224x Filetype XLSX File size 0.02 MB Source: www.bundesbank.de

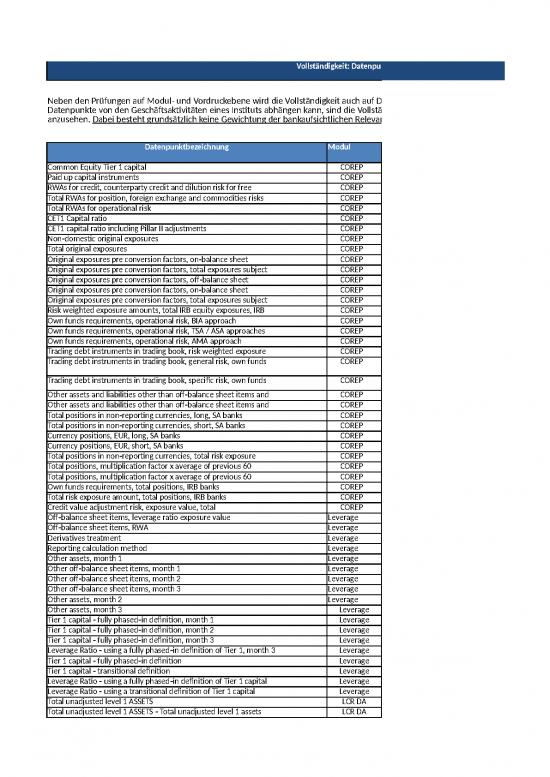

Vollständigkeit: Datenpunktebene

Neben den Prüfungen auf Modul- und Vordruckebene wird die Vollständigkeit auch auf Datenpunktebene abgeprüft. Da die Meldung insbesondere einzelner

Datenpunkte von den Geschäftsaktivitäten eines Instituts abhängen kann, sind die Vollständigkeitsvorgaben auf Datenpunktebene als technisches Mindestmaß

anzusehen. Dabei besteht grundsätzlich keine Gewichtung der bankaufsichtlichen Relevanz einzelner Datenpunkte.

Datenpunktbezeichnung Modul

Common Equity Tier 1 capital COREP

Paid up capital instruments COREP

RWAs for credit, counterparty credit and dilution risk for free COREP

Total RWAs for position, foreign exchange and commodities risks COREP

Total RWAs for operational risk COREP

CET1 Capital ratio COREP

CET1 capital ratio including Pillar II adjustments COREP

Non‐domestic original exposures COREP

Total original exposures COREP

Original exposures pre conversion factors, on‐balance sheet COREP

Original exposures pre conversion factors, total exposures subject COREP

Original exposures pre conversion factors, of‐balance sheet COREP

Original exposures pre conversion factors, on‐balance sheet COREP

Original exposures pre conversion factors, total exposures subject COREP

Risk weighted exposure amounts, total IRB equity exposures, IRB COREP

Own funds requirements, operational risk, BIA approach COREP

Own funds requirements, operational risk, TSA / ASA approaches COREP

Own funds requirements, operational risk, AMA approach COREP

Trading debt instruments in trading book, risk weighted exposure COREP

Trading debt instruments in trading book, general risk, own funds COREP

Trading debt instruments in trading book, specific risk, own funds COREP

Other assets and liabilities other than of‐balance sheet items and COREP

Other assets and liabilities other than of‐balance sheet items and COREP

Total positions in non‐reporting currencies, long, SA banks COREP

Total positions in non‐reporting currencies, short, SA banks COREP

Currency positions, EUR, long, SA banks COREP

Currency positions, EUR, short, SA banks COREP

Total positions in non‐reporting currencies, total risk exposure COREP

Total positions, multiplication factor x average of previous 60 COREP

Total positions, multiplication factor x average of previous 60 COREP

Own funds requirements, total positions, IRB banks COREP

Total risk exposure amount, total positions, IRB banks COREP

Credit value adjustment risk, exposure value, total COREP

Of‐balance sheet items, leverage ratio exposure value Leverage

Of‐balance sheet items, RWA Leverage

Derivatives treatment Leverage

Reporting calculation method Leverage

Other assets, month 1 Leverage

Other of‐balance sheet items, month 1 Leverage

Other of‐balance sheet items, month 2 Leverage

Other of‐balance sheet items, month 3 Leverage

Other assets, month 2 Leverage

Other assets, month 3 Leverage

Tier 1 capital ‐ fully phased‐in definition, month 1 Leverage

Tier 1 capital ‐ fully phased‐in definition, month 2 Leverage

Tier 1 capital ‐ fully phased‐in definition, month 3 Leverage

Leverage Ratio ‐ using a fully phased‐in definition of Tier 1, month 3 Leverage

Tier 1 capital ‐ fully phased‐in definition Leverage

Tier 1 capital ‐ transitional definition Leverage

Leverage Ratio ‐ using a fully phased‐in definition of Tier 1 capital Leverage

Leverage Ratio ‐ using a transitional definition of Tier 1 capital Leverage

Total unadjusted level 1 ASSETS LCR DA

Total unadjusted level 1 ASSETS ‐ Total unadjusted level 1 assets LCR DA

Total unadjusted level 1 assets excluding extremely high quality LCR DA

Coins and banknotes LCR DA

Total unadjusted level 1 extremely high quality covered bonds LCR DA

Total unadjusted level 2A assets (Value according to Article 9) LCR DA

Outflows LCR DA

Infow ‐ Subject to the 75% cap on infows LCR DA

Numerator, denominator, ratio ‐ LIQUIDITY BUFFER LCR DA

Numerator, denominator, ratio ‐ NET LIQUIDTY OUTFLOW LCR DA

Numerator, denominator, ratio ‐ LIQUIDITY COVERAGE RATIO (%) LCR DA

Cash (Dimension € Total) LCR

Amount of exposures to central bank (Dimension € Total) LCR

All other liabilities, amount (Dimension € Total) LCR

All other liabilities, outflows (Dimension € Total) LCR

Monies due from retail customers, infows (Dimension € Total) LCR

Monies due from retail customers, amount (Dimension € Total) LCR

Monies due from financial customers that the institution owing LCR

Monies due from financial customers that the institution owing LCR

Other infows, amount (Dimension € Total) LCR

Other infows, infows (Dimension € Total) LCR

Total cash infows excluded due to the cap, amount (Dimension € LCR

Liabilities from customers which are financial customers, liabilities NSFR

Liabilities from customers which are financial customers, liabilities NSFR

Own funds after deduction have been applied where apropriate, NSFR

Own funds after deduction have been applied where apropriate, NSFR

Liabilities excluding own funds, any other liabilities (Dimension € NSFR

Liabilities excluding own funds, any other liabilities (Dimension € NSFR

Exposures to central banks (Dimension € Total), within 3 months NSFR

Items requiring stable funding, any other assets (Dimension € NSFR

Items requiring stable funding, any other assets (Dimension € NSFR

Cash and cash balances at central banks FINREP

Total assets FINREP

Total liabilities FINREP

Capital FINREP

Accumulated other comprehensive income FINREP

Retained earnings FINREP

Profit or loss attributable to owners of the parent FINREP

Total equity FINREP

Total operating income, net FINREP

Tax expense or (‐) income related to profit or loss from continuing FINREP

Profit or loss for the year FINREP

Other comprehensive income FINREP

Loans and advances, credit institutions FINREP

Loans and advances, non‐financial corporations FINREP

Carrying amount of the impaired assets, total FINREP

Specific allowances for individually assessed financial assets, total FINREP

Financial liabilities at amortised cost FINREP

Financial liabilities held for trading FINREP

Financial liabilities designated at fair value through profit or loss FINREP

Derivatives, notional amount, total trading FINREP

Derivatives, notional amount, total hedging FINREP

Increases due to amounts set aside for estimated loan losses during FINREP

Decreases due to amounts taken against allowances, total FINREP

Interest income, total FINREP

Interest expense, total FINREP

Gains (losses) from hedge accounting, net FINREP

Accumulated impairment, total FINREP

Cash and cash balances at central banks, accounting scope of FINREP

Total assets, accounting scope of consolidation FINREP

Of‐balance sheet exposures, accouting scope of consolidation FINREP

Liabilities, accounting scope of consolidation FINREP

Capital, accounting scope of consolidation FINREP

Total equity, accounting scope of consolidation FINREP

DEBT INSTRUMENTS other than HFT ‐ Performing FINREP

DEBT INSTRUMENTS other than HFT ‐ Non‐Performing FINREP

DEBT INSTRUMENTS other than HFT ‐ Gross carrying amount of FINREP

Assets, domestic actitivities FINREP

Assets, non‐domestic activities FINREP

Liabilities, domestic activities FINREP

Liabilities, non‐domestic activities FINREP

Total operating income, net, domestic activities FINREP

Total operating income, net, non‐domestic activities FINREP

Fee and commission income FINREP

Fee and commission expenses FINREP

Selected financial assets, subsidiaries and other entities of the same FINREP

Selected financial liabilities, subsidiaries and other entities of the FINREP

Total comprehensive income for the year, profit or (‐) loss FINREP

Total comprehensive income for the year, accumulated other FINREP

Carrying amount of encumbered assets of the reporting institution AE

Carrying amount of non‐encumbered assets of the reporting AE

Carrying amount of encumbered other assets AE

Carrying amount of non‐encumbered other assets AE

Total assets, collateral received and own debt securities issued, fair AE

Carrying amount of selected financial liabilities, matching liabilities, AE

Carrying amount of selected financial liabilities, assets, collateral AE

Total sources of encumbrance, matching liabilities, contingent AE

Total sources of encumbrance, assets, collateral received and own AE

Collateral received re‐used (receiving leg), between 1 day and 1 AE

Collateral received re‐used (re‐using leg), between 1 day and 1 AE

Decrease by 30% of the fair value of encumbered assets, additional a AE

Encumbered + non‐encumbered assets, total AE

Encumbered + Non‐encumbered collateral received, total AE

Encumbered assets, total debt securities AE

TOP TEN COUNTERPARTIES EACH GREATER THAN 1% OF TOTAL ALMM

RETAIL FUNDING, Sight deposits, Total amount received ALMM

RETAIL FUNDING, Fixed term deposits with an initial maturity less or ALMM

Savings accounts, with a notice period of withdrawal greater than ALMM

Savings accounts, without a notice period of withdrawal greater ALMM

WHOLESALE FUNDING, Unsecured wholesale funding, of which ALMM

WHOLESALE FUNDING, Unsecured wholesale funding, of which non‐ ALMM

WHOLESALE FUNDING, Unsecured wholesale funding, of which ALMM

WHOLESALE FUNDING, secured wholesale funding, Total amount ALMM

* Although the LCR module has a monthly frequency for the purpose of the

completeness analysis, the March, June, September and December modules are

analysed.

Stand: August 2017

Vollständigkeit: Datenpunktebene

Neben den Prüfungen auf Modul- und Vordruckebene wird die Vollständigkeit auch auf Datenpunktebene abgeprüft. Da die Meldung insbesondere einzelner

Datenpunkte von den Geschäftsaktivitäten eines Instituts abhängen kann, sind die Vollständigkeitsvorgaben auf Datenpunktebene als technisches Mindestmaß

Dabei besteht grundsätzlich keine Gewichtung der bankaufsichtlichen Relevanz einzelner Datenpunkte.

Datenpunkt ID Anwendbar (ab ‐ bis) Frequenz

C 01.00, r020, c010 Q4 2014 ‐> Quarterly

C 01.00, r040, c010 Q4 2014 ‐> Quarterly

C 02.00, r040, c010 Q4 2014 ‐> Quarterly

C 02.00, r520, c010 Q4 2014 ‐> Quarterly

C 02.00, r590, c010 Q4 2014 ‐> Quarterly

C 03.00, r010, c010 Q4 2014 ‐> Quarterly

C 03.00, r070, c010 Q4 2014 ‐> Q4 2015 Quarterly

C 04.00, r850, c010 Q4 2014 ‐> Quarterly

C 04.00, r860, c010 Q4 2014 ‐> Quarterly

C 07.00.a, r070, c010 Q4 2014 ‐> Quarterly

C 07.00.a, r010, c010 Q4 2014 ‐> Quarterly

C 07.00.a, r080, c010 Q4 2014 ‐> Quarterly

C 08.01.a, r020, c020 Q4 2014 ‐> Quarterly

C 08.01.a, r010, c020 Q4 2014 ‐> Quarterly

C 10.01, r010, c080 Q4 2014 ‐> Q4 2015 Quarterly

C 16.00.a, r010, c070 Q4 2014 ‐> Quarterly

C 16.00.a, r020, c070 Q4 2014 ‐> Quarterly

C 16.00.b, r130, c070 Q4 2014 ‐> Quarterly

C 18.00, r010, c070 Q4 2014 ‐> Quarterly

C 18.00, r011, c060 Q4 2014 ‐> Quarterly

C 18.00, r250, c060 Q4 2014 ‐> Quarterly

C 22.00, r100, c020 Q4 2014 ‐> Quarterly

C 22.00, r100, c030 Q4 2014 ‐> Quarterly

C 22.00, r010, c020 Q4 2014 ‐> Quarterly

C 22.00, r010, c030 Q4 2014 ‐> Quarterly

C 22.00, r130, c020 Q4 2014 ‐> Quarterly

C 22.00, r130, c030 Q4 2014 ‐> Quarterly

C 22.00, r010, c100 Q4 2014 ‐> Quarterly

C 24.00, r010, c030 Q4 2014 ‐> Quarterly

C 24.00, r010, c050 Q4 2014 ‐> Quarterly

C 24.00, r010, c120 Q4 2014 ‐> Quarterly

C 24.00, r010, c130 Q4 2014 ‐> Quarterly

C 25.00, r010, c010 Q4 2014 ‐> Quarterly

C 43.00.a, r010, c010 Q4 2014 ‐> Quarterly

C 43.00.a, r010, c020 Q4 2014 ‐> Quarterly

C 44.00, r020, c010 Q4 2014 ‐> Quarterly

C 44.00, r050, c010 Q4 2014 ‐> Q2 2016 Quarterly

C 45.00, r100, c010 Q4 2014 ‐> Q2 2016 Quarterly

C 45.00, r090, c010 Q4 2014 ‐> Q2 2016 Quarterly

C 45.00, r090, c020 Q4 2014 ‐> Q2 2016 Quarterly

C 45.00, r090, c030 Q4 2014 ‐> Q2 2016 Quarterly

C 45.00, r100, c020 Q4 2014 ‐> Q2 2016 Quarterly

C 45.00, r100, c030 Q4 2014 ‐> Q2 2016 Quarterly

C 45.00, r110, c010 Q4 2014 ‐> Q2 2016 Quarterly

C 45.00, r110, c020 Q4 2014 ‐> Q2 2016 Quarterly

C 45.00, r110, c030 Q4 2014 ‐> Q2 2016 Quarterly

C 45.00, r180, c030 Q4 2014 ‐> Q2 2016 Quarterly

C 47.00, r310, c010 Q3 2016 ‐> Quarterly

C 47.00, r320, c010 Q3 2016 ‐> Quarterly

C 47.00, r330, c010 Q3 2016 ‐> Quarterly

C 47.00, r340, c010 Q3 2016 ‐> Quarterly

C 72.00.a, r020, c010 Q3 2016 ‐> Quarterly*

C 72.00.a, r030, c010 Q3 2016 ‐> Quarterly*

no reviews yet

Please Login to review.