264x Filetype XLSX File size 0.05 MB Source: www.arthamfinometry.com

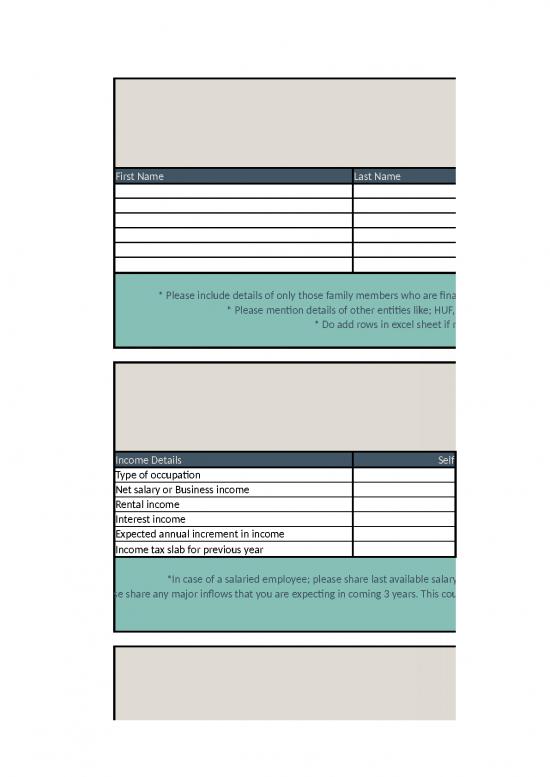

First Name Last Name

* Please include details of only those family members who are financially dependent on your family's income

* Please mention details of other entities like; HUF, family trust etc. if available

* Do add rows in excel sheet if required

Income Details Self

Type of occupation

Net salary or Business income

Rental income

Interest income

Expected annual increment in income

Income tax slab for previous year

*In case of a salaried employee; please share last available salary slip & EPF passbook

* Please share any major inflows that you are expecting in coming 3 years. This could be inheritence, sale of property etc.

Type: Per month average expense to be mentioned Self

Food & groceries

Children school or College expenses

House rent, maintenance & repair

Conveyance, fuel & maintenance

Medicines, doctor & healthcare expenses

Electricity, water, maid & maintainence charges

Mobile, telephone & internet charges

Clothes & accessories

Loan EMIs: Should match with liabilities sheet

Insurance premiums: Should match with liabilities

sheet

Shopping, gifts, whitegoods and gadget expenses

Dining, movies, sports & recreation expenses

Personal care & club membership fees

Annual taxes & regulatory fees

Travel & annual vacations

Support to parents, siblings etc

* Please mention per month average expenses against each head

* In case of periodic/annual nature of the expenses, please convert it in monthly and mention the same

Investments Last available valuation

Bank deposits

Corporate deposits

Bonds

PPF

NSC

Equity shares

Mutual Funds

Real estate other than home

Gold & Silver ETFs, coins or bars

ULIP insurance plans

PMSs

AIFs

Others

Assets Last available valuation

Residential property

Owned office or shop

Car(s) & Bike(s)

Jewellerry

Savings bank & cash in hand

Recievables from friend/family

Others

* For critical evaluation of exisiting investments; please provide detailed

sheet or detailed valuation report of all investments. Such report should

contain investor name, product name, investment date, maturity date,

interest rate etc.

Details of loans EMI

Home loan

Car loan

Bike loan

Personal loan

Business loan

Education loan

Loans from family or friends

Others

Insurance Premium Amount

Life insurance

Healt care insurance

Motor insurance

Home insurance

Others

* Please share all relevant documents pertaining to Life & Healthcare insurance for accurate

analysis and understanding of current risk cover.

Financial Milestones Year

Contigency fund: 8 months of monthly expenses -

Graduation Fees: Child 1

Graduation Fees: Child 2

Car

Post-graduation fees and other expenses: Child 1

Post-graduation fees and other expenses: Child 2

House

Wedding cost: Child 1

Wedding cost: Child 2

Annual holiday expenses

Build a corpus for setting up a business in future

Holiday home

Post retirement expenses: Self

Post retirement expenses: Spouse

Charity

Children trust funds as legacy

* Please do not fill details in blocks which are highlighted in red

* Do add any specific milestones which are not mentioned in the table above

no reviews yet

Please Login to review.