken from AFS - SFC Schedule | |||||||||||||

| Accounts Receivable Restructured | taken from AFS - SFC Schedule | |||||||||||||

| Loans Receivable Restructured | taken from AFS - SFC Schedule | |||||||||||||

| Accounts Receivable under litigation | taken from AFS - SFC Schedule | |||||||||||||

| Loans Receivable under litigation | taken from AFS - SFC Schedule | |||||||||||||

| Impaired Assets | - | =D9 | from new table above required to be supplied by coop | |||||||||||

| Sub-total | - | formula | ||||||||||||

| Total | - | formula | ||||||||||||

| Deposit Liabilites | taken from AFS - SFC | |||||||||||||

| Paid up Capital- Preferred | taken from AFS - SFC | |||||||||||||

| Paid up Capital-Common | taken from AFS - SFC | |||||||||||||

| Total Paid up Capital | - | formula | ||||||||||||

| Deposit for Share Capital Subscription | taken from AFS - SFC | |||||||||||||

| Total | - | formula | ||||||||||||

| Solvency Rate | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| 1.4 Net Institutional Capital | Reserve Fund + [(Allowance for Probable Losses on Receivables) - (Past Due Receivables + Receivables in Litigation)] | 10% and above | 3 | 3 | General Reserve Fund | Measures the level of institutional capital to absorb potential losses | taken from AFS - SFC Schedule | |||||||

| Total Assets | 7% to below 10% | 2.5 | Allowance for Probable Losses on Receivable | taken from AFS - SFC Schedule | ||||||||||

| 5% to below 7% | 2 | |||||||||||||

| 3% to below 5% | 1.5 | Less: Past Due Accounts Receivable | taken from AFS - SFC Schedule | |||||||||||

| 1% to below 3% | 1 | Past Due Loans Receivable | taken from AFS - SFC Schedule | |||||||||||

| Below 1% | 0 | Accounts Receivable in litigation | taken from AFS - SFC Schedule | |||||||||||

| Loans Receivable in litigation | taken from AFS - SFC Schedule | |||||||||||||

| Total | - | formula | ||||||||||||

| Total Assets | taken from AFS - SFC | |||||||||||||

| Net institutional Capital | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| 1.5 Capital Adequacy Rate | Net Worth (Equity - unbooked allowance for probable loss-unbooked allowance for impairment of Assets) | 8% and above | 4 | 4 | Net Worth: | Measures the sufficiency of the capital to cover the risk assets | ||||||||

| 6% to less than 8% | 3 | Paid up Capital- Preferred | taken from AFS - SFC | |||||||||||

| 4% to less than 6% | 2 | Paid up Capital-Common | taken from AFS - SFC | |||||||||||

| Risk Assets | 2% to less than 4% | 1 | Deposit for Share Capital Subscription | taken from AFS - SFC | ||||||||||

| below 2% | 0 | Total Paid up Capital | - | formula | ||||||||||

| Donations and Grants | taken from AFS - SFC | |||||||||||||

| Reserve Fund | taken from AFS - SFC Schedule | |||||||||||||

| Revaluation Surplus | taken from AFS - SFC | |||||||||||||

| Less: Unbooked Allowances | - | =H127 | taken from here | |||||||||||

| Total Net Worth | - | formula | ||||||||||||

| Sufficient Allowance for Probable Loss | Risk Assets: | |||||||||||||

| 35% and 100% of past due receivables based on PAR | Total Assets | taken from AFS - SFC | ||||||||||||

| Less: Cash on Hand | taken from AFS - SFC Schedule | |||||||||||||

| Petty Cash Fund | taken from AFS - SFC Schedule | |||||||||||||

| Revolving Fund | taken from AFS - SFC Schedule | |||||||||||||

| Change Fund | taken from AFS - SFC Schedule | |||||||||||||

| Property, Plant and Equipment (net of depreciation) | taken from AFS - SFC Schedule | |||||||||||||

| Total Risk Assets | - | formula | ||||||||||||

| Capital Adequacy Rate | #DIV/0! | 4 | final answer for rating | |||||||||||

| **Unbooked Allowance for probable losses on loans | Unbooked Allowance - insufficient provisioning of allowance for probable losses based on PAR | |||||||||||||

| Past Due Loans Receivable - 12 months past due | taken from AFS - SFC Schedule | |||||||||||||

| Past Due Accounts Receivable -12 months past due | taken from AFS - SFC Schedule | |||||||||||||

| Total Past Due Loans - 12 months | - | formula | ||||||||||||

| Required Allowance - 12 months (35%) | - | formula | ||||||||||||

| Past Due Loans Receivable - over 12 months past due | taken from AFS - SFC Schedule | |||||||||||||

| Past Due Accounts Receivable - over 12 months past due | taken from AFS - SFC Schedule | |||||||||||||

| Total Past Due Loans - over 12 months | - | formula | ||||||||||||

| Required Allowance - over 12 months (100%) | - | formula | ||||||||||||

| Total Required Allowance | - | formula | ||||||||||||

| Allowance for Probable Losses on Loans Receivable | taken from AFS - SFC Schedule | |||||||||||||

| Allowance for Probable Losses on Accounts Receivable | taken from AFS - SFC Schedule | |||||||||||||

| Total Allowance for Probable Losses | - | formula | ||||||||||||

| Unbooked Allowance | - | formula | ||||||||||||

| Unbooked Allowance for Impairment of Assets | - | =D10 | from new table above required to be supplied by coop | |||||||||||

| Total unbooked allowance | - | formula | ||||||||||||

| SUB-TOTAL, STABILITY | 19 | 5 | ||||||||||||

| 2 | TURN-OVER RATIO | |||||||||||||

| 2.1 Asset turn over | Gross Revenue | Above 10.5 | 2 | 2 | Gross Revenue | Measures how efficiently the cooperative uses its asset to generate revenue | taken from AFS - SO Schedule | |||||||

| Average Total Assets | 10.5 and below | 1 | Average Total Assets | |||||||||||

| Zero or negative | 0 | Total Assets, previous year | - | =D11 | from new table above required to be supplied by coop | |||||||||

| Total Assets, current year | taken from AFS - SFC | |||||||||||||

| (based on csimarket.com/screening/index.php?s=at&pageS=1&fis=) | Average Total Asset (divided by 2) | - | formula | |||||||||||

| Asset Turn Over | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| 2.2 Receivable turn-over | 4 | 0 | Average rating for 2.2 | to get the ratings on 2.2 get the ratings of 2.2.1, 2.2.2, and 2.2.3 then divide by the number of denominator answered | ||||||||||

| 2.2.1 Accounts Receivable turn-over | Net Credit Sales | 8 times and more | 4 | 4 | Net Credit Sales | Measures the number of times accounts receivables are collected within the reporting period | taken from capris - volume of business | engaged in consumer/marketing/trading | ||||||

| Average Accounts Receivables | 6 to below 8 | 3 | Average Accounts Receivable | - | =H147 | taken from here | ||||||||

| (For Consumer, Marketing) | 3 to below 6 | 2 | Receivable turn-over | #DIV/0! | 0.00 | final answer for rating | ||||||||

| 0.1 to Below 3 | 1 | |||||||||||||

| Zero or negative | 0 | Average Accounts Receivable: | ||||||||||||

| Accounts Receivable, previous year | - | =D12 | from new table above required to be supplied by coop | |||||||||||

| Accounts Receivable, current year | taken from AFS - SFC Schedule | |||||||||||||

| Average Accounts Receivable | - | formula | ||||||||||||

| 2.2.2 Loan Receivable Turn Over | Loan Releases | 4 times and more | 4 | 4 | Loan Releases (from CAPR - volume of business) | Measures the number of times loans receivables are collected within the reporting period | taken from CAPRIS - Volume of business -M | engaged in credit | ||||||

| (for Credit, Agriculture & ARB) | Average Loans Receivable | 3 to below 4 | 3 | Average Loans Receivable | - | =H157 | taken from here | |||||||

| 2 to below 3 | 2 | Loans Receivable turn-over | #DIV/0! | 0.00 | final answer for rating | formula | ||||||||

| above 0 to Below 2 | 1 | |||||||||||||

| Zero or negative | 0 | Average Loans Receivable: | ||||||||||||

| Loans Receivable previous year | - | =D13 | from new table above required to be supplied by coop | |||||||||||

| Loan Releases - principal amount of loans granted to members within the reporting period | Loans Receivable current year | taken from AFS - SFC Schedule | ||||||||||||

| Average Loans Receivable: | - | formula | ||||||||||||

| 2.2.3 Service Receivable Turn Over | Gross Receipts | engaged in service | ||||||||||||

| (For Service & Labor Service Coop) | 9 and above | 4 | 4 | Gross Receipts | taken from AFS - SO Schedule | |||||||||

| Average Service Receivable | 8 to below 9 | 3 | Average Service Receivable | - | =H169 | taken from here | ||||||||

| 7 to below 8 | 2 | Service Receivable Turn-over | #DIV/0! | 0.00 | final answer for rating | |||||||||

| Below 7 | 1 | |||||||||||||

| Gross Receipts - refers to the | Zero or negative | 0 | Average Service Receivable: | |||||||||||

| amount for the year taken from CAPRIS | Service Receivable previous year | - | =D14 | from new table above required to be supplied by coop | ||||||||||

| Service Receivable current year | taken from AFS - SFC Schedule | |||||||||||||

| Average Service Receivable: | - | formula | ||||||||||||

| SUB-TOTAL, TURN-OVER RATIO | 6 | 0 | ||||||||||||

| 3 | EFFICIENCY | Administrative cost - (members benefit expense+ social service expense) | ||||||||||||

| 3.1 Administrative Efficiency | Below 10% | 4 | 4 | Total Administrative Cost | Measures the cost of efficiently managing the cooperative's assets | taken from AFS - SO Schedule | ||||||||

| Average total assets* | 10% to below 15% | 3 | Less Members Benefit Expense | taken from AFS - SO Schedule | ||||||||||

| 15% to below 20% | 2 | Social Service Expense | taken from AFS - SO Schedule | |||||||||||

| *Average total assets = (Beginning Total Asset + Ending Total Asset)/2 | 20% to below 25% | 1 | Total | - | formula | |||||||||

| Above 25% | 0 | |||||||||||||

| Average Total Assets | ||||||||||||||

| Total Assets, previous year | - | =D11 | required to be encoded by coop | |||||||||||

| Total Assets, current year | taken from AFS - SFC | |||||||||||||

| Average Total Asset (divided by 2) | - | formula | ||||||||||||

| Administrative Efficiency | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| 3.2 Cost of External Borrowing Rate | Interest on Borrowings+ Other Borrowing Costs | Below inflation rate | 3 | 3 | Interest Expense on Borrowings | Measures the efficiency of borrowings in financing its operation | taken from AFS - SO Schedule | |||||||

| Average Total Loans Payable | Within inflation rate | 2 | Other Financing Charges | taken from AFS - SO Schedule | ||||||||||

| Above inflation rate | 1 | Total | - | formula | ||||||||||

| Inflation rate as of _____ (to be updated annually) | 3.3% | Loans Payable, previous year | - | =D15 | from new table above required to be supplied by coop | |||||||||

| Loans Payable, current year | taken from AFS - SFC | |||||||||||||

| Average Loans Payable | - | formula | ||||||||||||

| Cost of External Borrowing Rate | #DIV/0! | 3 | final answer for rating | formula | ||||||||||

| 3.3 Cost of Borrowings from Members | Interest on Deposits+Interest on Revolving Capital Payable | Below inflation rate | 3 | 3 | Interest Expense on Deposit Liabilities | Measures the efficiency of borrowings from members in financing its operation | taken from AFS - SO Schedule | |||||||

| Average Total Deposit Liabilities + Average Revolving Capital Payable | Within inflation rate | 2 | Other Financing Charges-Interest on Revolving Capital Payable | - | =D16 | from new table above required to be supplied by coop | ||||||||

| Above inflation rate | 1 | Total | - | |||||||||||

| Deposit Liabilities, previous year | - | =D17 | from new table above required to be supplied by coop | |||||||||||

| Inflation rate as of _____ (to be updated annually) | 3.3% | Deposit Liabilities, current year | taken from AFS - SFC | |||||||||||

| Average Deposit Liabilities | - | formula | ||||||||||||

| Revolving Capital Payable, previous year | - | =D18 | from new table above required to be supplied by coop | |||||||||||

| Revolving Capital Payable, current year | taken from AFS - SFC | |||||||||||||

| Average Revolving Capital Payable | - | formula | ||||||||||||

| Total Averages | - | formula | ||||||||||||

| Cost of Borrowing from Members Rate | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| 3.4 Cost per volume of Business | Total Cost - Members' Benefit Expenses-Social Service Expenses | 25 cents and below | 3 | 3 | Financing Cost | Measures the efficiency in managing the cooperative's business | taken from AFS - SO | |||||||

| 26 to 32 cents | 2 | Selling/Administrative Cost | taken from AFS - SO | |||||||||||

| Total Volume of Business | 33 to 39 cents | 1 | Administrative Cost | taken from AFS - SO | ||||||||||

| 40 to 46 cents | 0.5 | Total Cost | - | formula | ||||||||||

| 47 cents and above | 0 | Less: Members' Benefit Expense | taken from AFS - SO Schedule | |||||||||||

| Less: Social Benefit Expense | taken from AFS - SO Schedule | |||||||||||||

| Net | - | formula | ||||||||||||

| Loan Releases | taken from CAPRIS - Volume of business | |||||||||||||

| Net Sales | taken from AFS - SO Schedule | |||||||||||||

| Gross Service Revenue | ||||||||||||||

| Total Volume of Business | - | formula | ||||||||||||

| Cost per Volume of Business | #DIV/0! | 0 | final answer for rating | |||||||||||

| 3.5 Extent of Volume of Business | Total volume of business | 100% and above | 5 | 5 | Loan Releases | Measures the ability of the cooperative to use the assets to generate business | taken from CAPRIS - Volume of business | |||||||

| Average Total assets | 75% to below 100% | 4 | Net Sales | taken from AFS - Schedule - SO | ||||||||||

| 50% to below 75% | 3 | Gross Service Revenue | taken from AFS - Schedule - SO | |||||||||||

| 25% to below 50% | 2 | Total Volume of Business | - | formula | ||||||||||

| 5%to below 25% | 1 | Average Total Asset | - | =H135 | taken from here | |||||||||

| below 5% | 0 | Extent of Volume of Business | #DIV/0! | 0 | final answer for rating | |||||||||

| 3.6 Growth in Members' Contribution | Paid up Capital End - Paid-up Capital, Beg. | above 12% | 5 | 5 | Paid up Capital-Common, current year | Measures the ability of the cooperative to encourage members to increase their capital contribution | taken from AFS - SFC | |||||||

| Paid up Capital Beg. | above 10% to 12% | 4 | Paid up Capital- Preferred, current year | taken from AFS - SFC | ||||||||||

| avove 8% to 10% | 3 | Deposit for Share Capital Subcription, current year | taken from AFS - SFC | |||||||||||

| above 6% to 8% | 2 | Total Paid-up Capital, current year | - | formula | ||||||||||

| above 4% to 6% | 1 | |||||||||||||

| 4% and below | 0 | Paid up Capital-Common, previous year | - | =D19 | from new table above required to be supplied by coop | |||||||||

| Paid up Capital- Preferred, previous year | - | =D20 | from new table above required to be supplied by coop | |||||||||||

| Deposit for Share Capital Subcription, previous year | - | =D21 | from new table above required to be supplied by coop | |||||||||||

| Total Paid-up Capital, previous year | - | formula | ||||||||||||

| Net | - | formula | ||||||||||||

| Total Paid-up Capital, previous year | - | =H237 | taken from here | |||||||||||

| Growth in Membership | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| 3.7 Delinquency Rate | Balance of Loans/Accounts Receivables with one day Missed Payment | 5% and below | 5 | 5 | Past Due Accounts Receivable | Measures the riks of default in the portfolio or the rate of uncollectible accounts | taken from AFS - SFC Schedule | |||||||

| above 5% to 10% | 4 | Past Due Loans Receivable | taken from AFS - SFC Schedule | |||||||||||

| Total Loans/Accounts Receivable Outstanding | above 10% to 15% | 3 | Accounts Receivable in Litigation | taken from AFS - SFC Schedule | ||||||||||

| above 15% to 20% | 2 | Loans Receivable in Litigation | taken from AFS - SFC Schedule | |||||||||||

| above 20% to 25% | 1 | Total | - | formula | ||||||||||

| above 25% | 0 | |||||||||||||

| Total Accounts Receivable | taken from AFS - SFC Schedule | |||||||||||||

| Total Loans Receivable | taken from AFS - SFC Schedule | |||||||||||||

| Total Receivables | - | formula | ||||||||||||

| Delinquency Rate | #DIV/0! | 5 | final answer for rating | formula | ||||||||||

| 3.8 Adequacy of Provisioning of APLL (over 12 months past due) | Total amount of allowance | 100% | 5 | 5 | Allowance for Probable Losses on Accounts Receivable | Measures the adequacy of the allowance for expected losses on loans for over 12months past due | taken from AFS - SFC Schedule | |||||||

| Total outstanding balance of loans/accounts receivable over 12 months past due using PAR | 80% to less than 100% | 4 | Allowance for Probable Losses on Loans Receivable | taken from AFS - SFC Schedule | ||||||||||

| 60% to less than 80% | 3 | Total Amount of Allowance | - | formula | ||||||||||

| 35% to less than 60% | 2 | |||||||||||||

| 10% to less than 35% | 1 | Past Due Accounts Receivable - over 12 months | taken from AFS - SFC Schedule | |||||||||||

| less than 10% | 0 | Past Due Loans Receivable - over 12 months | taken from AFS - SFC Schedule | |||||||||||

| Total Past Due Receivable over 12 months | - | formula | ||||||||||||

| Adequacy of provisioning of APLL over 12 months | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| 3.9 Adequacy of Provisioning of 1 to 12 months past due | (Total amount of allowance* - Required amount of allowance for loans over 12 months past due using PAR) | 35% | 5 | 5 | Allowance for Probable Losses on Accounts Receivable | taken from AFS - SFC Schedule | ||||||||

| 25% to less than 35% | 4 | Allowance for Probable Losses on Loans Receivable | taken from AFS - SFC Schedule | |||||||||||

| Total outstanding balance of loans/accounts receivable 1 to 12 months past due using PAR | 17% to less than 25% | 3 | Total Amount of Allowance | - | ||||||||||

| 9% to less than 17% | 2 | Less Total Past Due Receivable over 12 months | - | =H261 | taken from here | |||||||||

| 1% to less than 9% | 1 | Amount of Allowance available for 1-12 months past due | - | formula | ||||||||||

| less than 1% | 0 | |||||||||||||

| Past Due Accounts Receivable -30 to 360 days | taken from AFS - SFC Schedule | |||||||||||||

| Past Due Loans Receivable - 30 to 360 days | taken from AFS - SFC Schedule | |||||||||||||

| Total Past Due Loans Receivable - 1 to 12 months past due | - | formula | ||||||||||||

| Adequacy of provisioning of APLL for 1 to 12 months | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| SUB-TOTAL, EFFICIENCY | 38 | 8 | ||||||||||||

| 4 | PROFITABILITY | Net surplus before Other Items | 20% and above | 5 | 5 | Net Surplus before Other Items | Measures the capacity of assets to generate income | taken from AFS - SO | ||||||

| 4.1 Return on Assets | Average Total Assets | 15% to below 20% | 4 | Average Total Assets | - | =H285 | taken from here | |||||||

| 10% to below 15% | 3 | Return on Assets | #DIV/0! | 0 | final answer for rating | formula | ||||||||

| 5% to below 10% | 2 | |||||||||||||

| Below 5% | 1 | |||||||||||||

| Average Total Assets | ||||||||||||||

| Total Assets, previous year | - | =D11 | required to be encoded by coop | |||||||||||

| Total Assets, current year | taken from AFS - SFC | |||||||||||||

| Average Total Asset | - | formula | ||||||||||||

| 4.2 Return on Member's share | Amount Allocated for Interest on Share Capital | Higher than the inflation rate | 5 | 5 | Amount Allocated for Interest on Share Capital | Measures the earning capacity of member's share capital | taken from AFS - SO | |||||||

| Average Paid up Share Capital + Deposit for Share Capital Subscription - Treasury Shares | Within the inflation rate | 4 | ||||||||||||

| 2 points below the inflation rate | 3 | Paid up Capital- Preferred, previous year | - | =D20 | required to be encoded by coop | |||||||||

| 3 points or more below the inflation rate | 2 | Paid up Capital-Common, previous year | - | =D19 | required to be encoded by coop | |||||||||

| Net Loss | 0 | Deposit for Share Capital Subcription, previous year | - | =D21 | required to be encoded by coop | |||||||||

| Less: Treasury Shares - Common, previous year | - | =D22 | from new table above required to be supplied by coop | |||||||||||

| Inflation rate as of _____ (to be updated annually) | 3.3% | Treasury Shares - Preferred, previous year | - | =D23 | from new table above required to be supplied by coop | |||||||||

| Total, Previous Year | - | formula | ||||||||||||

| Paid up Capital- Preferred, current year | taken from AFS - SFC Schedule | |||||||||||||

| Paid up Capital-Common, current year | taken from AFS - SFC Schedule | |||||||||||||

| Deposit for Share Capital Subcription, current year | taken from AFS - SFC | |||||||||||||

| Less Treasury Shares - Common, current year | taken from AFS - SFC Schedule | |||||||||||||

| Treasury Shares - Preferred, current year | taken from AFS - SFC Schedule | |||||||||||||

| Total, Current Year | - | formula | ||||||||||||

| Average Paid up Share Capital | - | formula | ||||||||||||

| Return on Member's Share | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| 4.3 Rate of Net Surplus | Net Surplus | 30% and above | 5 | 5 | Net Surplus | Measures the capacity of the cooperative to generate surplus | taken from AFS - SO | |||||||

| Gross Revenue | 25% to below 30% | 4 | Gross Revenue/Margin | taken from AFS - SO Schedule | ||||||||||

| 10% to below 25% | 3 | Rate of net surplus | #DIV/0! | 0 | final answer for rating | formula | ||||||||

| 5% to below 10% | 2 | |||||||||||||

| below 5% | 1 | |||||||||||||

| In case of break-even or net loss | 0 | |||||||||||||

| SUB-TOTAL, PROFITABILITY | 15 | 0 | ||||||||||||

| 5 | STRUCTURE OF ASSETS | |||||||||||||

| 5.1 Percentage of non-earning asset over total assets | Non-Earning Assets | 5% and below | 5 | 5 | Non Earning Assets | Measures the percentage of total assets that are not producing income | ||||||||

| Total Assets | above 5% to 8% | 4 | Cash on Hand | taken from AFS - SFC Schedule | ||||||||||

| above 8% to 10% | 3 | Petty Cash Fund | taken from AFS - SFC Schedule | |||||||||||

| above 10% to 12% | 2 | Revolving Fund | taken from AFS - SFC Schedule | |||||||||||

| above 12% to 14% | 1 | Change Fund | taken from AFS - SFC Schedule | |||||||||||

| above 14% | 0 | Supplies | taken from AFS - SFC Schedule | |||||||||||

| Prepaid Expenses | taken from AFS - SFC Schedule | |||||||||||||

| Property, Plant and Equipment (net) | taken from AFS - SFC Schedule | |||||||||||||

| Other Non-Earning Assets | - | =D24 | from new table above required to be supplied by coop | |||||||||||

| Total Non-Earning Assets | - | formula | ||||||||||||

| Total Assets | taken from AFS - SFC | |||||||||||||

| % of Non-Earning Asset over total Assets | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| 5.2 Percentage of Investment | Total Investments | 0% to 5% | 4 | 4 | Investments in equity and debt instruments (current and long term) | Measures the degree of assets devoted to investments | taken from AFS - SFC | |||||||

| Net Worth | above 5% to 10% | 3 | Investments Property less ROPA | taken from AFS - SFC | ||||||||||

| above 10% to 15% | 2 | Investments in Subsidiary, Associates and Joint Ventures | taken from AFS - SFC | |||||||||||

| above 15% to 20% | 1 | Total Investments | - | formula | ||||||||||

| above 20% | 0 | |||||||||||||

| Net Worth: | ||||||||||||||

| Paid up Capital- Preferred | taken from AFS - SFC | |||||||||||||

| Paid up Capital-Common | taken from AFS - SFC | |||||||||||||

| Deposit for Share Capital Subscription | taken from AFS - SFC | |||||||||||||

| Total Paid up Capital | - | formula | ||||||||||||

| Donations and Grants | taken from AFS - SFC | |||||||||||||

| Reserve Fund | taken from AFS - SFC Schedule | |||||||||||||

| Revaluation Surplus | ||||||||||||||

| Less: Unbooked Allowance for probable losses on Loans | - | =H124 | taken from here | |||||||||||

| Total Net Worth | - | formula | ||||||||||||

| Percentage of Investment | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| 5.3 Extent of Assets financed by Deposit Liabilities | Total Deposit Liabilities | 50% and above | 5 | 5 | Saving Deposits | Measures the extent of assets financed by deposit liabilities | taken from AFS - SFC Schedule | |||||||

| Total Assets | 40% to below 50% | 4 | Time Deposits | taken from AFS - SFC Schedule | ||||||||||

| 30% to below 40% | 3 | Total Deposit Liabilities | - | formula | ||||||||||

| 20% to below 30% | 2 | Total Asset | taken from AFS - SFC | |||||||||||

| 10% to below 20% | 1 | Extent of Assets financed by Deposit Liabilities | #DIV/0! | 0 | final answer for rating | formula | ||||||||

| Below 10% | 0 | |||||||||||||

| 5.4 Extent of Total Assets to External Borrowings and Statutory Reserves | External Borrowings + Statutory Reserves | No borrowings | 3 | 3 | Loans Payable - current | Measures the extent of assets financed by external borrowings and statutory reserve | taken from AFS - SFC Schedule | |||||||

| Total Assets | 15% and below | 2 | Loans Payable - non-current | taken from AFS - SFC Schedule | ||||||||||

| above 15% to 40% | 1 | Finance Lease - current | taken from AFS - SFC Schedule | |||||||||||

| above 40% | 0 | Finance Lease - Long term | taken from AFS - SFC | |||||||||||

| Total External Borrowings | - | formula | ||||||||||||

| Reserve Fund | taken from AFS - SFC Schedule | |||||||||||||

| Cooperative Education Training Fund | taken from AFS - SFC Schedule | |||||||||||||

| Community Development Fund | taken from AFS - SFC Schedule | |||||||||||||

| Optional Fund | taken from AFS - SFC Schedule | |||||||||||||

| Total Statutory Reserves | - | formula | ||||||||||||

| Total Assets | taken from AFS - SFC | |||||||||||||

| Extent of Borrowings | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| 5.5 Extent of Assets financed by Members' Share Capital | Paid-up share capital + Deposits for capital subscription-Treasury Shares | 50% and above | 5 | 5 | Paid up Capital- Preferred, current year | taken from AFS - SFC Schedule | ||||||||

| Total Assets | 40% to below 50% | 4 | Paid up Capital-Common, current year | Measures the degree of participation of members' share to total assets | taken from AFS - SFC Schedule | |||||||||

| 30% to below 40% | 3 | Deposit for Share Capital Subscription, current year | taken from AFS - SFC | |||||||||||

| 20% to below 30% | 2 | Total | - | formula | ||||||||||

| 10 % to below 20% | 1 | Less Treasury shares | taken from AFS - SFC Schedule | |||||||||||

| below 10% | 0 | Net | - | formula | ||||||||||

| Total Assets | taken from AFS - SFC | |||||||||||||

| Extent of Assets financed by Members' Share Capital | #DIV/0! | 0 | final answer for rating | formula | ||||||||||

| SUB-TOTAL, STRUCTURE OF ASSETS | 22 | 0 | ||||||||||||

| TOTAL POINTS | 100 | 13 | ||||||||||||

| Annex C PERFORMANCE AUDIT REPORT - SUMMARY REPORT FOR PRIMARY AND OTHER SPECIAL TYPE COOPERATIVES |

||||||||||||||||||||

| ABC Cooperative is a duly registered cooperative with the Cooperative Development Authority (CDA) under Registration No. _________ with official postal address at __________________________________________ _________________ engaging in the provision of ________________________. | ||||||||||||||||||||

| The audit was conducted by the _____________ last _____ of _______ 20____to ascertain the documents required by MC No. 2021-04 Series of 2021 issued by the CDA, a government agency in-charge in the regulation and development of cooperatives. Methodologies employed include verification of the presence of the documents, whether the document is updated, and whether it is duly approved by the CDA. Prior the conduct of the audit, a memorandum was issued to the concerned units/person at least two (2) weeks before the conduct of the audit. | ||||||||||||||||||||

| A. Governance and Management | ||||||||||||||||||||

| Summary of observations and findings are found below: | ||||||||||||||||||||

| STRONG AREAS | *summarized "Yes" responses in GMR only | |||||||||||||||||||

| Add more lines, if necessary | ||||||||||||||||||||

| AREAS TO BE IMPROVED/FOR COMPLIANCE | NEEDED ACTION | TIMELINE | *Copy per item with "No" responses as is from GMR | |||||||||||||||||

| Add more lines, if necessary | ||||||||||||||||||||

| B. Result of Financial Performance | ||||||||||||||||||||

| STEPS | STANDARD RATING | COOP'S RATING | ||||||||||||||||||

| STABILITY | 19 | 5 | ||||||||||||||||||

| TURN-OVER RATIO | 6 | 0 | ||||||||||||||||||

| EFFICIENCY | 38 | 8 | ||||||||||||||||||

| PROFITABILITY | 15 | 0 | ||||||||||||||||||

| STRUCTURE OF ASSETS | 22 | 0 | ||||||||||||||||||

| TOTAL RATING - STEPS | 100 | 13 | ||||||||||||||||||

| C. Total Points | ||||||||||||||||||||

| Total Points | ||||||||||||||||||||

| Governance and Management | x 40% | 0.4 | ||||||||||||||||||

| STEPS | x 60% | 7.8 | ||||||||||||||||||

| Grand Total | 100% | 8.20 | ||||||||||||||||||

| ADJECTIVAL RATING | ||||||||||||||||||||

| Your cooperative obtained a total rating of ____ with adjectival rating of ___________ (please refer to our M.C. 2021-__ for the matrix of adjectival rating), which means that_______. | ||||||||||||||||||||

| Prepared by: | ||||||||||||||||||||

| Audit Committee | ||||||||||||||||||||

no reviews yet

Please Login to review.