266x Filetype XLSX File size 0.03 MB Source: rbidocs.rbi.org.in

Sheet 1: Introduction

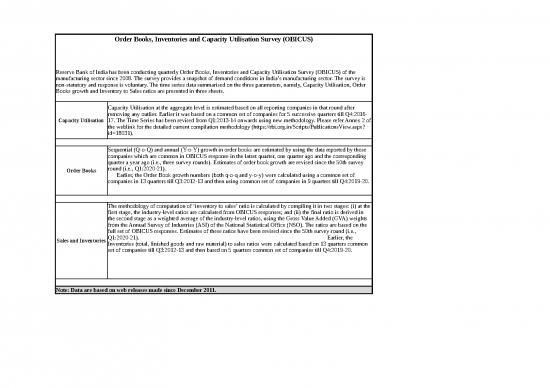

| Order Books, Inventories and Capacity Utilisation Survey (OBICUS) | ||

| Reserve Bank of India has been conducting quarterly Order Books, Inventories and Capacity Utilisation Survey (OBICUS) of the manufacturing sector since 2008. The survey provides a snapshot of demand conditions in India’s manufacturing sector. The survey is non-statutory and response is voluntary. The time series data summarised on the three parameters, namely, Capacity Utilisation, Order Books growth and Inventory to Sales ratios are presented in three sheets. | ||

| Capacity Utilisation | Capacity Utilisation at the aggregate level is estimated based on all reporting companies in that round after removing any outlier. Earlier it was based on a common set of companies for 5 successive quarters till Q4:2016-17. The Time Series has been revised from Q1:2013-14 onwards using new methodology. Please refer Annex 2 of the weblink for the detailed current compilation methodology (https://rbi.org.in/Scripts/PublicationsView.aspx?id=18031). | |

| Order Books | Sequential (Q-o-Q) and annual (Y-o-Y) growth in order books are estimated by using the data reported by those companies which are common in OBICUS response in the latest quarter, one quarter ago and the corresponding quarter a year ago (i.e., three survey rounds). Estimates of order book growth are revised since the 50th survey round (i.e., Q1:2020-21). Earlier, the Order Book growth numbers (both q-o-q and y-o-y) were calculated using a common set of companies in 13 quarters till Q3:2012-13 and then using common set of companies in 9 quarters till Q4:2019-20. | |

| Sales and Inventories | The methodology of computation of ‘inventory to sales’ ratio is calculated by compiling it in two stages: (i) at the first stage, the industry-level ratios are calculated from OBICUS responses; and (ii) the final ratio is derived in the second stage as a weighted average of the industry-level ratios, using the Gross Value Added (GVA) weights from the Annual Survey of Industries (ASI) of the National Statistical Office (NSO). The ratios are based on the full set of OBICUS responses. Estimates of these ratios have been revised since the 50th survey round (i.e., Q1:2020-21). Earlier, the Inventories (total, finished goods and raw material) to sales ratios were calculated based on 13 quarters common set of companies till Q3:2012-13 and then based on 5 quarters common set of companies till Q4:2019-20. | |

| Note: Data are based on web releases made since December 2011. | ||

| Table 1: Capacity Utilisation | |||

| Round | Quarter | Number of Respondants | Capacity Utilisation |

| 2 | Q1:2008-09 | 1232 | 73.7 |

| 3 | Q2:2008-09 | 1386 | 77.3 |

| 4 | Q3:2008-09 | 1185 | 71.5 |

| 5 | Q4:2008-09 | 1167 | 75.0 |

| 6 | Q1:2009-10 | 1154 | 73.3 |

| 7 | Q2:2009-10 | 1135 | 78.6 |

| 8 | Q3:2009-10 | 1135 | 80.9 |

| 9 | Q4:2009-10 | 1135 | 80.2 |

| 10 | Q1:2010-11 | 1135 | 76.0 |

| 11 | Q2:2010-11 | 1135 | 77.3 |

| 12 | Q3:2010-11 | 1135 | 79.8 |

| 13 | Q4:2010-11 | 1135 | 83.2 |

| 14 | Q1:2011-12 | 1135 | 77.7 |

| 15 | Q2:2011-12 | 1135 | 77.4 |

| 16 | Q3:2011-12 | 1166 | 77.5 |

| 17 | Q4:2011-12 | 1019 | 78.4 |

| 18 | Q1:2012-13 | 1082 | 73.1 |

| 19 | Q2:2012-13 | 1179 | 73.3 |

| 20 | Q3:2012-13 | 1191 | 74.6 |

| 21 | Q4:2012-13 | 1049 | 78.0 |

| 22 | Q1:2013-14 | 1491 | 72.0 |

| 23 | Q2:2013-14 | 1483 | 73.8 |

| 24 | Q3:2013-14 | 1460 | 71.5 |

| 25 | Q4:2013-14 | 1429 | 74.9 |

| 26 | Q1:2014-15 | 1421 | 71.5 |

| 27 | Q2:2014-15 | 1404 | 73.7 |

| 28 | Q3:2014-15 | 1377 | 72.5 |

| 29 | Q4:2014-15 | 1331 | 74.8 |

| 30 | Q1:2015-16 | 1265 | 72.3 |

| 31 | Q2:2015-16 | 1002 | 72.2 |

| 32 | Q3:2015-16 | 1007 | 73.8 |

| 33 | Q4:2015-16 | 770 | 75.5 |

| 34 | Q1:2016-17 | 872 | 71.7 |

| 35 | Q2:2016-17 | 902 | 72.0 |

| 36 | Q3:2016-17 | 710 | 71.0 |

| 37 | Q4:2016-17 | 724 | 74.6 |

| 38 | Q1:2017-18 | 805 | 71.2 |

| 39 | Q2:2017-18 | 756 | 71.8 |

| 40 | Q3:2017-18 | 940 | 74.1 |

| 41 | Q4:2017-18 | 921 | 75.2 |

| 42 | Q1:2018-19 | 850 | 73.8 |

| 43 | Q2:2018-19 | 818 | 74.8 |

| 44 | Q3:2018-19 | 860 | 75.9 |

| 45 | Q4:2018-19 | 802 | 76.1 |

| 46 | Q1:2019-20 | 781 | 73.6 |

| 47 | Q2:2019-20 | 819 | 69.1 |

| 48 | Q3:2019-20 | 700 | 68.6 |

| 49 | Q4:2019-20 | 349 | 69.9 |

| 50 | Q1:2020-21 | 406 | 47.3 |

| 51 | Q2:2020-21 | 563 | 63.3 |

| 52 | Q3:2020-21 | 610 | 66.6 |

| 53 | Q4:2020-21 | 557 | 69.4 |

| 54 | Q1:2021-22 | 640 | 60.0 |

| 55 | Q2:2021-22 | 728 | 68.3 |

| 56 | Q3:2021-22 | 757 | 72.4 |

| Table 2: Order Books | ||||||||||

| Quarter | Amount (in ₹ crores) | Q-o-Q Growth(%) | Y-o-Y Growth(%) | |||||||

| No. of Companies | Average Backlog Order | Average New Order Book | Average Pending Order | Backlog Order | New Order Book | Pending Order | Backlog Order | New Order Book | Pending Order | |

| Q1:2008-09 | 567 | 129.0 | 95.3 | 143.1 | ||||||

| Q2:2008-09 | 627 | 124.0 | 105.0 | 127.0 | 11.5 | 7.0 | 8.3 | |||

| Q3:2008-09 | 627 | 145.0 | 69.0 | 138.0 | 8.1 | -24.1 | -3.0 | |||

| Q4:2008-09 | 468 | 141.0 | 87.0 | 137.0 | -3.7 | 8.1 | -0.9 | |||

| Q1:2009-10 | 467 | 149.0 | 95.0 | 151.0 | -3.7 | 10.0 | 1.1 | |||

| Q2:2009-10 | 466 | 149.0 | 104.0 | 153.0 | 1.2 | 9.8 | 2.4 | |||

| Q3:2009-10 | 466 | 153.0 | 108.0 | 156.0 | 2.8 | 4.1 | 2.1 | |||

| Q4:2009-10 | 466 | 157.0 | 112.0 | 157.0 | 2.6 | 3.9 | 0.3 | 2.0 | 35.9 | 3.8 |

| Q1:2010-11 | 466 | 153.0 | 106.0 | 154.0 | -2.5 | -5.6 | -1.7 | 3.9 | 13.4 | 3.3 |

| Q2:2010-11 | 466 | 154.0 | 115.0 | 159.0 | 0.5 | 8.4 | 3.2 | 3.4 | 10.7 | 4.0 |

| Q3:2010-11 | 466 | 159.0 | 127.0 | 167.0 | 3.4 | 10.6 | 4.8 | 4.0 | 17.7 | 6.7 |

| Q4:2010-11 | 466 | 167.0 | 136.0 | 169.0 | 5.0 | 7.6 | 1.4 | 6.5 | 21.8 | 7.9 |

| Q1:2011-12 | 466 | 167.0 | 120.0 | 166.0 | 0.0 | -11.7 | -1.9 | 9.2 | 14.0 | 7.7 |

| Q2:2011-12 | 466 | 166.0 | 129.0 | 163.0 | -0.8 | 7.4 | -1.7 | 7.8 | 12.9 | 2.5 |

| Q3:2011-12 | 504 | 145.0 | 117.0 | 149.0 | -1.1 | 5.0 | 2.4 | 6.3 | 9.6 | 3.7 |

| Q4:2011-12 | 436 | 159.0 | 111.0 | 157.0 | 3.6 | 6.7 | -1.5 | 3.1 | 7.3 | 0.7 |

| Q1:2012-13 | 451 | 142.0 | 118.0 | 149.0 | -0.3 | -0.2 | 4.4 | 7.4 | 22.1 | 10.3 |

| Q2:2012-13 | 484 | 156.0 | 114.0 | 155.0 | 3.8 | -4.0 | -0.7 | 12.3 | 5.6 | 11.0 |

| Q3:2012-13 | 490 | 176.3 | 119.6 | 174.2 | -0.5 | 1.6 | -1.2 | 11.7 | -4.9 | 3.1 |

| Q4:2012-13 | 436 | 135.8 | 123.8 | 126.1 | -4.7 | 3.5 | -9.1 | 2.6 | -6.7 | -7.6 |

| Q1:2013-14 | 502 | 172.4 | 131.2 | 175.7 | -7.5 | -3.8 | 0.5 | -4.4 | -3.8 | -7.1 |

| Q2:2013-14 | 516 | 174.2 | 141.8 | 176.8 | 1.5 | 6.8 | 1.5 | -6.3 | 9.5 | -3.0 |

| Q3:2013-14 | 530 | 174.4 | 150.2 | 178.9 | 1.5 | 7.5 | 2.6 | -4.4 | 12.1 | -2.5 |

| Q4:2013-14 | 518 | 148.5 | 137.7 | 147.8 | 3.0 | -1.0 | -0.2 | -2.1 | 9.8 | 5.6 |

| Q1:2014-15 | 508 | 147.6 | 138.5 | 153.6 | -3.6 | -1.5 | 1.1 | 3.5 | 10.2 | 5.2 |

| Q2:2014-15 | 373 | 162.7 | 127.4 | 166.1 | 3.7 | 6.5 | 2.0 | 6.1 | 12.6 | 6.5 |

| Q3:2014-15 | 366 | 166.0 | 111.0 | 161.8 | 2.1 | -9.1 | -2.4 | 7.8 | -8.9 | -0.7 |

| Q4:2014-15 | 305 | 175.9 | 129.5 | 168.9 | -2.5 | 8.4 | -4.1 | 6.5 | 1.2 | 1.3 |

| Q1:2015-16 | 267 | 156.6 | 128.1 | 157.5 | -3.0 | -6.6 | 0.7 | 4.4 | -1.3 | -0.9 |

| Q2:2015-16 | 256 | 132.0 | 86.4 | 134.5 | -0.3 | 1.1 | 1.9 | -0.5 | -3.3 | -3.1 |

| Q3:2015-16 | 169 | 110.8 | 91.5 | 110.6 | 7.9 | -1.3 | -0.2 | 4.9 | 5.6 | 7.7 |

| Q4:2015-16 | 141 | 84.6 | 85.0 | 78.8 | -2.5 | 4.7 | -8.2 | 0.3 | 4.9 | 2.0 |

| Q1:2016-17 | 156 | 71.8 | 63.6 | 70.5 | -6.0 | -10.0 | -1.9 | 2.9 | -2.9 | -3.3 |

| Q2:2016-17 | 123 | 121.3 | 97.0 | 117.8 | 2.9 | -2.9 | -2.9 | -11.3 | 1.0 | -4.7 |

| Q3:2016-17 | 118 | 124.2 | 135.7 | 120.5 | -3.0 | 6.0 | -3.0 | -14.0 | -4.7 | -21.6 |

| Q4:2016-17 | 120 | 119.1 | 120.4 | 104.3 | -2.1 | 17.2 | -12.5 | -20.7 | 30.2 | -16.0 |

| Q1:2017-18 | 103 | 71.7 | 126.3 | 80.7 | -16.2 | 6.4 | 13.5 | -16.7 | 15.6 | -11.3 |

| Q2:2017-18 | 106 | 79.6 | 141.9 | 102.3 | 12.5 | 20.1 | 28.9 | -10.6 | 45.8 | 18.8 |

| Q3:2017-18 | 103 | 94.1 | 165.0 | 134.6 | 32.5 | 18.9 | 43.9 | 18.5 | 76.5 | 73.3 |

| Q4:2017-18 | 91 | 157.0 | 124.5 | 138.5 | 42.7 | -29.8 | -11.8 | 62.6 | 12.7 | 74.7 |

| Q1:2018-19 | 99 | 184.8 | 182.2 | 222.6 | -6.6 | 31.0 | 20.4 | 68.1 | 43.6 | 79.5 |

| Q2:2018-19 | 93 | 107.9 | 149.8 | 119.0 | -3.5 | 18.2 | 10.4 | 34.8 | 13.1 | 13.6 |

| Q3:2018-19 | 115 | 115.1 | 150.0 | 113.9 | 8.8 | -7.8 | -1.0 | 13.2 | 0.5 | 3.8 |

| Q4:2018-19 | 75 | 110.9 | 150.3 | 112.2 | -0.1 | 7.7 | 1.2 | 0.7 | 1.0 | 3.8 |

| Q1:2019-20 | 63 | 165.0 | 172.8 | 169.6 | 0.5 | -6.0 | 2.6 | 0.6 | 7.5 | 9.1 |

| Q2:2019-20 | 56 | 119.7 | 151.6 | 116.6 | 7.8 | -15.1 | -2.3 | 11.9 | -14.7 | 3.6 |

| Q3:2019-20 | 51 | 217.0 | 141.1 | 225.3 | 4.4 | 6.0 | 3.8 | 8.0 | -30.0 | 11.8 |

| Q4:2019-20 | 45 | 184.0 | 146.6 | 178.8 | -1.6 | -0.9 | -2.8 | 4.5 | -16.8 | -1.8 |

| Q1:2020-21 | 100 | 103.7 | 71.0 | 109.3 | -0.8 | -41.1 | 5.4 | 1.3 | -48.5 | 5.0 |

| Q2:2020-21 | 137 | 146.3 | 184.8 | 154.1 | 0.5 | 108.6 | 5.2 | 6.0 | 10.4 | 8.6 |

| Q3:2020-21 | 155 | 181.2 | 242.7 | 194.2 | 0.3 | 15.4 | 7.2 | -13.8 | 22.1 | -7.7 |

| Q4:2020-21 | 85 | 199.8 | 243.4 | 196.3 | 7.6 | 2.3 | -1.8 | 7.2 | 32.9 | 2.3 |

| Q1:2021-22 | 120 | 188.1 | 171.0 | 197.8 | -0.5 | -19.0 | 5.3 | 11.8 | 105.7 | 17.3 |

| Q2:2021-22 | 184 | 197.9 | 195.7 | 207.4 | 10.8 | 2.1 | 3.9 | 10.2 | 16.9 | 15.1 |

| Q3:2021-22 | 205 | 182.3 | 224.4 | 196.6 | 3.5 | 10.5 | 7.8 | 19.5 | 20.9 | 20.5 |

no reviews yet

Please Login to review.