247x Filetype DOCX File size 0.05 MB Source: www.westpac.com.au

Westpac Banking Corporation ABN 33 007 457 141

AFSL and Australian credit licence 233714

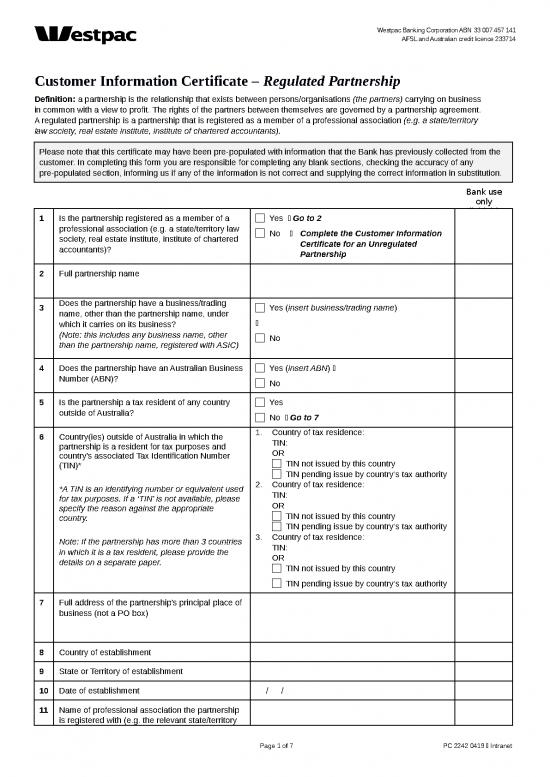

Customer Information Certificate – Regulated Partnership

Definition: a partnership is the relationship that exists between persons/organisations (the partners) carrying on business

in common with a view to profit. The rights of the partners between themselves are governed by a partnership agreement.

A regulated partnership is a partnership that is registered as a member of a professional association (e.g. a state/territory

law society, real estate institute, institute of chartered accountants).

Please note that this certificate may have been pre-populated with information that the Bank has previously collected from the

customer. In completing this form you are responsible for completing any blank sections, checking the accuracy of any

pre-populated section, informing us if any of the information is not correct and supplying the correct information in substitution.

Bank use

only

(initials)

1 Is the partnership registered as a member of a Yes Go to 2

professional association (e.g. a state/territory law No Complete the Customer Information

society, real estate institute, institute of chartered Certificate for an Unregulated

accountants)? Partnership

2 Full partnership name

3 Does the partnership have a business/trading Yes (insert business/trading name)

name, other than the partnership name, under

which it carries on its business?

(Note: this includes any business name, other No

than the partnership name, registered with ASIC)

4 Does the partnership have an Australian Business Yes (insert ABN)

Number (ABN)? No

5 Is the partnership a tax resident of any country Yes

outside of Australia? No Go to 7

6 Country(ies) outside of Australia in which the 1. Country of tax residence:

partnership is a resident for tax purposes and TIN:

country’s associated Tax Identification Number OR

(TIN)* TIN not issued by this country

TIN pending issue by country's tax authority

*A TIN is an identifying number or equivalent used 2. Country of tax residence:

for tax purposes. If a ‘TIN’ is not available, please TIN:

specify the reason against the appropriate OR

country. TIN not issued by this country

TIN pending issue by country's tax authority

Note: If the partnership has more than 3 countries 3. Country of tax residence:

in which it is a tax resident, please provide the TIN:

details on a separate paper. OR

TIN not issued by this country

TIN pending issue by country's tax authority

7 Full address of the partnership’s principal place of

business (not a PO box)

8 Country of establishment

9 State or Territory of establishment

10 Date of establishment / /

11 Name of professional association the partnership

is registered with (e.g. the relevant state/territory

Page 1 of 7 PC 2242 0419 Intranet

law society)

12 Membership details (e.g. membership number

issued by the professional association)

13 Full name of ONE partner in the partnership

Note: For partners that are individuals (natural

persons), full name (given name(s) including

middle name(s) and family name) is required. An

initial, nickname, alias, shortened name or part of

a name is NOT acceptable.

14 Is the partner listed above at Q13 an existing Yes

Westpac customer? No Complete the applicable Customer

Information Certificate for the partner

who is not an existing Westpac

customer

15 Beneficial Owner – Owner Yes Go to 17

Does the partnership have any INDIVIDUALS No Go to 16

(NATURAL PERSONS), who ultimately own

directly or indirectly, 25 per cent or more of the

partnership?

Note: This includes INDIVIDUALS (NATURAL

PERSONS) who are owners of an underlying

entity (e.g. company) and who ultimately own 25

per cent or more of the partnership listed above

at Q2.

16 Beneficial Owner – Controller or Other Go to 17

The partnership must have at least one ultimate

beneficial owner. If you have answered “No” to

Q15 above, provide the details of each

INDIVIDUAL (NATURAL PERSONS), who is any

of the following:

An individual with 25 per cent or more voting

rights (including a power of veto)

An individual who holds the position of senior

managing official (or equivalent), e.g. a

controlling/managing partner

An individual who controls the partnership

through a capacity to make financial and

operating decisions on behalf of the

partnership

17 Provide the details of each INDIVIDUAL

(NATURAL PERSON) who is a beneficial owner BENEFICIAL OWNER 1

Note: the identity of all beneficial owners must be All given names:

verified. This can be completed through the Family name:

provision of certified copies of identification Other name(s) known by (if any):

documents or via electronic verification. Date of birth: / /

Electronic verification is only available to

individuals with an Australian residential address Permanent residential address, including country

and an Australian mobile number. (not a PO Box):

Foreign Tax Residency Information:

A Tax Identification Number (TIN) is an identifying Email address for electronic verification purposes:

number or equivalent used for tax purposes. If a

‘TIN’ is not available, please specify the reason Foreign Tax Residency Information:

against the appropriate country.

Is beneficial owner 1 a tax resident of any country

Note: If the beneficial owner has more than 3 outside of Australia?

countries in which they are a tax resident, please Yes

provide the details on a separate paper.

No

Page 2 of 7 PC 2242 0419 Intranet

If yes, please indicate the country(ies) in which

beneficial owner 1 is a resident for tax purposes and

each country’s associated TIN.

1. Country of tax residence:

TIN:

OR

TIN not issued by this country

TIN pending issue by country's tax authority

2. Country of tax residence:

TIN:

OR

TIN not issued by this country

TIN pending issue by country's tax authority

3. Country of tax residence:

TIN:

OR

TIN not issued by this country

TIN pending issue by country's tax authority

BENEFICIAL OWNER 2

All given names:

Family name:

Other name(s) known by (if any):

Date of birth: / /

Permanent residential address, including country

(not a PO Box):

Email address for electronic verification purposes:

Foreign Tax Residency Information:

Is beneficial owner 2 a tax resident of any country

outside of Australia?

Yes

No

If yes, please indicate the country(ies) in which

beneficial owner 2 is a resident for tax purposes and

each country’s associated TIN.

1. Country of tax residence:

TIN:

OR

TIN not issued by this country

TIN pending issue by country's tax authority

2. Country of tax residence:

TIN:

OR

TIN not issued by this country

TIN pending issue by country's tax authority

3. Country of tax residence:

TIN:

OR

TIN not issued by this country

TIN pending issue by country's tax authority

Page 3 of 7 PC 2242 0419 Intranet

BENEFICIAL OWNER 3

All given names:

Family name:

Other name(s) known by (if any):

Date of birth: / /

Permanent residential address, including country

(not a PO Box):

Email address for electronic verification purposes:

Foreign Tax Residency Information:

Is beneficial owner 3 a tax resident of any country

outside of Australia?

Yes

No

If yes, please indicate the country(ies) in which

beneficial owner 3 is a resident for tax purposes and

each country’s associated TIN.

1. Country of tax residence:

TIN:

OR

TIN not issued by this country

TIN pending issue by country's tax authority

2. Country of tax residence:

TIN:

OR

TIN not issued by this country

TIN pending issue by country's tax authority

3. Country of tax residence:

TIN:

OR

TIN not issued by this country

TIN pending issue by country's tax authority

BENEFICIAL OWNER 4

All given names:

Family name:

Other name(s) known by (if any):

Date of birth: / /

Permanent residential address, including country

(not a PO Box):

Email address for electronic verification purposes:

Foreign Tax Residency Information:

Is beneficial owner 4 a tax resident of any country

outside of Australia?

Yes

No

If yes, please indicate the country(ies) in which

beneficial owner 4 is a resident for tax purposes and

each country’s associated TIN.

1. Country of tax residence:

Page 4 of 7 PC 2242 0419 Intranet

no reviews yet

Please Login to review.