247x Filetype XLSX File size 0.02 MB Source: blogs.cornell.edu

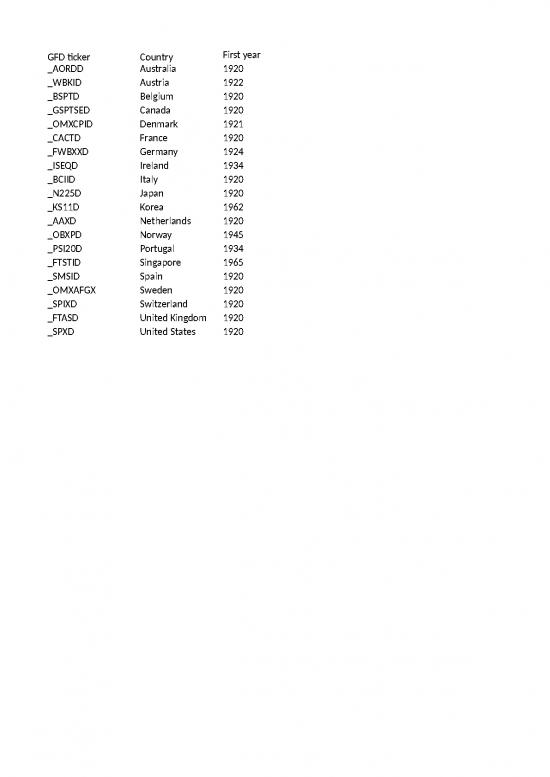

Sheet 1: Price index

| GFD ticker | Country | First year | Name | Description from GFD |

| _AORDD | Australia | 1920 | Australia ASX All-Ordinaries (w/GFD extension) | The All Ordinaries index is Australia's premier market indicator. The index represents the 500 largest companies listed on the Australian Stock Exchange. Market capitalisation is the only eligibility requirement of constituents, as liquidity is not considered, with the exception of foreign domiciled companies. The index comprised 99% of the Australian market at June 30, 2002. The old Sydney indices were replaced in 1958 with a new set of indices that were calculated back to July 1936 by Lamberton and covered over 20 sectors. Data were calculated back to 1875 on a monthly basis for the industrial and commercial index, and daily data began in January 1958. The historical data and a description of the indices, as well as other Australian indices, can be found in D. McL. Lamberton, Share Price Indices in Australia, Sydney: Law Book Co., 1958. Monthly data have been taken from the Sydney Stock Exchange Journal, Australian Stock Exchange Journal, Personal Investing, and SXJ Journal, which are the various journals published by the Sydney and Australian stock exchanges. The All-Ordinaries Price Index was capitalization-weighted using the Paasche formula with chaining, which is adjusted for capitalization changes. The index includes the top stocks by capitalization, covering about 92% of domestic companies by market value. Shares should have an aggregate market value of at least 0.02% of all domestic equities on the Exchange, and maintain an average turnover in excess of 0.5% of it quoted shares each month. Components are reviewed monthly. Monthly data have been taken from the Sydney Stock Exchange Journal, Australian Stock Exchange Journal, Personal Investing, and SXJ Journal, which are the various journals published by the Sydney and Australian stock exchanges. The data are also available in the ASX Price and Indices Yearbook, which is published annually by the Australian Stock Exchange. |

| _WBKID | Austria | 1922 | Austria Wiener Boersekammer Share Index (WBKI) | The Wiener Borsekammer Index (WBKI) includes historical data series for Vienna. Data were taken from Statistisches Reichsamt Statistische Nachrichten,(1921-1924), Institute fur Konjunkturforschung (1925-1938); Vienna Statistical Yearbook (1943-1945), and Statistisches Nachrichten (1946-). The data starting in 1922 are from a general index of stocks on the Vienna Stock Exchange taken from the Statistische Nachrichten. An index of 21 industrial shares calculated by the Institut fur Konjunkturforschung is used from 1925 until 1928, and an index of 34 industrial shares from January 1929 to June 1939. No data are available for October 1931, April 1938, July 1939 until 1942, and April 1945 to March 1946. The Central Statistical Office Index is used through 1951. It included 18 shares through October 1946, 19 shares through August 1947, and 23 shares thereafter. Beginning in 1952, an index of 42 shares which was calculated by the Institute of Economic Research is used which was an unweighted arithmetic average of prime relatives with a base of March 1938 = 100 which included 36 industrial and 6 bank shares. In 1954 shares of nationalized enterprises were replaced by private enterprises. This index is used until December 1967 when the Wiener Borsekammer index is substituted for it. In 1980 the old indices calculated by the Vienna Stock Exchange were replaced with new indices which were rebased to December 31, 1967 = 100. The index is capitalization-weighted and includes all domestic Official Market shares. The index uses the Paasche formula, and adjusts for capitalization changes and component changes. It has been calculated on a daily basis since September 2, 1985. The index is an arithmetic mean, weighted according to the market capitalisation of the company and calculated at closing prices using the Paasche formula. Monthly figures refer to the middle of the month. Annual and quarterly data are averages of monthly figures. The index is based 31 December 1967 = 100. |

| _BSPTD | Belgium | 1920 | Brussels All-Share Price Index (w/GFD extension) | The Spot Index includes the long-term historical data for Belgium's stock market. No data are available from 1914 to 1918. Data for 1919 to 1925 uses a quarterly index calculated by the Moniteur des Interets Materiels. Beginning in 1926, a monthly index of 80 industrial shares calculated by the National Bank of Belgium is used. No data are available for June to November 1940 and from August 1944 to May 1945 when the stock market was closed in Belgium due to the war. The post-war index was a weighted, arithmetic average of price relatives with moving base, chain-linked to 1953 = 100. The index was weighted by the market value of shares of all companies included at the beginning of the month in Brussels and Antwerp, omitting in the calculation for any period shares of companies changing their capitalization during the period. This index was an all-share index consisting of 400-500 shares that was calculated at the beginning of each month. The current Brussels SE Price Index was introduced in 1985 and calculated back to the base of December 31, 1979. It includes all shares traded on the Brussels Stock Exchange. Monthly volume begins in December 1940. Sources for the index include: Bulletin Trimestriel de l'Institut des Sciences Economiques, December 1929, p. 34 (1897-1913), International Statistics Institute (1919-1936), League of Nations (1937-1940), Institut National de Statistique, Bulletin de Statistique Brussels: INS (1940-79), Brussels Stock Exchange (1980-). The BAS index is an "All shares" index representing the evolution of the Euronext Brussels Market as a whole. The Index is based on the closing prices of all belgian shares listed on the fixing and continuous segment, of the First and the Second Market. The shares are weighted according to their daily market capitalisation. However, companies having a free float of 5% or less will be taken out of the index with free float being a measure ( in %) for the part of the issued shares of the company that are available to the public for trading.The BAS index has two versions, Price and Return. The basis of both the Price and Return Index is 01.01.1980 = 1000. The indexes are calculated once a day at the closing of the market and are published after 5.40 pm. The only difference between a Price Index and a Return Index is that the price index does not take into account the reinvestment of NET dividends. |

| _GSPTSED | Canada | 1920 | Canada S&P/TSX 300 Composite (w/GFD extension) | Data from 1914 to 1918 use indices published by the Financial Post. The index is an arithmetic average of the prices of 10 Bank stocks (1914-1918), 4 Light and Power Stocks (1914-1918), 20 Industrials (1916-1918), 4 Textile Stocks (1917-1918) and 6 Newsprint Stocks. The Dominion Bureau of Statistics kept the Investor’s Index on a weekly basis beginning in 1926 and daily beginning in 1937. It covered over 100 stocks and about 15 sectors at any one point in time. Monthly data are averages of weekly data. Up until the 1960s these were the broadest sector indices kept in Canada. The primary source for this data has been the Dominion Bureau of Statistics, Canada Yearbook, Ottawa: DBS from 1919 until 1969, and DBS Monthly Review of Business Statistics Ottawa: DBS for 1970 through 1975. The indices were also published each week in The Financial Post. The index was an aggregative index, weighted by shares outstanding with an original base of 1913 = 100 and with a final base of 1971 = 100. These indices are used through 1955. Data from 1956 on are from the Toronto Stock Exchange Indices. In January 1977, the Toronto Stock Exchange indices were revised again to produce the current set of indices covering around 50 sectors. The base for these indices is 1975 = 1000. The TSE-300 Composite is a capitalization-weighted price index using the Paasche formula. It is adjusted for capitalization and component changes, and includes 14 group indices and 34 sub-group indices. See the February 1977 issue of the Toronto Stock Exchange Monthly Review for more information on the indices. Data are monthly from 1956 through 1970, weekly from 1971 to 1981 and daily thereafter. The S&P/TSX Composite Index comprises approximately 71% of market capitalization for Canadian-based, Toronto Stock Exchange listed companies. The size of the S&P/TSX Composite (C$913.3 Billion in float market capitalization as of October, 2000) and its broad economic sector coverage has made the S&P/TSX Composite the premier indicator of market activity for Canadian equity markets since its launch on January 1, 1977. |

| _OMXCPID | Denmark | 1921 | OMX Copenhagen All-Share Price Index | KAX is the Exchange's all-share index. On 15 June 2001, KAX replaced the previous all-share index. KAX is here calculated as a price index. Denmark introduced stock exchange indices in 1921 with data calculated back to 1914. The data are taken from the Statistiske Efterretninger for and from the Statistiske Department, Statistisk Arbog, Copenhagen: Statistiske Dept. Two primary revisions have occurred in the indices. The first occurred in 1960 when several new indices were introduced. Information on these changes can be found in “Nyt Aktiindeks,” Statistiske Efterretninger, Vol. 52, No. 52 (1960): 795-797. The second revision came in 1983 when several financial indices were introduced. Data are annual averages for 1914 through 1920 and monthly thereafter. The base for the current indices is January 1, 1983 = 100 through 2001. For the main index, data are annual from 1914 through 1920 and monthly thereafter. The Copenhagen Stock Exchange was closed between September 20, 1931 and October 14, 1931. No data are available for May 1940 because the stock market was closed from April 9 to June 5, 1940 and from September 1-11, 1940. The pre-war index was a weighted arithmetic average of price relatives, weighted by value of shares outstanding, adjusted for new capital, share dividends and rights. The average of the monthly high and low quotations in Copenhagen was used to calculate the index value. The index covered about 20 companies, which represented 60% of the share capital of industrial companies on the exchange. The indices underwent major revisions in 1960 and in 1983. Historical data is taken from Statistiske Department, Statistisk Arbog and Statistiske Efternetringer, Copenhagen: Statistiske Dept. (1916-1984). The Copenhagen SE index is a capitalization-weighted price index of all shares excluding foreign companies, mutual funds and two holding companies (EAC-Holding and GN Store Nord Holding), using the Paasche formula and adjusting for capitalization and component changes. Data before 1983 have been adjusted to the new base. |

| _CACTD | France | 1920 | France CAC All-Tradable Index (w/GFD extension) | The SBF 250 index has been extended back on an annual basis to 1801. Monthly data begin in 1898 although no monthly data are available from 1915 through 1918. No data are available for September 1939 and from June 1940 until February 1941 because the stock market was closed due to the war. The INSEE index was a weighted average of price relatives with a moving base. The index was based upon the last Friday of the month in Paris, included about 300 shares, and kept the same base date from the 1940s until December 1993 when the INSEE indices were discontinued because of the new indices introduced by the Societe des Bourses Francaises. No data are available for April 1974 and for March 1979 due to strikes that closed the Paris bourse. The SBF-250 Index name was changed to CAC All-Tradable Index on March 18, 2011. The CAC General Index is used beginning in November 1979, and the SBF-250 index is used beginning in December 1990. This index is used rather than the CAC-40 because the CAC-40 represents only 50% of the capitalization of the Paris Bourse. Sources for the data are Marcel Lenoir, "Le mouvement des course des valeurs mobilieres francaise depuis 1856," Bulletin de la Statistique Generale de la France, (9) October 1919: 65-92; Jean Dessirer, "Le Prevision statistique des Mouvements des Valeurs de Bourse," Journal de la Societe Statistique de Paris, (May 1928): 160-192, "Cours et revenu des valeurs mobilieres en France de 1919 a 1927," ibid., (17) 1927: 390-405; and "Cours des valeurs mobilieres a revenu variable en France despuis 1927," ibid., (22), Jan-March 1932: 243-251 (1919-1927). Institut National de la Statistique et des Etudes Economiques, Annuaire Statistique de la France, Paris: INSEE and INSEE, Bulletin Mensuel Statistique, Paris: INSEE (1928-). The SBF-250 is a capitalization-weighted price index, using the Paasche formula, and adjusting for capitalization and component changes. The new indices introduced by the SBF (Societe des Bourses Francaises) in 1993 replaced the former CAC (Compagnie des Agents de Change) indices. Data were back-calculated to December 31, 1990 for these indices. The SBF 250 index represents the 250 largest stocks by capitalisation traded on Euronext Paris among all stocks (after the exclusion of “holding” companies) with annual velocity ratio of more than 5%. To ensure a degree of stability in the composition of the index, systematic sampling based on annual turnover rate is performed only once a year.At the end of each quarter, stocks are replaced only if they have been merged or delisted or if their velocuty ratio has fallen below 2.5%. |

| _FWBXXD | Germany | 1924 | Germany CDAX Composite Index (w/GFD extension) | The CDAX and FAZ Aktien indices contain the long-term historical series for Germany. A monthly index of about 80 stocks was calculated from 1870 until 1913 by Otto Donner for the Konjunkturforschung. The Berlin Stock Exchange was closed in August 1914 and reopened in December 1917. Beginning in 1924, a nominal index of about 213 shares is used which includes all sectors of the exchange. This index was calculated until June 1943. In July 1948, the Statistisches Bundesamt began keeping a new share index on a monthly basis, which covered about 300 shares. The index was calculated on a monthly basis from 1948 to 1953, weekly from 1954 until 1973, and daily until the indices were discontinued in June 1995. The Commerzbank Index is used from 1956 to 1969. The current index is the CDAX Price Index, which includes all stocks traded on the Deutsche Borse. The index was introduced in 1987 and calculated back to 1970. The CDAX-share price index of the Deutsche Börse AG shows the average price movements of all the ordinary and preferred shares officially listed on the Frankfurt Stock Exchange of companies based in Germany. Prices are ex-dividend and exclude taxes. All companies listed on the Frankfurt Stock Exchange are included in the index. The index is computed according to a Laspeyres Index formula where the price of each stock is weighted by the number of shares listed on the stock exchange and declared to be deliverable. Sources for the series are Statistisches Reichsamt, Statistisches Jahrbuch fur das Deutsche Reich, Berlin: Statistisches Reichsamt and Statistisches Reichsamt, Wirtschaft und Statistik, Berlin (1917-1943), Bayerischen Statistichen Landesamt, Bayern in Zahlen, Munchen: Bayerisches Statistisches Landesamt (1945-1948), Statistisches Bundesamt, Wirtschaft und Statistik and Bundesbank, Statistisches Bundesamt, Geld und Kredit--Reihe 2.S.1--Index der Aktienkurse--Lange Reihen, Wiesbaden: Statistisches Bundesamt, 1985 (1948-1954), Commerzbank, Deutscher Aktienmarkt seit 1953, Frankfurt: Commerzbank, 1988, and The Financial Times (1955-) |

| _ISEQD | Ireland | 1934 | Ireland ISEQ Overall Price Index (w/GFD extension) | The ISEQ index is the primary index for Ireland today. This index has been tied to previous stock market indices calculated by the Central Statistical office. The original index was a general, weighted aggregative index, excluding railway shares, and based upon the first of the following month prices. The index covered around 100 companies on the Dublin Stock Exchange. The historical index begins in 1934, and the ISEQ Overall index is used beginning in 1983. The sources are Central Statistical Office, Statistical Yearbook, (1934-1988) for the two general indices, and the web site of the ISEQ for the data since 1983. The ISEQ (Irish Stock Exchange Equity Index) Overall share price index measures the change in the prices of ordinary stocks and shares quoted on the Irish Stock Exchange. Coverage: The ISEQ indices include all domestic and Northern Ireland companies quoted on the Official List and Developing Companies Market equities of the Irish Stock Exchange (78 companies). Calculation: The index is an arithmetic mean weighted according to the market capitalisation of the company. The national base of the index is 4 January 1988. Monthly data are arithmetic averages of daily closing prices. Annual and quarterly figures are averages of monthly data. |

| _BCIID | Italy | 1920 | Banca Commerciale Italiana Index (w/GFD extension) | The long-term index begins in September 1905 using the index calculated by Prof. Bachi through December 1930, which consisted of 173 stocks. No data are available for August through December of 1914 due to the war, and data are annual for 1915, 1916, and 1922 through June 1924. Beginning in 1931, Prof. Guarneri's index of 74 stocks is used until June 1939. The index calculated by the Gruppo Edison of 24 shares on the Milan stock exchange is used from 1939 through 1973. It had a base of December 1938 = 100. This index was a weighted aggregative index, adjusted by new capital and share dividends based upon an average of daily quotations in Milan. No datum is available for May 1945. All indices are based upon shares traded on the Milan stock exchange. The BCI Index data begins on January 3, 1973. To give more historical perspective, the Edison General Index of Italian shares has been appended onto the BCI index to extend the data back to 1956. The BCI Index includes over 325 companies listed on the Milan Stock Exchange; it is capitalization-weighted and uses the Paasche formula. Sources include La Riforma Sociale (1905-1921), Statistisches Reichsamt (1922-1930); League of Nations (1931-1945), Italian Statistical Institute, Annuario della Congiuntura, Milan: ISI (1946-1949), Banca d'Italia, Bolletino, December 1964, pp. 650-657 (1950-1956), Congiuntura Economica (1956-1972), Banca Commerciale Italiana, Trend of the BCI Indices, Milan: BCI, 1995 |

| _N225D | Japan | 1920 | Nikkei 225 Stock Average (w/GFD extension) | The National Bank Index is used from July 1914 through December 1932, and the Oriental Economist Index is used from 1933 through September 1948. The stock market was closed between September and November 1923 due to the earthquake, so no data is available for October 1923. No data are available from September 1945 until April 1946. The Oriental Economist index is used from May 1946, when black market trading resumed in Tokyo, to September 4, 1948. The index includes 30 stocks. Data are weekly HLC through June 1948 and daily thereafter. The Fisher index is used from September 1948 through April 1949. From 1930 to 1964, the Tokyo Stock Exchange used a chain index calculated to Professor Irving Fisher`s "ideal" formula with stocks weighted by volume. Sources include Bank of Japan, Annual Financial Statistics (1914-1932), Oriental Economist (1933-1945) Tokyo Stock Exchange, Tokyo Tokei Geppo, Tokyo: Tokyo Shoken Torihikijo Chosabu (1946-). The Tokyo stock exchange officially reopened in May 1949, and the Nikkei 225 is used from May 1949 on. The Nikkei-225 Index is an average price index using the Dow formula, adjusting for capitalization changes, and whose components are reviewed annually. Stocks are chosen based upon liquidity and industry representation. Sources include Daiwa Securities, Japan Stock Market Manual, Tokyo: Daiwa Securities, and Tokyo Stock Exchange, Tokyo Tokei Geppo, Tokyo: Tokyo Shoken Torihikijo Chosabu. |

| _KS11D | Korea | 1962 | Korea SE Stock Price Index (KOSPI) | The primary sources for these data are Korea Stock Exchange, Korea Composite Stock Price Index, Seoul: KSE, 1991, and Korea Stock Exchange, Monthly Key Statistics, Korea: The Exchange (1990-). The index included 50 shares from 1972 to 1974, and is an all-share index starting in 1975. This is a capitalization-weighted price index including all stocks listed on the Seoul Stock Exchange, using the Paasche formula, and adjusting for capitalization and component changes. Sources are Fact Book, Seoul: Korea Stock Exchange and Korea Stock Exchange, Monthly Key Statistics, Korea: The Exchange (1970-) and Bank of Korea, Monthly Statistical Review, Seoul: Bank of Korea. |

| _AAXD | Netherlands | 1920 | Netherlands All-Share Price Index (w/GFD extension | No data are available for the All-Share index from May until August 1940 and from August 1944 to April 1946 when the stock exchange was closed. The pre-war index was a weighted arithmetic index calculated by the Central Bureau of Statistics and consisted of 50 stocks with a base of 1921-25 = 100, which was a general index of all sectors traded in the Netherlands. The post-war index was an all-share index as calculated by the Central Bureau of Statistics based upon 27 industrial stocks as well as non-industrials, and was an arithmetic average of daily index prices. The ANP-CBS All-Share index is used currently. The current all-share index covers 137 shares and has data back-calculated to 1952. Sources include International Statistical Institute (1919-1924), Central Bureau of Statistics, Maandschrift, Amsterdam: CBS (1924-) |

| _OBXPD | Norway | 1945 | Oslo SE OBX-25 Stock Index (w/GFD extension) | The OBX Index consists of the 25 most traded securities in the OSEBX Index. The constituents are selected on the basis of six months turnover rating. It is a semiannually revised free float adjusted price index (not dividend adjusted) with composition changes implemented on the third Friday in December and June. In the period between the composition review dates the number of shares for each constituent is fixed with exception of continuous adjustments for corporate actions with priority for existing shareholders. The OBX Index includes industrial, banking and whaling/shipping shares from 1918 to date. No data are available for April and May 1940 due to the war. The index was calculated by the Central Bureau of Statistics a weighted geometric average of price relatives, weighted according to the approximate paid-up capital of the companies included, omitting in the calculation for any period, shares of companies changing their capitalization during the period. About 50 shares were included in the index. Weights were adjusted only when large changes in paid-up capital of a company occurred. Mid-month prices in Oslo were used. Sources include Statistisk Sentralbyra, Statistisk Arbok, Oslo: Statistisk Sentralbyra and Statistisk Sentralbyra, Statistisk Manedshefte and Statistiske Meldinger, Oslo: Statistisk Sentralbyra (1918-). The Oslo SE indices are capitalization-weighted total return indices that include all domestic companies on the main list, using Paasche formula with chaining. Adjustment is made for capitalization changes, component changes and dividend payments. The OBX Stock Index is a capitalization-weighted price index that includes the 25 most traded shares during the previous six months, using the Paasche formula with chaining. Components are reviewed twice a year, and it has a base of January 1, 1987 = 200. |

| _PSI20D | Portugal | 1934 | Oporto PSI-20 Index | Data for the general indices are semi-annual from 1931 to 1933 and monthly thereafter. The pre-1974 index was a general index of weighted arithmetic average of price relatives, weighted by paid-up capital and covered about 20 companies. Weights were revised annually, and the index was based upon daily prices in Lisbon. No data are available from May 1974 until February 1977 due to the political and economic problems caused by the fall of the dictatorship and the revolutionary government, which succeeded it. The general index calculated by the Central Bank is used through 1985. The Banco Totta and Acores Index is used beginning in 1986 and the PSI-20 Index from December 31, 1992 on. The Banco Totta and Acores Index is a price-weighted index of about 40 large cap stocks traded on the Lisbon Stock Exchange with a base of March 31, 1977 = 100. The PSI-20 index includes the 20 stocks with the largest capitalization on Euronext Lisbon. Sources include International Statistics Institute (1931-36), Statistisches Reichsamt (1937-38), League of Nations, UN (1939-1946), Central Bank of Portugal, Monthly Financial Statistics (1947-1987), Bolsa de Valores de Lisboa (1988-). |

| _FTSTID | Singapore | 1965 | Singapore FTSE Straits-Times Index | The STI is a value-weighted index, with weight factors that track the free float of constituent stocks. The index currently comprises 50 constituent stocks listed on the Singapore Exchange Securities Trading Limited (SGX-ST), formerly known as the Stock Exchange of Singapore (SES). The source for the data through the 1990s is Singapore Indian Chamber of Commerce, Economic Bulletin. The STI was introduced on August 31, 1998 to replace the Straits Times Industrial Index (STII). It was further revised on the September 12, 2001. There are three major differences between the new and old STI: (1) The old STI was weighted by market capitalization, while the new STI is a value-weighted index, with weight factors that track the free float of constituent stocks. (2) The secondary objective of having the STI reflect the Singapore economy was dropped. The new STI comprises of 50 stocks, while the old STI covered 55 stocks; and (3) The restriction that any stock with more than a 40 per cent cross-holding by another component stock was ineligible for inclusion has been removed. |

| _SMSID | Spain | 1920 | Madrid SE General Index (w/GFD extension) | The monthly index begins in 1918. No data are available for July 1936 through February 1940 because of the Spanish Civil War. The Stock Exchange in Madrid was reopened in March 1940. The 1919-36 index is a 22-share weighted index and the 1940 index initially had 29 shares in it. The Madrid General Index of Shares is used beginning in 1941. This is a capitalization-weighted price index, with the choice of stocks based upon capitalization, liquidity and frequency of trading. Banks and utilities dominate the index, and foreign stocks are excluded. The Laspeyres formula is used, and adjustment is made for capitalization changes and annual component changes. Sources include Instituto Nacional de Estadistica, Anuario Estadistica d'Espana (1874-1917), ISI (1918-36), Instituto Nacional de Estadistica, Bulletin Mensual de Estadistica, Madrid: INE (1940-1985), Bolsa de Madrid, Financial Times (1986-). Coverage: The index covers a selected group of shares, taking into account their market capitalisation and their trading volume and frequency. Currently, the shares of more than 100 companies are included, representing some 85% of total market capitalization. The composition of the securities included in the index is revised annually. |

| _OMXAFGX | Sweden | 1920 | Sweden OMX Affärsvärldens General Index | Data are annual for 1901 through 1912 using the Affarsvarlden Index. The Riksbank Index is used from 1913 to 1943. No data are available for August and September 1914 when the stock exchange was closed. From 1944 on the Affarsvarlden General Index is used. NASDAQ OMX took over the calculation of the index on April 1, 2009 and changed its name. The Affarsvarlden index is a weighted arithmetic average of price relatives with moving base using end of month prices of about 45 shares on the "A" list in Stockholm. The Affarsvarlden General Index (AFGX) is calculated and administered by Dextel Findata. It includes all the shares of companies registered on the Stockholm Stock Exchange “A-list” which includes over 110 stocks. The AFGX is a capitalization-weighted index whose weights are recalculated daily. Dividends are not reinvested, and the index is not adjusted for dividend payments. Sources include Bank of Sweden, Ekonomisk Oversikt, Stockholm: Bank of Sweden (1913-1962), Statistics Sweden, Allman Manadstatistik, Stockholm: Statistics Sweden, (1963-). The AFGX (Äffärsvärldens Generalindex) is a broad stock market index designed to measure the market performance of the Stockholm Stock Exchange. This index is used to evaluate share performance, not portfolio performance, as dividends are not reinvested in the index. |

| _SPIXD | Switzerland | 1920 | Switzerland Price Index (w/GFD extension) | An index of 21 stocks calculated by the Swiss National Bank is used from 1910 to 1925 when a broader index of stocks was introduced. The Swiss National Bank (Schweizerisches Nationalbank) published weekly indices of Swiss stocks until they were discontinued in 1988 when they were replaced by the Switzerland Performance Indices. Data are monthly through 1937, semi-monthly through 1955, and weekly thereafter. The Swiss Bankcorp indices were discontinued in 1997. The SBC indices included over 400 stocks traded on the Zurich, Geneva and Basle exchanges. SBC calculated a general index and 11 sector indices. SBC calculated price indices that were capitalization-weighted using the Laspeyres formula and omitting dividends. Where possible, data from the Swiss National Bank indices have been added to provide more historical data. The primary sources for these data are Statistischen Bureau, Statistisches Jahrbuch der Schweiz, Bern: Verlag des Ar. Institut Orell Fussli (1920-1965) and Schweizerisches Nationalbank, Monatsbericht, Zurich. Data are monthly through 1937, semi-monthly through 1955, and weekly thereafter. |

| _FTASD | United Kingdom | 1920 | UK FTSE All-Share Index (w/GFD extension) | Sources include Banker's Magazine (January 1907-May 1933), Economist (1933-1962), Financial Times (1950-). The Banker's Magazine kept a capitalization-weighted index of 287 stocks, which gave the total capital values of the companies that were included. The London market closed in August 1914 and reopened in January 1915. The Banker's Magazine Index is used through May 1933. Beginning in June 1933, the Actuaries General Index is used. This index included financial stocks, commodities and utilities, but excluded debentures and preferred shares. Beginning in April 1962, the Financial Times-Actuaries All-Share Index is used. The All-Share Index is a capitalization-weighted price index and covers about 98-99% of the capital value of all UK companies. It uses the Paasche formula, adjust for capitalization changes, and has its components reviewed in December. Data are weekly from 1965 to 1968 and daily thereafter. |

| _SPXD | United States | 1920 | S&P 500 Composite Price Index (w/GFD extension) | S&P indices are weighted by capitalization. Beginning in 1871, the Cowles/Standard and Poor's Composite index of stocks is used. The Standard and Poor's indices were first calculated in 1918, and the Cowles Commission back-calculated the series to 1871 using the Commercial and Financial Chronicle. The 90-stock Composite was calculated from 1926 through February 1957 when S&P introduced the S&P 500 stock average including 425 industrials, 25 rails and 50 utilities, weighting the index substantially in favor of the industrials. The indices were revised again in July 1976 when the rail index was dropped, and was replaced by the Transportation index, and a Financial Index was added. Until that time, financial shares had been excluded from the S&P 500 because many were over-the-counter stocks making it difficult to calculate exact prices for the averages. The components were changed from 425 industrials, 60 utilities and 15 rails to 400 industrials, 40 utilities, 20 transportation and 40 financial stocks in 1976. On April 6, 1988, exact numerical allocations were abandoned allowing the sectoral composition of the S&P 500 index to change as new stocks were removed and added to the S&P 500. |

no reviews yet

Please Login to review.