352x Filetype XLSX File size 0.02 MB Source: kase.kz

Approved

by a decision of the Management Board

of Kazakhstan Stock Exchange JSC

(minutes no 73 of the meeting

on June 2, 2020)

Effective from

August 3, 2020

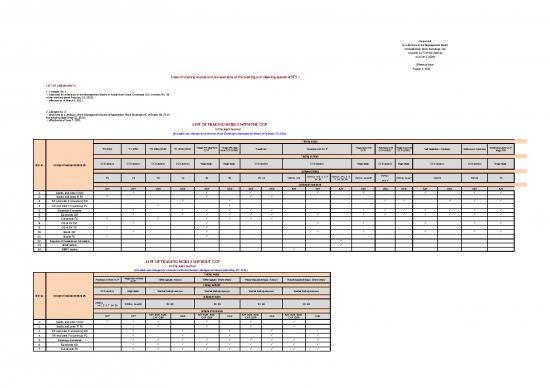

Lists of trading modes and transactions of the trading and clearing system ASTS +

LIST OF AMENDMENTS

1. Changes No. 1:

– approved by a decision of the Management Board of Kazakhstan Stock Exchange JSC (minutes No. 18

of the meeting dated February 25, 2021);

– effective as of March 9, 2021.

2. Changes No. 2:

– approved by a decision of the Management Board of Kazakhstan Stock Exchange JSC (minutes No. 51 of

the meeting dated May 25, 2021);

– effective as of June 7, 2021.

LIST OF TRADING MODES WITH THE CCP

in the stock market

(this table was changed by a decision of the Exchange's Management Board of February 25, 2021)

Trading modes

"Т0 [FIG]" "Т+ [FIG]" "Т0 [FIG] (USD)" "Т+ [FIG] (USD)" "Nego P/S deal with "Nego P/S deal "Small lots" "Autorepo with CCP" "Nego repo with "Autorepo with "Nego repo with Self-regulation: Autorepo Settlement: Autorepo Settlement auto CCP:

CCP" with CCP (USD)" CCP" CCP (USD)" CCP (USD)" Nego P/S

Trading methods

Item No. Groups of financial instruments CCD auction CCD auction CCD auction CCD auction Nego deals Nego deals CCD auction CCD auction Nego deals CCD auction Nego deals CCD auction CCD auction Nego deals

Settlement codes

Y0/Ycn, n=1, 2, 3, 7, Y0/Ycn, n=1, 2, 3, Y0/Ycn,

Т0 Y2 Т0 Y2 Т0 Т0 T0, Y2 Y0/Ycn, n=1 14, 30 7, 14, 30, 90 Y0/Ycn, 1≤n≤30 Y0/Ycn, 1≤n≤7 Y0/Yc1 T0/Yc1 T0

n=1, 7

Settlement currencies

KZT KZT USD USD KZT USD KZT USD KZT KZT KZT KZT USD USD KZT USD KZT KZT

1. Stocks and other FI CO P P P P P P P P

2. Stocks and other FI FC P P P P

3. DR and other FI (currency) CO P P P P P P P

4. DR and other FI (currency) FC P P

5. Sovereign Euronotes P P P P P P P P P P P P P

6. Eurobonds CO P P P P P P P P P P P P P P

7. Eurobonds FC P P P P P P

8. GS of RK CO P P P P P P P

9. GS of RK FC P P

10. Bonds CO P P P P P P P

11. Bonds FC P P

12. Republic of Kazakhstan GS basket P

13. BISP basket P

14. NBRK basket P

LIST OF TRADING MODES WITHOUT CCP

on the stock market

(this table was changed by a decision of the Exchange's Management Board dated May 25, 2021 )

Trading modes

"Autorepo without CCP" "Nego repo without "Offering/sale: Auction "Offering/sale: Direct orders" "Repurchase/purchase: Auction" "Repurchase/purchase: Direct orders"

CCP"

Trading methods

CCD auction Nego deals Special trading sessions Special trading sessions Special trading sessions Special trading sessions

Item No. Groups of financial instruments Settlement codes

Z0/Zcn, Z0/Zcn, 1≤n≤90 Z0, B0 Z0, B0 Z0, B0 Z0, B0

n=1, 2, 3, 7, 14, 30

Settlement currencies

KZT KZT KZT, EUR, RUB, USD KZT, EUR, RUB, USD KZT, EUR, RUB, USD KZT, EUR, RUB, USD

CHF, GBP CHF, GBP CHF, GBP CHF, GBP

1. Stocks and other FI CO P P P P P P

2. Stocks and other FI FC P P P P P

3. DR and other FI (currency) CO P P P P P

4. DR and other FI (currency) FC P P P P P

5. Sovereign Euronotes P P P P P P P P P

6. Eurobonds CO P P P P P P P P P

7. Eurobonds FC P P P P P P P P P

8. GS of RK CO P P P P P

9. GS of RK FC P P P P P

10. Bonds CO P P P P P

11. Bonds FC P P P P P

12. RK GS basket (gross) P

LIST OF TRANSACTIONS ON TRANSFER TO

SETTLEMENTS

(this table was changed by a decision of the Exchange's Management Board of

February 25, 2021)

Trading modes

"Т0 [FIG]" "Т+ [FIG]" "Т0 [FIG] (USD)" "Т+ [FIG] (USD)" "Nego P/S deal with "Nego P/S deal "Autorepo with "Nego repo with "Autorepo with CCP "Nego repo with CCP

CCP" with CCP (USD)" CCP" CCP" (USD)" (USD)"

Transfer settlement codes

Item No. Transactions "Transfers to settlements" Y0/Yсn,

Т0 Y0/Y1/Y2 Т0 Y0/Y1/Y2 Т0 Т0 Y0/Yсn, n=1, 2, 3, Y0/Yсn, 1≤n≤30 Y0/Yсn, 1≤n≤30

7, 14, 30, 90 n=1, 7

Transfer settlement currencies

KZT KZT USD USD KZT USD KZT KZT USD USD

1. "Cast.: Transfer exec. P/S-Т0" P P

2. "Cast.: Transfer exec. P/S-Т0 USD" P P

3. "Cast.: Transfer exec. P/S-Т+" P

4. "Cast.: Transfer exec. P/S-Т+ USD" P

5. "Cast.: Transfer exec. Repo USD" P P

6. "Cast.: Transfer exec. repo" P P

LIST OF TRANSACTIONS ON COLLATERAL TRANSFER

№ Transactions "Collateral Transfer settlement Transfer currency

transfers" codes

1. Securities transfer Т0 –

2. Money transfer Т0 KZT, USD

Used abbreviations and designations

Stocks and other FI CO the group includes shares and securities of investment funds, with

settlements in Kazakh tenge, included in the List T+ ;

the group includes shares and securities of investment funds, bonds

Stocks and other FI FC traded in "dirty" prices, with settlements in Kazakh tenge, not included in

the List T+;

DR and other FI (currency) CO the group includes derivative securities, shares and securities of

investment funds, with settlements in US dollars, included in the List T+;

the group includes derivative securities, shares, investment funds'

DR and other FI (currency) FC securities and bonds traded in "dirty" prices, settled in US dollars, not

included in the List T+;

the group includes securities denominated in US dollars, issued by the

Sovereign Euronotes Ministry of Finance in accordance with the legislation of states other than

the Republic of Kazakhstan, included in the List T +;

the group includes bonds denominated in US dollars, issued in

Eurobonds CO accordance with the legislation of a state other than the Republic of

Kazakhstan (including bonds of international financial organizations), and

foreign government securities included in the List T+;

the group includes bonds denominated in US dollars, issued in

Eurobonds FC accordance with the legislation of a state other than the Republic of

Kazakhstan (including bonds of international financial organizations), and

foreign government securities not included in the List T+;

the group includes securities issued by the Ministry of Finance of the

RK GS CO Republic of Kazakhstan and the National Bank of the Republic of

Kazakhstan, with settlements in Kazakh tenge, included in the List T+;

the group includes securities issued by the Ministry of Finance of the

RK GS FC Republic of Kazakhstan and the National Bank of the Republic of

Kazakhstan, securities of local executive bodies, settled in Kazakh tenge,

not included in the List T+;

Bonds CO the group includes corporate bonds traded in "clean" prices, with

settlements in Kazakh tenge, included in the List T+;

the group includes corporate bonds traded in "net" prices, with

Bonds FC settlements in Kazakh tenge, not included in the List T+;

RK GS basket includes securities in accordance with the Specification of repo

transactions carried out "automatically"

RK GS basket (gross) includes securities in accordance with the Specification of repo

transactions carried out "automatically"

BISP basket includes securities in accordance with the Specification of repo

transactions carried out "automatically"

NBRK basket includes securities in accordance with the Specification of repo

transactions carried out "automatically"

FIG Group of financial instruments

a condition for concluding deals with the central counterparty, under which

CO the sufficiency of collateral is monitored until the fulfillment of obligations

under them;

a condition for concluding deals with the central counterparty, under which

FC it is verified that there is full collateral for the resulting obligations in the

financial instruments in which they arise prior to their execution;

P/S purchase-sale deal;

"Autorepo" repo transactions carried out "automatically";

"Nego repo" repo transactions carried out by "nego" method;

CCD auction conclusion of deals by the method of continuous counter auction;

Nego deals conclusion of deals by the method of conclusion of nego deals;

settlement code used when concluding purchase and sale deals, for

which the Exchange performs the functions of the central counterparty,

obligations for which are subject to fulfillment following the results of

Т0 trading with inclusion in the general netting, which determines that when

an order is submitted, the procedure for monitoring the full provision of

arising obligations is carried out, the day of settlement of which is the date

of the conclusion of these deals;

settlement code used when concluding purchase and sale deals, for

which the Exchange performs the functions of the central counterparty,

which determines that when an order is submitted, the procedure for

Yn monitoring the sufficiency of collateral is carried out, settlements for which

fall on the date determined as T+n, where T is the date of the deal, and n

is the number of settlement days, the value of which is determined by the

last digit of the deal settlement code;

the settlement code used when performing repo transactions, for which

the Exchange performs the functions of the central counterparty, which

determines that when placing an order, the procedure for controlling the

sufficiency of collateral is carried out, the date of execution of a repo

Y0/Ycn opening transaction is the date defined as T0, and the date of execution

of a repo closing transaction is the date defined as Т + cn, where Т is the

date of the repo trade conclusion, and cn is the number of calendar days,

the value of which is determined by the last digit of the trade settlement

code;

the settlement code used when concluding deals without the CCP,

obligations under which are to be performed on a gross basis, which

Z0 determines that when an order is submitted, the procedure for monitoring

the full provision of arising obligations is carried out, the settlement date

for which is the date of concluding these deals;

settlement code used in repo transactions, for which the Exchange does

not perform the functions of the central counterparty, which determines

that when an order is placed, the full collateral control procedure is carried

out, the date of execution of a repo opening transaction is the date

Z0/Zcn defined as T0, and the date of execution of a repo closing transaction is

the date , defined as Т + cn, where Т is the date of the repo deal

conclusion, and cn is the number of calendar days between the repo

opening and closing dates, the value of which is determined by the last

digit of the deal settlement code;

the settlement code used when deals without the CCP, the obligations for

which are to be performed on a gross basis, which determines that the

collateral control procedure is carried out at the time of submission of the

B0 report for execution, the date of settlement is the date set by the initiator

of trading with the only seller (buyer) (as this concept is defined by the

Exchange's internal document "Regulations on membership fees,

exchange and clearing fees").

Trading modes

Settlement

auto CCP:

Nego repo

Trading methods

Nego deals

Settlement codes

Y0

Settlement currencies

KZT

P

P

P

P

P

P

no reviews yet

Please Login to review.