| Example profit and loss statement |

|

|

|

|

|

|

|

What is a profit and loss statement?

The profit and loss statement is a summary of a business’s income and expenses over a specific period. It should be prepared at regular intervals (usually monthly and at financial year end) to show the results of operations for a given period.

Calculating the cost of goods sold varies depending on whether the business is retail, wholesale, manufacturing, or a service business. In retailing and wholesaling, computing the cost of goods sold during the reporting period involves beginning and ending inventories. This, of course, includes purchases made during the reporting period. In manufacturing, it involves finished-goods inventories, plus raw materials inventories, goods-in-process inventories, direct labour, and direct factory overhead costs.

In the case of a service business, the revenue is being derived from the activities of individuals rather than the sale of a product and hence the calculation of cost of goods sold is a smaller task due to the low-level use of materials required to earn the income. |

|

|

|

|

|

|

|

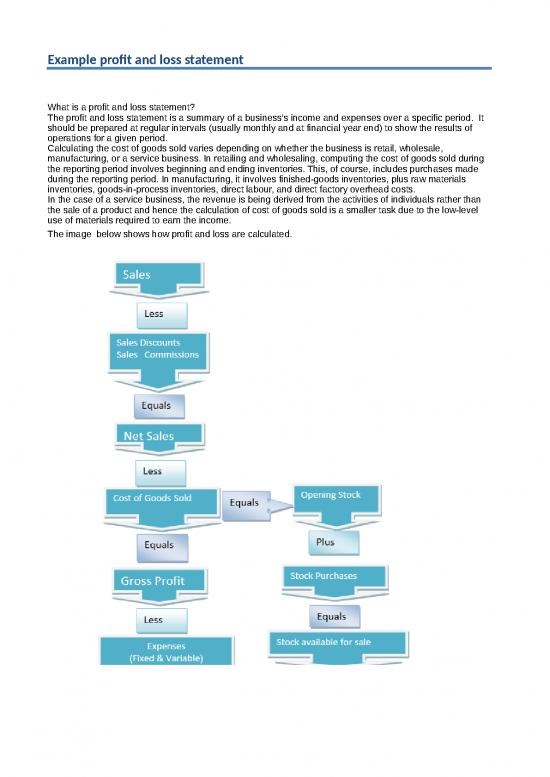

| The image below shows how profit and loss are calculated. |

|

|

|

Joe’s Motorbike Tyres |

|

|

|

|

|

|

|

Profit and Loss Statement |

|

|

|

|

|

|

For the Period ended Year One |

|

|

|

|

|

|

Income |

|

|

|

|

|

|

|

Sales |

52000 |

( 1,000 tyres @ $ 52 each) |

|

|

|

|

Total Sales |

52000 |

|

|

|

|

Cost of Goods Sold |

|

|

|

|

|

|

|

Opening Stock |

$ - |

|

|

|

|

|

Stock Purchases |

34320 |

|

|

|

|

|

Less Closing Stock |

3120 |

|

|

|

|

Total Cost of Goods Sold(COGS) |

|

31200 |

( See note below) |

|

|

|

Gross Profit |

|

20800 |

|

|

|

|

Expenses |

|

|

|

|

|

|

|

Advertising |

500 |

|

|

|

|

|

Bank Service Charges |

120 |

|

|

|

|

|

Insurance |

500 |

|

|

|

|

|

Payroll |

13000 |

|

|

|

|

|

Professional Fees (Legal, Accounting) |

200 |

|

|

|

|

|

Utilities & Telephone |

800 |

|

|

|

|

|

Other: Computer Software |

480 |

|

|

|

|

|

Expenses total |

15600 |

|

|

|

|

Net Profit before Tax |

|

5200 |

|

|

|

|

|

|

|

|

|

|

|

Note; Cost of Goods Sold calculation: |

|

|

|

Towards the end of the year, Joe manages to purchase 100 more tyres on credit from his supplier for an order in the new year. This leaves him with $3,120 of stock on hand at the end of the year. |

|

|

|

Joe’s Cost of Goods Calculation |

|

|

|

Opening Stock Nil |

|

|

|

|

|

|

Add Stock Purchased during the year |

|

$34,320 |

(1100 tyres @ 31.20 each) |

|

|

|

Equals Stock available to sell |

|

$34,320 |

|

|

|

|

Less Stock on hand at end of year |

|

$3,120 |

(100 tyres @ 31.20 each) |

|

|

|

Cost of Goods Sold |

|

$31,200 |

|

|

|

|

Where a business is a service business, that is, you are selling services not goods or products, then the profit and loss statement will generally not have a cost of goods sold calculation. In some instances, where labour costs can be directly attributed to sales, then you may consider including these costs as a cost of goods (services) sold. |

|

|

|

|

|

|

|

Tip: Regularly produce profit and loss information (monthly) and compare against previous month’s activities to ensure your profit expectations are being met.

Hint: Only those businesses that have goods (products) to sell will use the calculation of cost of goods sold |

|

|

|

|

|

|

|

| Profit and Loss Statement |

|

|

|

|

|

|

|

|

|

|

|

|

| Instructions |

|

|

|

|

|

|

|

|

|

|

|

|

| Give careful thought to the headings. |

|

|

|

|

|

|

|

|

|

|

|

|

| Expand the sales income and expenses area if your business has distinct categories (e.g. a restaurant may have food sales and beverage sales listed separately and cost of sales for each also separated). |

|

|

|

|

|

|

|

|

|

|

|

|

| Month |

Insert start month and year

Jan 19 |

Feb 19 |

Mar 19 |

Apr 19 |

May 19 |

Jun 19 |

Jul 19 |

Aug 19 |

Sep 19 |

Oct 19 |

Nov 19 |

Dec 19 |

| Income |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales |

|

|

|

|

|

|

|

|

|

|

|

|

| Sale of goods/services |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Sundry Income (e.g. Commission earned, frachise fees etc.) |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Etc. |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Sales |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Less Discounts/Commissions |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales Discounts given |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Sales Commissions paid |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Discounts/ Commissions |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Net Income |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Cost of Sales |

|

|

|

|

|

|

|

|

|

|

|

|

| Opening Stock |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Stock Purchased |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Less Closing Stock |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Cost of Sales |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| General & Administrative |

|

|

|

|

|

|

|

|

|

|

|

|

| Bank charges |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Credit card commission |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Consultant fees |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Office Supplies |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| License fees |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Business insurance |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Etc. |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total General & Administrative |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Marketing & Promotional |

|

|

|

|

|

|

|

|

|

|

|

|

| Advertising |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Promotion - General |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Promotion - Other |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Etc. |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Marketing & Promotional |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Newspapers & magazines |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Parking/Taxis/Tolls |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Entertainment/Meals |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Travel/Accomodation |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Laundry/dry cleaning |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Cleaning & cleaning products |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Sundry supplies |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Equipment hire |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Etc. |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Operating Expenses |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Motor Vehicle Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Fuel |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Vehicle service costs |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Tyres & other replacement costs |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Insurance |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Registrations |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Motor Vehicle Expenses |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Website Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Domain name registration |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Hosting expenses |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| etc |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Website Expenses |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Employment Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Permanent |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Salaries/Wages |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| PAYE |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Superannuation |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Other - Employee Benefits |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Recruitment costs |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Perm. Employment Expenses |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Casual |

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries/Wages |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| PAYE |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Superannuation |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Other - Employee Benefits |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Recruitment costs |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Casual Employment Expenses |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Workcover Insurance |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Employment Expenses |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Occupancy Costs |

|

|

|

|

|

|

|

|

|

|

|

|

| Electricity/Gas |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Telephones |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Property Insurance |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Rates |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Rent |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Repair & maintenance |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Waste removal |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Water |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Etc. |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Occupancy Costs |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Other Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Add an expense description here |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Add an expense description here |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Add an expense description here |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Add an expense description here |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Add an expense description here |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Add an expense description here |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Add an expense description here |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Other Expenses |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Expenses |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Month Net Profit / (Loss) |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Total Year to Date Net Profit / (Loss) |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

$- |

| Instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Give careful thought to the headings. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expand the sales income and expenses area if your business has distinct categories |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (e.g. a restaurant may have food sales and beverage sales listed separately and cost of sales for each also separated). |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit & Loss Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Month |

Insert start month and year

Jan 19 |

Feb 19 |

Mar 19 |

Apr 19 |

May 19 |

Jun 19 |

Jul 19 |

Aug 19 |

Sep 19 |

Oct 19 |

Nov 19 |

Dec 19 |

| Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Sales |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Less Total Disc/Comm |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Total Net Income |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Less Total Cost of Gooods Sold |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Gross Profit |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

General & Administrative |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Marketing & Promotional |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Operating Expenses |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Motor Vehicle Expenses |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Website Expenses |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Total Employment Expenses |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Occupancy Costs |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Other Expenses |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| Total Expenses |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| Monthly Net Profit / (Loss) |

|

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| Total Year to Date Net Profit / (Loss) |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| Profit and Loss Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin

(Gross Profit / Net Income) |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

Net Margin

(Net Profit / Net Income) |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

|

|

|

|

|

|

|

|

|

|

|

|

Mark Up

((Net Income Less Cost of Goods Sold) / (Cost of Goods Sold)) x 100 |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Break Even

( Expenses/((1-(Cost of Goods Sold/ Net Income)) |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |

#DIV/0! |