319x Filetype XLSX File size 0.06 MB Source: arpa.sog.unc.edu

Sheet 1: Cover Sheet

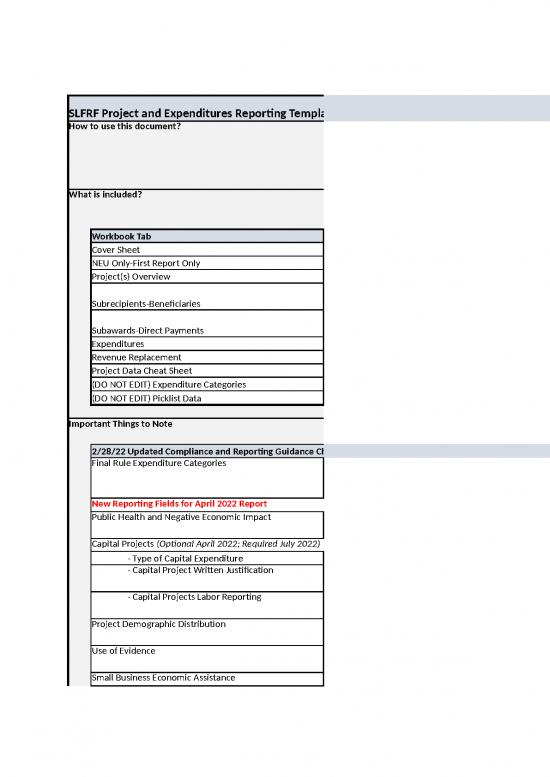

| SLFRF Project and Expenditures Reporting Template | |||

| How to use this document? | This template outlines the information that will be collected by US Treasury in the SLFRF Project and Expenditure Report. This template should be used as a guide to help you track necessary project information. You should adapt this template as necessary for the specific needs of your organization. Please reference US Treasury documents including the Final Rule, Compliance and Reporting Guidance, and Project and Expenditure Report User Guide for official guidance on reporting requirements. | ||

| What is included? | This template follows the structure of the Treasury Portal for the Project and Expenditure Report. Information on each tab is outlined below. | ||

| Workbook Tab | Purpose | ||

| Cover Sheet | General template introduction and important information. | ||

| NEU Only-First Report Only | (One time entry for first report) Track completion of documentation required for NEUs only. | ||

| Project(s) Overview | Track required project level information. | ||

| Subrecipients-Beneficiaries | Track required identification information about each subrecipient or beneficiary that has received at least one Subaward or Direct Payment of federal funding $50,000 or greater to execute projects supporting the SLFRF program. | ||

| Subawards-Direct Payments | Track required information regarding Subawards or Direct Payment of federal funding $50,000 or greater for all direct payments, subawards, and contracts made by your organization under SLFRF. | ||

| Expenditures | Track required information on current period expenditures at project and subaward levels. | ||

| Revenue Replacement | Track decision on revenue loss standard allowance option and track additional required information on revenue loss. | ||

| Project Data Cheat Sheet | Table providing quick overview of the additional reporting data required for projects in each EC. | ||

| (DO NOT EDIT) Expenditure Categories | (DO NOT EDIT) Data on expenditure categories. | ||

| (DO NOT EDIT) Picklist Data | (DO NOT EDIT) Data on various picklist options used throughout this template. | ||

| Important Things to Note | |||

| 2/28/22 Updated Compliance and Reporting Guidance Changes | |||

| Final Rule Expenditure Categories | Expenditure Categories have been updated to reflect the categories defined under the final rule. The Compliance and Reporting Guidance provides a break down of how these categories have changed from the interim final rule. Make sure the correct final rule EC is identified for each of project to ensure collection of the correct programmatic data. (P.35-39 Compliance and Reporting Guidance) | ||

| New Reporting Fields for April 2022 Report | |||

| Public Health and Negative Economic Impact | Recipients must provide description of the structure and objectives of programs and how the response is reasonable and proportional. (P.23 Compliance and Reporting Guidance) | ||

| Capital Projects (Optional April 2022; Required July 2022) | |||

| - Type of Capital Expenditure | Recipients must select the type of capital expenditure from a list of enumerated uses. (P.23-24 Compliance and Reporting Guidance) | ||

| - Capital Project Written Justification | For enumerated uses, written justification is required for projects over $10 million. For other uses, written justification is required for projects over $1 million. (P.24 Compliance and Reporting Guidance) | ||

| - Capital Projects Labor Reporting | All capital projects over $10 million must complete Davis-Bacon and Labor Agreement certifications. (P.24 Compliance and Reporting Guidance) | ||

| Project Demographic Distribution | Recipients must report whether certain types of projects are targeted to impacted and disproportionately impacted communities. (P.20-21 Compliance and Reporting Guidance) | ||

| Use of Evidence | Recipients must report the amount of project spending allocated towards evidence based interventions for relevant EC's. (P.24 & P.40 Compliance and Reporting Guidance) | ||

| Small Business Economic Assistance | Recipients must report on the number of small businesses served. (P.25 Compliance and Reporting Guidance) | ||

| Assistance to Non-Profits | Recipients must report on the number of non-profits served. (P.25 Compliance and Reporting Guidance) | ||

| Aid to Travel, Tourism, and Hospitality or Other Impacted Industries | Recipients must report if the aided industry experienced at least 8% employment loss from pre-pandemic levels, or the industry is experiencing comparable or worse economic impacts as the national tourism, travel, and hospitality industries as of the date of the final rule, and rationale for providing aide to the industry (P.25 Compliance and Reporting Guidance) | ||

| Premium Pay for K-12 School Workers | Recipients must report on the number of K-12 school workers provided premium pay. (P.26 Compliance and Reporting Guidance) | ||

| Water and Sewer Projects | Recipients must report on the Median Household Income and Lowest Quintile Income of the service area. (P.27-28 Compliance and Reporting Guidance) | ||

| Other Things to Note | |||

| Expenditures Over $50,000 | ALL expenditures $50,000 or greater must be reported as subawards. This means that recipients must fill out required subrecipient and subaward fields for ALL expenditures $50,000 or greater even if that expenditure is not a subaward as defined in the Final Rule. | ||

| How will I update this template for any future changes Treasury makes to reporting requirements? | This will be the final version of this template that we publish. If Treasury makes any future changes to the reporting requirements, we will issue a memo with guidance on how you can update this template to match those changes. | ||

| What changes are currently anticipated? | |||

| Topic | Current Information | ||

| Civil Rights Act Compliance | Treasury will request information on recipients’ compliance with Title VI of the Civil Rights Act of 1964, as applicable, on an annual basis. This information may include a narrative describing the recipient’s compliance with Title VI, along with other questions and assurances. This collection does not apply to Tribal Governments | ||

| Broadband projects (EC 5.16-5.17) | Additional programmatic data will be required for broadband projects beginning in July 2022 and will be defined in a subsequent version of the Reporting Guidance. | ||

| NEU Documentation (NEUs Only) | ||

| Have you documented the signed award terms & conditions agreement? | Have you documented the signed assurances of compliance with Title VI? | Have you documented the budget documents provided in request for funding? |

| Project Name* | Project ID Number* | Project Expenditure Category Group* | Project Expenditure Category (EC)* | Project Description* | Status of Completion* | Adopted Budget (only required for recipients with population over 250,000*) | Current Period Obligations* | Cumulative Obligations | Current Period Expenditures* | Cumulative Expenditures | Expenditures Reporting: | Program Income Earned | Program Income Expended | Subaward(s) and/or Direct Payments $50,000 or greater reporting: | The following columns pertain only to certain ECs - fill out as applicable | Public Health and Negative Economic Impact | Capital Expenditures | Capital Expenditures Over $10 Million | Project Demographic Distribution | Use of Evidence | Small Business Economic Assistance | Assistance to Non-Profits | Aid to Travel, Tourism, and Hospitality or Other Impacted Industries | Household Assistance | Education Assistance | Payroll for Public Health and Safety Employees | Rehiring Public Sector Staff | Premium Pay | Infrastructure Projects | Infrastructure Projects Over $10 Million | Water and sewer projects | Broadband projects | ||||||||||||||||||||||||||||||||||||||||||||||||

| EC 1.1 - 3.5 | EC 1.1 - 3.5 - Capital Expenditures | EC 1.1 - 3.5 (for capital projects over $10 million in expected total cost) | EC 1.1-2.37 | EC 1.4, 1.11-1.13, 2.1-2.4, 2.6-2.7, 2.9-2.20, 2.25-2.26, 2.30, 2.32-2.33, 2.37 | EC 1.8, 2.29-2.33 | EC 1.9, 2.34 | EC 1.10, 2.35-2.36 | EC 2.1-2.8 | EC 2.14, 2.24-2.27 | EC 3.1 | EC 3.2 | EC 4.1-4.2 | EC 5 (All) | EC 5 (For projects over $10 million in expected total cost) | EC 5.1-5.18 | EC 5.19-5.21 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| In the expenditures tab, have you recorded individual expenditures $50,000 or greater (these must be reported separately)? | In the expenditures tab, have you recorded expenditures under $50,000 (these must be aggregated)? | Does this project have any contracts, grants, loans, transfers made to other government entities, or direct payments $50,000 or greater? | Is the data recorded in the subrecipient and subaward reporting tabs? | Brief description of structure and objectives of assistance program(s), including public health or negative economic impact experienced* | Brief description of how a recipient’s response is related and reasonably and proportional to a public health or negative economic impact of COVID-19* | Does this project include a capital expenditure?* | If yes, what is the total expected cost of the capital expenditure, including pre-development costs?* (If no, enter zero) | Type of capital expenditure, based on the following enumerated uses* | If capital expenditure is an enumerated eligible use and total expected expenditures are greater than or equal to $10 million, have you documents written justification? | If capital expenditure is an "other" use and total expected capital expenditures are greater than or equal to $1 million, have you documented written justification? | Does the project prioritize local hires?* | Does the project have a Community Benefit Agreement, with a description of any such agreement?* | Davis-Bacon Act Certification* Recipients must maintain sufficient records to substantiate this information upon request | Number of employees of contractors and sub-contractors working on the project | Number of employees on the project hired directly | Number of employees on the project hired through a third party | Wages and benefits of workers on the project by classification | Are any of the wages at rates less than those prevailing? | Certification for Labor Agreements* Recipients must maintain sufficient records to substantiate this information upon request | How will the recipient ensure the project has ready access to a sufficient supply of appropriately skilled and unskilled labor to ensure high-quality construction throughout the life of the project, including a description of any required professional certifications and/or in-house training? | How will the recipient minimize risks of labor disputes and disruptions that would jeopardize timeliness and cost-effectiveness of the project? | How will the recipient provide a safe and healthy workplace that avoids delays and costs associated with workplace illnesses, injuries, and fatalities, including descriptions of safety training, certification, and/or licensure requirements for all relevant workers (e.g., OSHA 10, OSHA 30)? | Will workers on the project receive wages and benefits that will secure an appropriately skilled workforce in the context of the local and regional labor market? | Does the project have a completed project labor agreement? | What Impacted and/or Disproportionally Impacted population does this project primarily serve? Please select the population primarily served based on the options listed for this project's expenditure category.* | If this project primarily serves more than one Impacted and/or Disproportionately Impacted population, please select up to two additional populations served. | The dollar amount of the total project spending that is allocated towards evidence-based interventions* | Indicate if a program evaluation of the project is being conducted* | Number of small businesses served* | Number of Non-Profits served* | Description of pandemic impact on industry and rational for providing aid* | Number of households served* | NCES School ID or NCES District ID* | Payroll for Public Health and Safety Employees* | Number of FTEs rehired by governments under this authority* | List of sectors designated as critical to protecting the health and well-being of residents by the chief executive of the jurisdiction, if beyond those included in the final rule* (Recipients should refer to "Sectors designated as essential critical infrastructure sectors" in the Project and Expenditure Report User Guide) | Number of workers to be served* | Number of workers to be served with premium pay in K-12 schools* | Have you documented a Premium Pay Narrative where necessary? (Recipients must submit a written justification unless workers receiving premium pay meet one of two criteria: (1) the eligible worker(s) receiving premium pay earn below 150 percent of state or county’s average annual wage; or (2) the eligible worker(s) is not exempt from the Fair Labor Standards Act overtime provisions.) | Projected/actual construction start date (month/year) | Projected/actual initiation of operations date (month/year) | Location Type | Location Information | Does the project prioritize local hires?* | Does the project have a Community Benefit Agreement, with a description of any such agreement?* | Davis-Bacon Act Certification* Recipients must maintain sufficient records to substantiate this information upon request | Number of employees of contractors and sub-contractors working on the project | Number of employees on the project hired directly | Number of employees on the project hired through a third party | Wages and benefits of workers on the project by classification | Are any of the wages at rates less than those prevailing? | Certification for Labor Agreements* Recipients must maintain sufficient records to substantiate this information upon request | How will the recipient ensure the project has ready access to a sufficient supply of appropriately skilled and unskilled labor to ensure high-quality construction throughout the life of the project, including a description of any required professional certifications and/or in-house training? | How will the recipient minimize risks of labor disputes and disruptions that would jeopardize timeliness and cost-effectiveness of the project? | How will the recipient provide a safe and healthy workplace that avoids delays and costs associated with workplace illnesses, injuries, and fatalities, including descriptions of safety training, certification, and/or licensure requirements for all relevant workers (e.g., OSHA 10, OSHA 30)? | Will workers on the project receive wages and benefits that will secure an appropriately skilled workforce in the context of the local and regional labor market? | Does the project have a completed project labor agreement? | NPDES Permit Number | PWS ID number | Median Household Income of service area* | Lowest Quintile Income of the service area* | Project is designed to, upon completion, reliably meet or exceed symmetrical 100 Mbps download and upload speeds.* | If No, Explain why not* | Confirm that the project is designed to, upon completion, meet or exceed symmetrical 100 Mbps download speed and between at least 20 Mbps and 100 Mbps upload speed, and be scalable to a minimum of 100 Mbps download speed and 100 Mbps upload speed.* | ||||||||||||||||

no reviews yet

Please Login to review.