218x Filetype XLSX File size 0.05 MB Source: forms.uct.ac.za

Sheet 1: Expense GL (excl HR)

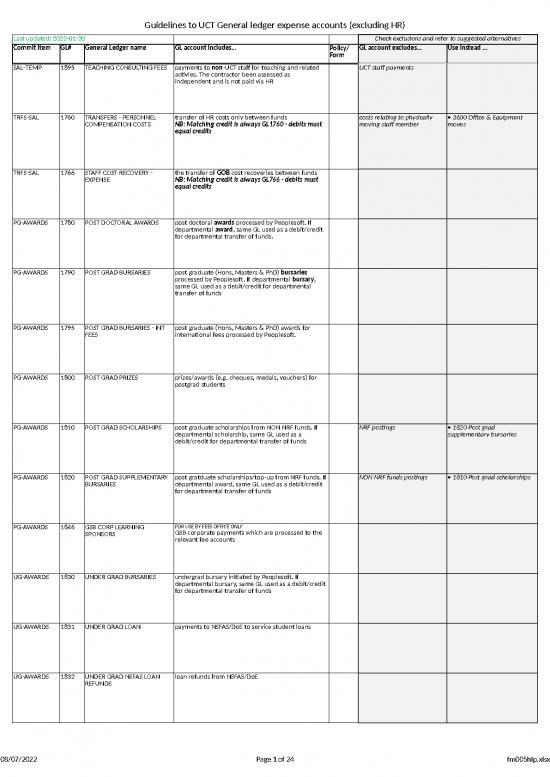

| Last updated: 2022-01-20 | Check exclusions and refer to suggested alternatives | |||||

| Commit Item | GL# | General Ledger name | GL account includes… | Policy/ Form |

GL account excludes… | Use instead … |

| SAL-TEMP | 1895 | TEACHING CONSULTING FEES | payments to non-UCT staff for teaching and related activies. The contractor been assessed as independent and is not paid via HR | UCT staff payments | ||

| TRFS-SAL | 1760 | TRANSFERS - PERSONNEL COMPENSATION COSTS | transfer of HR costs only between funds NB: Matching credit is always GL1760 - debits must equal credits |

costs relating to physically moving staff member | • 3600 Office & Equipment moves | |

| TRFS-SAL | 1766 | STAFF COST RECOVERY - EXPENSE | the transfer of GOB cost recoveries between funds NB: Matching credit is always GL766 - debits must equal credits | |||

| PG-AWARDS | 1780 | POST DOCTORAL AWARDS | post doctoral awards processed by Peoplesoft. If departmental award, same GL used as a debit/credit for departmental transfer of funds. | |||

| PG-AWARDS | 1790 | POST GRAD BURSARIES | post graduate (Hons, Masters & PhD) bursaries processed by Peoplesoft. If departmental bursary, same GL used as a debit/credit for departmental transfer of funds | |||

| PG-AWARDS | 1795 | POST GRAD BURSARIES - INT FEES | post graduate (Hons, Masters & PhD) awards for international fees processed by Peoplesoft. | |||

| PG-AWARDS | 1800 | POST GRAD PRIZES | prizes/awards (e.g. cheques, medals, vouchers) for postgrad students | |||

| PG-AWARDS | 1810 | POST GRAD SCHOLARSHIPS | post graduate scholarships from NON NRF funds. If departmental scholarship, same GL used as a debit/credit for departmental transfer of funds | NRF postings | • 1820 Post grad supplementary bursaries | |

| PG-AWARDS | 1820 | POST GRAD SUPPLEMENTARY BURSARIES | post gratduate scholarships/top-up from NRF funds. If departmental award, same GL used as a debit/credit for departmental transfer of funds | NON NRF funds postings | • 1810 Post grad scholarships | |

| PG-AWARDS | 1846 | GSB CORP LEARNING SPONSORS | FOR USE BY FEES OFFICE ONLY GSB corporate payments which are processed to the relevant fee accounts |

|||

| UG-AWARDS | 1830 | UNDER GRAD BURSARIES | undergrad bursary initiated by Peoplesoft. If departmental bursary, same GL used as a debit/credit for departmental transfer of funds | |||

| UG-AWARDS | 1831 | UNDER GRAD LOAN | payments to NSFAS/DoE to service student loans | |||

| UG-AWARDS | 1832 | UNDER GRAD NSFAS LOAN REFUNDS | loan refunds from NSFAS/DoE | |||

| UG-AWARDS | 1840 | UNDER GRAD PRIZES | prizes/awards (e.g. cheques, medals, vouchers) for undergrad students | |||

| UG-AWARDS | 1850 | UNDER GRAD SCHOLARSHIPS | undergrad scholarship initiated by Peoplesoft. If departmental scholarship, same GL used as a debit/credit for departmental transfer of funds | |||

| UG-AWARDS | 1835 | ENHANCE CURRICULUM BURSARY | FOR USE BY FEES OFFICE ONLY cost reduction to students on an approved enhanced curriculum |

|||

| UG-AWARDS | 1845 | BURSARIES -EXTERNAL EXPENSES | UCT external payments which are processed to the relevant fee accounts, based on students selected by the external bursar | |||

| ADMIN-FEE | 1870 | ADMINISTRATION FEES - INTERNAL | internal admin fee charged between 2 units at UCT, incl UCT overseas offices, but not as part of Research Cost Recovery (RCR). This includes cost of parking on UCT campus for visitors, contractors etc. Staff/student parking discs are not claimable without specific approval from Director of Finance | PAY005 | research cost recovery | • 3340 Research cost recovery |

| ADMIN-FEE | 1887 | COMMISSION PAID | commission fees paid to external parties, per agreement | |||

| ADMIN-FEE | 1880 | AUDIT FEES | audit fees paid to external auditors for annual, tax, IT, funder/donor or specifically requested audits | |||

| ADMIN-FEE | 1890 | CONSULTING FEES & SERVICES | external consulting advice/services provided to UCT, where the consultant is an independent contractor | teaching consultants | • 1895 Teaching consulting fees | |

| ADMIN-FEE | 1900 | LEGAL ADVICE & FEES | external legal advice/services provided to UCT, as well as sheriff fees, stamp duty and costs associated with lease agreements | |||

| ADMIN-FEE | 1910 | MANAGEMENT FEES | regular management fees paid as part of agreement with an external independent contractor (e.g. GSB management fee for the Breakwater Lodge) | |||

| ADMIN-FEE | 2506 | MANAGEMENT FEES NO 3 PORTFOLIO | FOR USE BY TREASURY ONLY regular management fees paid for no3 portfolio |

|||

| BANK-CHRGS | 1940 | BANK CHARGES | all UCT bank charges: includes fees & charges for telegraphic transfers (TT), debit/credit card, lost card protection, annual card, cash advances, stop payments, special instructions, CATS billing, Stancom billing, cashed cheques, forex, bank finance | |||

| BANK-CHRGS | 1960 | CASH DEPOSIT FEES | FOR USE BY TREASURY ONLY cash deposit fee, special instructions |

|||

| BANK-CHRGS | 1990 | CREDIT CARD COMMISSION PAID | FOR USE BY TREASURY ONLY credit card commission, charges, discount |

|||

| BANK-CHRGS | 2000 | DRAFT DEPOSIT FEES | FOR USE BY TREASURY ONLY fees for foreign/ZAR drafts deposited. |

|||

| BANK-CHRGS | 2010 | EXCHANGE CONTROL APPLICATION | FOR USE BY TREASURY ONLY fees for exchange control applications |

|||

| BANK-CHRGS | 2015 | FOREIGN CHEQUE FEES | FOR USE BY TREASURY ONLY fees on issuing of foreign cheques |

|||

| BANK-CHRGS | 2030 | BANK SERVICE FEES | FOR USE BY TREASURY ONLY bank service fee, R/D cheque fee, wire transfer fee |

|||

| CATERING | 2060 | CROCKERY | FOR USE BY RESIDENCES ONLY purchase and hire of crockery |

• 4400 Equipment < R25,000 | ||

| CATERING | 2090 | FOOD COSTS | FOR USE BY RESIDENCES ONLY food purchased for use in UCT residences |

food purchased for committee teas, courses, workshops | • 2558 Refreshments | |

| CATERING | 2100 | KITCHEN UTENSILS & CUTLERY | FOR USE BY RESIDENCES ONLY kitchen smalls, e.g. mixing bowls, knives, can opener |

• 4400 Equipment < R25,000 | ||

| CATERING | 2110 | NON-CONSUMABLE STOCK COSTS | FOR USE BY RESIDENCES ONLY catering overhead costs |

|||

| COMP-EXPS | 2130 | COMPUTER CONSUMABLES | all general computer consumables e.g. printer/ink/laser cartridges, memory sticks, CDs, DVDs, disks, flash drives, mouses, keyboards, fax cartridge/toner | AS001 | computer hardware, computer services, consulting, software or licences | • 4320 Computer hardware equipment < R25,000 • 2140 Computer services/consulting • 2150 IT contractual payments |

| COMP-EXPS | 2140 | COMPUTER SERVICES/CONSULTING | mainly ICTS & GSB contractual payments for maintenance and base support plus website development/hosting, off site storage, database support, additional bandwidth | internet connectivity (e.g. ADSL/LTE), payments to internet service providers, computer consumables or hardware | • 2900 Internet connectivity • 2130 Computer consumables • 4320 Computer hardware equipment < R25,000 |

|

| COMP-EXPS | 2150 | IT CONTRACTUAL PAYMENTS, INCL SW & LICEN | ICTS contractual payments for software licences, plus new software acquisitions | internet connectivity (e.g. ADSL/LTE), payments to internet service providers, computer consumables or hardware | • 2900 Internet connectivity • 2130 Computer consumables • 4320 Computer hardware equipment < R25,000 |

|

| CONFER-EXP | 2170 | CONFERENCE REGISTRATION | registration fees for conferences and workshops ONLY. This GL will be used by HR to gather SETA information, so text field must have STAFF NUMBER (or STUDENT NUMBER), MONTH & YEAR OF CONFERENCE, AS WELL AS NAME OF CONFERENCE captured before anything else, in this exact order, e.g. 01234567, June 2013, NAPCP UK Should the fee be for neither staff or student, put NOT UCT in place thereof. It is noted that P-card entries will have the vendor first This applies to external and internal conferences and workshops. |

business functions and entertainment, as well as any other entrance fees except those associated with conferences also excludes venue hire |

• 2200 Functions • 2190 Entertainment • 2195 Admission & Entry Fees • 3620 Venue hire |

|

| CONFER-EXP | 2195 | ADMISSION & ENTRY FEES | registration, admission & entry fees for internal and external workshops. Includes entry to galleries, museums & other places for educational purposes; Also to be used for UCT sports clubs & societies admission/tournament fees, including umpire, referee, medals, prizes, trophies, entry, green fees | • business functions and entertainment • conferences registration fees |

• 2200 Functions • 2190 Entertainment • 2170 Conference registration fees |

|

| ENTER-FUNC | 2190 | ENTERTAINMENT | business meals with UCT colleagues/visitors/clients, including when entertaining a group as part of UCT business travel | food purchased for committee teas, courses, workshops etc. | • 2558 Refreshments | |

| ENTER-FUNC | 2200 | FUNCTIONS | specific functions or conferences hosted by UCT (e.g. farewell), and the expenses associated with the function such as flowers & decorations | 1) food purchased for committee teas, courses, workshops etc. 2) venue hire |

• 2558 Refreshments • 3620 Venue hire |

|

| ENTER-FUNC | 2210 | GIFTS & PRESENTATIONS | gifts (e.g. flowers) purchased by UCT ito the guidelines, also includes donations made to external organisations | |||

| EXAM-EXPS | 2230 | EXAMINERS FEES - COURSEWORK | FOR USE BY REGISTRARS OFFICE ONLY external examiners fees for coursework |

all other expenses associated with external examiners | • 3381 Accommodation (local) • 3360 Travel tickets (local) If required, use PO text to differentiate external exps |

|

| EXAM-EXPS | 2240 | EXAMINERS FEES - DOCTORAL THESIS | FOR USE BY REGISTRARS OFFICE ONLY external examiners fees for doctoral students |

all other expenses associated with external examiners | • 3381 Accommodation (local) • 3360 Travel tickets (local) If required, use PO text to differentiate external exps |

|

| EXAM-EXPS | 2250 | EXAMINERS FEES - MASTERS THESIS | FOR USE BY REGISTRARS OFFICE ONLY external examiners fees for masters students |

all other expenses associated with external examiners | • 3381 Accommodation (local) • 3360 Travel tickets (local) If required, use PO text to differentiate external exps |

|

| OPER-EXPS | 2310 | ADVERTISING - MEDIA PLACEMENT (NON-STAFF) | costs associated with placing general ads in various medias that are not staff related e.g. student recruitment, productions, orientation, courses | advertising for staff | ||

| OPER-EXPS | 2316 | ADVERTISING - MEDIA PLACEMENT (STAFF) | costs associated with placing ads in various medias for UCT staff - used mainly by HR | advertising for anything but staff | ||

| OPER-EXPS | 2320 | STAFF PLACEMENT FEES | once-off costs paid to recruitment agencies for staff placements ito agreement | all monthly temp staff charges | • 1580 CASUAL/SUPPORT STAFF NON ACAD or • 1700 FEES/SALARY - AD HOC STF (Refer staffing expense GLs on FM005) |

|

| OPER-EXPS | 2323 | ADVERTISING - PUBLICITY & PROMOTIONS | cost associated with advertising for services, events (e.g. branding, banners, posters, make-up for shoots) and promotional items (e.g. water bottles) | printing of brochures & posters | • 3015 Brochures, handbooks & publicity | |

| OPER-EXPS | 2365 | CLOTHING | promotional clothing, t-shirts, uniforms, sporting kits, swimming costumes, gowns & hoods, personal graduation gowns (only red) | protective clothing, theatrical costumes | • 3910 Protective clothing & appliances • 3150 Costumes |

|

| OPER-EXPS | 2330 | ANIMAL HOUSE SERVICES | all costs associated with Animal House Services, including lab test, animal food, transport, health monitoring, board and lodging | |||

| OPER-EXPS | 2340 | ANIMAL PURCHASES | the cost of animal purchases for research and teaching activities | |||

| OPER-EXPS | 2350 | JAMMIE SHUTTLE CORE SERVICE | FOR USE BY P&S ONLY regular campus bus transport service provided to students and staff - Jammie shuttle - core service |

bus hire for fieldwork / class outings | • 3660 Shuttles, bus & coach hire | |

| OPER-EXPS | 2355 | BREAKWATER LODGE OPERATING EXPENSES | FOR USE BY GSB ONLY operating costs of the Breakwater Lodge |

|||

| OPER-EXPS | 2356 | MOWBRAY HOTEL OPERATING EXPENSES | FOR USE BY CENTRAL FINANCE ONLY operating costs of the Mowbray Hotel |

|||

| OPER-EXPS | 2360 | CHEMICALS | all chemicals used for teaching and research - used mainly for purchases by the Chemistry and MCB stores | |||

| OPER-EXPS | 2370 | CUSTOMS CLEARING SERVICE CHARGES | Clearing costs (e.g. agency/handling fee) associated with clearing goods through customs | Libraries electronic resources | • 2615 SARS VAT for Lib Acq • 2616 SARS VAT on electronic resources & services - Foreign |

|

| OPER-EXPS | 2380 | CUSTOMS DUTY | customs duty payable on the value of goods cleared through customs. | |||

| OPER-EXPS | 2391 | DEBT COLLECTION EXPENSES - TRADE DEBTORS | FOR USE BY DEBTORS ONLY costs associated with handing over Trade Debtors for collection |

|||

| OPER-EXPS | 2420 | FREIGHT - INTERNATIONAL | freight (e.g. cargo, airfreight) payable on imported and exported goods - usually done via import/export agents. Includes related costs e.g. boxes, permits | delivery & courier charges, bulk postage | • 2890 Postage & delivery fees | |

| OPER-EXPS | 2425 | FREIGHT - LOCAL | freight (e.g. cargo, airfreight) payable on the movement of goods within SA - usually done via a freight company. Includes related costs e.g. boxes, permits | delivery & courier charges, bulk postage | • 2890 Postage & delivery fees | |

| OPER-EXPS | 2430 | GENERAL EXPENSES | only to be used for expenses with no appropriate GL NB: Report will be run monthly on this GL to ensure that only legitimate usage is occurring |

|||

| OPER-EXPS | 2475 | LAB & STUDIO MATERIALS & SERVICES | all laboratory and studio materials/supplies/consumables/services, including analyses, for teaching and research purposes. Includes inter-department charges for services & materials provided iro teaching or research activities | chemicals, cleaning materials, gas, gas cylinder rentals | • 2360 Chemicals • 3530 Cleaning material • 3980 Gas general • 3990 Gas cyclinder rentals • 1890 Consulting Fees & Services |

|

| OPER-EXPS | 2480 | LAUNDRY OUTSIDE CONTRACTORS | laundry and dry cleaning | |||

| OPER-EXPS | 2490 | LICENCES OTHER THAN MV | all licences except motor vehicles e.g. radio, liquor, TV | motor vehicle licences | • 3470 Licences motor vehicles | |

| OPER-EXPS | 2500 | LINEN | FOR USE BY RESIDENCES ONLY linen required for residences e.g. bedding, curtains, sheets, duvets, bathmats, shower curtain |

|||

| OPER-EXPS | 2510 | MATERIALS & CONSUMABLES | materials and consumables used in the operations of the university except for teaching & research | teaching or research related materials, cleaning materials | • 2475 Lab & studio materials • 3530 Cleaning material |

|

| OPER-EXPS | 2515 | PATIENT/PARTICIPANT INDUCEMENT FEES | patient/participant inducement incentives paid to participants in medical trials/research studies for time/costs | |||

| OPER-EXPS | 2520 | PAYMENTS TO HOUSE COMM | FOR USE BY DEPT OF STUDENT AFFAIRS ONLY grants/payments to residence/house committees |

|||

| OPER-EXPS | 2525 | PETTY CASH MINOR EXPENSES | minor (usually <R100) expenses from petty cash | |||

| OPER-EXPS | 2530 | PHOTOGRAPHS | processing of photographs (e.g. faculty photos, passport pictures) | |||

| OPER-EXPS | 2540 | PLANTS & SHRUBS | purchase, maintenance and rental of plants (mainly indoor) | |||

| OPER-EXPS | 2545 | PUBLICATIONS - DESIGN | design costs associated with the production of publications and promotional material | |||

| OPER-EXPS | 2553 | PUBLICATIONS - REPRODUCTION | reproduction/publication costs for books/journals (e.g. translation, editing, proof reading, peer review transcription, page fees) | |||

| OPER-EXPS | 2554 | PUBLICATIONS - OPEN ACCESS | open access platform publishing costs | |||

| OPER-EXPS | 2558 | REFRESHMENTS | general refreshments (e.g. tea, coffee, snacks, bottled water & water refills) purchased for specific events (e.g. meetings, workshops, training courses) and for general internal usage | refreshments for functions, entertainment costs | • 2200 Functions • 2190 Entertainment |

|

| OPER-EXPS | 2560 | ROYALTY PAYMENTS | payments iro a royalty agreement | |||

| OPER-EXPS | 2570 | HEALTH SERVICES & SUPPLIES | all medical examinations & screenings, health checks, supplies and other services related to health of UCT staff & students | vaccinations & health checks for purpose of foreign travel | • 3375 Travel ancillary costs (foreign) | |

| OPER-EXPS | 2580 | SUBSCRIPTIONS & AFFILIATIONS | subscriptions and affiliations to professional bodies, clubs and societies. Also DSTV. | subscriptions to journals or periodicals | • 2860 Subscriptions to periodicals | |

| OPER-EXPS | 2590 | TEACHING HOURS JMS | FOR USE BY HEALTH SCIENCES ONLY amounts invoiced to the NHLS based on the agreed percentage of Joint Medical Staff (JMS) |

|||

| OPER-EXPS | 2595 | COURSE MATERIALS | textbooks, course material, notes for teaching and research purposes | books | • 2820 Books & journals | |

| OPER-EXPS | 2600 | THESIS MATERIALS (INCL DIGITAL) | material required for production of a thesis, for teaching and research purposes. Includes digital theses. | |||

| OPER-EXPS | 2610 | SARS VAT ON FOREIGN PURCHASES | THIS IS FOR ALL NON-LIBRARY PURCHASES The local SA VAT paid on foreign purchases cleared through customs (i.e. physical items received). VAT amounts which can be claimed are managed by Foreign Payments. |

|||

| OPER-EXPS | 2615 | SARS VAT FOR LIB ACQ | FOR USE BY LIBRARY OFFICE ONLY This is ONLY for Library VAT - - Local SA VAT payable as a separate line item on a Purchase Order for physical items purchased via the Library interface or VAT paid to Clearing Agents on behalf of the Libraries by Foreign Payments and - VAT payable on UCT electronic resources and services. This is used for VAT paid to local vendors. This is also used for foreign vendors registered in SA or where an accrual on behalf of the foreign vendor is required. VAT amounts which can be claimed are managed by Foreign Payments. |

|||

| OPER-EXPS | 2616 | SARS VAT ON ELECTONIC RESOURCES & IMPORTED SERVICES - FOREIGN | THIS IS FOR ALL NON-LIBRARY PURCHASES VAT payable on UCT electronic resources and imported services. This is for foreign vendors registered in SA VAT where is SA VAT is payable on the foreign invoice. VAT amounts which can be claimed are managed by Foreign Payments. |

|||

| INSURANCES | 2640 | INSURANCE - INVENTORY TRANSIT PREMIUM | FOR USE BY INSURANCE OFFICE ONLY insurance on inventories in transit as part of a relocation package approved by HR |

|||

| INSURANCES | 2660 | INSURANCE - MANAGEMENT FEES | FOR USE BY INSURANCE OFFICE ONLY management fees related to insurance |

|||

| INSURANCES | 2670 | INSURANCE - EXCESSES | FOR USE BY INSURANCE OFFICE ONLY insurance excesses paid to suppliers, and netted off refunds from departments/individuals |

|||

| INSURANCES | 2680 | INSURANCE - CLAIM PAYOUT | FOR USE BY INSURANCE OFFICE ONLY the transfer of monies received from insurers (debits) and refunded to departments (credits) |

|||

| INSURANCES | 2690 | INSURANCE - STUDENT RELATED | FOR USE BY INSURANCE OFFICE & DSA ONLY all student-related insurance - mainly medical insurance |

|||

| INSURANCES | 2710 | INSURANCE - CONTRACTORS ALL RISK | FOR USE BY INSURANCE OFFICE ONLY additional insurance purchased for contractors on UCT property - usually for the duration of a project |

|||

| INSURANCES | 2720 | INSURANCE - VALUATION FEES | FOR USE BY INSURANCE OFFICE ONLY valuation fees related to insurance claims |

|||

| INSURANCES | 2740 | INSURANCE - MARINE SMALLCRAFT | FOR USE BY INSURANCE OFFICE ONLY insurance purchased for watercraft/sea vessels e.g. boats, waterskis |

|||

| INSURANCES | 2760 | INSURANCE - MOTOR | FOR USE BY INSURANCE OFFICE ONLY insurance purchased for motor vehicles in the UCT fleet |

|||

| INSURANCES | 2770 | INSURANCE - ALL RISKS | FOR USE BY INSURANCE OFFICE ONLY all insurance premiums, except those for which there are separate GLs (e.g. marine, contractors, student-related) |

|||

| INSURANCES | 2775 | INSURANCE - RECOVERIES | recoveries of insurance costs by the Insurance Office / individual departments contributing to the insurance costs paid by the Insurance Office. NB: Matching credit is always GL2775 - debits must equal credits |

|||

| PERIOS-BKS | 2810 | BINDING | the binding of documents, including thesis | |||

| PERIOS-BKS | 2820 | BOOKS & JOURNALS | purchase/loan of books, journals, manuals, magazines - not for the UCT Libraries | purchase of textbooks, UCT Libraries' purchase of books | • 2595 textbooks • 4580 Lib book acquisitions |

|

| PERIOS-BKS | 2830 | MAPS | maps e.g. fieldwork maps | |||

| PERIOS-BKS | 2840 | REFERENCE FEES | page fee, reference fee related to the request of material for reference purposes | |||

| PERIOS-BKS | 2850 | BOOK REPRINTS | costs related to the additional prints where an article has been published in a book/journal | not photographic reprints | • 2530 Photographs | |

| PERIOS-BKS | 2860 | SUBSCRIPTIONS TO PERIODICALS | subscriptions to periodicals, journals, newspapers, surveys, magazines (non-UCT Libraries) | subscriptions and affiliations to professional bodies, clubs and societies | • 2580 Subscriptions & affliations | |

| POST-TX-FX | 2880 | FAX SERVICES | fax services provided by ICTS; fax service from external provider | cost of the fax machine, Internet connectivity, fax paper, maintenance of fax machine | • 4400 Equipment < R25,000 • 2900 Internet connectivity • 3280 Stationery • 3720 Rep & Maint - furniture & equipment |

|

| POST-TX-FX | 2890 | POSTAGE & DELIVERY FEES | domestic and international postage, courier charges, delivery charges, driver charges, bulk mail, stamps - usually a letter/envelope of documents or light package | |||

| POST-TX-FX | 2900 | INTERNET CONNECTIVITY | off site / remote internet access and subscriptions (e.g. ADSL, 3G, home internet service providers) | recharge vouchers, cellphone charges | • 2990 Cell phone charges | |

| POST-TX-FX | 2920 | TELEPHONE CALLS | all calls - local, international, trunk, cell phone calls made from UCT telephone system or landline reimbursements | recharge vouchers, cellphone charges | • 2990 Cell phone charges | |

| POST-TX-FX | 2950 | TELECOM INSTALLATION COSTS | FOR ICTS & GSB USE ONLY new telephone/fax installations, moves and disconnection costs |

the cost of the telephone handset / fax machine | • 4400 Equipment < R25,000 | |

| POST-TX-FX | 2960 | TELECOM RENTALS | FOR ICTS USE ONLY monthly telephone handset, headset, line (telephone/fax) rentals, voicemail |

|||

| POST-TX-FX | 2980 | TELEPHONE MAINTENANCE | FOR RESIDENCES & GSB USE ONLY telephone maintenance contracts (e.g. switchboard) |

|||

| POST-TX-FX | 2990 | CELLPHONE CHARGES | all cellphone calls/contract costs/airtime/vouchers either reimbursed or from UCT cellphones, as well as bulk electronic messaging e.g. Vula SMS service | GEN004 | cell phone allowance, cell phone calls from UCT phones | • 2920 Telephone calls NB: Cellphone allowances via HR • 1435 Cellphone allow - perm stf • 1438 Cellphone allow - fixed tm |

| PRINT-COPY | 3005 | COPYRIGHT EXPENSES | all expenses related to copyright - used mainly by the Registrar's office | |||

| PRINT-COPY | 3010 | PHOTOCOPYING & PRINTING | all photocopying and printing, including business cards | |||

| PRINT-COPY | 3015 | BROCHURES & HANDBOOKS | for expenses related to the printing of brochures, posters, handbooks & research reports | all other photocopying & printing | • 3010 Photocopying & printing | |

| PUR-RESALE | 3070 | PURCHASES FOR RESALE | purchase of goods/services for resale (e.g. bird rings, cost of tours purchased as part of courses) | |||

| DIFF-AUTO | 3090 | SMALL DIFFERENCES - AUTOMATIC | automatic postings as a result of small rounding differences on SAP documents. NB: No manual postings allowed |

|||

| STF-TRAIN | 3110 | STAFF TRAIN - EDUCATION ASSISTANCE PLAN | FOR USE BY HR ONLY staff loans for educational purposes |

|||

| STF-TRAIN | 3120 | STAFF TRAIN - EXTERNAL COURSES | costs of funding external training courses, and formal studies, as part of a staff members Personal Development Plan (PDP) | conference registration fees | • 2170 Conference fees & registration exps | |

| STF-TRAIN | 3130 | STAFF TRAIN - INHOUSE COURSES | costs of inhouse UCT courses (not part of a formal qualification), as part of a staff members Personal Development Plan (PDP) | |||

| STAGE-EXPS | 3150 | COSTUMES | costumes for productions, including repairs | excluding clothing, swimming costumes | • 3910 Protective Clothing & Appliances • 2365 Clothing |

|

| STAGE-EXPS | 3220 | SCRIPTS & SCORES | hire of music, music scored, performing rights | |||

| STAGE-EXPS | 3230 | STAGE, PRODUCTION & PROPS | all scenery expenses (e.g. props, DIY materials) and stage production costs | studio contracts, incl amounts to eg CT Opera | ||

| STATIONERY | 3250 | EXAMINATION STATIONERY | all stationery associated with examinations, e.g. answer booklets that are used for exams, attendance slips, as well as mulitiple choice questionnaire (MCQ) answer sheets | |||

| STATIONERY | 3260 | AUDIO VISUAL MATERIAL | film, audio, videos, DVDs used for film productions, batteries & memory sticks for production equipment, recordings, and transfers | mouses & flash drives, projectors, cameras, tripod, DVD player. Also excludes the cost of the production crew | • 2130 Computer Consumables • 4400 Equipment < R25,000 • 1890 Consulting Fees & Services |

|

| STATIONERY | 3270 | PAPER REAMS | blank paper reams ONLY | |||

| STATIONERY | 3280 | STATIONERY & OFFICE CONSUMABLES | all stationery items (e.g. pens, stapler, punch) and office consumables (e.g. batteries, air freshner) | paper | • 3270 Paper reams | |

| STATIONERY | 3290 | TICKETS - PRE-PRINTED STATIONERY | pre-printed tickets for UCT organised shows, meals, productions and concerts | all transport tickets (e.g. air, bus, train) | • 3350 Tickets - travel (Foreign) • 3360 Tickets - travel (Local) |

|

| TRF-EXPS | 3450 | TRANSFER - GENERAL EXPENSES | the transfer of general expenses between funds NB: Matching credit is always GL3450 - debits must equal credits | |||

| VEH-EXPS | 3470 | LICENCES MOTOR VEHICLE | cost of licences and renewals for UCT vehicles and trailers | all other licences | • 2490 Licences other than mv | |

| VEH-EXPS | 3480 | FUEL PURCHASES | the cost of filling up with fuel - petrol/diesel | car hire, mileage claims, ancillary travel costs | • 3390 Travel - Car Hire (Local) • 3374 Travel - Car Hire (Foreign) • 3420 Travel Mileage Claims • 3440 Travel - ancilliary costs (Local) • 3375 Travel - ancilliary costs (Foreign) |

|

| VEH-EXPS | 3490 | REP & MTCE - MOTOR VEHICLES | repairs, service, car batteries, number plates, car alarm, window replacement, and general maintenance of UCT vehicles | car hire, fuel purchases traffic fines |

• 3390 Travel - Car Hire (Local) • 3374 Travel - Car Hire (Foreign) • 3480 Fuel Purchases |

|

| DISC-GIVEN | 2390 | DISCOUNT GIVEN | FOR USE BY TREASURY ONLY the discount on EDU loans |

|||

| SCRAP-CHEM | 3332 | STOCK SCRAPPING ACCOUNT - CHEMISTRY | FOR USE BY STORES ONLY scrapping of stock in the Chemistry store |

|||

| DIFF-CHEM | 3322 | STOCK DIFFERENCES ACCOUNT - CHEMISTRY | FOR USE BY STORES ONLY stock differences in the Chemistry store |

|||

| REA-LEVY-E | 3340 | RESEARCH INDIRECT COST RECOVERY - EXPENSE | the general % levy charged (not necessarily 10%) as a general cost recovery on research contracts / grants NB: Matching credit is always GL464 or GL465 - debits must equal credits | where the levy expense is itemised into specific staffing, IT, space, admin expenses, library then specific GLs to be used. | • 1766 - Research staff cost recovery - expense | |

| FOREX-DIFF | 2400 | EXCHANGE RATE DIFFERENCES REALISED | FOR USE BY CENTRAL FINANCE ONLY exchange rate differences related to foreign payments (purchase orders) and receipts (sales orders) |

|||

| GBP-USD-DF | 2402 | EXCHANGE RATE DIFFERENCES | FOR USE BY TREASURY ONLY exchange rate differences related to USD & GBP bank account fluctuations |

|||

| DIFF-MCB | 3320 | STOCK DIFFERENCES ACCOUNT - MCB | FOR USE BY STORES ONLY stock differences in the Microbiology store |

|||

| SCRAP-MCB | 3330 | STOCK SCRAPPING ACCOUNT - MCB | FOR USE BY STORES ONLY scrapping of stock in the Microbiology store |

|||

| CLEANING | 3530 | CLEANING MATERIALS | all cleaning materials e.g. paper towels, sprays, bleach, paper tissues, foil, washing powder, detergent, mop heads, towels, disinfectant, soap, pool chemicals | chemicals, contract cleaning | • 2360 Chemicals • 3540 Contract cleaning |

|

| CLEANING | 3540 | CONTRACT CLEANING | contracted cleaning services e.g. Supercare, pest management/control, carpet cleaning - used mainly by P&S, GSB, Residences & UCT Libraries | any repairs and maintenance | • 3800 Rep & maint - grounds • 3750 Rep & maint - buildings |

|

| EQ-NON-CAP | 3600 | OFFICE & EQUIPMENT MOVES | shipping and delivery costs of furniture and equipment; office/departmental moves; movement of stock | delivery & courier charges, bulk postage | • 2890 Postage & delivery fees | |

| RENT-BLDGS | 2731 | RENT INTERNAL RECOVERIES | recoveries between UCT departments for the rental of space (e.g. office/garage) NB: Matching credit is always GL2731 - debits must equal credits |

payments to 3rd parties | 3630 Property Lease | |

| RENT-BLDGS | 3620 | VENUE HIRE | venue hire for conferences, functions, short courses and sporting events (e.g. sports fields, pools). Includes hire of mobile venues (e.g. containers) | |||

| RENT-BLDGS | 3630 | PROPERTY LEASE | rental of premises ito an agreement (includes student accommodation e.g. international & GSB students, also medical students, staying at hospital) | student residences | ||

| RENT-EQUIP | 3650 | EQUIPMENT HIRE | all equipment that is hired, e.g. catering, office, recording or diving equipment, also fax rental | photocopiers purchase of equipment |

• 3670 Photocopier rental • 4400 Equipment < R25,000 |

|

| RENT-EQUIP | 3660 | SHUTTLES, BUS & COACH HIRE | shuttle/bus/coach hire, commercial vehicle hire | Jammie shuttle | • 2350 Jammie Shuttle core service | |

| RENT-EQUIP | 3670 | PHOTOCOPIER RENTAL | lease/rental of copiers | photocopying & printing charges | • 3010 Photocopying & printing | |

| REP-MTC | 3690 | AD HOC - VOICE & DATA INFRASTRUCTURE | all cabling and site preparation required for voice and data infrastructure. | |||

| REP-MTC | 3720 | REP & MAINT - FURNITURE & EQUIPMENT | all repairs and maintenance to furniture and equipment, incl water coolers/purifiers | all other repairs & maintenance. | Use one of the specific GLs that belong to Commitment Item REP-MTC | |

| REP-MTC | 3730 | REP & MAINT - ELECTRICAL | all electrical repairs and maintenance to buildings - usually done by an electrician. | all other repairs & maintenance. | Use one of the specific GLs that belong to Commitment Item REP-MTC | |

| REP-MTC | 3740 | REP & MAINT - LIFTS | FOR USE BY P&S, GSB & RESIDENCES ONLY all maintenance to lifts |

all other repairs & maintenance. | Use one of the specific GLs that belong to Commitment Item REP-MTC | |

| REP-MTC | 3750 | REP & MAINT - BUILDINGS | all non-electrical repairs and maintenance to buildings, including carpeting, locks, keys, padlocks, painting, burglar bars, signage for rooms & buildings | all other repairs & maintenance. | Use one of the specific GLs that belong to Commitment Item REP-MTC | |

| REP-MTC | 3755 | REP & MAINT - COMPUTER EQUIPMENT | all repairs and maintenance to computer equipment - used mainly by ICTS & GSB | all other repairs & maintenance. | Use one of the specific GLs that belong to Commitment Item REP-MTC | |

| REP-MTC | 3760 | REP & MAINT - AIR CONDITIONING | all repairs and maintenance to air conditioners. | all other repairs & maintenance. | Use one of the specific GLs that belong to Commitment Item REP-MTC | |

| REP-MTC | 3800 | REP & MAINT - GROUNDS | all repairs and maintenance to the UCT grounds/estate, including gardens, roads, fencing & road/direction signage | all other repairs & maintenance. | Use one of the specific GLs that belong to Commitment Item REP-MTC | |

| REP-MTC | 3830 | REP & MAINT - PLUMBING | all plumbing repairs and maintenance - usually done by a plumber. | all other repairs & maintenance. | Use one of the specific GLs that belong to Commitment Item REP-MTC | |

| REP-MTC | 3860 | REP & MAINT - CATERING EQUIPMENT | all repairs and maintenance to catering equipment - used mainly in the residences and GSB. | all other repairs & maintenance. | Use one of the specific GLs that belong to Commitment Item REP-MTC | |

| REP-MTC | 3875 | REP & MAINT - CONSUMABLES | all workshop stock/consumable items required for repairs and maintenance jobs or research activity. | all other repairs & maintenance. | Use one of the specific GLs that belong to Commitment Item REP-MTC | |

| SAFETY-EXP | 3890 | FIRE FIGHTING EQUIPMENT & SERVICING | purchase and servicing of fire fighting equipment and servicing. | all equipment and services unrelated to fire | • 3900 First aid equipment & services • 4320 Computer hardware equipment < R25,000 • 4400 Equipment < R25,000 |

|

| SAFETY-EXP | 3900 | FIRST AID EQUIPMENT & SERVICES | first aid supplies and services e.g. sports matches, graduation. | all equipment and services unrelated to first aid | • 3890 Fire fighting equipment & servicing • 4320 Computer hardware equipment < R25,000 • 4400 Equipment < R25,000 |

|

| SAFETY-EXP | 3910 | PROTECTIVE CLOTHING & APPLIANCES | specific items of safety clothing and appliances used for protection e.g. lab coats, boots, jackets, gloves, masks, goggles, safety glasses, aprons, wet suits, flippers, masks | T-shirts, sporting kits, promotional clothing, uniforms, specific safety equipment | • 3150 Costumes • 2365 Clothing • 3890 Fire fighting equipment & servicing • 3900 First aid equipment & services |

|

| SAFETY-EXP | 3930 | SECURITY - SERVICES | services rendered by professional security personnel, includes UCT contracted security company, armed banking guards, body guards | keys, padlocks, burglar bars, alarm installations & monitoring, tracker devices | • 3750 Rep & Maint - Buildings • 3935 Security - systems |

|

| SAFETY-EXP | 3935 | SECURITY - SYSTEMS | access cards, alarm installation & maintenance, tracker, UCT libraries tattle tapes, alarm monitoring | keys, padlocks, burglar bars, security guards | • 3750 Rep & Maint - Buildings • 3930 Security - services |

|

| UTILITIES | 3960 | MUNICIPAL SERVICES | charges related to provision of utilities generally used by government/public utility initiated projects e.g. Central Improvement District (CID) | floral arrangements, alarm monitoring, CCTV, car hire, insurance, cell phone calls, venue hire, electricity, water | • 2210 Gifts & presentations • 2990 Cell phone charges • 3620 Venue hire • 3930 Security - services |

|

| UTILITIES | 3970 | ELECTRICITY | electricity | |||

| UTILITIES | 3980 | GAS - GENERAL | the cost of the gas purchased NB: If differentiation of gas purchased is important, ensure that the type is included first in the text description when placing PO, e.g. CO2, LN |

gas cylinder rental | • 3990 Gas - cylinder rental | |

| UTILITIES | 3990 | GAS - CYLINDER RENTAL | the cost of the gas cylinder rental | gas purchased | • 3980 Gas - general | |

| UTILITIES | 4000 | MUNICIPAL RATES | FOR USE BY P&S, RESIDENCES & GSB ONLY property rates payable to the local municipality |

|||

| UTILITIES | 4005 | SEWERAGE CHARGE | FOR USE BY P&S, RESIDENCES & GSB ONLY sewerage charge payable to the local municipality |

|||

| UTILITIES | 4010 | REFUSE REMOVAL | refuse removal | toxic waste | • 4020 Toxic waste | |

| UTILITIES | 4020 | TOXIC WASTE | removal of toxic waste from the UCT campus. | refuse removal | • 4010 Refuse removal | |

| UTILITIES | 4030 | WATER | FOR USE BY P&S, RESIDENCES & GSB ONLY water charge payable to the local municipality |

bottled water | • 2558 Refreshments | |

| S&T | 3360 | TRAVEL TICKETS (LOCAL) | cost of local airfares, where the final destination is within SA, as well as train and bus tickets to local destinations, where air travel is not appropriate. | accommodation, local leg of international flight | • 3381 Accommodation (local) • 3350 Travel tickets (foreign) |

|

| S&T | 3380 | SUBSISTENCE & TRAVEL (LOCAL) | monies paid for subsistence and travel related expenses, while on UCT business within SA, in terms of the UCT S&T policy (PAY002) and approved local daily rates NB: Can only be claimed if away for at least one night |

PAY002 | accommodation, airfare visa application charges, car hire, mileage claims, toll fees, approved functions, e.g. group dinners |

• 3381 Accommodation (local) • 3360 Travel tickets (local) • 3440 Travel ancillary costs (local) • 3390 Travel car hire (local) • 3420 Travel mileage claims • 2190 Entertainment |

| S&T | 3381 | ACCOMMODATION (LOCAL) | cost of local accommodation - hotel, travel lodge, B&B, guest house | |||

| S&T | 3390 | TRAVEL - CAR HIRE (LOCAL) | car hire and all costs associated with the hire, e.g. insurance, petrol, for local travel |

PAY002 | ||

| S&T | 3420 | TRAVEL MILEAGE CLAIMS | all mileage claims paid to staff, students, external parties, based on the UCT mileage policy | PAY004 | ||

| S&T | 3440 | TRAVEL ANCILLARY COSTS (LOCAL) | travel insurance, travel vaccinations, airport shuttle, transfer or taxi fares, parking (both at airport & other parking for business meetings or conferences), toll fees, reimbursed bank charges related to travel | PAY002 | ||

| S&T-FOREGN | 3350 | TRAVEL TICKETS (FOREIGN) | the cost of airfares, where the final destination is outside SA, including the local leg of an international flight, as well as train and bus tickets, related to international travel | Accommodation (foreign) (GL3371), visa part of Travel Ancillary Costs (GL3375) | ||

| S&T-FOREGN | 3370 | SUBSISTENCE & TRAVEL (FOREIGN) | monies paid for subsistence and travel related expenses, while on UCT business outside SA, in terms of the UCT S&T policy and approved country specific daily rates. [Taxi, toll fees and parking expenses are considered to be part of S&T for foreign travel & are NOT claimable as separate expenses.] | PAY002 | accommodation, airfare visa application charges, car hire, approved functions, e.g. group dinners |

• 3371 Accommodation (foreign) • 3350 Travel tickets (foreign) • 3375 Travel ancillary costs (foreign) • 3374 Travel car hire (foreign) • 2190 Entertainment |

| S&T-FOREGN | 3371 | ACCOMMODATION (FOREIGN) | the cost of international accommodation - hotel, travel lodge, B&B, guest house | |||

| S&T-FOREGN | 3374 | TRAVEL - CAR HIRE (FOREIGN) | car hire and all costs associated with the hire, e.g. insurance, petrol, for foreign travel | |||

| S&T-FOREGN | 3375 | TRAVEL ANCILLARY COSTS (FOREIGN) | visa, travel insurance, travel vaccinations, toll fees, reimbursed bank charges related to travel, as well as parking expenses, if S&T alowance NOT claimed. | |||

| BDEBT-WO | 4050 | BAD DEBT WRITE OFFS | FOR USE BY CENTRAL FINANCE ONLY bad debts written off not previously provided for |

Fees and Trade Debtors written off adjusted for against the bad debt provision centrally | • 4150 Provision for bad debts | |

| EXTRA-ORD | 4070 | EXTRA ORDINARY ITEMS | FOR USE BY CENTRAL FINANCE ONLY one-off items of material amounts |

|||

| INT-CHRGS | 4110 | OTHER INTERNAL CHARGES | internal charges between two UCT departments - used with internal vendors NB: Matching credit is always GL4410 - debits must equal credits | |||

| PROVISIONS | 4130 | PROFIT & LOSS FROM SALE/DISPOSAL ASSETS | FOR USE BY ASSETS OFFICE ONLY profit & loss on sale/disposal of assets |

|||

| PROVISIONS | 4150 | PROVISION FOR BAD DEBTS | FOR USE BY CENTRAL FINANCE ONLY provision for bad and doubtful debts - adjusted annually. Bad debt write offs (Fees & Trade Debtors) to be adjusted against prior year provision |

|||

| PROVISIONS | 4160 | PROVISIONS - OTHER | FOR USE BY CENTRAL FINANCE ONLY other UCT provisions, adjusted annually |

|||

| REFUNDS | 4200 | REFUNDS TO GRANTORS/LESSEES | surplusses returned to funders or grantors in terms of the contract; balances paid to lessees of external Baxter productions, in terms of the contract | |||

| REFUNDS | 4205 | TRANSFERS TO GOVT COLLABORATORS | transfers to other institutions based on government funding received | |||

| REFUNDS | 4206 | TRANSFERS TO OTHER COLLABORATORS | transfers to other institutions based on sub-contracts/agreements | |||

| REFUNDS | 4201 | REFUNDABLE DEPOSITS | deposits refunded mainly to students or deposits paid | |||

| LOAN-INT | 4220 | INTEREST INTERNAL LOANS | interest on Internal loans | |||

| LOAN-INT | 4250 | INTEREST UNSUBSIDIZED LOANS | FOR USE BY GENERAL LEDGERS ONLY interest paid on long-term loans approved by Council |

|||

| LOAN-REDEM | 4270 | REDEMPTION INTERNAL LOANS | FOR USE BY TREASURY ONLY redemption on Internal loans |

|||

| LOAN-REDEM | 4280 | REDEMPTION LOANS GOVT SHARE | FOR USE BY GENERAL LEDGERS ONLY redemption on subsidized loans - government share |

|||

| LOAN-REDEM | 4290 | REDEMPTION LOANS UCT SHARE | FOR USE BY GENERAL LEDGERS ONLY redemption on subsidized loans - UCT share or UCT only loans |

|||

| COMPUTERS | 4320 | COMPUTER HARDWARE EQUIPMENT < R25,000 | desktop computers, laptops, monitors, scanners, printers, external hard drive (only if < R25,000). NB: includes the transfer to a computer replacement provision, in terms of an approved multi-year asset replacement cycle, as well as internally purchased used IT equipment |

AS001 | computer consumables, computer services & consulting, computer software & licences NB: For all computer equipment >R25,000, complete Asset form AS001 |

• 4410 Assets > R25,000 - TFR to replacement provision • 2130 Computer consumables • 2140 Computer services/consulting • 2150 IT contractual payments |

| ICT002 | ||||||

| FURNITURE | 4360 | FURNITURE < R25,000 | desks, chairs, tables, filing cabinet (only if < R25,000) | furniture >R25,000, repairs & maintenance, computer equipment, office equipment, equipment hire NB: For all furniture >R25,000, complete Asset form AS001 |

• 3720 Rep & Maint - Furniture & equipment • 4320 Computer hardware equipment < R25,000 • 4400 Equipment <R25,000 • 3650 Equipment hire |

|

| REG-ASSETS | 4380 | ASSETS: MUSEUM & ART TREASURES | art purchased via the Works of Art Committee (WAC) | all other assets | ||

| REG-ASSETS | 4400 | EQUIPMENT < R25,000 | lab/research/teaching/residence/office equipment such as fax machines, shredders, white boards, teaching models. Also includes water coolers/purifiers, heaters, fans, kitchen appliances, musical instruments, diving gear, sporting equipment, crockery, kitchen utensils & cutlery for non-residence use | AS001 | equipment >R25,000, repairs & maintenance, computer equipment, equipment hire NB: For all equipment >R25,000, complete Asset form AS001 |

• 4360 Furniture <R25,000 • 3720 Rep & Maint - Furniture & equipment • 4320 Computer hardware equipment < R25,000 • 3650 Equipment hire • 2100 Kitchen utensils & cutlery (residence use only) • 2060 Crockery (residence use only) |

| REG-ASSETS | 4410 | ASSETS > R25,000 - TFR TO REPLACEMENT PROVISION | transfers to operating asset replacement provision, in terms of an approved multi-year asset replacement cycle. Assets include all equipment and vehicles greater than R25,000. NB: Matching credit is always GL4410 - debits must equal credits | replacement provision for computers | • 4320 Computer hardware equipment < R25,000 | |

| TRF-ASSETS | 4440 | TRANSFERS - ASSETS | transfer of funds to one fund for the acquisition of an asset NB: Matching credit is always GL4440 - debits must equal credits | |||

| ELECT-INFO | 4460 | LIB ELECTRONIC SUBSCRIPTIONS & CHARGES | FOR USE BY LIBRARIES ONLY costs incurred to access an international database for cataloguing records, access to inter-library loans infrastructure, and other electronic information requests |

|||

| LIB-AUDIO | 4500 | LIB ELECTRONIC BOOK AND DIGITAL TEXTS | FOR USE BY LIBRARIES ONLY costs incurred to purchase books and text received individually or as a package in electronic format |

books, periodicals/journal subscriptions, reprints | • 2820 Books & journals • 2595 Textbooks • 2850 Book reprints • 2860 Subscriptions to periodicals |

|

| LIB-AUDIO | 4520 | LIB AUDIO VISUAL ACQUISITIONS | FOR USE BY LIBRARIES ONLY costs incurred when purchasing audiovisual material for the Libraries collection. Includes digital sound, film, video and photographs |

|||

| LIB-BOOKS | 4580 | LIB BOOK ACQUISITIONS | FOR USE BY LIBRARIES ONLY costs incurred when purchasing books (monographs) for the Libraries collection |

books, periodicals/journal subscriptions, reprints | • 2820 Books & journals • 2595 Textbooks • 2850 Book reprints • 2860 Subscriptions to periodicals |

|

| LIB-PERIOS | 4601 | LIB PERIODICALS - DATA BASES | FOR USE BY LIBRARIES ONLY collection of titles, usually journals, in electronic format. Includes search engines and platforms |

books, periodicals/journal subscriptions, reprints | • 2820 Books & journals • 2595 Textbooks • 2850 Book reprints • 2860 Subscriptions to periodicals |

|

| LIB-PERIOS | 4610 | LIB PERIODICALS - ELECTRONIC SERIALS | FOR USE BY LIBRARIES ONLY costs incurred to purchase individual titles in electronic format |

|||

| LIB-PERIOS | 4620 | LIB PERIODICALS - PRINT | FOR USE BY LIBRARIES ONLY costs incurred to purchase journals received only in print |

books, periodicals/journal subscriptions, reprints | • 2820 Books & journals • 2595 Textbooks • 2850 Book reprints • 2860 Subscriptions to periodicals |

|

| LIB-PERIOS | 4630 | LIB PERIODICALS - PRINT & ELECTRONIC | FOR USE BY LIBRARIES ONLY costs incurred purchasing journals that are received both in print and electronically, as a combined package |

books, periodicals/journal subscriptions, reprints | • 2820 Books & journals • 2595 Textbooks • 2850 Book reprints • 2860 Subscriptions to periodicals |

|

| LAND-BLFG | 4810 | LAND PURCHASED | FOR USE BY ASSETS OFFICE ONLY land purchases |

cost of building on the land | ||

| CAP-PROJ | 4680 | FEES - ARCHITECT | architect fees | |||

| CAP-PROJ | 4690 | FEES - ENGINEERING | all engineering fees, including structural, civil, electrical, mechanical | |||

| CAP-PROJ | 4710 | FEES - QUANTITY SURVEYOR | all fees related to quantity surveying | |||

| CAP-PROJ | 4651 | CAPITAL PRJ - DEMOLITION & EARTHWORKS | FOR USE BY P&S ONLY capital costs associated with demolition and earthworks - only for Assets Under Construction (AUC) |

|||

| CAP-PROJ | 4652 | CAPITAL PRJ - BUILDING | FOR USE BY P&S ONLY capital costs associated with the building - only for Assets Under Construction (AUC) |

|||

| CAP-PROJ | 4653 | CAPITAL PRJ - ELECTRICAL | FOR USE BY P&S ONLY capital costs associated with the electrical installations - only for Assets Under Construction (AUC) |

|||

| CAP-PROJ | 4654 | CAPITAL PRJ - VOICE & DATA INFRASTRUCTURE | FOR USE BY ICTS & P&S ONLY capital costs associated with the voide and data infrastructure - only for Assets Under Construction (AUC) |

|||

| CAP-PROJ | 4655 | CAPITAL PRJ - ROOF | FOR USE BY P&S ONLY capital costs associated with the roofing- only for Assets Under Construction (AUC) |

|||

| CAP-PROJ | 4656 | CAPITAL PRJ - PLUMBING | FOR USE BY P&S ONLY capital costs associated with the plumbing - only for Assets Under Construction (AUC) |

|||

| CAP-PROJ | 4720 | FEES - SCRUTINY | scrutiny fees payable when plans are approved/assessed/reviewed e.g. by the City of Cape Town, heritage consultants | |||

| CAP-PROJ | 4740 | FEES - PROJECT MANAGEMENT | FOR USE BY P&S ONLY all fees related to project management |

|||

| FLOATS | 4830 | SUNDRY ADVANCES | sundry amounts taken in advance of supporting documentation ito the UCT Advances policy | PAY006 | ||

| FLOATS | 4837 | S&T ADVANCES - LOCAL AND FOREIGN | travel amounts taken in advance of supporting documentation ito the UCT Advances policy | PAY006 | ||

| FLOATS | 4850 | PETTY CASH FLOAT | petty cash advanced to restore petty cash float to imprest amount, or to create petty cash float | |||

| FUNDTRR-D | 4815 | GOB FUND CONTRIBUTION - DEBIT | the transfer of GOB contributions between funds NB: Matching credit is always GL433 - debits must equal credits | |||

| FUNDTRR-D | 4820 | GRANT TRANFERS - DEBIT | the transfer of grant contributions between funds (mainly research) NB: Matching credit is always GL436 - debits must equal credits |

|||

| FUNDTRR-D | 4825 | INVESTMENT INCOME TRANSFER - DEBIT | the transfer of investment income between funds NB: Matching credit is always GL439 - debits must equal credits |

|||

| FX-ASS-DEP | 4370 | POST CAP: ACQ ASSETS EXP IN PRIOR YRS | FOR USE BY ASSETS OFFICE ONLY assets capitalised that were expensed in prior years |

|||

| FX-ASS-DEP | 4421 | REAL ESTATE ASSETS DEPRECIATION | FOR USE BY ASSETS OFFICE ONLY monthly depreciation charged on Real estate assets over its useful life, refer Assets policy |

AST001 | ||

| FX-ASS-DEP | 4423 | FURNITURE & EQUIPMENT ASSETS DEPRECIATION | FOR USE BY ASSETS OFFICE ONLY monthly depreciation charged on Furniture and Equipment assets over its useful life, refer Assets policy |

AST001 | ||

| FX-ASS-DEP | 4426 | COMPUTERS ASSETS DEPRECIATION | FOR USE BY ASSETS OFFICE ONLY monthly depreciation charged on Computer assets over its useful life refer Assets policy |

AST001 | ||

| FX-ASS-DEP | 4428 | MOTOR VEHICLES (DEPT) ASSETS DEPRECIATION | FOR USE BY ASSETS OFFICE ONLY monthly depreciation charged on Motor Vehicle assets over its useful life |

|||

| FX-ASS-DEP | 4770 | AUC SETTLEMENT ACCOUNT | FOR USE BY ASSETS OFFICE ONLY monthly settlement of Assets under Construction Internal orders |

|||

no reviews yet

Please Login to review.