316x Filetype XLSX File size 0.06 MB Source: www.qld.gov.au

Sheet 1: Overview & Instructions

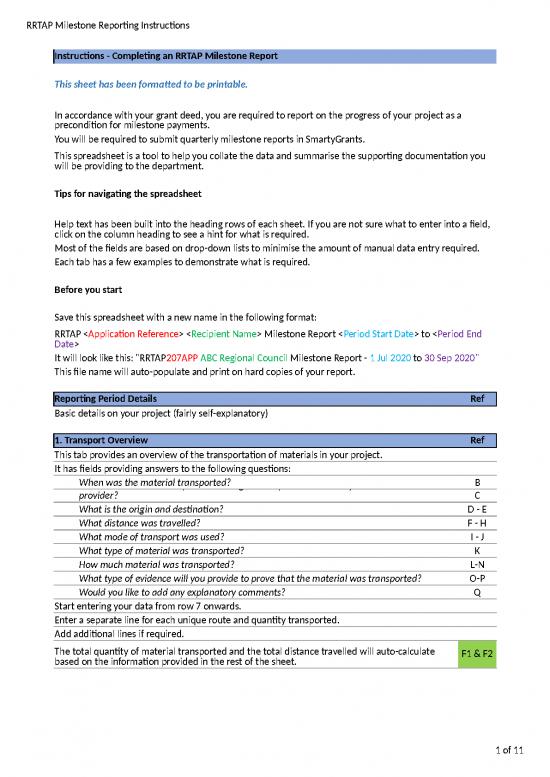

| Instructions - Completing an RRTAP Milestone Report | ||||||||

| This sheet has been formatted to be printable. | ||||||||

| In accordance with your grant deed, you are required to report on the progress of your project as a precondition for milestone payments. | ||||||||

| You will be required to submit quarterly milestone reports in SmartyGrants. | ||||||||

| This spreadsheet is a tool to help you collate the data and summarise the supporting documentation you will be providing to the department. | ||||||||

| Tips for navigating the spreadsheet | ||||||||

| Help text has been built into the heading rows of each sheet. If you are not sure what to enter into a field, click on the column heading to see a hint for what is required. | ||||||||

| Most of the fields are based on drop-down lists to minimise the amount of manual data entry required. | ||||||||

| Each tab has a few examples to demonstrate what is required. | ||||||||

| Before you start | ||||||||

| Save this spreadsheet with a new name in the following format: | ||||||||

| RRTAP <Application Reference> <Recipient Name> Milestone Report <Period Start Date> to <Period End Date> | ||||||||

| It will look like this: "RRTAP207APP ABC Regional Council Milestone Report - 1 Jul 2020 to 30 Sep 2020" | ||||||||

| This file name will auto-populate and print on hard copies of your report. | ||||||||

| Reporting Period Details | Ref | |||||||

| Basic details on your project (fairly self-explanatory) | ||||||||

| 1. Transport Overview | Ref | |||||||

| This tab provides an overview of the transportation of materials in your project. | ||||||||

| It has fields providing answers to the following questions: | ||||||||

| When was the material transported? | B | |||||||

| Who conducted the transport? Did the grant recipient do it or did you use another provider? | C | |||||||

| What is the origin and destination? | D - E | |||||||

| What distance was travelled? | F - H | |||||||

| What mode of transport was used? | I - J | |||||||

| What type of material was transported? | K | |||||||

| How much material was transported? | L-N | |||||||

| What type of evidence will you provide to prove that the material was transported? | O-P | |||||||

| Would you like to add any explanatory comments? | Q | |||||||

| Start entering your data from row 7 onwards. | ||||||||

| Enter a separate line for each unique route and quantity transported. | ||||||||

| Add additional lines if required. | ||||||||

| The total quantity of material transported and the total distance travelled will auto-calculate based on the information provided in the rest of the sheet. | F1 & F2 | |||||||

| 2.a) Third Party Invoices | Ref | |||||||

| Use this tab if transport was provided by another entity. | ||||||||

| The source documents for this information will most likely be invoices from your transport or logistics service provider. | ||||||||

| Note that you will have to provide scanned copies of all the source documents. | ||||||||

| The department may also request the original documents, so make sure to retain them for the duration of the grant period. | ||||||||

| This sheet is structured to help you substantiate your claim, by providing details of: | ||||||||

| The transport provider | B - C | |||||||

| Elements of the invoice | D - M | |||||||

| Relevant comments | N | |||||||

| The total amount claimed will auto-calculate based on the information in the rest of the sheet. | L1 | |||||||

| 2.b) Recipient transport costs | Ref | |||||||

| Use this tab if you conducted the transport yourself. | ||||||||

| The source documents for this information will be varied; it will include the different elements of your transportation costs as set out in your application. | ||||||||

| Note that you will have to provide scanned copies of all the source documents. | ||||||||

| The department may also request the original documents, so make sure to retain them for the duration of the grant period. | ||||||||

| This sheet is structured to help you substantiate your claim, by providing details of: | ||||||||

| The type of cost element (e.g. fuel or labour) | B - C | |||||||

| The activity that this relates to | D | |||||||

| Details on how you will substantiate the claim | E - N | |||||||

| Relevant comments | O | |||||||

| The total amount claimed will auto-calculate based on the information in the rest of the sheet. | L1 | |||||||

| 3. Evidence from receiving entity | Ref | |||||||

| This tab captures the details of your claim that the materials were delivered to the receiving entity nominated in your application and stated in Item 3 of your grant deed. | ||||||||

| The source document for this information will be a receipt from the receiving entity containing the following details: | ||||||||

| Receiving entity name | B | |||||||

| The date the materials were received | C | |||||||

| Receipt number | D | |||||||

| Details of the material received (type, quantity and origin) | E - H | |||||||

| The transaction value: | I | |||||||

| If the receiving entity paid you for the materials: enter a positive value | ||||||||

| If you had to pay the receiving entity to accept the materials: enter a negative value | ||||||||

| If no payment was exchanged between parties: enter zero | ||||||||

| Relevant comments | K | |||||||

| The total quantity of materials delivered to your receiving entities will auto-calculate based on the information in the rest of the sheet. | L1 | |||||||

| 4. Totals | ||||||||

| This tab is a summary of the total claim amount and the materials transported. | ||||||||

| A comment on invoices and other supporting documentation | ||||||||

| You will have to attach copies of supporting documentation, including tax invoices to your claim. You have acknowledged these requirements in your Project Plan, but here is a reminder. | ||||||||

| A valid tax invoice should include the following information: | ||||||||

| The words “Tax Invoice” | ||||||||

| The date of issue | ||||||||

| The name of the supplier | ||||||||

| The supplier’s ABN | ||||||||

| The name of the recipient (correct legal name or trading name) | ||||||||

| Either the address or the ABN of the recipient | ||||||||

| A brief description of each supply of goods and/or services | ||||||||

| For each description: the quantity of goods or extent of services supplied | ||||||||

| The GST inclusive price of the supply | ||||||||

| Where the invoice contains taxable supplies only: | ||||||||

| a) a statement that the total amount payable includes GST or | ||||||||

| b) the total amount of GST must be stated | ||||||||

| Where the invoice contains some taxable and some non-taxable supplies: | ||||||||

| a) Each taxable supply must be identified; and | ||||||||

| b)The total amount of GST payable must be stated; and | ||||||||

| c) The total amount payable must be stated. | ||||||||

| If the amount payable in the invoice is in foreign currency, the invoice must show the GST payable in Australian dollars or provide sufficient information to calculate that amount (the conversion rate used by the supplier). | ||||||||

| Questions? Concerns? | ||||||||

| Send an email to WastePrograms@des.qld.gov.au and a staff member will be in touch | ||||||||

| Recipient Entity Name | ||||||

| Application ID | SmartyGrants reference number - RRTAPXXXXAPP | |||||

| Reporting Period Start Date | These dates should align with your grant deed | |||||

| Reporting Period End Date | These dates should align with your grant deed | |||||

no reviews yet

Please Login to review.