269x Filetype XLSX File size 0.04 MB Source: busfin.osu.edu

Sheet 1: Instructions

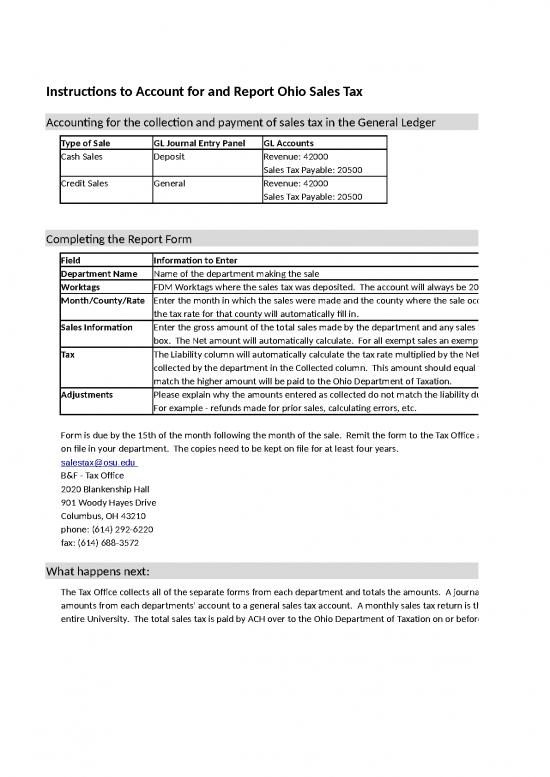

| Instructions to Account for and Report Ohio Sales Tax | ||||||||||

| Accounting for the collection and payment of sales tax in the General Ledger | ||||||||||

| Type of Sale | GL Journal Entry Panel | GL Accounts | ||||||||

| Cash Sales | Deposit | Revenue: 42000 | ||||||||

| Sales Tax Payable: 20500 | ||||||||||

| Credit Sales | General | Revenue: 42000 | ||||||||

| Sales Tax Payable: 20500 | ||||||||||

| Completing the Report Form | ||||||||||

| Field | Information to Enter | |||||||||

| Department Name | Name of the department making the sale | |||||||||

| Worktags | FDM Worktags where the sales tax was deposited. The account will always be 20500. | |||||||||

| Month/County/Rate | Enter the month in which the sales were made and the county where the sale occurred. When the county is entered | |||||||||

| the tax rate for that county will automatically fill in. | ||||||||||

| Sales Information | Enter the gross amount of the total sales made by the department and any sales that were exempt from tax in the exempt | |||||||||

| box. The Net amount will automatically calculate. For all exempt sales an exemption form must be kept on file. | ||||||||||

| Tax | The Liability column will automatically calculate the tax rate multiplied by the Net Sales. Enter in the amount actually | |||||||||

| collected by the department in the Collected column. This amount should equal the liability column. If they do not | ||||||||||

| match the higher amount will be paid to the Ohio Department of Taxation. | ||||||||||

| Adjustments | Please explain why the amounts entered as collected do not match the liability due. | |||||||||

| For example - refunds made for prior sales, calculating errors, etc. | ||||||||||

| Form is due by the 15th of the month following the month of the sale. Remit the form to the Tax Office at the address below. Keep a copy | ||||||||||

| on file in your department. The copies need to be kept on file for at least four years. | ||||||||||

| salestax@osu.edu | ||||||||||

| B&F - Tax Office | ||||||||||

| 2020 Blankenship Hall | ||||||||||

| 901 Woody Hayes Drive | ||||||||||

| Columbus, OH 43210 | ||||||||||

| phone: (614) 292-6220 | ||||||||||

| fax: (614) 688-3572 | ||||||||||

| What happens next: | ||||||||||

| The Tax Office collects all of the separate forms from each department and totals the amounts. A journal entry is completed to move the | ||||||||||

| amounts from each departments' account to a general sales tax account. A monthly sales tax return is then completed on behalf of the | ||||||||||

| entire University. The total sales tax is paid by ACH over to the Ohio Department of Taxation on or before the 23rd of each month. |

no reviews yet

Please Login to review.